THH – The Curious Case of Silver: A New Age?

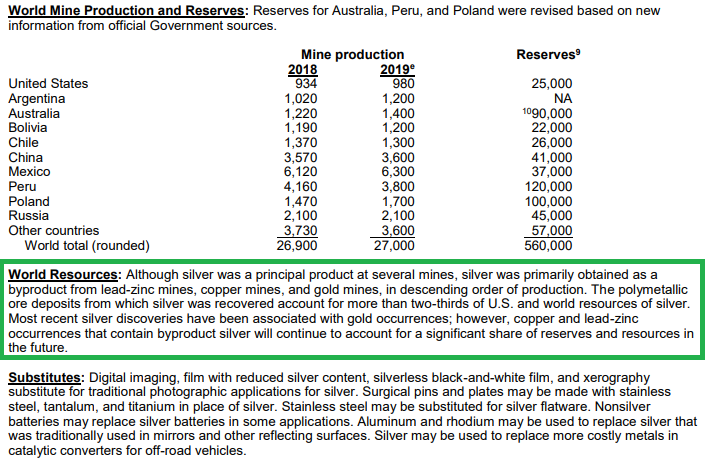

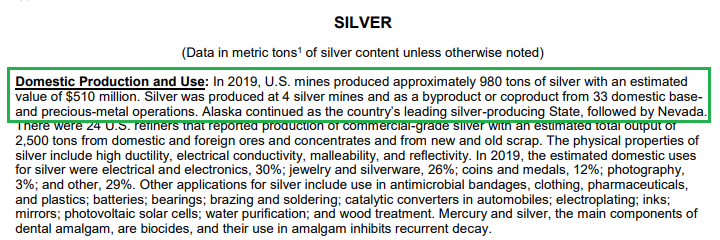

Physical silver has typically been in a surplus, almost every year, for over a decade. Since silver is primarily produced as a bi-product to other metals most of the supply is inelastic:

Meaning that all the big mines around the world, which have silver as a bi-product, will produce silver regardless of the price of silver. Given that there has been more silver supply than silver demand over the last ten years it makes sense why silver has been a poor performer. I mean it would take a lot of sudden investor demand to put silver in a deficit…

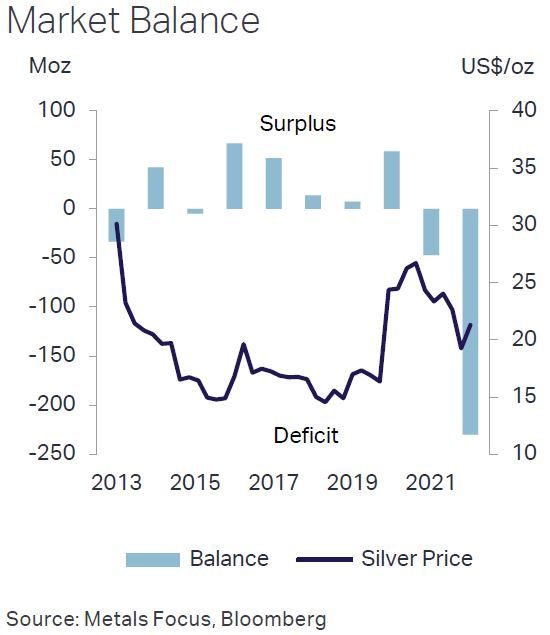

But as Chen Lin has pointed out several times over the last several months the industrial demand for silver from the photovoltaic (solar) sector is having enormous impact on the silver demand. So much so that last year saw physical silver hit a deficit that was larger than the combined yearly surpluses since 2013:

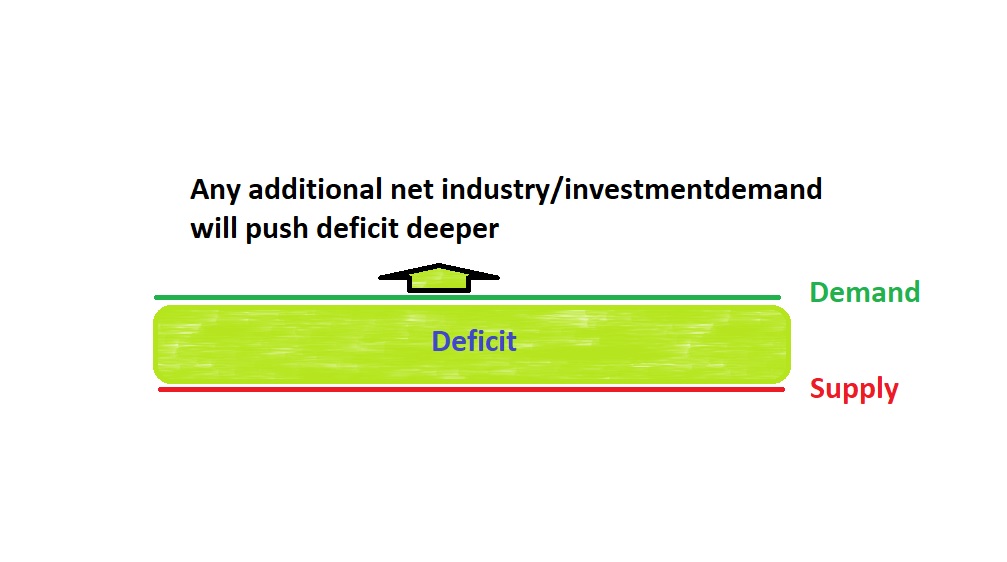

I think this has immense ramification for silver as an investment case. Why? Because silver supply is inelastic and all of a sudden it appears that the increased industrial demand has put silver in perhaps a chronic deficit instead of a chronic surplus. So where it used to be that investment demand needed to spike, for silver to make demand larger than supply, we now appear to already be above water. Thus any increase in net industry/investing demand would simply push silver into a deeper deficit (contrary to just shrinking a surplus). On that note I recently spoke with an industry insider that suggested that smelters are buying up all the silver they can and they are paying premiums to do so.

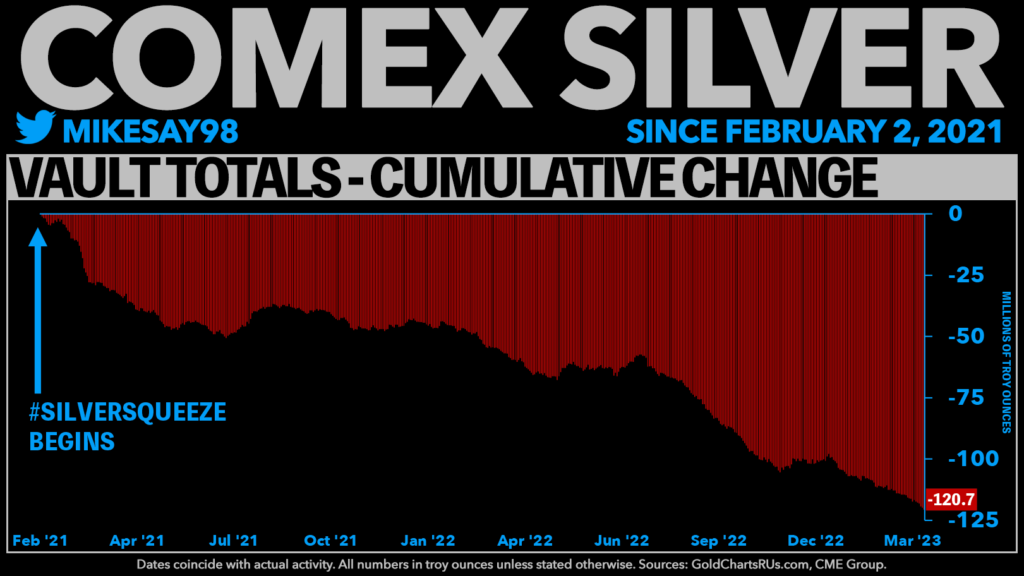

The above would explain why we have seen a steady decline in COMEX silver inventories over the last couple of years:

In short

For as long as most of us can remember the big base metal and gold mines were producing enough silver as a bi-product to have almost a chronic surplus in the metal. Why? Because silver is one of those commodities that will get produced almost regardless of the silver price. If zinc crashes like it did in 2015 one saw zinc mines being put on care and maintenance which obviously contracted the zinc supply. But when silver crashes the majority of mines that produces silver will keep producing the metal unless the “main” metal of the mine crashes too far below production costs as well. This it has been up to investment demand to overcome the semi-chronic surplus

Now silver is in quite deep deficit and any incremental demand vs supply increase will just go straight into a bigger deficit rather than just shrinking the semi-chronic surplus we have seen over the last decade:

Conclusion

Silver has been a very poor performer since 2011 in wake of the semi-chronic surplus thanks to supply being mostly inelastic. This has meant that there has typically been more supply than demand for over at least ten years. Now however things might have changed as silver reported a deficit larger than the cumulative surpluses for all other years since 2013. If the photovoltaic demand trend continues, and there is no real new supply, then we might be in for a period where price pressure will be higher until price dampens demand.

All in all I think the fundamentals for silver is the best I have personally ever seen. As such I have increased my exposure to silver over the last 6 months.

Note: This is not investing advice.

Isn’t this just typical of the market today? No reason for a supply and demand equilibrium. Nope just drop your pants and pay a lot more when the spot price is at multiples. Just can’t see used paper contracts being used in solar panels and silver’s industrial applications.

It’s been like waiting for Godot, but I believe he’s finally shown up. And to think the reason is a faulty premise driving the demand curve makes it all the more remarkable. But as ‘ole Otto said,

“People don’t need to know how their wars are fought or their sausage is made.”