Charts of the Day: Warning Signs For the Stock Market

- BIG divergence between the stock market and the underlying fundamentals:

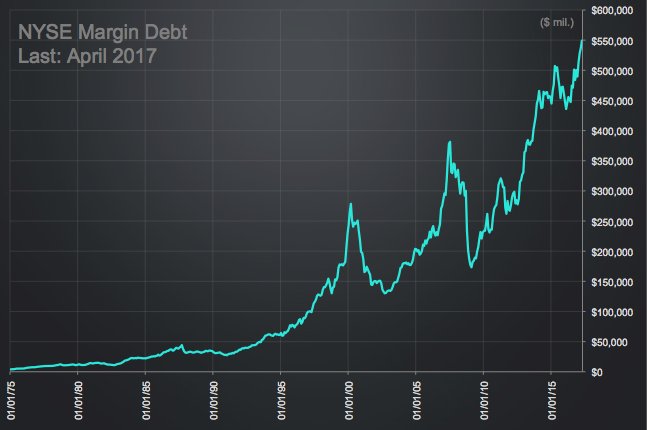

- Margin debt at all time highs:

- “Irrational exuberance” indicator at highest point since at least 2001:

To sum up: There are bubble warning signs pretty much everywhere one bothers to look. This market is fueled on speculation (“Greater fools”), debt and hope. Everything of course made easier by the record amount of central bank liquidity pouring in, chasing yields. With financial institutions, pension funds and all kinds of investors getting basically ZERO yield from fixed income, is it a surprise that PE ratios have been pushed up to bubble levels?

Bonus chart: