Chart of the Day: Will the FED Rate Hikes Kick-Start Inflation?

No one could have escaped hearing financial media pundits talk about how bad rate hikes are for gold. What is interesting is the fact that since the start of FED’s latest hiking cycle in late 2015, gold has actually rallied right after each hike (Potentially with the exception of this latest hike).

So ,what gives…?

It may be because the market believes the FED is making a mistake and that each rate hike takes us closer to the end of the tightening cycle and the beginning of more aggressive forms of “helicopter money”.

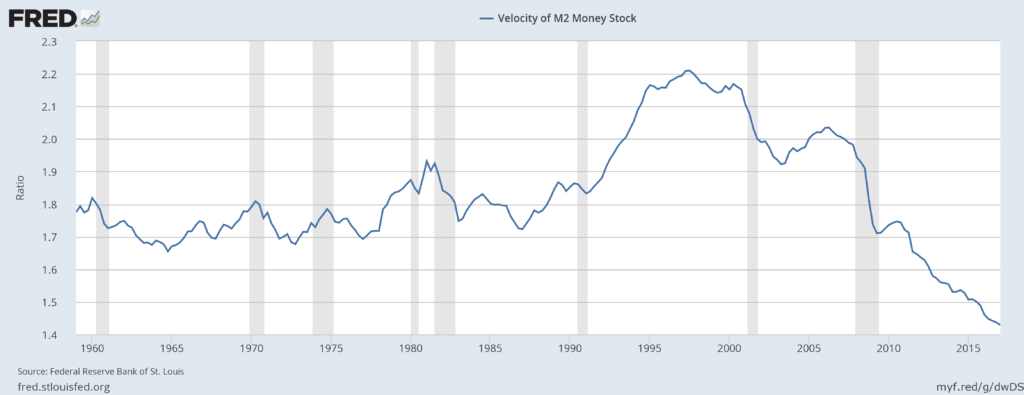

It may also be because the market believes something may be about to change in regards to money velocity, which has been trending down for about 10 years(!), and thus kept a lid on inflation no matter how much money the FED prints:

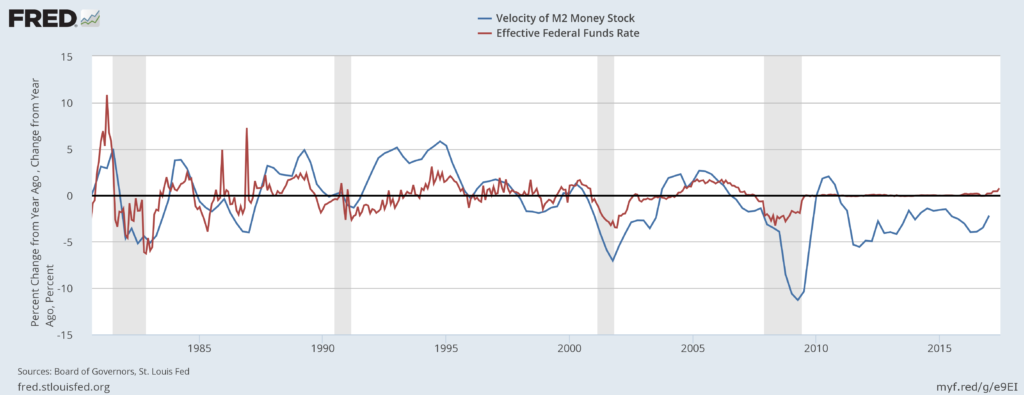

If that horrible downtrend was a bout to turn up, it might lead to an inflation shock given how much money is slushing around in the system. And for it to turn up, rate hikes are perhaps exactly what the doctor ordered:

Notice that these lines track each other pretty well, and that as of last quarter, both lines has been going up together (again). If M2 Money Velocity starts to really pick up, helped by FED rate hikes, we could see inflation rear it’s “ugly head” again. Much to the chagrin of every day people, but not so much to the precious metal investors. Add in more geopolitical turbulence in the middle east, leading to a spike in oil, and we could see a perfect storm in terms of shock inflation.