Brigadier Gold Limited (BRG.V): A Sleeper That Might Soon Awaken For Real

Brigadier Gold (BRG.V) has been on my radar ever since I read Bob Moriarty’s piece on it (Caesarsreport also did a good piece on the company). I finally jumped off the fence and started buying shares last week for the simple reason that the stock price has been hammered down to a level that does not make any sense to me given; a) There should very soon be drill results coming and b) The description of what they are seeing sounds quite encouraging. Thus I see Brigadier as a very cheap sleeper stock (for reasons I will explain later), which could possibly awaken for real, sooner rather than later. Risk is overpaying for something that ends up not being true and Brigadier is pretty much not pricing anything at all. Honestly, the valuation looks brain dead to me, and there is no way I am buying this one anywhere near “high”. Thus I have bought quite a bit of shares in the open market lately, as I see this one to have 5+ bagger potential in the short to medium term, and with very limited downside from these levels. Even if the stock doubles tomorrow to C$0.52/share, the company would only have an Enterprise Value of around US$21 M, which might still be too cheap even before encouraging drill results. Remember that no matter how good the risk/reward looks one should never bet the farm on any single stock and especially not an exploration play.

Lastly, assays should start to trickle in any day now which would be the most obvious catalysts for a rerating to a more fair valuation.

My Case For Brigadier Gold in Short:

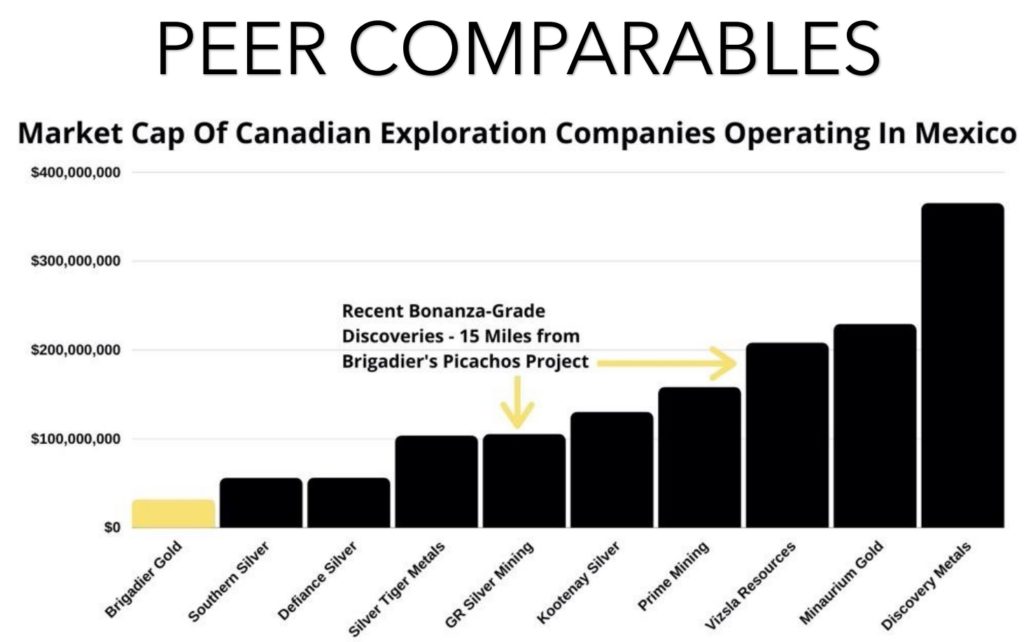

Brigadier Gold currently has a Market Cap of only C$15 (US$12 M) and I believe the company has around C$3 M in cash at the moment which puts the Enterprise Value at around C$12 M (or ~US$9 M) at $0.26/share.

- Remarkably low valuation both in relative and absolute terms

- Highly prospective district scale land package

- Head geo has 10 years experience with the project and is involved with Brigadier’s neighbour Vizsla Resources

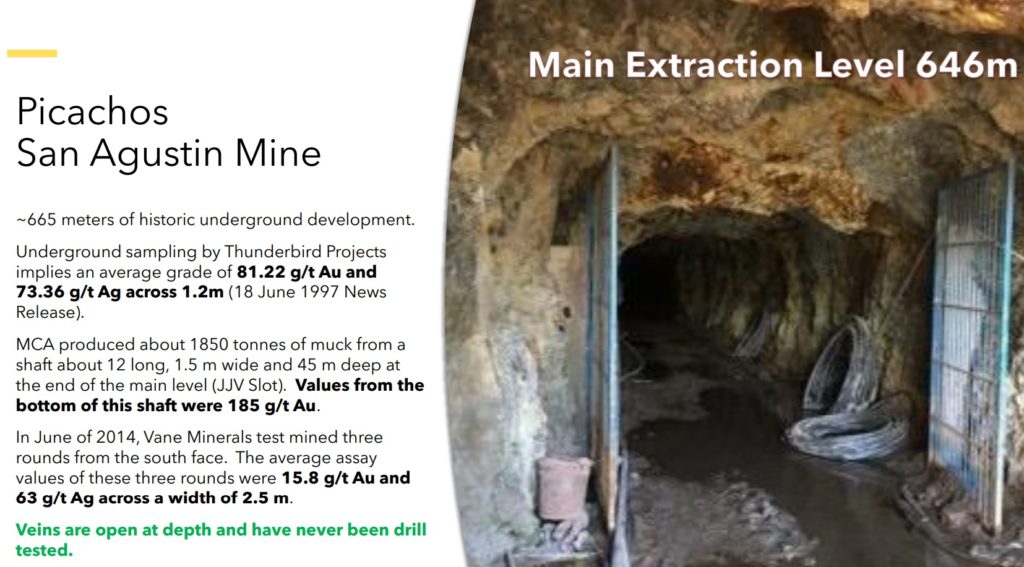

- Currently drilling and plan to drill 40 core holes in total below historic workings (The San Augustin mine has never seen diamond drilling before)

- All of the first five holes seems to have hit what the company was hoping to hit:

- All holes hit the main San Augustin vein at depth

- XRF analysis of core shows silver

- I has been reported that panned pulp samples contain gold

- Some of the holes indicate seems to get thicker at depth

- To quote the company:

- “… promising early results indicating that the vein which hosts the historic high grade San Agustin gold mine may be of material width and vertical continuity.”

Snippet From The “Bottom Line” at the end of the article:

This is a salivating risk/reward proposition to me since there are 35 more holes planned. Thus I think the company pretty much has 40 chances in total to hit anything that would even slightly excite the market and the stock should revalue higher. Perhaps much higher if the company hits something really exciting. The more I think about the more I see the risk/reward as outrageously good in light of what has been seen in the five first holes already and this is just the maiden drill campaign on the very first target to boot. With no success at all priced in really, the upside potential is palpable, and this valuation would be cheap if gold was at $1,300 IMHO.

Short Company Introduction:

A longer presentation from the Metals Investor Forum can be accessed HERE.

Setting The Scene

The reason for the remarkably low valuation seems to be that there has been a lot of very cheap shares that became free trading as of Oct 4 according to caesarsreport.com. This makes perfect sense given that the Private Placement was done at C$0.05 and included a full warrant with an exercise price of C$0.10. Again, this would explain why the share price started off hot shortly after the company got listed in June and then has been absolutely hammered ever since:

(non log chart)

Personally I think that the initial market reaction was relatively rational given the apparent quality of the project. In other words I think a share price of C$0.55-C$0.65 which puts the Enterprise Value around C$35 M sounds somewhat like what would have been fair value back then at least. Then the selling started and many people probably front ran the fact that a lot of cheap shares would soon hit the market. Thus, the share price is down around 56% in only four months despite the fact that metals and most miners have done pretty well over the same period and that the news from the company has actually been highly encouraging. In other words I view the current valuation as artificially low due to the fact that there has been a lot of motivated sellers who were sitting on nice profits already… Hence the opportunity today and if one is lucky there might still be some flippers left that want to take profits even at these ridiculous prices.

With drill results expected to start coming very shortly I think Brigadier Gold is a very good tactical bet with great risk/reward at the current valuation. Let me explain why…

Project

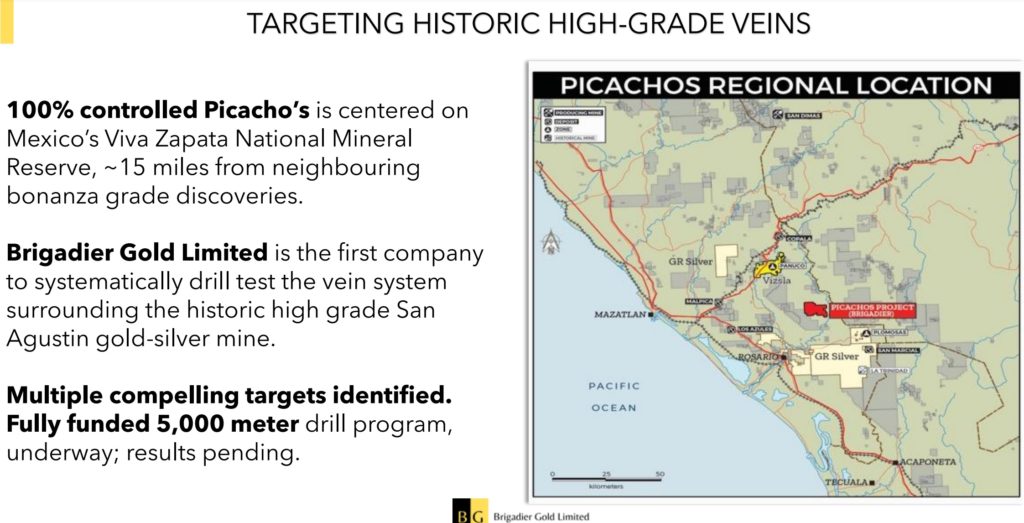

Brigadier Gold has an option to acquire 100% of the Picachos gold-silver project in Mexico’s Sinaloa province. The projects measures 3,954 hectares and is located between Vizsla Resources’s (currently C$120 M Market Cap) and GR Silver’s (currently C$80 M Market Cap) flagship projects:

Infrastructure is great, the location is in “mining country” and there are over 160 historic mines and workings within the property boundary. That it looks prospective would probably be an understatement. The claim package was put together by Michelle Robinson who is also now the head geo for Brigadier Gold and she has 10 years of experience with the project. Michelle is also active in Vizsla Resources which hit a high of C$200 M in Market Cap shortly after the first good assays were announced by the company:

The upside potential in Brigadier Gold should be obvious per the slide above. Brigadier would have to be a 6+ bagger to catch the Market Cap of GR Silver on the back of their good holes and would have to be a 13+ bagger to catch Vizsla after their good drill holes from this level. Brigadier Gold is basically where Vizsla was earlier this year when Vizsla too started off by drilling below historic workings.

The current focus of the company is the historic San Augustin Mine:

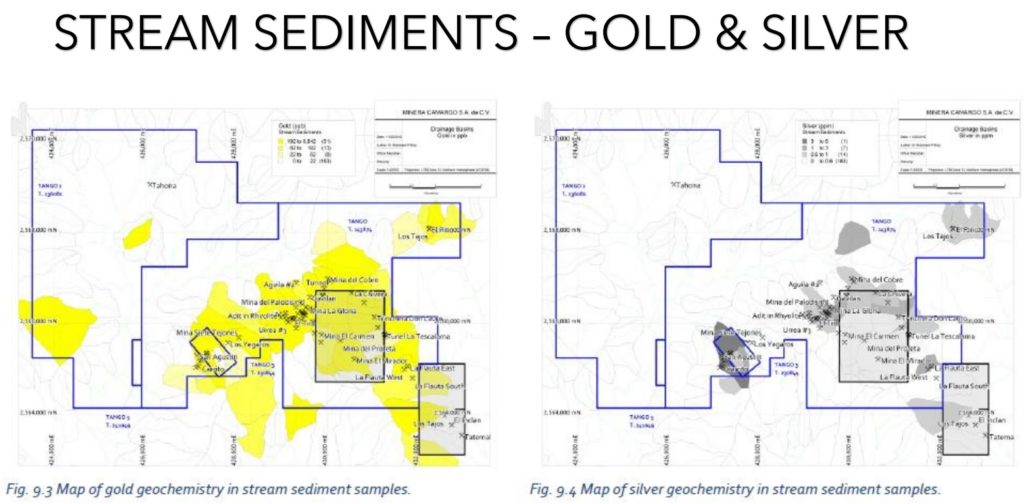

Given that this was mined by the old timers it should not come as a surprise that samples have shown very high grades. Brigadier is currently undergoing a 5,000 m drill program in an effort to prove that the “San Augustin vein” continues at depth beyond the old underground workings. This is of course just the start since there are numerous historic workings, mines and there are very extensive gold and silver stream anomalies within the 3,954 ha property:

Or as the company puts it in the presentation:

“Overlaps one of the largest, most contiguous and highest amplitude anomalies for gold, silver and base metals in regional fine-fraction stream sediment samples in the Western Sierra Madre.”

Now on to the most exciting part…

Maiden Drill Campaign

Brigadier Gold is well underway on its maiden 5,000 m drill campaign which will be the first time ever that any of the San Augustin veins have seen diamond drilling. The company has made sure to update the market, in regards to what they are seeing in the holes, which is why there have been several news releases lately:

- October 6: “Brigadier Drilling At Picachos Intersects 5-Metre-Wide Vein Below High-Grade Historical Gold Mine”

- October 27: “Brigadier’s Drilling At Picachos Proves Up To 5-Metre-Width And 170 Metres Down-Dip Extension In Vein Hosting High-Grade Historical Gold Mine”

- November 2: “Brigadier Steps-Out 23 Metres And Drills Two More Holes Intersecting Vein Hosting High-Grade Historical Gold Mine”

To sum up the company has so far drilled five out of 40 planned holes and lo and behold the company has successfully intercepted veins at depth in all five of them. The company is using a Niton FXL benchtop XRF analyzer to scan for silver because silver “is expected to correlate with gold” as per the news releases.

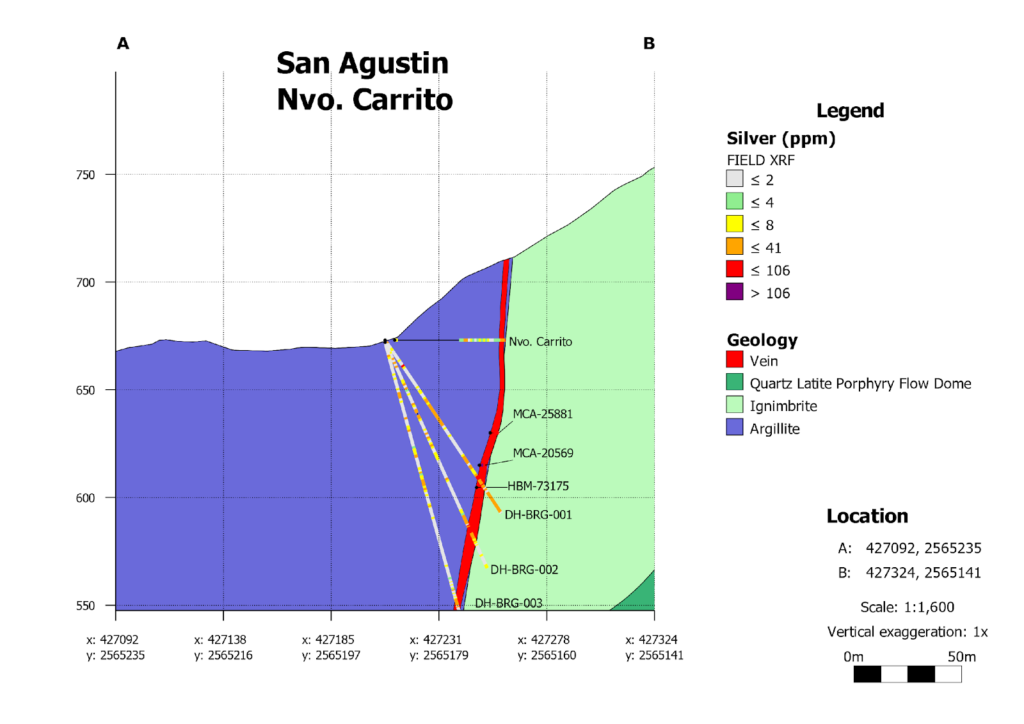

Details on holes BRG-001, BRG-002 and BRG-003:

Hole BRG-001: “Field XRF readings of sample pulps cut with a Makita grinder (procedure described below) indicate that elevated silver occurs in quartz-carbonate veins and veinlets above and below the San Agustín Vein between 65 and 94 metres depth. Silver correlates well with gold and is more reliably measured in sample pulps with the field XRF. The San Agustin Vein was intercepted between 75.2 and 81.5 metres at roughly 609 m elevation. The true width is estimated to be 5 metres.A panned pulp sample confirms that gold is present in the vein. Other minerals include hematite, galena, sphalerite, calcite and grey microcrystalline quartz. Elevated silver was also indicated by XRF analyses above the San Agustin Vein between 14 and 15 metres down hole and 33 to 48 metres downhole. “

“From the cross-section presented below, it appears that BRG-001 cut through underground workings just above HBM-73175 and about 10 metres below historical sample line MCA-20569 which sample line returned XRF values of 94 ppm silver, 0.3% copper, 0.4% lead and 2% zinc across 1.6 metres. Approximately 15 metres above sample line MCA-20569, historical sample line MCA-25881 had a lab assay result of 29.5 g/t gold, 83 g/t silver, 0.1% copper, 0.5% lead, and 0.6% zinc across approximately 2.6 metres (see cross-section below).”

“BRG-002 is collared at the same location as BRG-001 and is angled -66 degrees under BRG-001. BRG-002 intercepted quartz-carbonate veining between 93 and 103 metres down hole, approximately 25 metres down-dip of BRG-001 and is believed to be well-under all of the underground workings. Similarly, BRG-003 is drilled under BRG-002 at a dip of -75 degrees. BRG-003 intercepted quartz-carbonate veining between 123 and 130 metres down-hole, approximately 40 metres down-dip of the intercept of BRG-002. Collectively, these historical and new drill hole intercepts have defined the San Agustin vein for more than 170 metres down-dip from surface.“

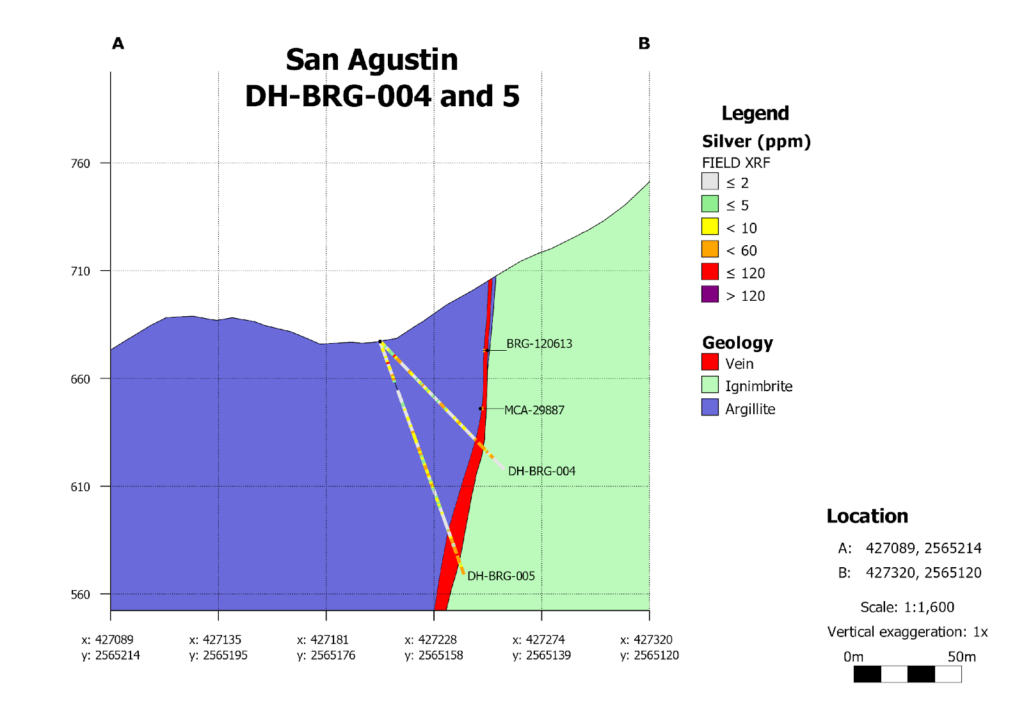

Details on holes BRG-004 and BRG-005:

“Holes BRG-004 and BRG-005 are collared below the southwestern part of a historic exploration drift accessed from the El Carrito Adit. Underground rock-chip channel sample BRG-120613 from this drift yielded an SGS lab result of 8.02 g/t gold, 63 g/t silver, 446 ppm Cu, 0.3% Pb and 0.5% Zn across 1 metre. Historic underground rock-chip channel sample MCA-29887 from extraction Level 646 contained 125.52 g/t Au and 76 g/t Ag across 1.5 metres. Drill hole BRG-004 is angled at -46 degrees towards the southeast (azimuth 112 degrees) and tested the San Agustin Vein 16 metres below MCA-29887. Anomalous silver that is expected to correlate with gold was identified using a Niton FXL benchtop XRF analyzer at several locations in the hole. The XRF silver anomaly associated with the San Agustin Vein peaks at 86 ppm Ag and occurs between 63 and 76 metres down-hole in BRG-004. “

“Drill hole BRG-005 is angled at -70 degrees towards the southeast (azimuth 114 degrees). It tested the San Agustin Vein 51 metres below the intercept of BRG-004. The XRF silver anomaly associated with the San Agustin Vein peaks at 68 ppm Ag and occurs between 92 and 115 metres down-hole in BRG-005. The upper part of this silver anomaly is associated with quartz-specularite veining in argillite. The lower part is located at the contact of argillite in the hanging wall, and porphyritic ignimbrite correlated to the Tarahumara Formation in the footwall. This contact is faulted and mineralized with precious metal bearing microcrystalline and crustiform quartz. Panned pulp samples from both quartz-specularite and microcrystalline quartz veinlets show gold.”

(THH: note increased thickness at depth)

Comments from the October 27 NR:

“Michelle Robinson and her team on the ground at Picachos have delivered promising early results indicating that the vein which hosts the historic high grade San Agustin gold mine may be of material width and vertical continuity. The projects first ever diamond core drill program is playing a substantial role in assisting the Company to better understand the geology and structure of the four vein systems we are targeting, while uncovering important details previously unknown to historical operators.”

A Few Things to Note

- All five holes hit the Augustin Vein at depth

- Especially holes BRG-004 and BRG-005 seems to have hit an area at depth where the vein has gotten thicker

- All holes seems to have indicative silver grades that are higher where they were expected to be and gold is also expected to correlate with silver

- At least hole BRG-001 and BRG-005 mentions that panned pulp samples show gold

- All holes seems to have been drilled underneath areas where there have been been samples taken that show decent, to very good, gold and silver grades

Bottom Line

My case for picking up some Brigadier Gold is rather straightforward. As I see it the company has gotten to a level of severe undervaluation due to a large amount of sellers who were sitting on fat gains already. When there are motivated sellers who can sell it down to almost whatever price and still make a buck that can present some good opportunities like I consider this one to be. Just reading the recent NRs would make one think that the stock would (should?) be ramping higher given the fact that the company is hitting pretty much what they hoped to be hitting at depth. With an Enterprise Value of around US$9 M I don’t think anything even closely resembling success in terms of the current drill program is priced in. I mean this valuation is something one might see for a pure grass root explorer that is perhaps a year and a financing away from even doing some wild cat drilling. It is not something I would expect to see for a company that HAS money, IS drilling, and seems to be hitting very encouraging stuff below historic mine workings. The fact that it’s in mining country with great infrastructure is icing on the cake. Lastly, I think it is noteworthy that the CEO recently said in an interview that larger companies are on site and following the drilling already… Which begs the question that if ANY larger company would take the time to be on site then how far off mustn’t the current valuation be?

I have no idea how many motivated sellers might be left but I have happily been adding shares recently since I am not aware of a single junior that has this amount of smoke in the core, in a good area, while being valued for less than US$9 M in EV. If the neighbors (Viszla & GR Silver) are a guide then this could realistically be a pretty quick 5-10 bagger if they hit something good in those five first holes. On the other hand I’m not sure that it would become and stay cheaper than where it currently is in case the first five holes were all dusters…

This is a salivating risk/reward proposition to me since there are 35 more holes planned. Thus I think the company pretty much has 40 chances in total to hit anything that would even slightly excite the market and the stock should revalue higher. Perhaps much higher if the company hits something really exciting. The more I think about the more I see the risk/reward as outrageously good in light of what has been seen in the five first holes already and this is just the maiden drill campaign on the very first target to boot. With no success at all priced in really, the upside potential is palpable, and this valuation would be cheap if gold was at $1,300 IMHO.

Catalysts As Per The Presentation

▪ “San Agustin high grade veins never tested with diamond drilling.”

▪ “Several high priority drill targets identified.”

▪ “Potential for near-term maiden 43-101 resource estimate.”

Some TA

Nothing fancy, just looks like it is getting read to break out, for very good reasons if you ask me:

(log chart)

Note: This is not investment advice. I am not a geologist nor am I a mining engineer. This article is speculative and I can not guarantee 100% accuracy. Junior mining stocks can be very volatile and risky. I have bought shares of Brigadier Gold in the open market. I can buy or sell shares at any point in time. I was not paid by any entity to write this article. Assume I am biased so always do your own due diligence and make up your own mind as always.

Best regards,

Erik Wetterling aka “The Hedgeless Horseman”

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My channel

I have the highest regard for Bob and Erik. I am hesitant to agree with them on Brigadier. I question the focus of the management. In January, they were about to become a cannabis company. Then in summer they were going to be a diamond company in Ontario. Shortly thereafter they got the Sinaloa property and were now a silver/ gold company. I am open to the possibility that they lucked into a very good property, and initial results seem to suggest this. But I wonder if management has the ability and expertise to do DD on cannabis, diamonds and silver. Moreover, apart from Ms. Robinson, P.eng. Geo, do they have the expertise to exploit a silver project? I would be more confident if somebody like Quinton Hennigh was on the advisory board and had brought the property to Brigadier. If Brigadier gets to $2.50 I’ll know I should have listened to Bob and Erik.

Mashall:

Fair comments. The best argument for Brigadier, as far as I am concerned, is that it’s so cheap that all of those worries are already more than discounted and if this turns out to be good then the returns will be much higher relative to a case where there is only “blue sky with no clouds”. In other words I don’t think there is tier one management in this case but a lot of problems should be solved just as long as the gold/silver is there. Apparently there are already larger companies on site so I would assume some of those would be interested in developing the project if they hit the jackpot..

Best regards,

Erik

One look at the man in the YT video – even before it begins to play – tells one with any insight into human nature that this is a person not glued together very well, and one should avoid such persons ( and any Company they might be running ) while keeping a firm hand on one’s wallet . Moose Pasture Perp Alert, folks!

You made your own decision which is good.

Hi Theawfulest,

I think you would be surprised how many people have great power yet know very little about the subject matter – you will find them in many boardrooms and esp in the state legislatures. The smarter ones know when to listen and if you recall, this guy seems to be delegating the mine-making to the pro – a woman that others (Eric Sprott comes to mind) also delegates to.

Lots of people with Real Estate winnings do this sort of thing when out of their normal element.

Moose Pasture? Hardly