Novo: Unwrapping Egina

(Note: This article includes a lot of speculation personal and forward looking statements. Always do your own due diligence. I am merely, as always, trying to explain my own personal thoughts and views. I am not a geologist, mining engineer or an investment advisor. I am just a curious guy with too much time on my hands it seems. Novo is a banner sponsor and I am very long the stock.)

Context for this article:

- Yesterday we got a news release from Novo Resources, titled “Novo’s First Egina Trench Supports Exploration Model”.

- Quinton Hennigh was also interviewed by Cory Fleck of Kereport.com. (A must listen!)

- Recent Egina article: LINK

- Egina map dump: LINK

My main take aways from the recent interview and News Relase:

(Comments by me in italic)

- The 600m trench was a “blind” trench which showed to have gold scattered through the entire length

- Very lucky or very promising?

- Majority of gold in the 600m trench is located in the swale

- In line with Quinton’s/Novo’s hypothesis which means the exploration model looks to be accurate!

- Ground Penetrating Radar seems to work great for identifying the swale(s).

- Might be a very cheap and effective tool to pinpoint the richest pay zones all over Egina

- Multiple areas around Egina with proven lag gravel gold occurrences

- Egina, Blue Moon, Womerina and the mid point between Womerina and Egina.

- Already looking at high margin processing options for Egina

- Obviously signals confidence

- Novo/Sumitomo might skip Feasibility Studies etc and go straight to full scale production if trial mining is successful

- Would speed up timeline to production immensely

- Sumitomo is very excited about what they are seeing in the first trench

- Quinton will meet with the Sumitomo team in a few days

- CEO Rob Humphreyson is currently looking at Eddy-Current Separators as a processing possibility

- Could mean dry processing, i.e. no water needed, which would be a big deal

- Nearly all gold in the trench is coarse which makes dry processing much more feasible

- Sumitomo is working “hand in hand” with Novo as it relates to relations with the Aboriginals

- Novo is currently collecting bulk samples immediately adjacent to the trench they just dug

- Samples being process at the moment

- Expect to have a number of samples to present within 1-2 weeks

- The bulk samples will contain BOTH the gold picked up by the metal detectors (numbers in the NR) and finer gold

- Believes that the bulk samples might contain 50% more gold when including the finer grain gold

- When Novo gets Heritage Clearance they will immediately step out and do more trenches

- Will also locate areas for the coming trial mining

- Should have a “concrete picture” of where to test/trial mine before years end

- … As well as more bulk samples

- “Because this is going so well, we are kinda seeing a more compressed timeline”

- Novo is putting together plans to start trials with the Eddy-Current Seperators on Egina gold

- “If we come up with a solution then the green light for test mining just moved up considerably”

- “Some time by next year we could be test mining this”

- If successful, it might break some timeline records for exploration to test mining

- “We are very excited about how well things are coming together right now”

- Maybe 3-5% of the gold might be ACTUAL fine gold that would require wet processes

- Current assumption is that it’s not worthwhile to try and capture the fine gold and just focus on the coarse gold

- Payzone is extremely shallow

- Could potentially scoop up the gravel, process it, and then put it straight back down!

- “Conceivably very very cheap mining and processing”

- “Could literally mine, process and put the material back and reclaim it within a day or two”

- Basically unheard of in this business as far as I know!

- Short term news flow:

- Bulk samples

- Might get Heritage Clearence later this month which would let Novo start opening up more trenches

Egina has lately become the main focus for Novo Resources and it is starting to show why that is. First of all, this looks to be as shallow as it gets for a potential gold deposit. It was stated in the News Release that the overburden looks to be only 0.2m thick, which means that only around 20cm might need to be removed before the actual pay zone starts. Furthermore, this is a free dig, loose, gravel horizon so no blasting etc will be required. Basically it’s an earth moving operation that should require very little CAPEX and OPEX. The main technical issue is probably access to water. Well, Novo has been looking at processing options for some time now and are currently looking at possibly using Eddy-Current Seperators, which requires no water. It’s kinda like a less advanced sorting machine (Think Tomra ore sorters which have shown remarkable trial results at Comet Well):

This solution might work very well because according to Quinton, over 95% of the gold content looks to be made up of coarse gold, which is perfect from a processing point of view. This solution is typically used to process waste material as far as I understand. If that’s worth it (profitable), I wonder how profitable it might be when sorting out almost pure gold out of gravel? Regardless, the possibility of being able to do dry processing would be a very big deal as it eliminates one of the main obstacles.

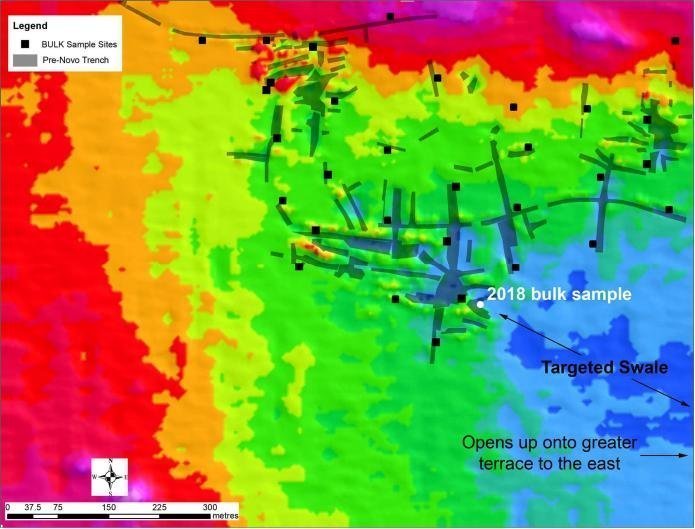

Many people might start to think about the obstacles of coarse gold as it relates to Comet Well for example. However, the beauty of Egina is that a) It’s not hardrock and b) it’s not under several meters or more of hardrock overburden. Why does that matter? Well, that means that in the case of Comet Well, one would need to incur costs to blast and remove a lot of hardrock to confirm the presence of gold in the underlying (extremely coarse) conglomerates. Remember, the fine gold at Comet Well is primarily limited to the nugget halo, which is only a few millimeters away from the nuggets. In contrast, Novo could simply dig a shallow ditch anywhere around Egina and quite readily confirm any presence of gold. Not only that, but Novo is also using Ground Penetrating Radar equipment to map the gravel horizon(s). The current hypothesis is that the best gravel horizon will be located in the “swales”, or depressions, at Egina as can be seen in this video (blue = depression):

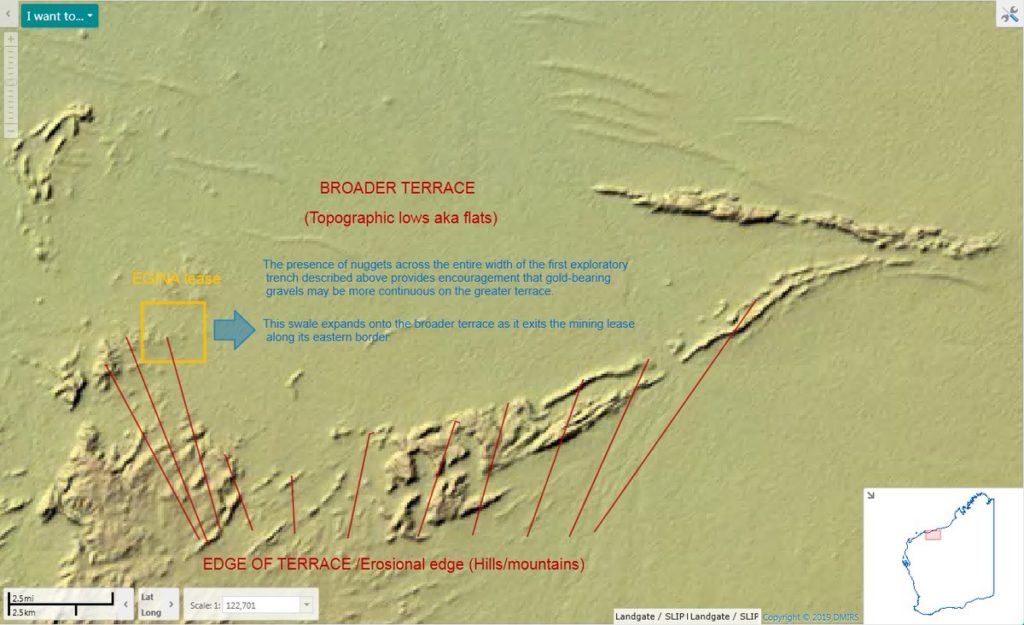

Remember, this was “blind” trench and yet they detected nuggets all through the almost 600m long trench. As you can see in the video, the depression (“swale”), looks to be expanding towards the east:

This is exactly what Novo hoped to see, since it is the direction towards the “greater terrace”, which is a huge where the land is flat like a pancake as you will see in the next slide. Furthermore, this quote from the news release is KEY:

“Nuggets were found scattered along the entire length of the 579 m long, 3.65 m wide north-south oriented trench, but most were recovered from a 50 m long interval within a swale, or topographic depression, in underlying basement rock as identified by ground penetrating radar (“GPR”) near the northern end of the trench. This swale is open to the east where it appears to expand out onto the greater terrace“

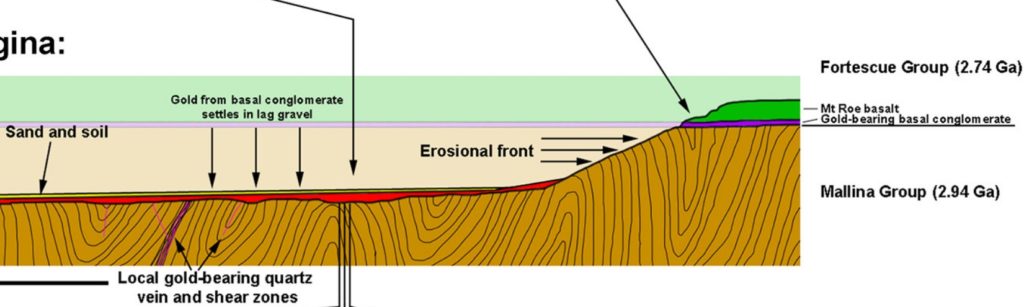

… As you can see, that is an immense and very flat area. The reason why it is flat is because some million years ago the ocean came in and cut/flattened out thousands of square kilometers between Egina and the modern coast. The Egina Mining Lease, which can be seen above in yellow, is at the edge of the “erosional front” and is the location of Novo’s 600m trench. Remember, the swale/depression is broadening out to the east which means it is broadening out into the area where the oceanic processes hammered the land for a long period of time. This meant that any gold which was hosted in rocks younger than the underlying Mallina Basin sediments was freed and deposited all over this area by the sea. This could potentially include gold hosted in Mt Roe conglomerates, Hardey Formation conglomerates and any other hardrock gold occurrences which litters the area.

Data dump for context…

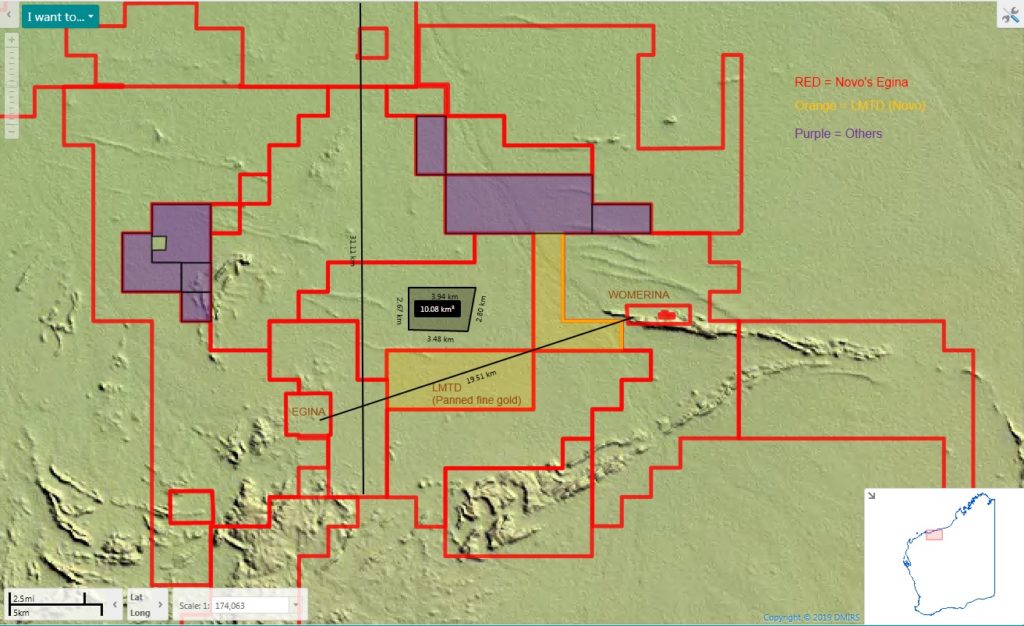

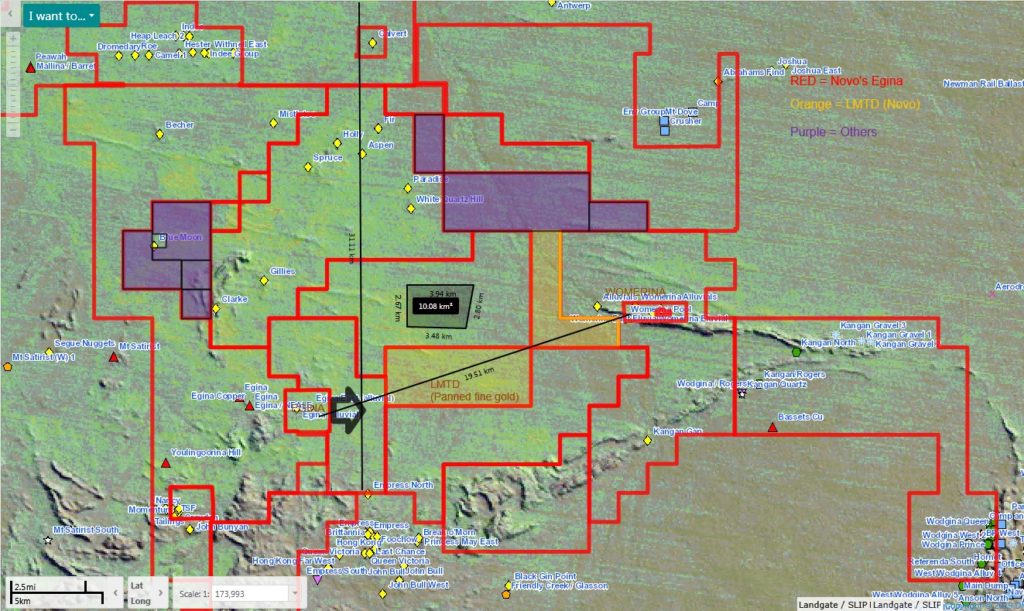

- Topographic map of the main Egina area with Novo’s interest added:

… As you can see, Novo/Sumitomo’s interest covers the majority of the Greater Terrace in this area. Furthermore, we know there is gravel gold at Egina and Womerina, which are 20km apart. Further still, LMTD (New Fronteer Exploration) went out to the middle of the Greater Terrace, between Egina and Womerina and got gold in their pan… Were they just lucky or does that infer that the gold bearing horizon might be present in a very very large area? Food for thought.

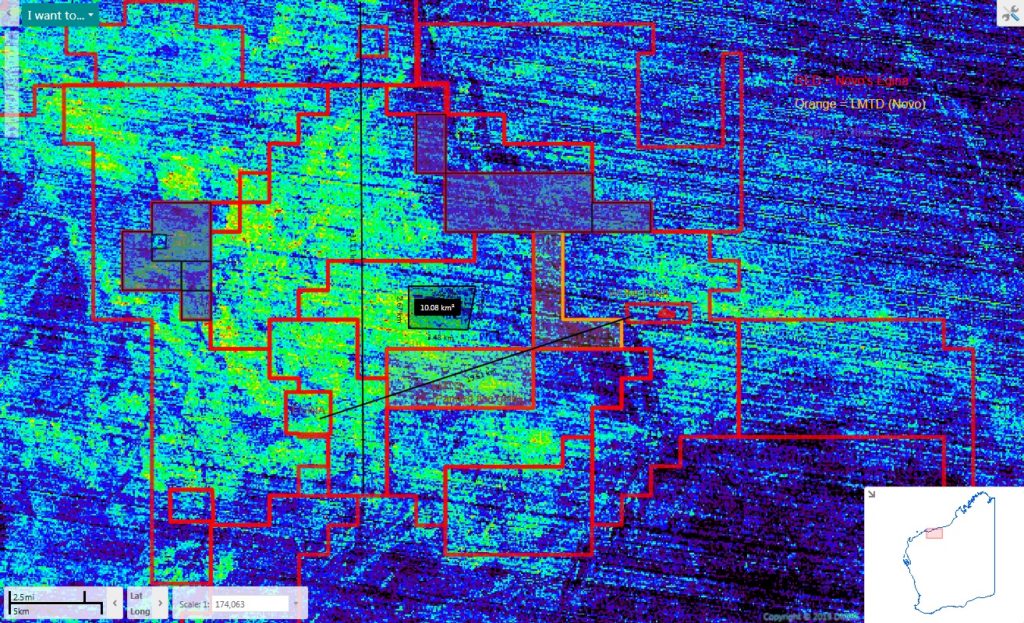

- Egina area with a quartz filter:

- Egina area with topography, quartz filter and mineral occurrences (yellow = gold occurences):

… As you can see in the slides above, the Egina area lights up like a Christmas tree with the quartz filter and high readings are present around many hardrock gold occurrences as well as covering most of the “flatlands”. Some quartz might possibly related to lode gold and some might be related to quartz found in the Mt Roe conglomerates as per the this Novo slide:

To Sum Up

There is no mistaking the overall confidence emanating from Quinton Hennigh, Novo and Sumitomo right now. Case in point is the fact that the Novo/Sumitomo duo is already about to trial processing options for Egina and are talking about skipping any economic studies and head straight for trial mining and then full scale production. That kind of path requires high conviction in terms of the possibility for the Egina lag gravels to be economic to mine. If one takes the time line mentioned in the interview at face vale then Egina might become a mine at record speed granted everything goes well (The average time from discovery to a mine is somewhere between 10-20 years!).

If Novo/Sumitomo is able to mine these gravels through dry processing options such as Eddy-Current Seperators coupled with the target horizon being extremely shallow then I think there is a good chance that a mining operation could be wildly profitable. Makes me think about Keith Barron’s comments about Egina: “It will be like owning a bank”.

A lot of work is left to be done before we could make such a bold claim as Egina being one of the largest gold fields on earth, but thankfully I would argue that Novo’s Enterprise Value (EV) is nowhere near pricing in such a future anyway.

Thus, I remain very long Novo Resources as I think the EV is not reflecting the combined potential from:

- Having Sumitomo Corporation as a direct partner and “personal bank” to cover any funding needs

- Egina

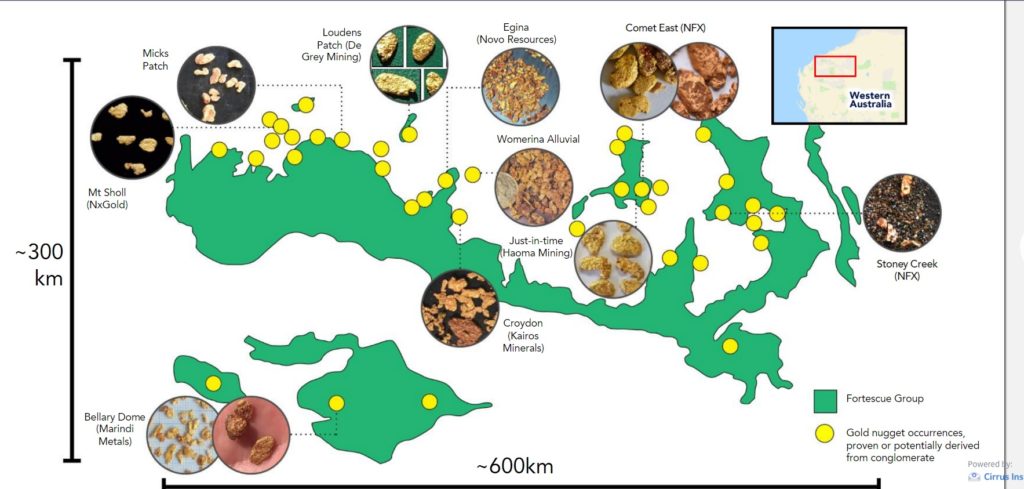

- All other areas prospective for Egina type gravels including the ground picked up from De Grey Mining

- Comet Well and Purdy’s Reward

- All other areas prospective for Mt Roe conglomerate gold including Contact Creek

- The fully permitted ~1Moz, oxide, high-grade, open pitable Beaton’s Creek

- All other areas prospective for Hardey Formation conglomerate gold including Virgin Creek

- Talga Talga & Blue Spec

- All other areas prospective for lode gold

- 13,000 km2 of land with potential to host all of the above

Novo is not about one prospect or one mine. If Egina works and it covers a vast area, then the Egina Project area might host the equivalent potential of multiple conventional mines, alone for example. Same goes for Mt Roe and Hardey Formation. If Novo makes Comet Well and/or Beaton’s Creek (Hardey Formation) work, then that might open up countless similar deposits all around Pilbara. That is the bet. that is the prize. Investing is not about certainties, but Risk/Reward. What is such a “ticket” worth? What chance of success is reflected in Novo’s current EV? Food for thought.

Novo’s current Enterprise Value is around US$251M, including C$40-C$45M in cash, with Egina being financed by Sumitomo Corporation.

(Note: This is not investment advice and I am not a geologist. Always do your own due diligence. I own a lot of shares of Novo Resources which I have bought in the open market and am thus biased. Novo is a passive banner sponsor on my site. )

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Horseman

You do such a great job explaining and laying out the info. It appears to me to be wildly positive. When do you think the stock market, Novo, would start to make a response. Thank you

Thanks for the kind words Joseph!

I try my best to break things down for other people. I am no geologist myself but fortunately I have picked up things here and there, and especially about Pilbara.

I do not really know to be honest. It might be assays or step out trenches that prove that Egina is continuous. Might be deals or financings (like an announcement that Beaton’s Creek will head to production with the help of Sumitomo). But in short: I really don’t know

All the best,

HH

I vary new at minning stocks, I’m learning a lot of all new stuff, QH enthusiasm first got me hooked,

Then I discovered HH, even though I’m down 45%,I’m staying on this Ride!

I started out wanting to know how Coal was formed in the Earth. After learning about Peatmoss

I could go on and on but I got to go down to the Beach now and watch the sun set

Thank you Roger

Same here Roger. I try to learn something new every day and so far I have learned a lot through my due diligence work on Novo and Pilbara. The lack of response from the market sure sucks, but a lot of that probably has to do with Novo not showing their cards yet. I got a tonne of stuff that I am looking to get updates on but Novo is very secretive, at least for now. If this is indeed one of the biggest gold fields in the world it is understandable that they want to get everything right from the start, because once the cat is out of the bag, there is no going back. I expect that the doldrums for Novo won’t last much longer (but no promises).

I have gotten a lot more interested in geology because of this company as well :). Enjoy the sunset!

All the best,

THH

Erik, I love your analysis that I could never come up with.

I can hardly wait to see the results of your analysis of the coming bulk sample numbers.

I can’t believe the cat isn’t already out of the bag. $US17,000 from a 560M trench on the first try seems pretty awesome to me.

Thanks for all that you do!

Hey JP,

Thanks for the kind words! I’m no geo, but I am a very curious person hehe. A lot of it is still extremely speculative of course so don’t take my articles to the bank if you know what I mean :P.

Yes, well I have given up on trying to understand how the marginal buyer/seller (the market) thinks. In my eyes, the valuations in the junior sector is faaar away from being efficient, and when I read some of the arguments used by the Novo bears for example, I sometimes can’t believe what I am reading…

Here’s to hoping that the Egina Mining lease is NOT unique, but rather just a glimpse of what the entire terrace(s) from Egina to the coast might look like!

Best regards,

HH

Hi HH:

My biggest position is Novo, with 41000 shares.

But I’m looking at Egina related juniors too, specifically De Grey and Pioneer due to their JV’s with Novo and proximity to Novos Egina piece.

If Egina turns out to be as good we think it might, would you speculate with more of your money on Pioneer or De Grey (or both?)

Thanks in advance,

T.

Hi Todd,

Novo is my biggest holding as well and has pretty much been the case since 2016, for better or worse haha. 41000 is a very impressive number! Lets hope our patience and QHs brilliance will pay off for many years to come.

I personally don’t like to speculate in the other juniors. My Pilbara portfolio is 95% Novo and 5% Pacton. There are a few reassons for this: a) I have a harder time buying shares listed on the ASX, b) I think Novo might actually be the cheapest when accounting for total prospective land package, stage of the projects (BC is a fully permitted deposit already for example), c) The quality of the backers and partners for Novo, d) cash on hand, and e) The people involved in Novo…

I know very little about the management teams in most other Pilbara juniors, and I usually put People as the top criteria when I evaluate an investment opportunity. I respect Quinton a lot and I have met the guy in person. He is extremely smart and cares about shareholders. The thing I hate with some juniors is that even if the company is successful, in actually finding something, the management/board sometimes finds a way to screw over us small retail investors. Quinton is someone who would never do that in my book. Everything he does (especially the delays) is for the benefit of Novo’s shareholders in the long term IMHO.

With that said, having a piece in either of those juniors shouldn’t be the worst thing in the world. DEG already having a few Moz of hardrock gold (and counting) might end up being quite valuable, even though I personally view Novo as a better Risk/Reward case.

Best regards,

HH

Remarkable posts and insights. I read every article and every press release on Novo and every interview with Quinton. I’m just an individual investor but having followed Novo for 2.5 years, I’ve build a really sizable position when the market gives me a gift. There will be a day when this story solidifies and the world learns about Western Australia, it’s endowment and its founder. Then the only question will be, when is the right time to take some off the table, because my gains have been truly life changing. My first 15,000 shares I was able to get for $0.66/share and in 2017 I watched this position go up >1000%. I didn’t sell. I sometimes think about if I would have sold the position and piled back in after it’s long and painful correction, eventually hitting $1.46 USD. I’m not greedy, just trying to this time keep the gains:)

Hi Kevin,

Thank you for the kind words. I wouldn’t be putting in all this work if no one found it useful, so I am very happy to hear you like it!

It sounds like you has done better than me in Novo, great job! I started taking profits way too early in 2017 because I had no idea what Karratha was about, or what Pilbara was really about for that matter. It wasn’t until late 2017 or something that I got my “aha moment” after spending thousands of hours on DD, and then I loaded up even more, just in time for the market to get totally bored with Novo haha…

With that said, I think Novo is a COMPLETELY different beast today and I consider Novo to be a better Risk/Reward case today than at 0.66 in 2016 for example. Sure it’s got a higher valuation, but now we know that the gold is all over Pilbara and that there looks to be multiple semi-basin wide to basin-wide systems. The question is of course what % of that might be economic to mine. There might be billions of ounces of gold in the ground, but unless it can be mined, and mined at a profit, it’s of course worthless. I do think it will take time, but that we will possibly unlock all three placer systems (Mt Roe, Hardey and Egina) with the help of unconventional tech, and IF that happens, Novo should go up a lot in value. Nothing is guaranteed, but if the brainiacs involved in Novo solves one or more of these large puzzles, then this could be a once in a lifetime events (IMHO).

Best regards,

HH

Could be cool to add the date to your articles Thank you for your excellent work!

Thank you for your excellent work!

Hi Thierry,

The dates should be presented at the bottom of each post. Otherwise let me know and I will start putting in the dates manually at the top of the articles.

You’re welcome! Glad you like it!

Best regards,

HH