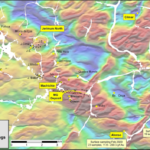

“District Metals (DMX.V) published the results of the airborne electromagnetic survey last week, and we had a follow-up call with CEO Garrett Ainsworth to discuss the details. The highlight of the survey is the confirmation of a three kilometer long trend along the Tomtebo mine trend,...

Continue reading » October 27, 2020 admin District Metals No Comment What has recently transpired in the stock of Cabral Gold is almost comical. I won’t recap the entire case, which can be read here, but I thought I would just comment on a few things… First of all, here are the highlights from the recent...

Continue reading » October 27, 2020 admin Cabral Gold, Gold & Silver Stocks, Horseman's Portfolio No Comment This will be an introduction article on New Found Gold Corp (NFG.V) which is a junior exploring a high-grade, Epizonal gold system(s) in Newfoundland, Canada. I directly own shares of New Found Gold, own shares via Novo Resources and the company recently came on as...

Continue reading » October 26, 2020 admin Gold & Silver Stocks, Horseman's Portfolio, New Found Gold, Uncategorized 6 Comments John Kaiser talks about Eskay Mining (ESK.V):

Continue reading » October 23, 2020 admin Eskay Mining, Gold & Silver Stocks, Horseman's Portfolio 3 Comments Bob Moriarty The Republican and Democratic candidates for president may be the most flawed in U.S. history. And yet one of these two men—God help us—will be sworn in this January… CLICK HERE to read the full article on 321gold.com

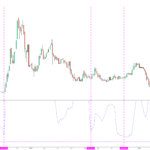

Continue reading » October 23, 2020 admin Bob Moriarty No Comment Novo Resources… Sooo tight… Note: This is not trading advice.

Continue reading » October 23, 2020 admin Chart of the Day, Horseman's Portfolio, Inflection Resources, Novo Resources 1 Comment Tom Larsen, CEO of Eloro Resources (V.ELO), is waiting, somewhat patiently, for the results of drilling at the company’s Iska Iska project in Southern Bolivia. Eloro signed the Iska Iska deal in January and the drills are turning. The Iska Iska project has the potential...

Continue reading » October 22, 2020 admin Eloro Resources, Gold & Silver Stocks, Horseman's Portfolio No Comment Bob Moriarty This year has been one of those years where everything changes. We have a pending civil war/revolution starting with riots in hundreds of cities. We have a pandemic what the “Experts” claim is the deadliest since the Black Plague and the front line doctors maintain has been over since...

Continue reading » October 22, 2020 admin Bob Moriarty No Comment WHITE GOLD CORP. EXPANDS GOLD MINERALIZATION ON MULTIPLE TARGETS IN TRENCHING PROGRAM INCLUDING 8.88 G/T GOLD OVER 2.5M AND IDENTIFIES NEW TARGET WITH PROBE SAMPLES UP TO 24.4 G/T GOLD ON JP ROSS PROPERTY, YUKON White Gold Corp. (TSX.V: WGO, OTC: WHGOF, FRA: 29W) (the “Company”)...

Continue reading » October 22, 2020 admin Gold & Silver Stocks, Horseman's Portfolio, White Gold Corp No Comment I am working on a few more extensive company presentations so I am quite busy ATM. With that said I will try to do some more real time commenting on some of the cases I like at current levels etc. Note that I own shares...

Continue reading » October 21, 2020 admin Gold & Silver Stocks, Horseman's Portfolio 3 Comments