Two interesting developments in the silver space

- “JP Morgan Silver Manipulation Lawsuit Revived By Appeals Court!” – AveryGoodman.com

- “Utah Bill Sets Stage For State Gold Depository…” – Zerohedge.com

It’s always good to see some positive developments in regard to sound money. In an ideal world a nation’s central bank and/or government should try to buy as much hard assets as possible before the coming currency and bond collapse. When the monetary system resets, it will not bode well for entities to hold promises of future notional payment. Zimbabwe, Venezuela and the fall of the Weimar Republic teaches us the lesson that one can start as a millionaire and end up as a trillionare, but still be poorer in real terms if one’s starting wealth was tied up in paper assets and FIAT currencies.

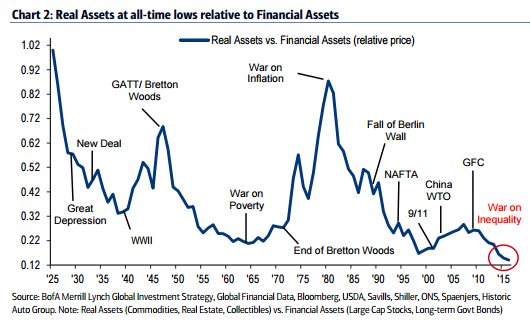

On that note, the following chart makes it even more clear that this is the time to be in HARD/REAL assets:

And finally a quick look at the paper silver price, where we are currently back-testing a breakout from a multi month channel pattern: