New Found Gold (NFG.V): Potential Tier #1 Epizonal Gold District at Shallow Depths

This will be an introduction article on New Found Gold Corp (NFG.V) which is a junior exploring a high-grade, Epizonal gold system(s) in Newfoundland, Canada. I directly own shares of New Found Gold, own shares via Novo Resources and the company recently came on as a passive banner sponsor of The Hedgeless Horseman. I will do my best to explain why I own quite a bit of shares shares, what I think the market is missing,why I was happy to be associated with this story and why this one has the potential to be the most exciting discoveries in the last couple of decades…

New Found Gold in Short:

- Ticker: NFG.V

- Website: LINK

- Presentation: LINK

- Video Presentation: LINK

- Basic Market Cap @ C$2.90/share: C$413 M (US$313 M)

- Working Capital: ~C$75.2 M

- Enterprise Value @ $C3.90/share: C$338 M (US$256 M)

- Flagship Project: The Queensway Project

- 150,030 hectares (!)

- Newfoundland, Canada

- Best drill hole so far: 92.9 g/t Au over 19 m

- Notable shareholders:

- Eric Sprott (18%)

- Rob McEwen (7%)

- Novo Resources (11%)

- Palisades Gold Corp (33%)

- Yours truly

- Share structure:

- The float is a tiny 19% so this stock should really be able to move

- Major Catalysts:

- Drilling…

- More drilling…

- Oh and then some more drilling!

Setting The Scene

My Case For New Found Gold

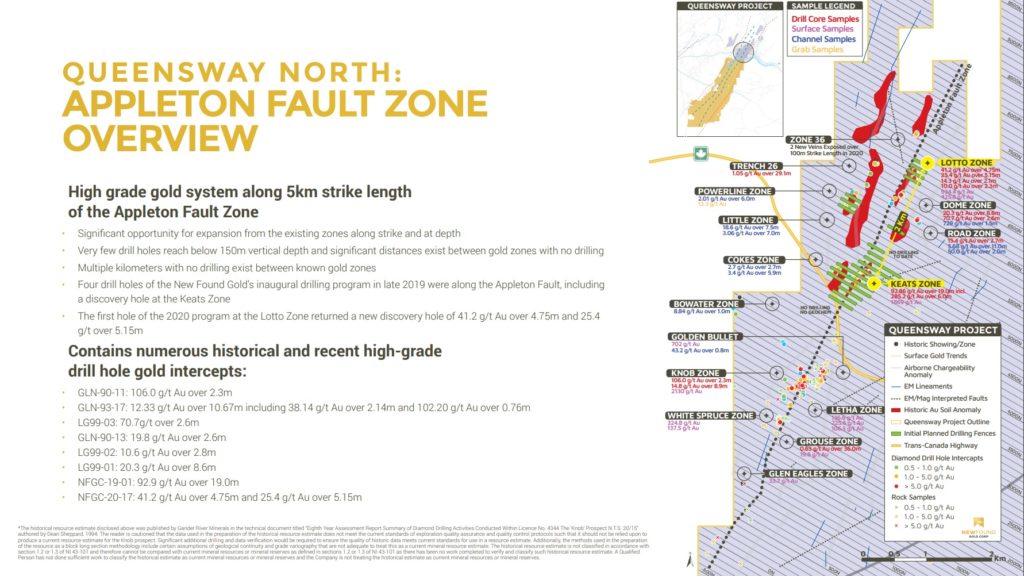

New Found Gold has drilled the best hole in Canada with 92.9 g/t Au over 19 m in the “Keats Zone” and recently hit 41.2 g/t Au over 4.75 m and 25.4 g/t Au over 5.15 m in an area called the “Lotto Zone” which is located 2 km away from the first barn burner hole. The company is well cashed up with C$75 .2 M in working capital and a whopping 100,000 m drill campaign is currently underway at the flagship Queensway Gold Project.

Why do I like New Found Gold at an Enterprise Value of US$256 M (C$338 M)?

Simple:

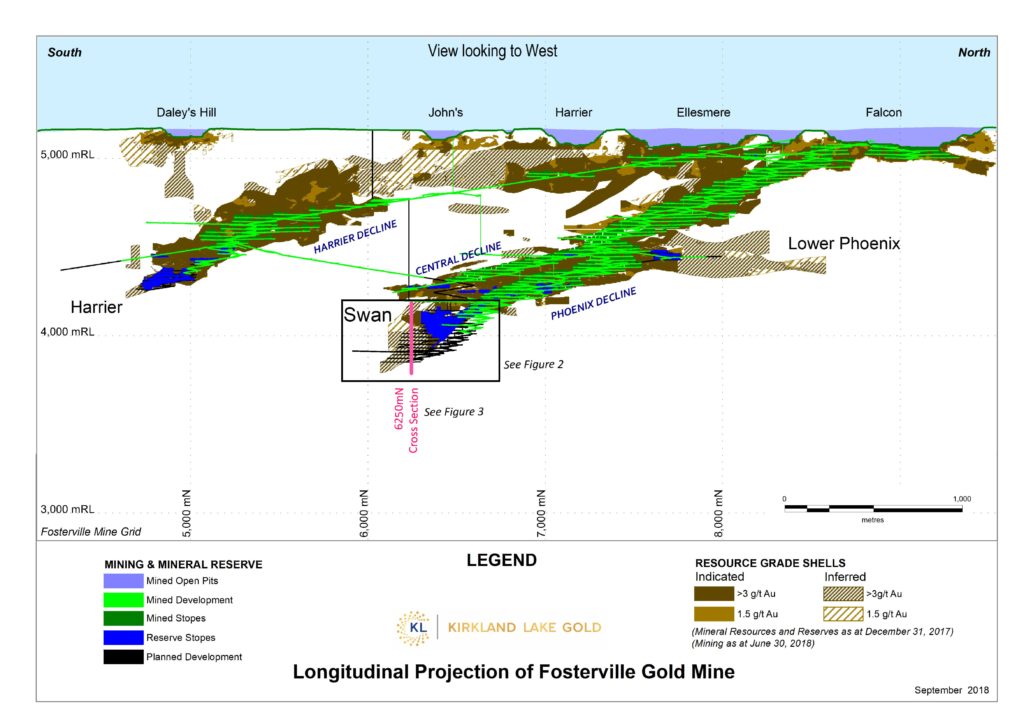

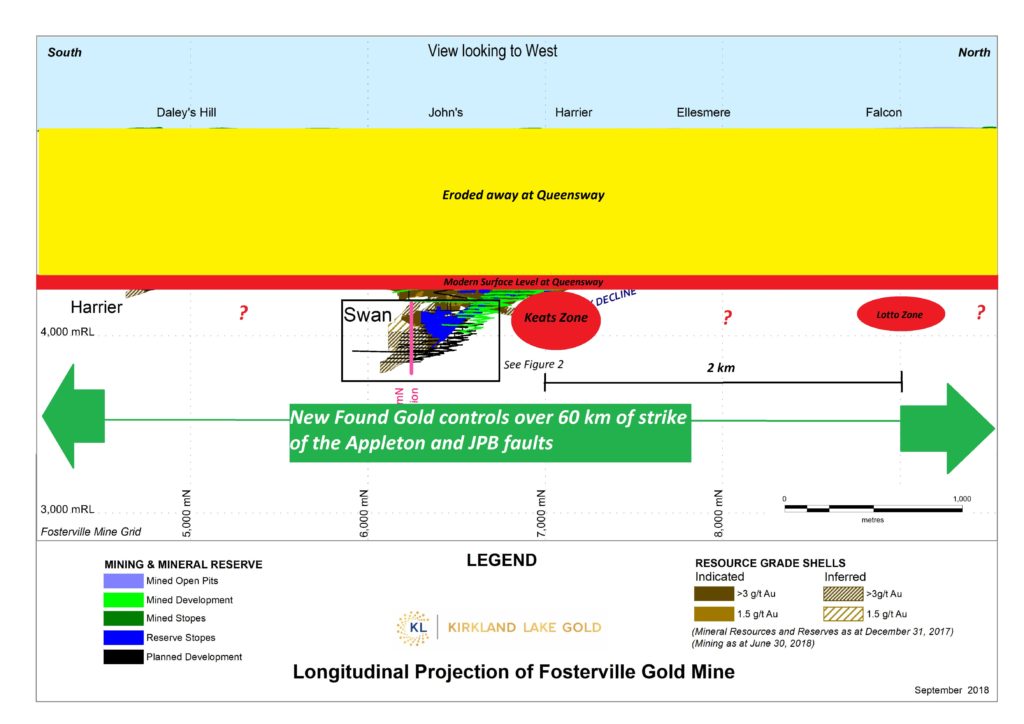

New Found Gold controls 151,030 hectares and around 60 km of strike length of both the Appleton Fault (Keats, Lotto) and the JBP Fault. Even though it is still quite early stage up at the Queensway projects there is already evidence of gold in multiple areas within said 151,030 hectares land package. In other words the company pretty much controls the bulk of an entire belt with confirmed Epizonal Gold mineralization (Fosterville style). Not only that, but so far the high grade hits have been shallow, such as the 92.9 g/t Au hit over 19 m. In fact, this was hit at a depth of mere 75 m below the surface. Compare that to the Fosterville mine where the high grade to bonanza grade regime (The Swan Zone) started around a kilometer at depth.

Even though the Swan Zone occupies a very small area it has proven to be worth billions of dollars. The problem for Kirkland Lake, who owns the Fosterville Gold Mine, is that it’s not easy to make additional discoveries if any additional deposits are located at the same depth (unless they are in very close proximity). This might explain why some people have started to worry about the mine life of what has been an insane cash cow so far. Furthermore Kirkland Lake does not control anywhere near 60 km of strike in terms of the major structure that fed the Fosterville system…

Compare this to New Found Gold and one quickly realizes that a) The Epizonal System(s) around the Keats Zone is very shallow and b) New Found Gold controls the lion’s share of the major structures over a huge area. If we are talking pure exploration potential and potential ease of exploration then New Found Gold’s Queensway project wins by a mile. Indeed, if we are talking pure potential for tier-1 (Epizonal) gold deposits then I’m not sure any other company compares. At least now when accounting for the apparently shallow nature which, all else equal, means higher margins and cheaper/faster exploration.

According to Kirkland Lake’s latest presentation the Fosterville Mine is expected to produce 590-601 Koz of gold in 2020 with Operating Cash Costs of US$130-US$150 per ounce. With gold at US$1,900 that means that Operating Cash Flow per ounce would be US$1,750-US$1,770. This should make one realize just how extremely valuable a Fosterville ounce is at the moment. One million ounces produced, all else equal, could produce up to a total of US$1,770 M in operating cash flow. In other words, one million ounces of this stuff can be worth more than 3+ million ounces of an average mining operation and will especially outperform in a low gold price environment (margin of safety). This is why I think one should forget all about the “norm” when looking at the valuation of New Found Gold since “even” one million ounces of super high margin gold can indeed be worth more than say a five million ounce deposit with crappy economics.

Majors hate business risk. If I look at the highest acquisition cost per ounce then my mind wanders to the acquisition of Richmond Mines by Alamaos Gold. The prize was the Island Gold mine which was a high margin mine in the Wawa Gold Camp, Canada. At the time of the acquisition valued at C$933 million, the Island Gold Mine had around 1.5 Moz in total resources and reserves, if I remember correctly. Keep in mind that this took place in 2017 when the price of gold was much lower than it is today. Another example of when quality fetches a much higher value than many might expect is when St Barbara Limited acquired Atlantic Gold Corporation for C$723 M in 2019. That year Atlantic Gold’s operations produced 93 Koz with All in Sustaining Costs (AISC) of US$616/oz. Neither of these examples were big mines in terms of production profile, nor had huge resources, but despite this the shareholders of the acquired companies were well rewarded. The Fosterville Mine still stands head and shoulders above both of these operations however and its margins led to Kirkland Lake becoming one of the best performing stocks in Canada as the (small) Swan Zone got into production and billions of dollars were created for Kirkland Lake’s shareholders.

It is important to remember that grade directly impacts margins and the higher the margins the higher the value per ounce still in the ground.

When it comes to tier 1 gold deposits it’s best to simply throw away what I like to call the “Greater Fool Trading Metrics” such as using the sector average for what an ounce in the ground “should” be worth. New Found Gold might always look expensive relative to your average crap deposit, and with good reason. True tier #1 deposits will be worth a lot more than 99.99% of the other deposits out there on an EV/ounce basis and the majors will pay up for it. Richmond Mine and Atlantic Gold did not have tier #1 mines but two mid tiers paid up big time relative to production profiles and deposit sizes. Just think about how many juniors there are out there, with 1-2 Moz of gold, who are valued sub $50 M… And yet Alamos Gold paid C$933 M for Richmond Mines.

In short:

Forget about comparing New Found Gold to sector averages if this indeed turns out to be a giant tier #1 system(s) or an entire district, because a major will pay up based on economic value per ounce, and not some benchmark valuation that is mostly based on deposits that will never even become mines.

Fosterville’s Swan Zone – You Don’t Need Much

In order to drive home the point of how little can be worth so much when you got a high grade to bonanza grade Epizonal gold system I will present the Swan Zone at Fosterville:

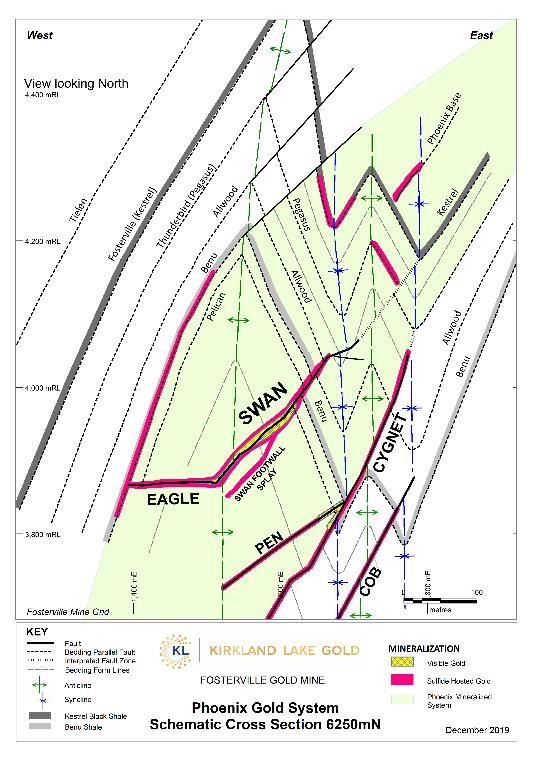

Cross Section of the Fosterville Mine (Note the Swan Zone and scale):

… That’s a pretty slime “bulge” if you will. Now lets see how the Swan Zone looked from the side according to this schematic from 2019:

(note scale)

… You see the Swan Zone just makes up a very small part of the overall system but it was THE thing that catapulted Newmarket/Kirkland Lake to become a $10+ B company. What is also important to point out is that the Swan Zone is located at a depth of 1+ km. The thing about New Found Gold’s discovery is that the insane drill intercept in the Keats Zone is located at a depth of just 75 m from surface… “Open pit depth” as described in the latest New Found Gold presentation.

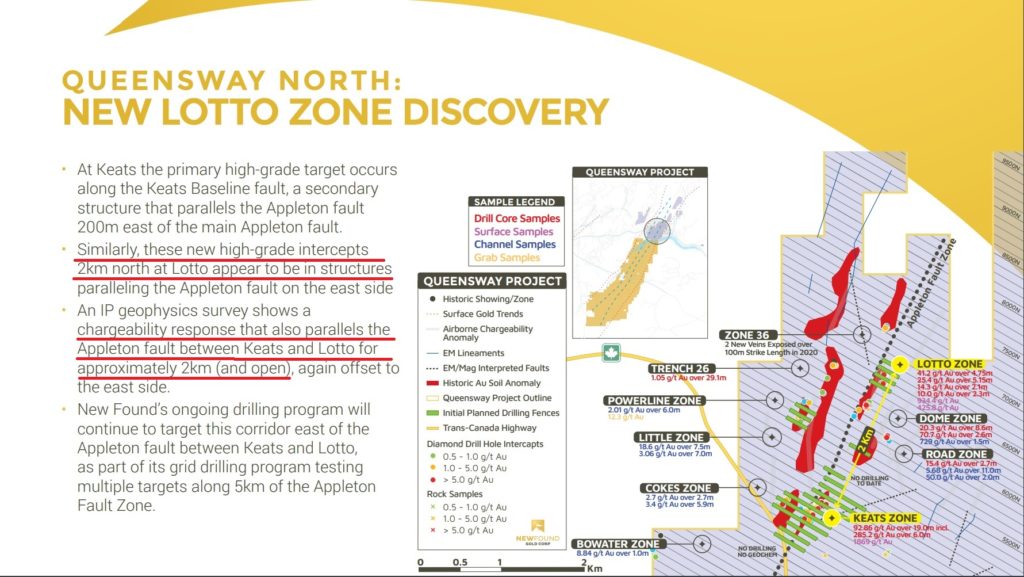

What early results did New Found Gold get when they drilled the Lotto Zone which is located 2 km away from the bonanza hit in the Keats Zone?

… 41.2 g/t Au over 4.75 m and 25.4 g/t Au over 5.15 m… That’s an average grade of 33.3 g/t Au.

Think about this for a minute. How many juniors ever achieve drill results like that? Not many. There is nothing suggesting that these holes were just lucky hits. There is nothing suggesting these will even be the best holes that will come out of this large scale drill campaign. On that note Quinton Hennigh pointed out the fact that it is unusual to get results like this right off the bat. He then went on to basically say that if you get results like this early on then it is suggesting that it might indeed be a very robust system (I’m paraphrasing but you can listen to his comments HERE).

In other words:

The balance of probabilities dictates that the reason for such good hits this early on is because it might very well be an unusually good gold system(s)… And that one should probably expect a lot more good hits going forward.

Enter Queensway

If the critical high grade to bonanza grade mineralization in the Epizonal (orogenic) gold system around the Queensway project is located at open pitable depths then that is a game changer in terms of both economics and exploration. If the ultimate pay zone (Swan Zone look-alike) was located at a depth of 1km then the risk/reward would be a LOT poorer. Never forget that exploration gets exponentially more costly, time consuming and difficult as depth increases. If the critical high grade regime was believed to be located at similar depths as Fosterville then the risk/reward would be materially worse. In other words New Found Gold might actually end up having a land position that could be worth multiples of what the Fosterville Mine was worth. I know it sounds very much like hyperbole but I mean consider the following, again:

- The Keats Zone is located at a MUCH shallower level than the Swan Zone

- New Found Gold recently hit shallow, high grade mineralization in the Lotto Zone which is 2 km to the north from the Keats Zone

- New Found Gold controls 150,030 hectares of the belt which includes over 60 km of total strike length of both the Appleton- and JBP Fault zones.

- … Which results in a lot more blue sky potential and would also potentially be a lot easier, cheaper and faster to explore compared to Kirkland Lake.

Finding a preserved Epizonal Gold System is hard enough since it is the upper part of an orogenic system and will be the area to erode first. To find one where the high grade regime is not only preserved, but close to surface at open pitable depths, is extremely rare. Make no mistake, New Found Gold might be on to something that is almost unique today. Especially when factoring in the fact that the company almost controls the entire “belt” and there is evidence of more than one zone.

In order to drive home how important the a) Shallow nature of the Keats and Lotto Zones, b) The distance between the two zones, and c) how it could compare to the Fosterville Swan zone I have made the following visualization:

Think about this for a minute. It took decades/years for the Fosterville Mine to become THE Fosterville Mine known to date. Why? Because the Swan Zone was, again, located at a depth of 1+ km and it took that long to “stumble” on it… Meanwhile New Found Gold seems to have hit two zones of Epizonal (Fosterville type) gold mineralization of unknown size, that are located two kilometers apart, and might be linked in some way (I will get back to this later in the article). Anyway, I hope you get a sense of just how fortunate New Found Gold seems to be in terms of the location (shallow) and potential size of their Epizonal gold system. As it stands right now I would even dare to say that the blue sky case for New Found Gold has the potential to blow Fosterville away. With that said, we are very early in the story but will know a lot more after the 100,000 m drill campaign…

I would argue that the market has yet to put this all together and therein lies the opportunity as I see it.

To quote Bob Moriarty in his latest piece on New Found Gold:

“There is no limit to where this company could go.”

… And hopefully you will have a better understanding of why he made that statement after reading this article.

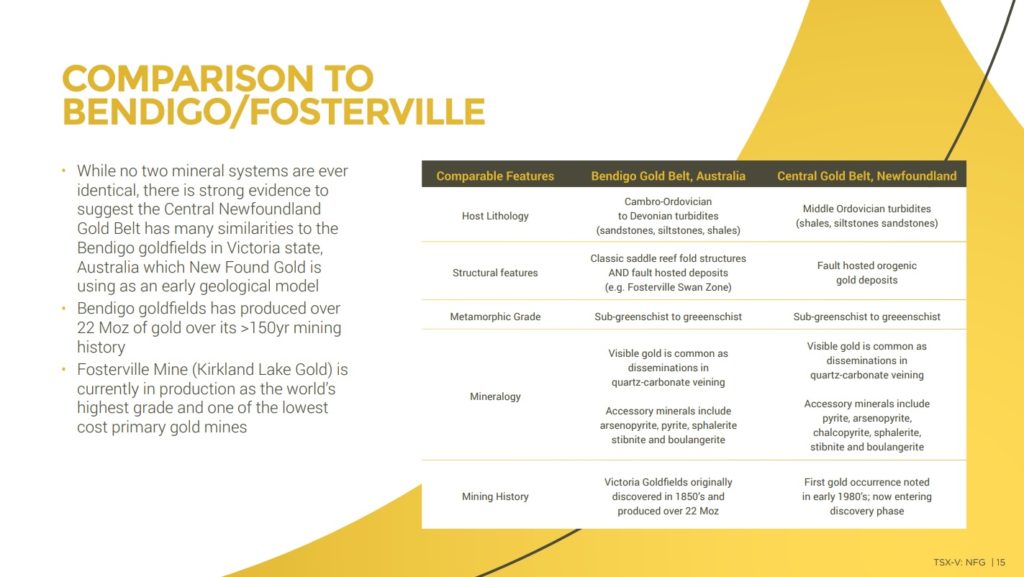

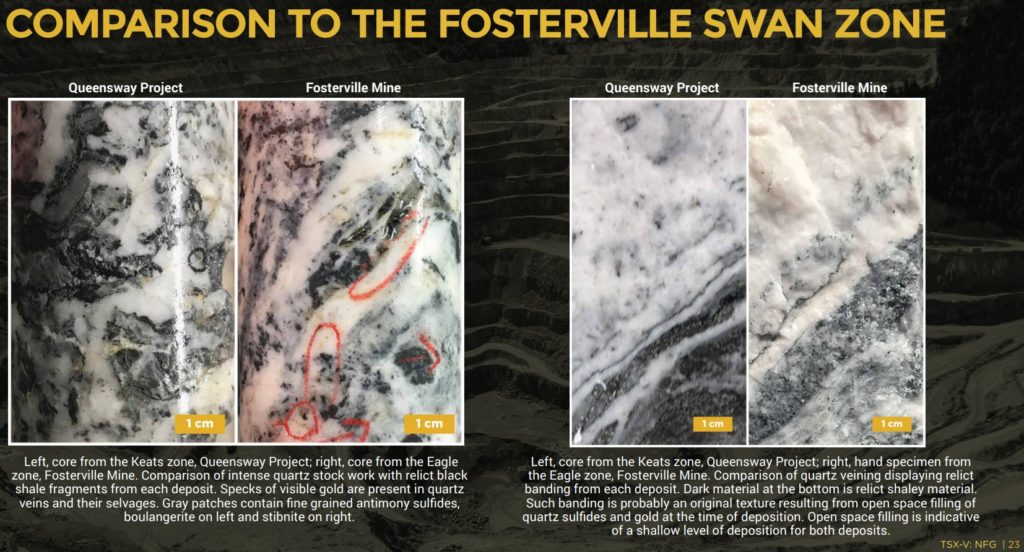

Geological Similarities Between Queensway and Fosterville

The overall geological setting:

Core comparison between New Found Gold’s Keatz Zone and Fosterville’s Swan Zone:

… Got it? If it looks like a duck and quacks like a duck then it is probably a duck! Again, these Epizonal Gold Systems are rare and to have on at an open pitable depth is almost unique.

Near Term Potential

Keats and Lotto Zones:

Remember what I said about how little tonnage/volume is needed to have a very valuable deposit if grades are high enough? Consider that while looking at this next slide:

As it says on the slide above, the 2 km step out holes at the Lotto Zone appears to be in a similar setting as the Keats Zone, and to top it all off there is a chargeability response that “also parallels the Appleton fault between Keats and Lotto for approximately 2km (and open)”(!). Again, remember what a small footprint the Swan Zone at Fosterville has (it’s only a few hundred meters long). Meanwhile there is already early indications of the Keats and Lotto zones to potentially be connect in some way over 2 km of strike(!).

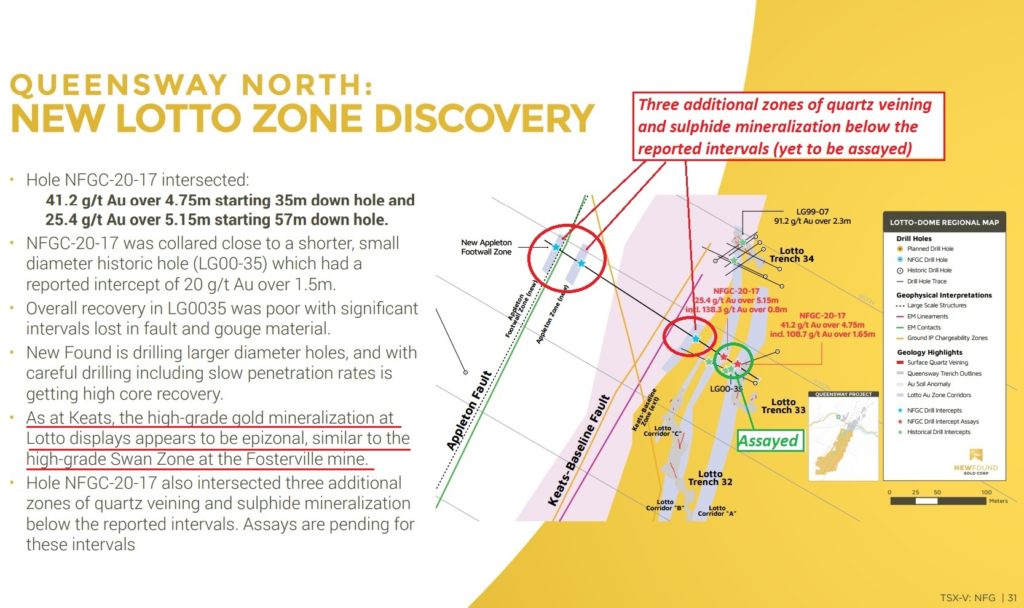

But wait, there is more. The first hole that was drilled into the Lotto Zone and hit 42.1 g/t Au and 25.4 g/t Au over 5.15 m actually intercepted “three additional zones of quartz veining and sulphide mineralization below the reported intervals”:

(Drawings added by me)

Assays are pending for these lower intervals in hole NFGC-20-17. Also note that it says “As at Keats, the high-grade gold mineralization at Lotto appears to be epizonal, similar to the high-grade Swan Zone at the Fosterville Mine”. Honestly, the potential looks bonkers and New Found Gold is only a few holes into the 100,000 m drill campaign.

Think about it:

A 2 km step out hole from the bonanza hole in the Keats Zone hits FIVE different zones of quartz veining and sulphide mineralization and appears to indeed be Epizonal in nature as well. So not only is the 2 km strike potential bonkers but the hole in the Lotto Zone did not hit one, two or three intervals of quartz veining but FIVE. This opens up some incredible potential in terms of ounces per vertical meter. In other words this appears to have the potential to be a much larger high-grade Epizonal gold system than the Swan Zone at Fosterville. And that is just based on early indications from a postage stamp of New Found Gold’s total land package that covers the relevant faults. I won’t do any blue sky potential calculations because the numbers get crazy really quickly based on; a) 2 km strike, b) multiple structures, and c) the grades that have been reported. But that doesn’t stop you from doing your own calculations. At the moment we do not know how much of the 2 km might be mineralized, what the average grade is, how many economic structures there are or what the depth potential is. With that said, nothing close to blue sky is priced in and even a single, small “Swan Zone lookalike” could be worth billions.

Quinton Commenting on New Found Gold and The 2 km Step Out Hole:

Beyond The Keats and Lotto Zones:

The following slide only covers parts of the northernmost land package that New Found Gold controls:

To say there is a lot of smoke around the Keats and Lotto Zones would be an understatement. There are historic soil anomalies, trenches and drill intercepts over many kilometers. The suggested footprint is more than enough to possibly contain gold worth several billions of dollars if the grades are anywhere near what is coming out of the Keats and Lotto Zones. Take the Knob Zone for example: 106 g/t Au over 2.3 m and 14.8 g/t Au over 8.9 m. Or the Little Zone with 18.6 g/t Au over 6. Or how about the Dome Zone with 70.7 g/t Au over 2.6 m. Quinton said it himself: That he has no idea how or why the previous explorers walked away from this project given the early results they were getting. Well, their loss obviously. Now New Found Gold controls the lion’s share and they started out with drilling the best hole that has ever been drilled in the area.

Regional/District Potential

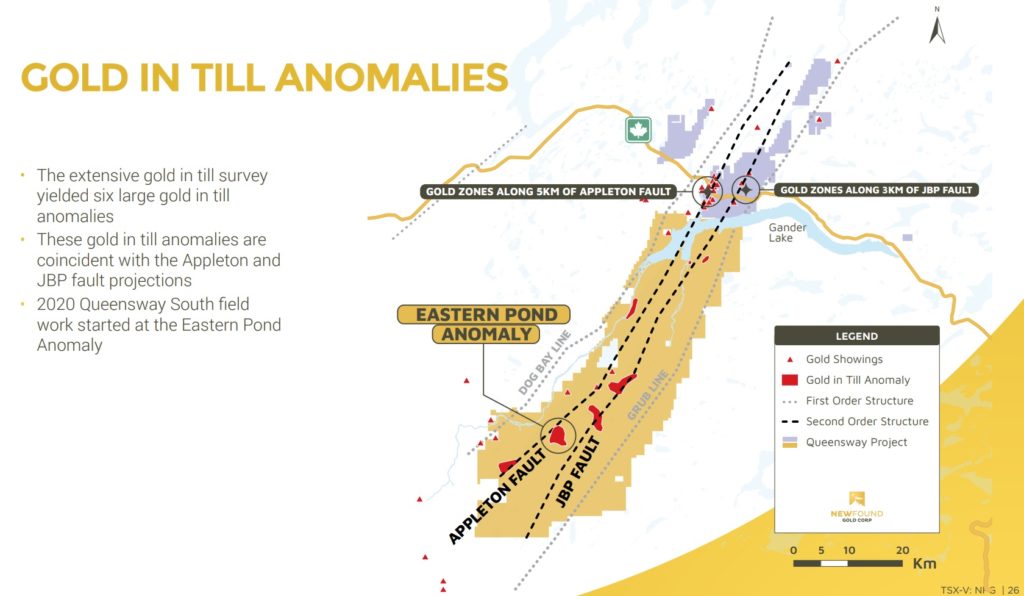

This next slide depicts gold in till anomalies and gold showings across New Found Gold’s entire land package (note the immense scale):

As you can see there are some multi square kilometer gold in till anomalies in the southern half of the land package as well as a few scattered along the way in the central portions. Are these also epizonal gold systems that are responsible for these? I don’t know but it shouldn’t be a stretch to assume it might indeed be. By now the total blue sky potential for New Found Gold should become obvious. Remember, Kirkland Lake only really have the Fosterville system(s) in their Bendigo land package so far. Kirkland Lake does not own 60 km of the relevant structures and so far the only discovered bonanza zone has been the Swan Zone which starts at a depth of around 1 km. When you compare the two from a pure exploration potential point of view the Queensway project wins hands down.

If New Found Gold ends up basically proving up a Swan Zone or two during this 100,000 m drill campaign then you better believe that any potential acquirer will pay up for the district scale potential as well. Again, New Found Gold might never “look cheap” relative to the 95% of crap that is out there but that does not mean that the current valuation might look very cheap before the current drill campaign is over. A tier #1 deposit(s), in a tier #1 jurisdiction with district scale potential is not something you see every day and the majors sure knows this. If this ends up becoming what it looks like then we will all be in for one helluva ride.

Bottom Line

If you think New Found Gold is expensive then I think you might be surprised of what the stock could do with 100,000 m of drilling. The higher the grade the less tonnage you need to get to a large deposit. If you own an entire district and have already gotten exceptional intercepts in the first holes then you figure out what this could become in the future. As it stands now I am very open to the possibility that New Found Gold could be worth multiple billions some day.

- Looks like a shallow Epizonal Gold System(s) akin to Fosterville

- Incredible grade and thickness in the Keats Zone discovery hole

- 2 km step out hole at the Lotto Zone hit high grade gold with good widths

- The hole at the Lotto Zone intersected a total of five intervals with quartz veining and sulphide mineralization

- Numerous targets surrounding the Keats and Lotto Zones

- Controls over 60 km of structural strike within a 150,030 hectares, district-scale land package

- Numerous multi square kilometer gold in till anomalies

While completing this piece it hit me that this actually has the potential to be one of the largest discoveries in the last couple of decades and it’s in a tier #1 jurisdiction to boot. This is why I love to flush out an investment case in long articles because it helps me a lot in terms of really understanding what I own and why.

New Found Gold’s current Enterprise Value (EV) of US$256 M pales in comparison to the overall potential that is being revealed and we are just in the early stages to boot. Given that nothing close to the blue sky scenarios is priced in it means that I am not taking on that specific risk and I do believe the current EV will prove to be very low in hind sight. And as it stands now it does look like the theoretical blue sky scenario for the Queensway project is beyond another Fosterville lookalike. This might be an Epizonal gold district and New Found Gold controls a huge area. I would also note that New Found Gold’s largest insider recently invested in Labrador Gold which owns some land to the north-east and on strike from the Lotto Zone. This tells me that the smart money really believes this is potentially not about one or two zones but literally an Epizonal gold district play. Anyway, I think this valuation will look low after 100,000 m of drilling, even though there are never any guarantees (oh and they will definitely not hit on EVERY hole!).

I love the risk/reward. I think the blue sky potential is one of the best in the entire sector and that’s why I own shares. If some decent percentage of blue sky materializes then I think I will make quite a bit of money in this stock. Furthermore the exploration should do the talking and I can see this stock performing well regardless of what the price of gold is doing.

As always you should do your own due diligence and make up your own mind.

Some TA

To me it looks like the stock is in a strong and obvious uptrend and that the current level might be a pretty good entry from a technical point of view. I have been buying from C$3.2/share and down recently at least. Personally I think this uptrend could continue for months and possibly years, granted that the 100,000 m of drilling isn’t total crap…

(log chart)

(non log chart)

Note: This is not investment advice. I am not a geologist nor am I a mining engineer. This article is speculative and I can not guarantee 100% accuracy. Junior miners can be very volatile and risky. I have bought shares of New Found Gold Corp in the open market. I can buy or sell shares at any point in time. I was not paid by any entity to write this article but the company is a passive banner sponsor of The Hedgeless Horseman. Therefore you should assume I am biased so always do your own due diligence and make up your own mind as always.

Best regards,

Erik Wetterling aka “The Hedgeless Horseman”

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My channel

What has impressed me most is that Hennigh, who has so much use for capital in the Pilbara craton, nevertheless used capital from Novo to buy a tenth of New Found Gold. Hennigh consults for a great number of companies. Novo seems to be unique for the level of Hennigh’s conviction and interest, as expressed in his investment.

Even though it was a share for share transaction I think it spoke volumes given that Novo (QH) did it at the stage Novo was in… I guess he saw something really good in NFG!

Best regards,

THH

“Basic Market Cap @ C$2.90/share: C$413 M (US$3313 M)”

I don’t think the USD is that weak. Perhaps an extra “3”?

lol, thanks for the heads up mate!

Best regards,

THH

What do you think about today’s drill results ? Very nice article on New found Gold.

Hi Eric,

200,000 metre drill campaign, not 100,000 metres; thanks for a great article on NFG!!

Stockhouse123