THH – Investing is an Art: Lessons From Poker

“Poker, of all games, is most like stock investing.” – Peter Lynch

In poker one can lose with AA 10 times in a row and win with 27 off suite 10 times in a row. Being outcome dependent in this scenario would be to argue that the one going all in with 27 off suite was right because he/she won 10 out of 10 times and that the one going all in with pocket aces was wrong. A non-outcome dependent person would have the complete opposite view. That going all in with Aces 10 times in a row was obviously the right decision and going all in with 27 off suite was obviously the wrong decision…

In some ways investing is a lot harder because we never know the exact odds of anything, unlike poker, where the cards are typically turned up on the river and one can calculate the exact chance of winning. In investing we never know for sure what will happen in the future and furthermore we never know or how the market will respond. We also do not know the exact odds of different scenarios happening on top of their being an infinite amount of future scenarios. All this highlights the importance of PRICE paid because that is the only known factor an investor can control in any given moment. An extreme example of this would be a debt free company with zero or negative Enterprise Value. In this case no Expected Value at all is attributed to the company’s assets and thus one could argue that there is a 100% chance of the assets getting hit by a tactical nuke is priced in. Anyway, at that point there is theoretically no red flag large enough for anyone to not invest, yet there are obviously people who will still sell. What I am trying to get across is that paying a low Price, relatively and even more so in absolute terms, is the ultimate weapon in an investors arsenal. It is universally effective. At zero Enterprise Value one could theoretically invest in a company one knows nothing about that operates in a sector that one knows nothing about. In reality this is not the case since crooks will find a way to steal the money from shareholders and thus the real value of cash is lower than the amount at face value unfortunately. Anyway I think you get the point about PRICE paid being the ultimate weapon in all things investing.

- In investing most people look for absolute certainty.

- A subjective “red flag” can put many investors off regardless of price paid (if it priced in or not)

- In poker one:

- One is forced to embrace and live with constant uncertainty since the almost never is absolute certainty

- One seeks absolute certainty about probability.

- One sees the assumed probabilities in conjuncture with “Price to play” in order to calculate the Expected Return

Only over a long period of time can one be relatively sure that one is good at assessing risk/reward as well as acting rationally. In Poker you can play 20K hands in one month and lose. Next month one might play 20K hands and win even though ones strategy was almost identical. This is called variance and highlights the fact that one can make similar quality decisions and yet have very different outcomes in a given time span.

The slide below is a profit/loss chart of my last stint at a Swedish poker site right up until I quit poker and started investing full time. Note how there were quite a few stretches of hands played that had very different results even though I probably had pretty similar strategies in place. There were stretches lasting 10-20K hands where I lost money, stretches of 10-20K hands where I was neutral and 10-20K stretches where I printed money. One thing I note is that in the second half of the graph the downturns got milder and the chart less volatile overall. I think that can be attributed to my overall strategies/skills improving if I had to guess (but I can’t rule out favorable variance):

When you have favorable variance and are “running hot” it is akin to being in a bull market. Mistakes can get masked and one starts feeling like a god in light of the favorable results on paper. In reality one might be playing worse than when one has poor variance and poor results (like a bear market). This highlights the need for discipline and outcome IN-dependence. It’s easy to think one is playing great when the results would suggest you are and vice versa. In reality the optimal strategy must always be used and one has to focus on getting the process right and see good results as the eventual bi-product. If the process is correct the results will align, eventually…

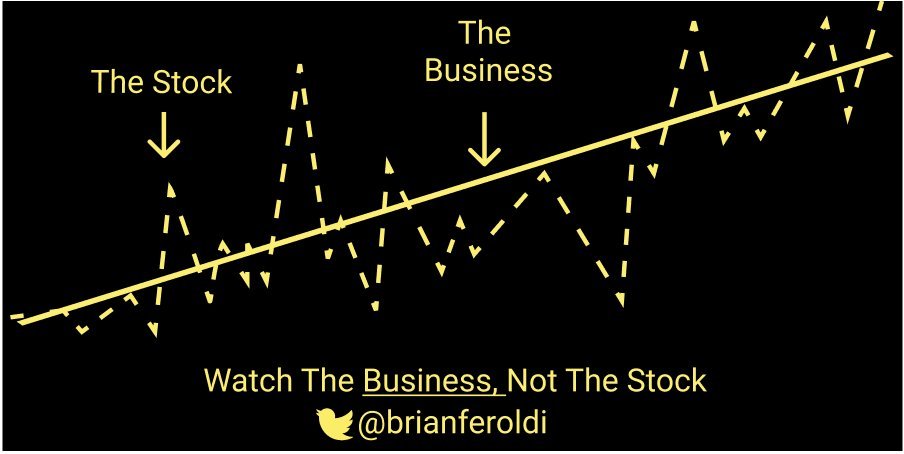

In investing you don’t get the feedback nearly as quickly. One can’t “play out” 40,000 cases in say two months. Perhaps one “Plays” 10 cases over 12 months. And again, just as one can lose with pocket aces 10 times in a row one can have unfavorable “variance” in 10 stocks straight or at least appear to be over a given time frame(!)…

Being somewhat right on news (fundamentals) and also looking right (market reception/perception) is what makes investing more complex than say poker. In poker there is no debate whether a full house beats a straight. It does. Always. With that said there is obviously a lot of psychology in play at all times (like feigning strength or weakness aka bluffing etc).

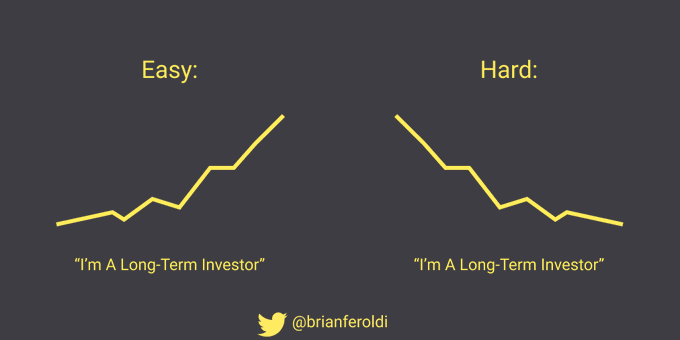

Yet one must have a theoretical strategy in place and apply it before one even knows if it works or not. Basically believing before seeing without the option to go back in time and adjust obviously. How this translates into the reality of the market place is that one can have identical (value) investing strategies yet see totally opposite results over a given time frame:

… The difference above could be explained by many different factors such as Black Swan events, unfavorable outcome variance, overall differences in sentiment levels and much more. The feedback will be completely different since you look super smart on surface in one scenario and super stupid in the other scenario. Furthermore you can’t even know for sure if your strategy is even good or bad as in you don’t even know what scenario should be closest to reality on a long enough time frame…

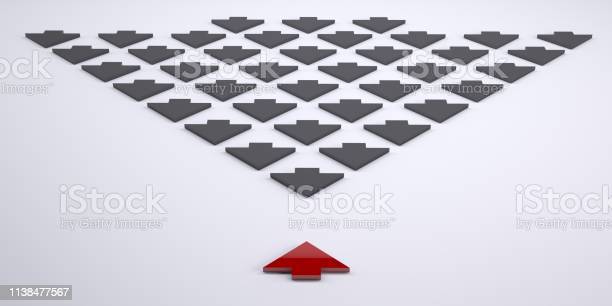

If you are a value investor it also means that you will should have a completely different opinion than the herd at extremes. So not only could you be fighting negative feedback in the case of paper losses that screams that you are wrong but you will also be fighting a swath of opinions from people who agree with the market that your are wrong:

So to sum up:

Investing is like Schrödinger’s cat where an infinite amount of future scenarios are possible and then on top of that there are an endless amount of ways for the market place to price those scenarios. It’s basically Schrödinger’s cat to the power of two. With that said it also means that one might see below expected turn of events yet get rewarded on paper thanks to lets say very positive sentiment. This is also why there are so many ways to make money in the market. Some use the value investing approach, and wait for the market to turn from a voting machine to a weighing machine, and some ride the voting machine (traders). One can of course apply varying degrees of both. The important thing is KNOWING what strategy you are using and FOLLOWING it at all times regardless of short to medium term results. Note that this assumes that the strategy is sound to begin with(!).

Again this highlights just how much of an art long term investing really is and just how much faith is actually involved… How many battles you must fight along the way, like paper losses and masses of people who tell you that you are wrong, while knowing that there are not even any guarantees that your strategy is efficient even if it actually is.

- Stop taking every paper win/loss so seriously

- Stop taking every paper win/loss personally

- Stop reading in so much into short term or even medium term results

- Never stop trying to identify logical fallacies in your investing approach regardless of apparent results

Harsh truths:

95% of people do not beat an index over the LONG TERM.

Thus, to be a successful value investor, is to be alone by definition…

To be unshakable, immovable…

The last man standing…

You have to become…

Batman…

In other words you have to have and/or develop…

- Self confidence/conviction

- 95% do not beat an index in the long term

- Said 95% will still bombard you with ideas/advice/noise and you will have to be able to disregard it

- Have the ability to trust your theory/strategy even though majority will not understand/appreciate it and disagree with you on a daily basis

- Discipline

- Have the ability to stick to your guns/strategy through thick and thin even though you might appear to be making mistakes

- I think it is bad to switch between strategies and instead focus on one and stick to it

- Have the ability to opt out of FOMO and have the fortitude to be greedy when others are fearful

- Have the ability to keep focus on the longer term where there is a bigger edge despite majority discussing the short term

- … The ability to think about news releases #2-#15 when all the discussion and market is focusing on the next news release

- A lot of the best performers (growth stories) are called chronically expensive at any point in time

- This is because future expectations are built in and what looks expensive now can often look cheap a few months ahead

- Have the ability to sit on your hands and do nothing for an extended period of time

- Especially hard when your portfolio is going down and you appear to be completely “wrong”

- Have the ability to look very wrong for an extended period of time

- Have the ability to look at paper losses and realize that what you own went down in Price but not necessarily Value

- Have the ability to realize that a low risk 50% return over 12 months is absurdly more valuable than a 5% chance of returning 100% tomorrow via grass root drill specs

- Have the ability to realize that if your case is built on 12-24 months expectations then one should not stray due to short term volatility/results unless the case changes enough for the worse.

- For example I don’t think it is a good idea to buy a stock that is arguably cheap based on the expected results of a full drill campaign and then sell if the first few holes disappoint.

- Have the ability to stick to your guns/strategy through thick and thin even though you might appear to be making mistakes

- Intuition/natural ability

- For better or for worse one obviously have to kind of “know” what is right to do regardless of the short term results and while not knowing the long term results

- Intuition can of course get better as more experience is attained and as one has more cases to reflect on

- Researching and learning successful investing concepts in order to internalize them becomes paramount

- Withstanding “myths”

- “Let your winners run” and “do not forget to take profits”

- You will hear either or depending on results which highlights the fact that outcome dependence is rampant among investors

- One can of course do a bit of both however

- “Let your winners run” and “do not forget to take profits”

- Knowing yourself

- If you know/feel you get emotional at a certain position size then know when to size it down.

- If you know you get easily influences by FOMO or fear you should stay away from forums/twitter or at least be very selective in terms of whos opinions you are exposed to

- See Black Swans For What They Are

- The ability to realize that a Black Swan even like the COVID crash is out of your hands

- Sometimes I see people bag on companies, and shareholders of said companies, because the stock price has been lackluster due to COVID collateral

- Your risk management should however account for possibilities of black swans

- If you’re on margin you might be right about the LT case but could get killed by a Black Swan before the LT has time to materialize

- The ability to realize that a Black Swan even like the COVID crash is out of your hands

I know my investing results over the last 6, soon to be 7 years, and I am occasionally called arrogant since I often disagree with people about investing theory. Ironically I think the most volatile and sentiment driven sector out there is one of few areas where appearing arrogant is actually good if you know what I mean. If everyone agreed with me then there is no way I could beat the market by definition since there would be zero opportunity. With that said I don’t necessarily think 6-7 years is a long enough time frame to make definite judgment. Yet I have conviction that I have a sufficiently good overall strategy and a belief that the longer term results will cement it.

Summing up Key Points

- Never stop learning and reflecting on experiences

- Shut out noise from the 95% who will tell you that your are wrong even though they do not themselves have a track record proving they are right

- Do not confuse short term or even medium term results with proof of concepts in terms of the quality of your strategy

- However do not stop reflecting on wins/losses in order to try and spot a logical flaw

- Look beyond the time frame of the short term oriented masses and build your case on subjective Expected Value events 3-24 months ahead

Personal adjustments over the years

- Greater appreciation for margin of safety for long term compounding

- You cannot compound

- Smaller position sizes in pre-discovery plays and greater appreciation for the fact that explorers can be much cheaper (better) from a Risk/Reward stand point after a discovery even though the stock might have gone up 100%.

- Realizing that trading was never my cup of tea and that the very thought of owning something that might be overvalued in hopes of someone paying more was disturbing to me. This led to low conviction and a lack of actual trading strategy.

- Realizing that value investing resonated with my core and allowed me to be authentically greedy when something was cheap. This allows for high conviction and increased buying when others experience a lot of pain. It however often leads me to, on surface, take profits “too early”.

- Realizing I have a reluctance to “chase” if I do not feel like I am in “early” even though it might be totally rational to chase

- Realizing I have a reluctance to buy if there are shareholders involved which I do not like even though it might be a good case

- Realizing I like to be a rebel and am reluctant to buy anything that is popular on MinTwit (just for the sake of proving I can beat the market anyway I guess)

Adjustments from Poker specifically

- In poker you can play an obscene amount of hands and risk little of your capital on each hand

- The large number of hands means that a mathematically pure EV based approach should have time to pay off

- In investing you should not just go all in based solely on EV math since losing money is much more costly due to compounding when you have 100% capital deployed, vs say 0.1%, as is the case in any given hand of poker

Note: This is actually investing advice.

Best regards,

The Hedgeless Horseman

LOL. Investing is a discipline and skill.

What do you think art is?

I think it’s little bit of luck, a little bit more in finding sectors undervalued or megatrends before they are well known, a little bit in buying at a cheap price and some art.

Ourstanding! Too good for a daily comment. Needs to be a chapter in HH’s book. In the current down market it is hard to realize that over the long run HH’s notions of Risk:Reward ad poker-type reaoning are key components in value speculation. Mr. Poker has been sharing a lot of valuable thinking with us. Keep up the good work, Erik!