White Gold Corp (WGO.V): Gotten Too Cheap?

White Gold Corp has been pretty beaten up lately and the question is: Is it warranted?

Setting The Scene:

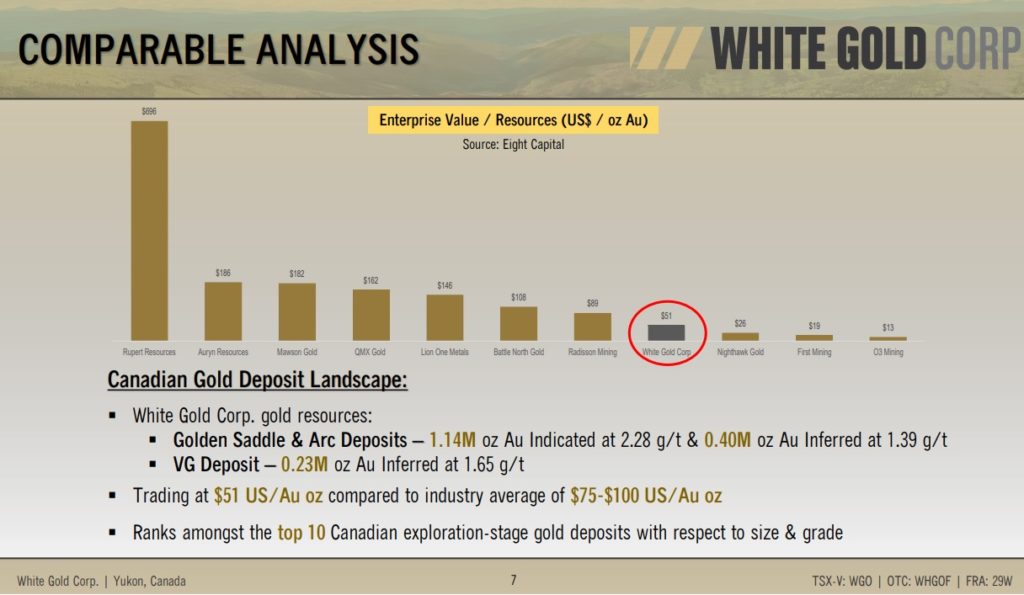

From a relative valuation perspective the company is certainly not expensive based on an EV/Oz basis:

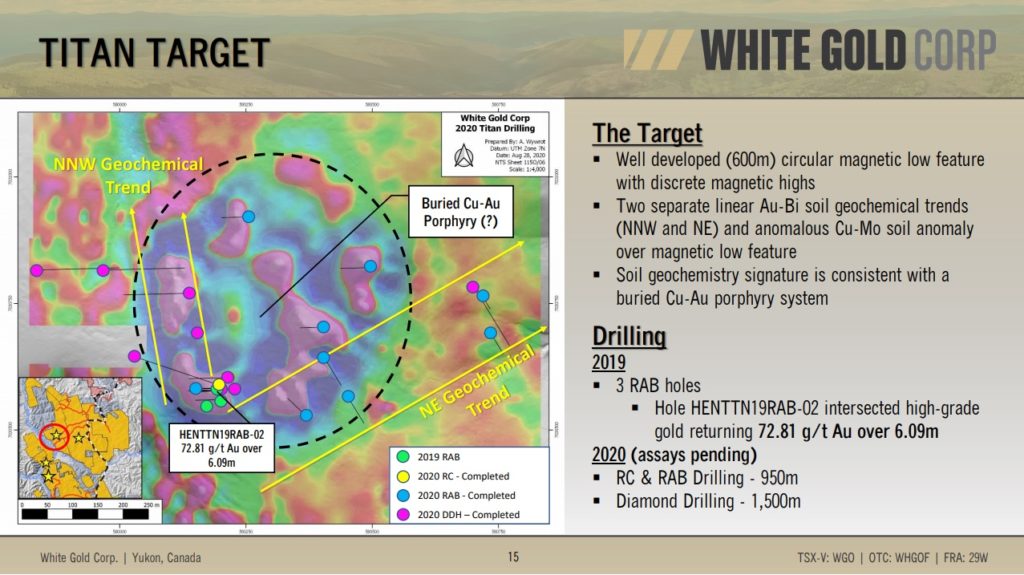

With close to 2 Moz in resources, with good grades for open pit deposits, a huge land package, more targets than I can count, it would suggest that the risk/reward ought to be getting pretty good at these valuation levels. One thing that I think has put a damper on sentiment is the long wait for assays from the Titan target:

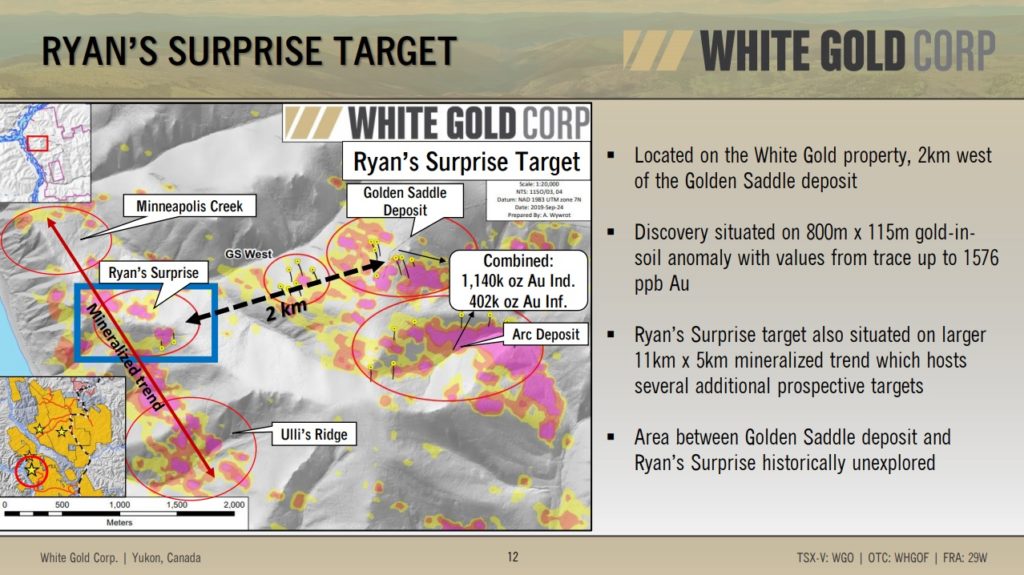

The company drilled three RAB holes in 2019 and one of them returned a spectacular 72.71 g/t Au over 6.09. Obviously there is something going on there and as per the slide above there might be a Cu-Au porphyry system hidden below ground. The 2020 drilling looks to cover quite a bit of ground so if there really is something there I would expect to see some sniffs in the upcoming drill results. With that said the company has already released results from the Ryan’s Surprise target:

… Which is located 2 km to the west of the Golden Saddle deposit (which has a resource over 1.5 Moz already). The drill results were quite encouraging as per the October 14 NR:

Highlights include:

- The diamond drilling program comprised 6 drill holes totalling 1,632.5m, with all holes encountering multiple gold intercepts, several of which are amongst the highest grade intercepts encountered to date on the White Gold property.

- High-grade gold intercepts were encountered in 5 of 6 holes including 17.40 g/t Au over 3.47m in WHTRS20D013, 12.80 g/t Au over 1.00m in WHTRS20D014, 9.10 g/t Au over 1.00m in WHTRS20D015, 10.96 g/t Au over 3.76m in WHTRS20D017 and 8.69 g/t Au over 12.30m in WHTRS20D018.

- Drilling was carried out on three 50m spaced cross-sections to test for extensions of mineralization along strike and down dip, and to further evaluate the geological/structural interpretation.

- Gold mineralization remains open in all directions and has now been encountered over a strike length of 250m by 130m wide and to a vertical depth of 300m. Mineralization is structurally controlled in brittle fracture and breccia zones predominately in metaquartzite and shows a strong association with anomalous arsenic.

- Ryan’s Surprise is situated on a large 11km by 5km mineralized trend which hosts several additional prospective targets

“We are very pleased to have encountered additional high-grade mineralization at the Ryan’s Surprise in new zones and extensions to previously encountered mineralization in multiple directions. These results and the close proximity to our established resources provides further evidence of the growth potential of these projects. We are also further encouraged by the prospectively of the other targets in this area which share geological and other characteristics with this recent discovery”, stated David D’Onofrio, CEO of the Company.

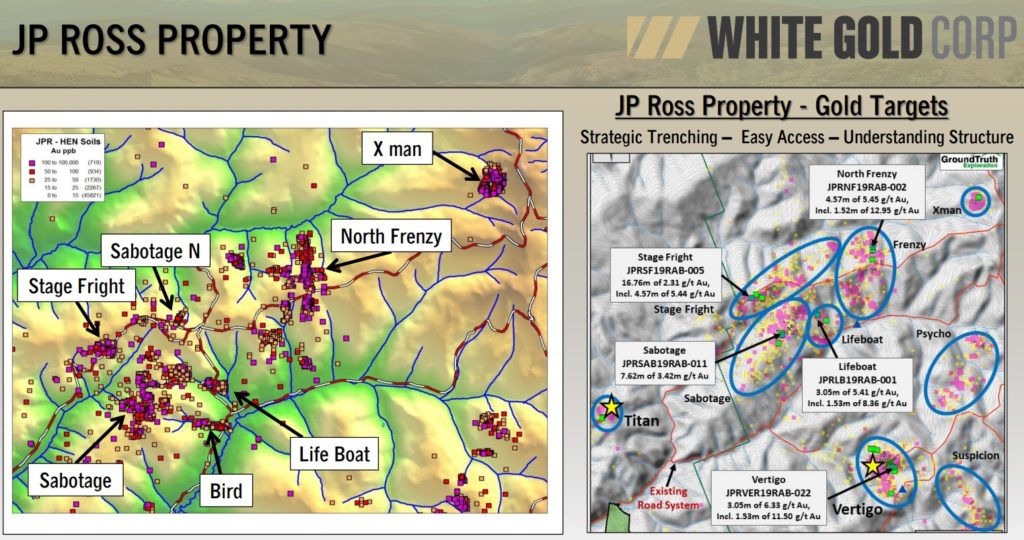

… Again, there is obviously something kicking around there and its not far from the Golden Saddle deposit which means that the threshold to reach critical mass should be way lower compared to a potential stand alone operation. The company also released encouraging trench results from multiple targets (8 targets tested in total) on October 22:

Highlights Include:

- Twenty-nine (29) trenches totalling 1,114 linear metres were trenched on 9 separate target areas utilizing an 8-ton tracked excavator. Results expanded known structurally controlled gold mineralization at multiple targets on the road accessible JPR property. Additional targets also to be tested in due course.

- Stage Fright target, trench JPRSF20T009 encountered a high-grade zone grading 8.88 g/t Au over 2.5m, and trench JPRSF20T010 exposed two separate mineralized zones grading 1.06 g/t Au over 2.5m, and 1.83 g/t Au over 2.5m.

- At the Sabotage target, five of seven trenches encountered gold mineralization including 3.40 g/t Au over 1.5m in trench JPRSAB20T023, 1.15 g/t Au over 8.5m in trench JPRSAB20T025, and 1.06 g/t Au over 2.1m and 15.00 g/t Au over 0.8m in trench JPRSAB20T029.

- Trenching on the North Frenzy target traced a north-south striking zone of mineralized quartz vein breccias with anomalous gold over a strike length of 600m.

- GT Probe (top of bedrock) samples on the newly identified and previously untested Notorious target area encountered multiple anomalous gold values ranging from 0.17 g/t Au to 24.4 g/t Au.

- Significant follow-up exploration work was executed pursuant to these findings which included expanded soil geochemistry surveys, a phase 2 trenching program utilizing a CanDig mini-excavator, hand excavated soil pits on existing anomalies and RAB drilling on several high priority targets.

- Virtual Site Tour & Corporate Update Today @ 4PM EST (Details below)

Figures and images to accompany this news release can be found at: http://whitegoldcorp.ca/investors/exploration-highlights/.

“We are pleased to have encountered additional gold mineralization across multiple recently identified zones as well as the high-grade gold mineralization on the newly discovered Notorious target, providing further indication that the abundant gold mineralization is part of a robust regional scale structurally controlled system. To date at least 14 gold targets have been identified on the JP Ross property across a 14km by 11km area, many within close proximity to significant current and historical placer gold operations,” stated David D’Onofrio, Chief Executive Officer. “This program has also provided valuable insight into the orientation and geometry of the mineralized systems, information that has been incorporated into our scientific and data driven methodology to define drill targets for the current and future seasons.”

The thing with White Gold is that the company has an absolutely enormous land package in the Yukon territories and it looks like there is gold all over the place as evidenced by how many targets have either been trenched and/or drilled with gold confirmed. With Agnico Eagle and Kinross Gold as major shareholders White Gold is swinging for the fences since the backers want them to find something really big. This aggressive exploration campaign probably obscures the fact that the company already has around 2 moz of (good) gold in the ground. Since this is the Yukon, where infrastructure is increasing but is not totally up to par just yet, it makes total sense to try and turn something good into something great. Anyway, I think this wrongfully gives off the vibe that the current resource is not valuable. Why the 2 Moz is very important to the story is that it of course means that it is much easier to reach “critical mass” in terms of ounces for a potential development decision if one starts off with 2 Moz and not 0 Moz. A good satellite deposit or two could change things a lot and any additional ounce discovered should bring more exponential value to the overall story compared to most stories around. It’s a highly leveraged exploration story if you will since a typical junior might need to go from 0 to 2 Moz for a development decision whereas White Gold might “only” need say 1 Moz on top of the pre-existing 2 Moz for the company to become much more valuable.

Anyway, I think this is a high potential story and on paper it should be relatively low risk given the 2 Moz banked already. And as I said previously I think it is extremely leveraged to any additional discoveries. If we are lucky the upcoming results from the Titan Target might be trigger that kicks this story into a higher gear. As always there are no guarantees, only variable risk/reward.

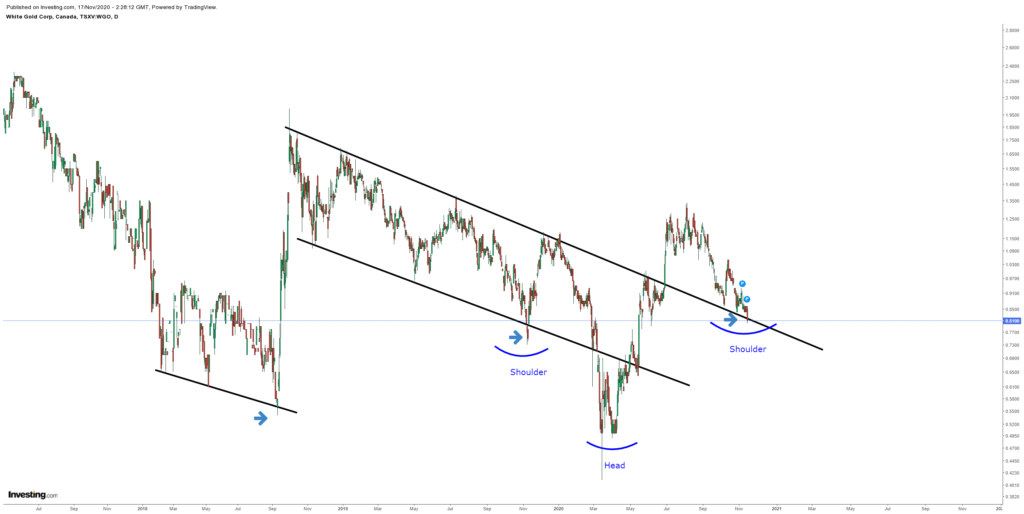

The chart looks quite interesting because depending on how you draw the upper support line it looks like it either -retesting the break out (again) or just slightly broke it yesterday. If it’s the latter then this could be another major fake out as has happened on multiple occasions before (Blue arrows). Lastly, the share price might also be forming a quite big Head and Shoulders reversal (bottoming) formation:

Anyway, I don’t think the current level is “buying high”, which is backed by some analyst targets that range between $2.25-$3.20/share. Furthermore we’re close to $1,900 gold and this leg down in WGO looks pretty overdone already and I think the next big wave is probably going to be up and not down (Especially if they hit something good at Titan). With that said anything can happen in the short term.

Note: This is not investing or trading advice. I own shares of White Gold Corp which I have bought in the open market and the company is a passive banner sponsor of The Hedgeless Horseman. Always do you own due diligence and make up your own mind. It’s your money and your decision.