A Look at Gold Miners Correlation Numbers

Background

In the last couple of days, some of my best performers have been Novo Resources and Orca Gold. These two companies performed pretty well despite gold posting a minor decline. I have personally found that the mentioned shares seem to trade somewhat differently compared to other gold holdings. What the cause is, I can’t say. Maybe it is because Orca and Novo is more dependent on exploration success?

What I like about companies such as Orca and Novo is that these kinds of development companies with huge exploration potential could very well be winners even if the price of gold pretty much goes nowhere in the coming years. This means that I feel I can be less accurate as to when we are in a bull market or close to a rally in gold.

In contrast, companies like Bear Creek Mining and Sandspring Resources have deposits that are already well drilled out, generally aren’t THAT focused on further development/exploration unless gold heads higher. These are two examples of so called “optionality plays”. If gold goes nowhere, I reckon these companies will also go nowhere since adding low grade ounces in a low gold price environment doesn’t give much bang for the buck if they are still pretty much uneconomic and/or hard to finance. Add maintenance costs and the picture gets even bleaker. But if I knew for a fact that gold would rocket higher tomorrow, I would reshuffle my entire portfolio into these kind of companies, since they could go from uneconomic to hugely economic, basically overnight.

TLDR: I believe a company like Sandspring has more “market risk” than Orca, because for Orca to be a successful investment, it is less reliant on simply a higher gold price.

… That is why I personally try to balance my portfolio with both high and low precious metal companies when it comes to “market risk ” . The result should be a portfolio with lower volatility since it is diversified in a way, despite being in the same sector. It should be noted that my first priority is to have solid companies regardless, ie diversification is not a goal in itself for me when it comes to precious metal miners.

Down to business

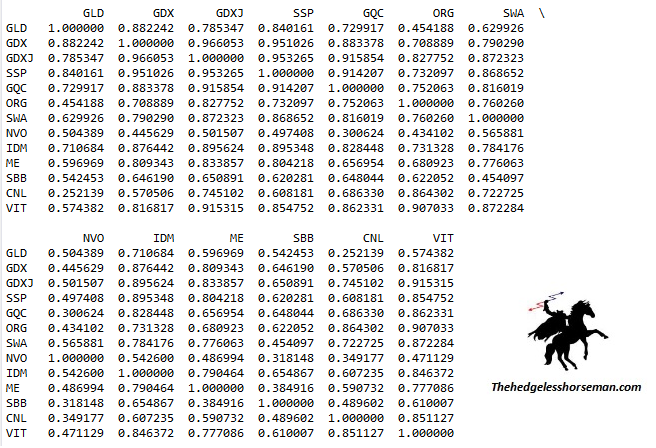

Anyway, I thought it would be interesting for others as well as for myself to compile a correlation matrix (a measure of how closely an asset tracks another) including some of the most popular junior gold stocks and see what we get. One should keep in mind that the numbers below in no way guarantees that the correlations will look the same going forward, since these kind of companies are very much “hit and miss”. This means that any given news item (drill result, soil sample, JV agreement etc etc) will often make a huge impact in share price regardless where gold is heading at any given point in time.

From a portfolio risk and volatility perspective, it would be optimal to include companies that have low correlation with one another. For example; NVO, SBB & CNL seem to have low correlations. This then also suggests that there are big company specific factors other than the gold price that investors are keeping an eye on (and/or low portfolio sharing among investors). If one would simply like to trade the miners as a leveraged bet on gold, then GDX has been the most accurate vehicle in terms of tracking gold’s movements (which could be expected).

The pretty much “shovel ready” companies SSP and GQC seem to have their company valuation tied with the price of gold more than the other individual companies, which is not unexpected since they have already passed uncertainty mile stones such as exploration success and project size.

The high correlation numbers for SSP, IDM, GQC, VIT and SWA could also imply that these companies share a lot of portfolio ownership. Thus if some individual investors are bullish or bearish on gold they will buy and sell these companies respectively, in tandem.