USD/JPY has been the driver for a lot of different asset classes for quite some time. It showed unusually high correlation with SPY, gold, silver and the miners. The atrocious ending action near resistance may prove to mark at least some form of rally in...

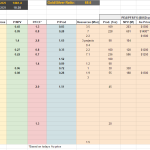

Continue reading » April 26, 2017 admin Gold, Gold & Silver Stocks, Silver, Silver & Guld No Comment Perhaps you have heard about the issues Van Eck have had in regards to GDXJ, in that the ETF has experienced such big inflow volumes that it started to push 10%+ ownership in some miners. This has led to operational problems and can lead to...

Continue reading » April 20, 2017 admin Gold, Gold & Silver Stocks, Horseman's Portfolio, Silver, Silver & Guld No Comment Background In the last couple of days, some of my best performers have been Novo Resources and Orca Gold. These two companies performed pretty well despite gold posting a minor decline. I have personally found that the mentioned shares seem to trade somewhat differently compared...

Continue reading » April 19, 2017 admin Gold, Gold & Silver Stocks, Silver, Silver & Guld No Comment Bought some more shares of Sage Gold, Southern Silver Exploration as well as Kootenay Silver. Sold a small percentage of Golden Arrow Resources. Also added a small position in JDST (A 3x leveraged gold junir bear ETF) for hedging purposes. I think the next few days...

Continue reading » April 18, 2017 admin Gold & Silver Stocks, Silver & Guld 1 Comment Gold and silver are having one of their best days in quite some time, while the mining indices GDX and GDXJ are underperforming. Why is this…? When gold and silver is up 1.5% and 2.0% respectively, the rule of thumb is for miners to be...

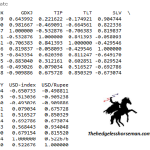

Continue reading » April 11, 2017 admin Gold, Gold & Silver Stocks, Silver, Silver & Guld No Comment I decided to add the currency of the worlds biggest or at least second biggest gold consumer, and the biggest silver consumer to my correlation table, namely the Indian Rupee (INR). One would think that the strength of India’s currency, ergo the international purchasing power...

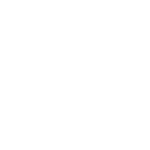

Continue reading » April 5, 2017 admin Silver & Guld No Comment Below is a snapshot from one of my spread sheets I use for comparisons in regards to gold developers and explorers. The valuation data is updated automatically every 2 minutes or so (Gold/silver price, stock price and exchange rate). I may be putting some documents online...

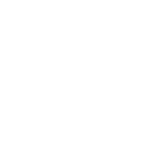

Continue reading » April 4, 2017 admin Silver & Guld 1 Comment I was interested to see what the correlation was between different assets and asset classes during the period from when gold topped 2011, to when it bottomed 2015. I just had to include the Yen (USD/JPY) since more and more people are noticing its seemingly...

Continue reading » April 3, 2017 admin Silver & Guld 2 Comments I believe that there will be some huge moves in the precious metals in the near future since we are nearing the end of some critical wedge patterns in both gold, silver, the silver/gold ration as well as the mining stocks. The direction of the...

Continue reading » March 29, 2017 admin Silver & Guld 1 Comment I believe the coming months will be very interesting…

Continue reading » March 25, 2017 admin Silver & Guld No Comment