Novo: Why The Risk/Reward is Better Than Ever

This article will sum up some of the recent news and then I will go into my thoughts on the current risk/reward of Novo Resources. There will be a lot of speculation and forward looking statements. I am a shareholder and Novo is a banner sponsor so consider me biased and make up your own mind if what I say makes any sense.

Setting The Scene

Quinton Hennigh was recently interviewed by Cory Fleck on the Kereport (LINK).

Below are some of the key take aways from the interview as far as I am concerned:

- Testing on fine material component was done with the NON custom made Steinert machine that is located in Perth

- Was able to basically sort everything down to “dust”

- Appears to be highly effective

- “Now we can sort the whole lot”

- This machine was able to sort the fine halo gold that surrounds the nuggets

- Working hard to get all the necessary permits

- Ngarluma approval at hand in regards to “mining exercise”

- The rest of the official approvals from the regulatory agencies are close to formalities

- Beaton’s Creek mill can treat the Karratha concentrate

- Sees mass pull range of less than 3% in total

- Nuggets tend to pop out (get liberated) during crushing and much goes into the finer fractions

- Which can be sorted

- “This is a huge win” – QH

- Great relationship with Ngarluma Aboriginal Corporation

- Going to use the Chrysos PhotonAssay technique to assay BC material

- New technique that is now lab certified

- “Going to take the mining industry forward” – QH

- Might use Chrysos on a “mine level” in the future

- Refurbishing the Millennium mill with the intent to be “mining here for the next 20-25 years”

Benefits of being able to utilize ore sorting as the only “processing” at Karratha

- No “wet chemical processes” needed

- Should make permitting easier

- Should lower CAPEX/OPEX

- “Perhaps way lower than a conventional mill”

- Position to fast track the project

- After crushing/screening the waste product could be used for aggregate

- Reclamation could be really quick and easy

When a Kereport reader asks how Novo shareholders will get rewarded and mentions examples such as; Dividends, gold coin distribution, Joint Ventures and/or Take Overs, Quinton says:

“Pretty much all of the above”

- Furthermore Quinton stated that he will push for excess “cash” being kept in the form of gold whenever possible.

- This would of course give Novo and Novo shareholders increased exposure to the value of gold.

- Quinton also says points out that he has previously stated that he wants Novo to grow and sees Novo being a much larger company in a few years time

- Current equity positions in other companies will either be “toeholds” for a take over by Novo or could be rewarded to shareholders in the future for example

One Thing to Note

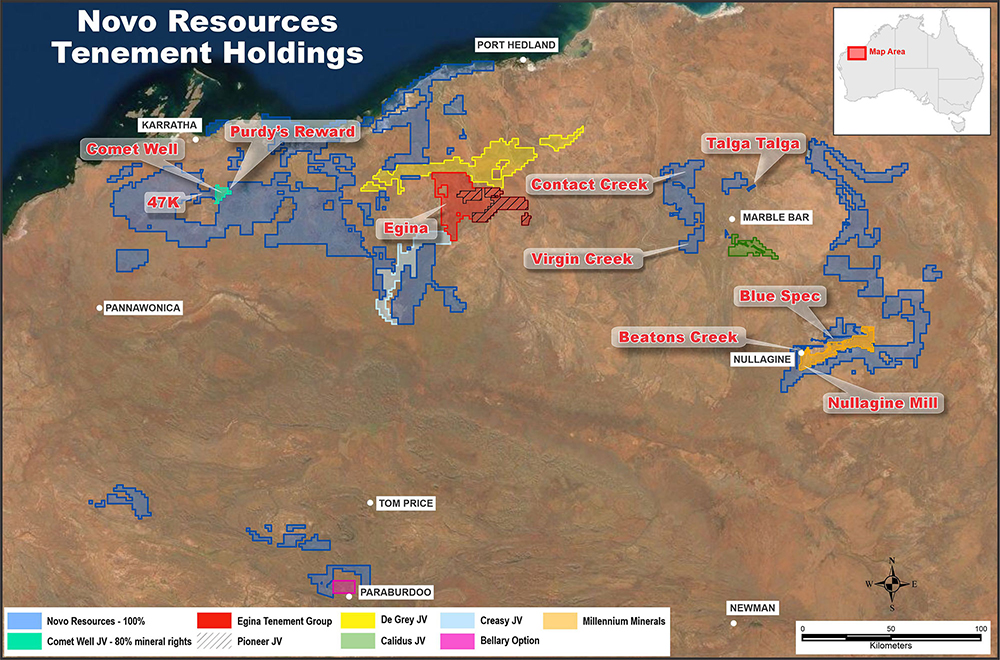

Being able to potentially sort ALL of the Karratha material means that this could be also be true for any additional conglomerate/Egina type deposits found within all of this:

In other words the impact of this advancement in sorting technology might have unmeasurable long term consequences for Novo and Pilbara as a whole. This is beyond huge (but of course will fly over the heads of 99.9% of people as per usual). On that note, the following is from CEO Rob Humphreyson on ore sorting:

“... suffice to say that with a simple processing solution of crushing / screening / sorting (no chemicals, no water, no tailings dam, no 3 year approval and construction period), I cannot conceive of anything that would remotely approximate the capital costs of a traditional processing facility. Then throw in the very rapid set up time, the mobility and flexibility of the units, high uptime characteristics, the long life nature of the assets and the low operating costs and it starts to get very interesting…“

Other Stuff Missed by the Market:

New Found Gold Corp

Shares of New Found Gold Corp (NFG.V) are up to C$4.48/share which means that Novo’s equity position in the company is currently worth C$67.2 M.

Calidus Resources

Calidus Resources is expected to pay A$19.5 M for parts of the Blue Spec project near Nullagine on November 30.

Elementum 3D

Elementum 3D was crowned winner of the US Air Force’s AMO Olympics Material Hurdles Challenge:

Current Thoughts

First of all I estimate the value of Novo’s stakes in New Found Gold, Kalamazoo resources, Elementum 3D couples with the sale partial sale of Blue Spec to be at least C$127 M (US$95 M). Furthermore I expect New Found Gold, Kalamazoo Resource and Elementum 3D to keep rising in value. Perhaps a lot…

Why?

Because New Found Gold might be on to something truly remarkable as I explain HERE. Bob also did a brilliant piece on New Found Gold recently where he stated the following:

“This is going to be a giant home run for everyone involved. When the shares get above $5 in US pesos brokers in the US will be allowed to recommend it. I’d highly suggest to management that they prepare for a US big board listing right now. I think Queensway is bigger than Fosterville. And I believe it will make the same sort of contribution to the market cap of NFG that Swan did for Kirkland Lake.

Today NFG has a market cap of right at $450 million Canadian. That’s going to change a lot in a hurry. Investors at this price are going to see a return of hundreds of percent. Soon.”

… There is a very real possibility that New Found Gold could be worth a couple of billions of dollars before their 100,000 m drill campaign is over. In other words Novo’s equity position in New Found Gold, which is currently valued at C$67.2 M, could become lets say C$200 M sooner than one might expect.

Then we have Kalamazoo Resources which has 1.65 Moz of gold in their Ashburton Project, Pilbara. Furthermore the company is about to come out of the boring period since recent news includes;

- 7,000m drilling program at the Ashburton Gold Project to commence early November and will focus on the Peake, Peake West, Waugh, Connie’s Find and Petra Prospects

- ~4,000m diamond drilling program at the Lightning Prospect located within the Castlemaine Gold Project (EL006679), commenced on 1st October 2020

- ~7,000m RC drilling program across four high priority targets at the South Muckleford Gold Project to commence on receipt of final Government approval

Given that Kalamazoo Resource only has a Market Cap of US$58 M I see a lot of revaluation potential for the company. This would of course increase the value of Novo’s equity stake in the company as well.

Then we have Elementum 3D which recently won a prestigious reward and has been hiring more people etc. In other words the company is growing and their patents are getting more valuable.One can sign up to their newsletter on their website which can be found HERE.

So What am I saying?

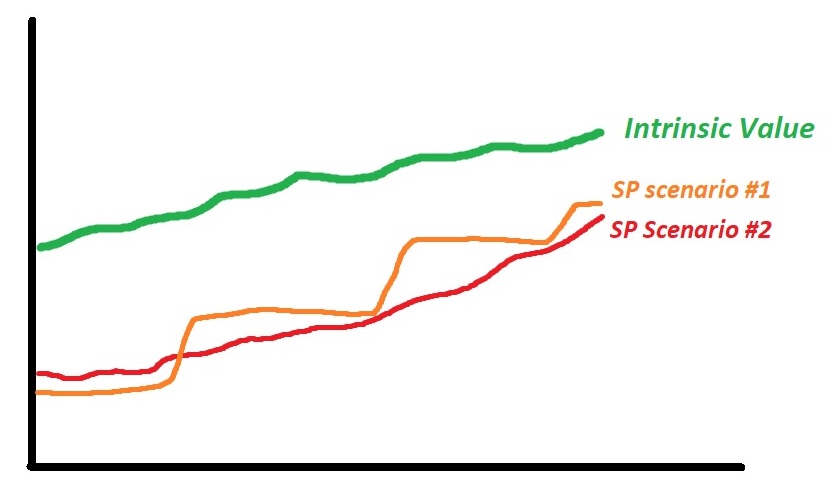

Novo’s intrinsic value has been heading higher and higher recently due to multiple factors. Yet, it has yet to be reflected in the Market Cap of Novo.

Let Me Paint You a Picture

1. Karratha

The latest news release indicated that EVERYTHING can be sorted at Karratha. The implications of this could be huge both in terms of CAPEX, OPEX, permitting and super-charging the value of the recently acquired mill. Given Quinton’s comments in the latest Kereport interview it doesn’t sound like permits are that far away either. Now, lets play with some numbers curtesy of “jimbowie” from CEO.CA:

“If you remember, the first sample from Purdy’s Reward run through a Steinert sorter, sorted out 82% of the gold into a 2% mass pull. The entire sample then had to be re-crushed to 2mm to be assayed to get the remaining 18% of the gold. What this NR implies that the sorter can now get (I”m guessing) 99% of the gold in a mass pull of 3% on 1 pass through the sorter with no additional work required. Quite the change in the last 3 years. From 82% of the gold in 2% mass pull to 99% of the gold in 3% mass pull. So for every ton of ore you process through the sorter, you get a concentrate weighting 60 lbs. This concentrate would average 67 gpt assuming a head grade of 2 gpt. A truck can haul 22 tons a trip. That equates to 733 tons per day sorted, which one sorter can easily handle. If Novo wants to process 5,000 tons per day at Purdy’s then it would need 6 sorters feeding concentrate to 6 trucks per day. 322 ounces of gold per day – 117,000 ounces per year. Looks like they have enough tons to operate Purdy’s and Comet Wells for 30 years at 117,000 ounces per year. This is hard to believe but it’s coming closer to being proven.”

Combine that with Keith Barron’s comments from his article on Novo Resources (with the scenario looking more likely now that everything might be sortable):

(Blue highlight added by me)

“It may never be possible to get a JORC compliant reserve number on this beastie but it doesn’t matter. Quinton will demonstrate, by going back to first principles through his bulk sampling programme (i.e. by doing it) that this will be the lowest cost gold mining in the entire industry….not through a geo-fantasy PEA abstraction. He will also demonstrate that he has years and years of gold-bearing conglomerate to chomp through. Unless he starts to get a bunch of duds in the bulk sampling the success already of the fossickers over some 8 km strike length tells me that this will be huge. How far and how rich down-dip? God knows…but it will be years before anyone needs to test that (unless of course you are pushed by one of those pesky investment bankers). Let me make a prediction. The Novo Discovery will be the lowest cost gold mine in the industry, by a massive margin. Maybe sub $100/oz! That’s what should be attracting people’s attention.”

To be conservative lets say the AISC is $500 instead of $100 and the production profile would be 80,000 ounces instead of 117,000. What could that mean in terms of pre-tax earnings to Novo from a (small scale) operation at Karratha?

Well, if we assume a US$1,800 gold price then it results in [(1,800-500) * 80,000] = US$104 M of pre-tax earnings.

2. Beaton’s Creek

Then we have Beaton’s Creek which is reportedly both on time, on schedule and the senior management team is now complete.

Lets assume that Beaton’s Creek gets up and running this year, on schedule, and will be producing [(1,500,000 * 2.1)/31-1)] = ~100,000 ounces per year when it reaches steady state.

Even though a) the Australian gold price is near all time highs, b) the deposit is open pitable, c) the grades are very high for an open pit, and d) the metallurgy looks fantastic, lets assume the AISC is US$900 per ounce in order to be a bit conservative. In that case Beaton’s Creek could provide [100,000 * (1,800-900)] = US$90 M in pre-tax earnings to Novo.

3. Egina

Then we have the potential beast in Egina. We know that the central Egina Project might have many tens of square kilometers of gold bearing swales. On that note I will simply pull some crude calculations from my “Egina For Dummies” piece:

“What might the cumulative operating cash flow be from Xkm2 of either zone on an undiluted basis?

Swales:

- 1 km2 of 1.5m deep swales grading 1.7 g/m3 (82,000 ounces) = AUD$195 M in cumulative operating cash flow

- 1 km2 of 1m deep swales grading 1.7 g/m3 (55,000 ounces) = AUD$130 M in cumulative operating cash flow

- 10 km2 of 1.5m deep swales grading 1.7 g/m3 (820,000 ounces) = AUD$1,947 M in cumulative operating cash flow

- 10 km2 of 1m deep swales grading 1.7 g/m3 (547,000 ounces) = AUD$1,299 M in cumulative operating cash flow

- 50 km2…”

Wrapping it Together

Based on perhaps conservative estimates we could be looking at:

- US$90 M in pre-tax earnings per year from Beaton’s Creek when it reaches steady state in lets say 12 months

- US$104 M in pre-tax earnings per year from Karratha when it reaches a (small scale) steady state in lets say 24 months

- US$137 M in pre-tax earning per year from Egina when it reaches a (very small scale) 1 km2/year production profile in lets say 12-24 months

- = Sum total of US$331 M per year

Agnico Eagle which is a high margin major currently trades at an EV/EBITDA multiple of 13.1 for 2020 according to consensus. If we assume that the US$331 M is EBITDA, and that Novo would at least get an EV/EBITDA multiple of 6 ,then it would imply an Enterprise value of 331 * 6 = US$1,986 within 24 months. This number would more than double if Novo was granted the same theoretical EV/EBITDA multiple that Agnico Eagle enjoys. Compare that to the current Enterprise Value which is around US393 M if one includes some of the equity positions and a guesstimate of what the Elementum 3D stake might be worth. Note that this is of course very speculative and forward looking but that is what investing is all about.

Another way to look at it is what Novo Currently prices in if we assume a forward looking EV/EBITDA ratio of;

- 6x = US$65.5 M in EBITDA

- 13.1x = US$30 M in EBITDA

Which I could argue implies that the current valuation of Novo Resources as a whole is pricing in lets say a 73% chance of ONLY Beaton’s Creek being able to throw off $US90 M in EBITDA per year for X amount of years (if one assume the lower/conservative 6x multiple). Do note that I indeed said Beaton’s Creek ONLY and the US$90 M could be conservative to boot.

It has become more than obvious that almost nobody in this sector knows anything about investing, risk/reward, margin of safety or how to do simple math. Well the rubber is soon about to hit the road thankfully and if Beaton’s Creek, and Beaton’s Creek only, is able to perform as expected then we’re already good.

Bottom Line

If one believes Novo is anything but undervalued then I would ask what all of this should be worth;

- Fully funded Beaton’s Creek soon becoming a potentially high margin operation

- Maybe 100,000 high margin ounces per year

- Karratha probably next in line on the back of Ngarluma agreement and ore sorters that could sort everything at extremely low costs (CAPEX and OPEX)

- Maybe 80,000 high margin ounces per year

- Egina probably next in line after that which could also have extremely low CAPEX and OPEX

- Maybe 82,000 high margin ounces per year

- New Found Gold stake worth C67.2 M and quite possibly heading a lot higher

- Elementum 3D plowing ahead towards someone like Lockheed taking it out?

- Kalamazoo going to try and grow the 1.65 Moz at Ashburton and drill multiple targets on their highly prospective Bendigo projects

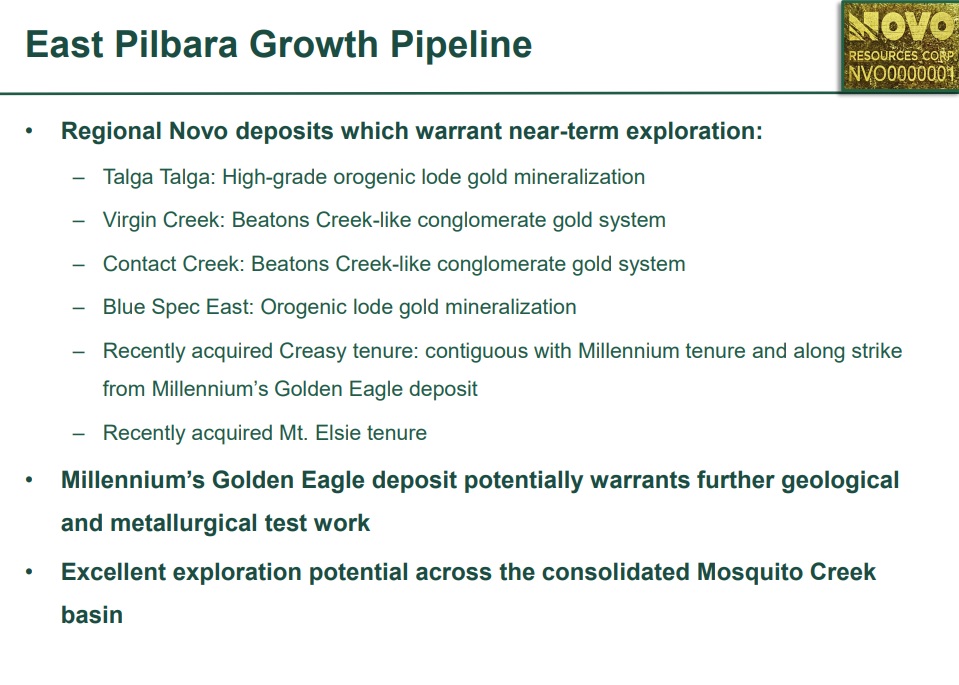

… On top of that we have:

… And that’s “just” the growth pipeline for East Pilbara which soon has an operating mill to boot.

Novo investors pretty much need either a) Beaton’s Creek, b) Small scale Karratha, or c) Small scale Egina to work in order to make a buck. If two or all three work out then we should make a really big buck. If Novo can ramp up any or all of the three in the future then we’ll make an even bigger buck still. If Novo can unlock a few more deposits such as Virgin Creek, Contact Creek, East Well, larger Egina, Blue Spec and/or Talga Talga then we’ll make a bigger, big buck. Meanwhile we have companies such as New Found Gold, Elementum 3D and Kalamazoo which I expect to continue to decrease the Enterprise Value of Novo further.

In any market: In order for you to do something smart someone else must do something dumb…

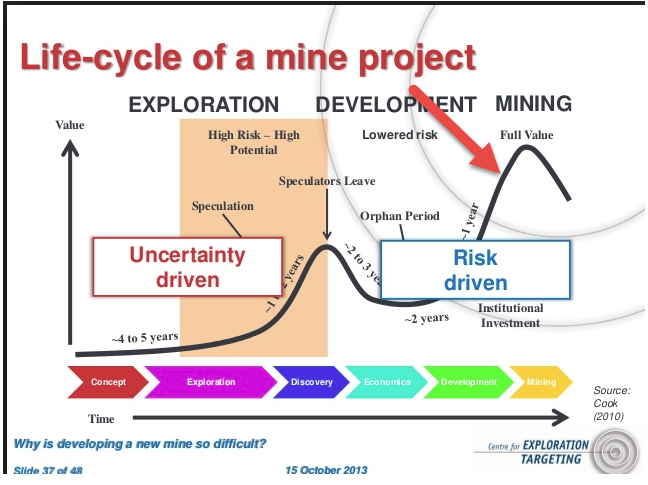

The Risk/Reward has never looked better since every of the three flagship projects are more advanced than ever and our largest investments continues to hike up the floor at the same time. With that said I have no idea when the market will finally realize how stupid it has been or what path the hopefully coming revaluations will take. Gradual increase or perhaps quiet periods followed by hockey sticks as theory becomes reality?…

All I know is that if you take the current Market Cap and then subtract the cash, growing equity positions and then divide it by number of projects then Novo is one of the cheapest companies out there. Especially when you factor in a) the advanced stages of certain projects, b) The potential impact of ore sorting on multiple semi-homogenous, semi-craton wide systems, c) The potential to treat a lot in the existing mill, and d) The potential otherworldly mine life of these systems, the Novo story is obviously beyond unique. Owning Novo is like owning 20+ juniors in one company and with the potential for the most obscene synergies you will have ever seen.

Should one be surprised that a sector that is notorious for being irrational would misprice the most unique story in the space?

I think not.

The best part about this particular story is that Novo Resources is pushing as many projects towards production as they can.

Why is this important?

Because cash flow is the single biggest “value forcer”. If Novo just sat on all projects the market might never be forced to value Novo correctly. You can see the inability of the market to fairly value anything other than a company’s flagship asset. This is why the Lundins tend to spin out exploration projects all the time and it often results in great returns for shareholders for the simple reason that it forces the market to value each project individually.

Novo’s way of forcing revaluation is to take the projects towards production instead of spinning everything out…

And ask yourself if you will be complaining that Novo traded at C$3.25/share in 2020 if it pulls in say C$1-C$2 per share in EBITDA within 24 months. This seems to be the hardest thing to wrap ones head around… That the reward in Novo is geared towards cash flow and dividends, not immediate share appreciation and a take over by some larger player.

If everyone agrees with you the chance of you seeing something that others don’t is slim by default.

Closing Thoughts

Beaton’s Creek, Karratha and Egina are all in different stages of the development slope and I would say no value is currently attributed to Karratha and Egina yet:

Note: This is not investment advice. I am not a geologist nor am I a mining engineer. This article is speculative and I can not guarantee 100% accuracy. Junior miners can be very volatile and risky. I own shares of Novo Resources. I can buy or sell shares at any point in time. I was not paid by any entity to write this article but the company is a passive banner sponsor of The Hedgeless Horseman. Therefore you should assume I am biased so always do your own due diligence and make up your own mind as always.

Best regards,

Erik Wetterling aka “The Hedgeless Horseman”

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My channel

Excellent work,thank you.

Greatly informative post as usual. If you keep this up I may be forced to increase my already outrageous position in Novo. Good luck with you continuous work on our behalf, and give Quinton our regards when you next talk.

6x = US$65.5 M in EBITDA

13.1x = US$30 M in EBITDA

Are those bullet points correct from above or are you misssing a 1 in front of 30 M?

Great article and I second the sentiments above. TY

I no longer think of Novo as a gold mining company. I believe it can become de facto the central gold reserve bank of Australia. I just own some shares in that bank.

” Furthermore Quinton stated that he will push for excess “cash” being kept in the form of gold whenever possible. ”

I like this comment!

Thanks, HH. When NuLegacy finds a 50 million oz elephant and goes for $10 or $20 a share I plan to sell it and buy more Novo.

HORSEMAN , excellent summary Of the Novo value proposition.

Only a 6 month wait to see Novo begin to execute on your outstanding analysis.

The Novo team has everything they need in place to turn your thesis into reality.

I hope Mr. Market recognizes it sooner rather than later.