Egina: Fun With Numbers

I thought it would be fun to play around with some numbers based off of the data from the recent news release and interview…

From the News Release:

- A total of 162 gold nuggets with a total weight of 324 grams was recovered through systematic metal detecting of Novo’s first exploratory trench

- Nuggets were found scattered along the entire length of the 579 m long, 3.65 m wide north-south oriented trench, but most were recovered from a 50 m long interval within a swale

From the Kereport interview:

- Bulk samples might contain 50% or more gold when including the “finer grained” gold

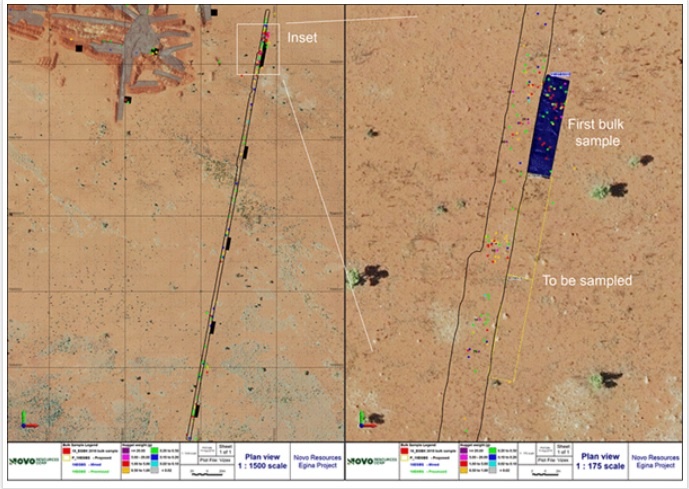

Now lets try to paint a picture of what that could mean in terms of gold value and lateral foot print. The following slide is from the NR:

As you can see in the slide above, the first bulk sample pretty much looks like a copy of the adjacent trench in terms of detectable nuggets. Thus, for simplicity sake, lets assume that ground heading to the main target doesn’t get better nor worse.

Recap of the known data:

324 grams of gold detectable gold was recovered from a trench measuring 579 x 3.65 m2 = 2113.4 m2.

Extrapolations:

Now lets bump it up 50% to account for the finer gold content. That would mean that there is 324 x 1.5 = 486 grams of gold in that trench.

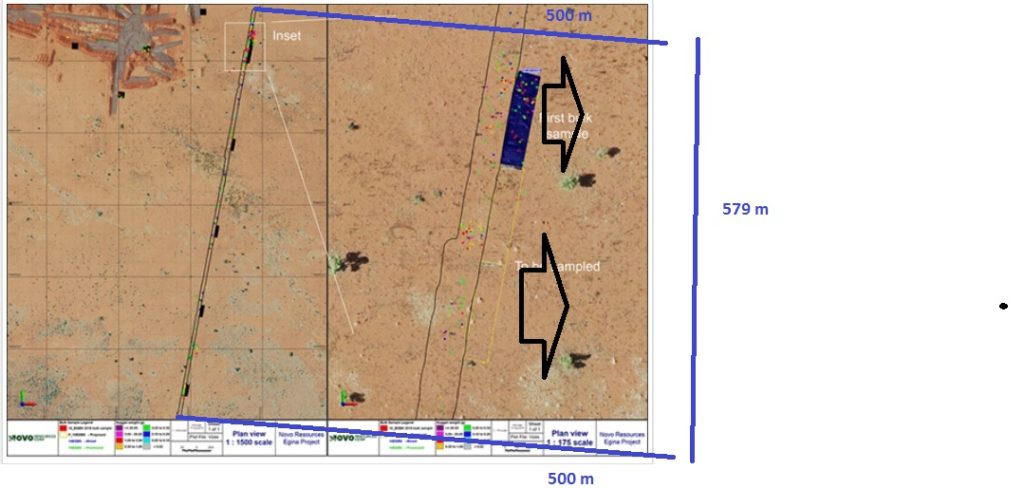

Now lets extrapolate that 3.65m wide slice into a 500m wide trench instead, like so:

This rectangle (“Trench 2”) measuring 579 x 500 m2 is made up of 137.0 copy-pasted slices of the original trench. Given that the swale looks to be broadening out, this might be conservative, but at the same time it is indeed a theoretical extrapolation so conservatism is justified.

Total extrapolated gold content for Trench 2 is thus: 486 * 136 = 66,582 grams of gold or 2,141 ounces.

2,141 ounces is worth about AUD$4.7 M assuming an aussie gold price of AUD$2,200/ounce.

Recap: A copy pasted extrapolation measuring 579 x 500 m2 of the known trench would contain gold worth around AUD$4.7 M.

A 579 x 500 m2 rectangle equates to a rectangle measuring 0.29 km2.

That would mean 1.0 square kilometer of the exact same gravel profile would contain a gold value of 1 / 0.29 * 4.7 = AUD$16.2 M.

Thus, a 10km2 patch would theoretically contain gold worth AUD$162 M.

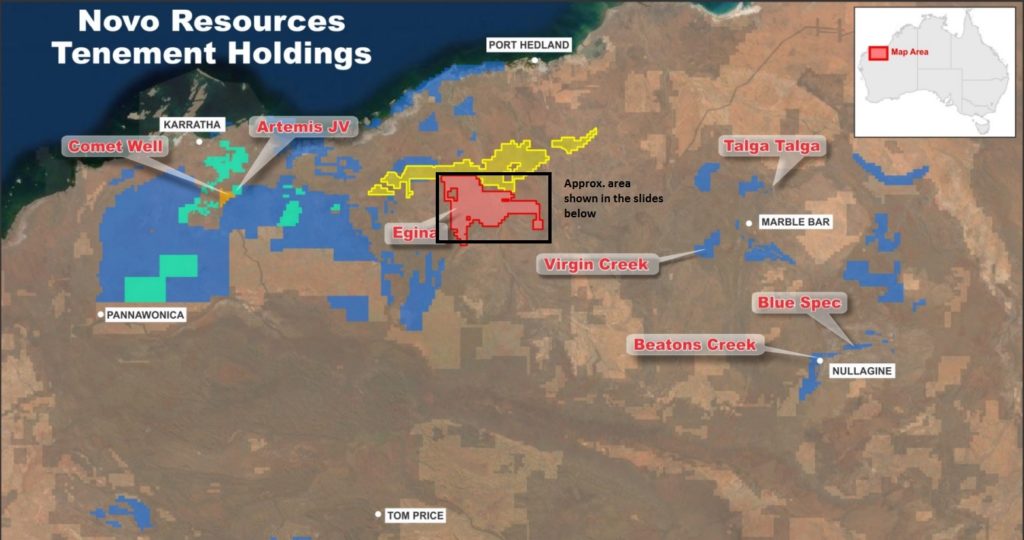

- For context:

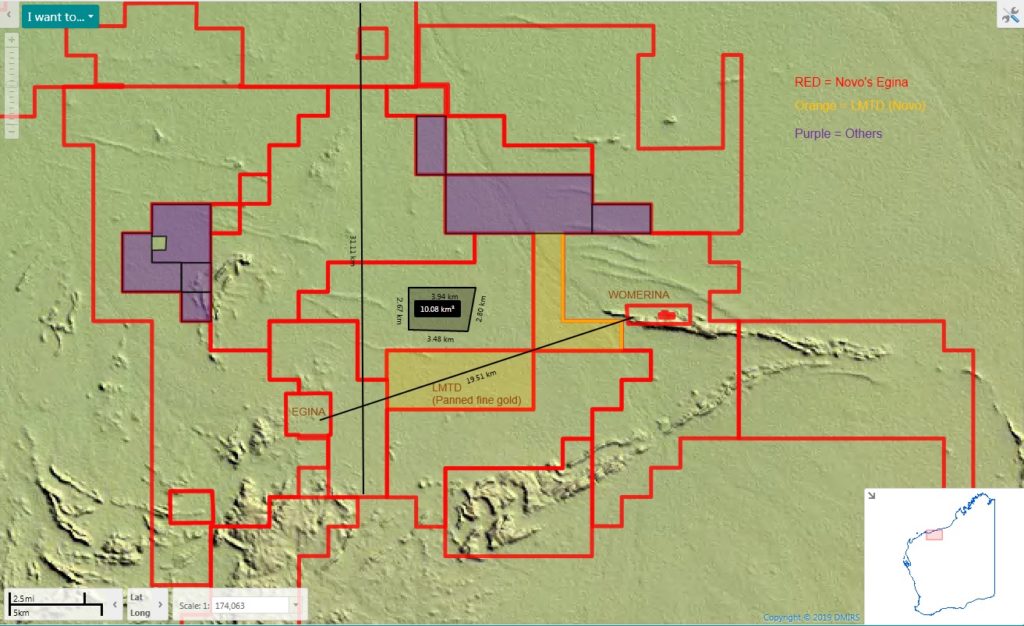

- Zoomed in view of the Egina Project area:

… I added a 10km2 box in the slide above for further context.

Now there are still a lot of question marks left to be answered that would affect the gold content as well as margins:

- Will the gold content improve as we head east from the Egina Mining lease where the swale(s) (main pay zone) broadens out?

- Will Novo/Sumitomo mine everything or focus on the swale(s), thus lowering recovered gold amount but hikes up margins?

- How much of the thousands of km2 of the Greater Terrace hosts mineralization similar to the first trench?

- What will the costs be?

- Will the pay zone get deeper out in the Greater Terrace and perhaps host more gold?

- Is the Egina Mining Lease area better or worse than the average gravel profile?

- What kind of footprint would we be allowed to mine?

To Sum Up

I wrote this article to put some context in regards to what the trench data could mean for the Egina Project and Novo’s vast land holdings outside of the Egina Project that are prospective for Egina type gravels. If the recent trench is a valid indicator of the average gold content across the immense terraces that covers thousands of km2, then the inferred value of Novo’s terrace ground could be… Very high.

We will know more in due time, but I think I understand why Novo/Sumitomo are seriously contemplating to go straight for full scale production and skip economic studies.

Now I’m patiently waiting for the bashers to proclaim that math is equal to pumping (It’s a trap!).

(Note: This is not investment advice and I am not a geologist. Always do your own due diligence. I own a lot of shares of Novo Resources which I have bought in the open market and am thus biased. Novo is a passive banner sponsor on my site. )

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

To: HH

From: Ed Goldschmidt

Re: Egina Value

Dear HH,

Dr. Hennigh’s positive outlook on the Egina trench results disclosed in Tuesday’s News Release have left me wondering what I’m missing. My initial thoughts led me to look at higher grade channels in swales.

I looked at but could have missed on CEO, what I have put below and I think it is right. Ignoring the bulk sample, non-detectable and fine gold and the 50 meter higher concentration of nuggets in the trench but focusing just on the average grade of the trench, a different result and outlook occur.

1) The average grade of the trench:

Volume- 579 m x 3.85m x .9m(av. trench depth)= 1902 cubic meters

Nuggets= 324 g

Grade of Trench= 324g/1902cubic meters= .17g/cubic meter

Each cubic meter= .17g

2) Volume(cubic meters) of 1 kilometer

Length= 1000m

Width= 1000m

Depth= 1m (this assumption may vary outward on terrace)

Volume= 1000m x 1000m x 1m= 1,000,000 cubic meters

3) Grams of Au per cubic kilometer(based on trench average)

a) 1 kilometer square and 1 meter in depth= 1,000,000 cubic meters

b) 1 cubic meter(Au at Egina)= .17g/cubic meter(based on trench results)

c) 1,000,000 cubic meters of Au= 1,000,000 cubic meters x .17g/cubic meter= 170,000g/cubic kilometer

4) Au in ounces per kilometer

170,000g/kilometer / 32g/ounce Au= 5312.5 ounces per kilometer

5) Value in US dollars per kilometer

5312 ounces Au per kilometer x $1500/ounce Au= $ 7,968,000/kilometer

6) Assuming 100 square km at 1 meter deep, the total value would be:

100 kilometers@ $ 7,968,000/kilometer= $796,800,000/100 kilometers

Pretty impressive number! I can see why Dr. Hennigh and Sumitomo are happy especially with over 2000 kilometers to explore.

Unless I am wrong in my calculations many Novo market participants are missing this and have gotten out at just the wrong time.

Please disregard this, if you are aware these calculations have already been done or if you find an error. On the other hand, please feel free to use if you find it of value.

Hi Edwin,

You’re math looks conservative and correct. The total gold amount hosting within these terraces might be truly staggering but I doubt we will be allowed to plow hundreds of km2 for better or for worse. It will probably not be needed either since even mining 100km2 will not be done for many many years. What I am very eager to see is if the gold gets more concentrated and/or richer when we go out in the terrace and why I am very much looking forward to Novo being allowed to step out into the real potential prize.

If the Egina gravels end up being “wavy” with parallell high-grade channels in between low-grade channels for example, then we might end up focusing on the high-grade areas which should give us the best margins. This would limit the overall footprint (ground disturbance) and might be the best way to move things forward. With that said, if we identify a processing technique that makes this an extremely low cost operation then it might be economic to plow everything… If that is feasible, I have no idea.

Best regards,

HH

HH, want to say thank you for your articles. Been out of this for well over a decade and so appreciate your insights.

Regarding Novo’s chart, are you seeing a double-bottom trend reversal pattern from roughly last Sept until present?

Hi Stephen,

Happy to hear and you’re welcome! 🙂

I am not a good trader and seldom actually buy/sell based on my (amateurish) TA, but I do look at it from time to time. As it stands now I am inclined to think that we have put in a double bottom however. The market hasn’t discounted much of the positive NRs that has come out over the past months so I think the “risk” is to the upside… Meaning I don’t know what kind of news would negatively surprise the market given the current sentiment, but we would only need a shift in sentiment to start discounting the last months progress (all IMHO ofc).

Double bottom: https://invst.ly/btyx3

Furthermore, the bollinger band width suggests that we should see a big move in the not to distant future: https://invst.ly/btyx9

… Abyssmal sentiment, coming news flow and a potential double bottom pattern makes me believe that the move will probably be up. BUT, that’s certainly not trading advice!

Best regards,

HH