Comparing Cross-Asset Correlations Before and After Trump

I was interested in examining the changes in cross-asset correlations for the months leading up to the elections versus the correlations after the election, ergo before and after “The Trump Hype” aka “The Reflation Trade”.

Additional background reading:

“Morgan Stanley: A ‘correlation crash’ is happening in the marktets” – Businessinsider.com (Dated: Jan 20)

Data

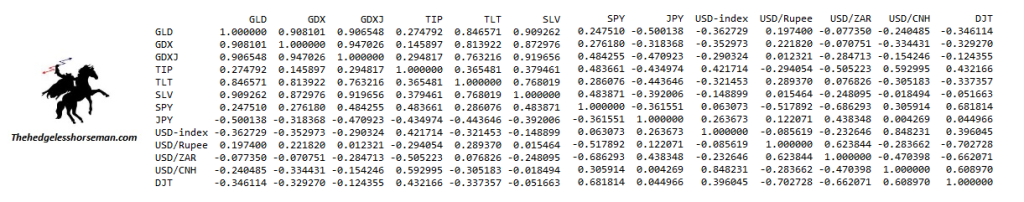

- First off is the correlation matrix for the time period 2016-06-08 up until 2016-11-08 (election day):

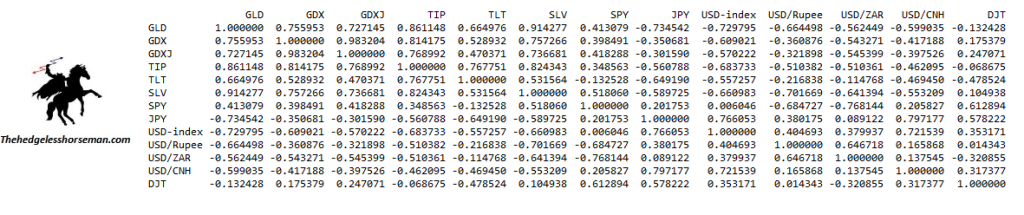

- Next is the correlation matrix for the time period 2016-11-08 (election day) up until 2017-04-07:

Analysis

Focusing on correlation changes for gold (and miners):

- Currencies seem to play a much bigger role since correlations (anti/negative correlations) have shot up pretty dramatically.

- USD-index correlation has gone from -0.363 to -0.730.

- The often acclaimed “main manipulation tool” USD/JPY has gone from -0.500 to -0.735.

- USD/CNH (Chinese Yuan) as gone from -0.240 to -0.599.

- Lastly, golds correlation with the Indian Rupee/USD exchange rate (inverse of USD/INR) has seen a huge swing, going from -0.197 to positive 0.664 !

- Gold miners tracking of gold (and silver) has gone down a bit.

- GDX has seen a correlation coefficient decrease from 0.908 to 0.756.

- GDXJ in turn has seen it decrease from 0.907 to 0.727.

- Gold’s correlation with TIP (Real Rates) has seen a huge increase.

- Going from a correlation coefficient of 0.275 to 0.861 !

- Meanwhile, gold and TLT (US 20+ Year Treasury Bond) correlation has gone down

- Decreasing from 0.847 to 0.665.

- Gold and SPY (S&P500 proxy) correlation has gone up a bit.

- From 0.248 to 0.413.

- Gold and it’s negative correlation with DOW Transports decreased to almost no “anti-correlation”.

(There are other noteworthy changes in cross-asset correlations, but I will leave that to a future post.)

Conclusions/Thoughts

The first thing that springs to mind regarding the correlation changes for gold is that after the election, and thus during this period of the so called “reflation trade”, it now seems to be much more effected by currency fluctuations and real rates compared to the months before the election. It suggests that in this “new era of Trump” gold is not only trading more like a CURRENCY, but also as an asset to protect against a decline in PURCHASING POWER (inflation hedge). These characteristics may of course change at any point in time.

This leaves me with the following questions regarding the mindset of investors during the Trump presidency (at this point in time at least)…

- Have investors become more worried about inflation?

- Does not seem so far fetched since many analysts are attributing the whole post-election stock market euphoria to the so called “reflation trade”.

- Also, inflation spikes have been seen in data from at least Europe and the US.

- Many commodities including oil, copper and zinc have rissen quite a bit from their respective lows.

- Some of Trumps policy goals seem to be involving larger deficits (trillions of infrastructure spending).

- Have investors become more worried about the integrity of the worlds reserve currency and/or FIAT currencies overall?

- More news about international trade deals that exclude the world reserve currency (USD) are coming out every week it feels like.

- Central banks are beginning to talk about rate hikes and easing of QE while much economic data from especially the US and China seem to be pointing to a slow down, not an acceleration.

- Increased likelihood of a FED audit since Trump got elected.

- Confusion about future composition of FOMC members, and therefore policies.

Afterthoughts

Should have added the Euro since there probably is a lot of anxiety regarding the Euro because of the coming France election etc. It may also have been interesting to add a few industrial commodities like oil and copper since they also would have shown higher correlations with real yields for example (inflation protection).

Five months of data does of course include more “noise” than multiple years etc.