Novo: Egina Evolving

A very encouraging picture is evolving for the lag gravel thesis over at Egina. So far Novo has only been permitted to thoroughly MAK sample the area within the Egina Mining Lease which makes up a postage stamp of the company’s entire landholdings within the Greater Terrace. As man should know already the Egina Mining Lease is a tiny part of the Egina Project and the Egina Project is about 1/3 of Novo’s total Greater Terrace ground.

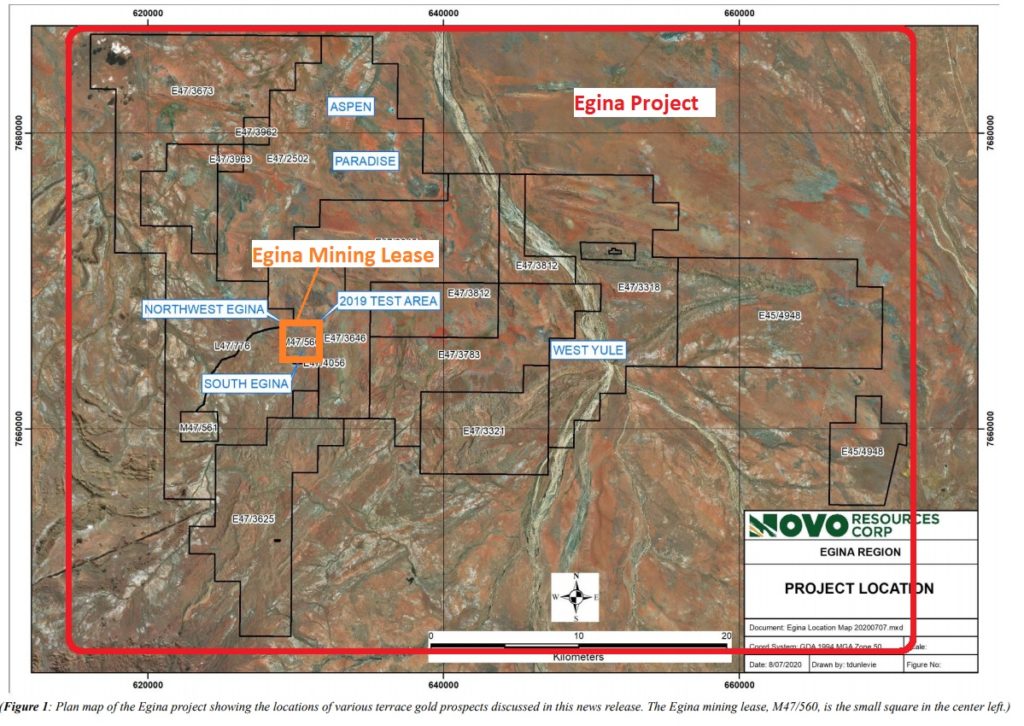

Egina Mining Lease (in orange) within the Egina Project (black claim blocks):

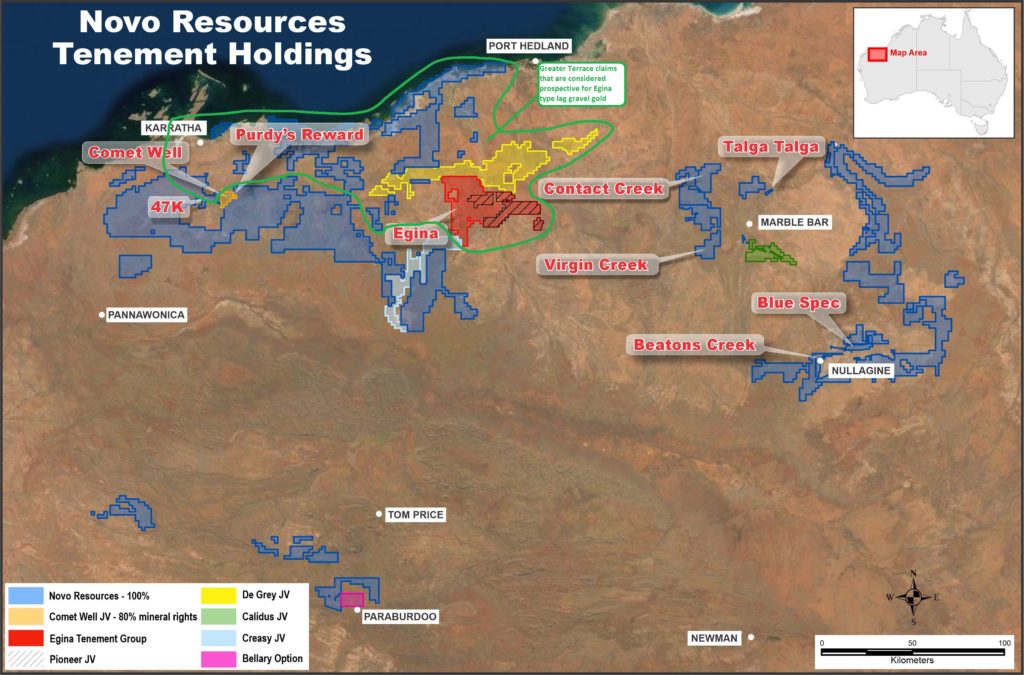

Egina Project (in red) and most of Novo’s Greater Terrace ground circled in green:

In other words the Egina Mining Lease, is a small sub sample of the Egina Project, which in turn is a sub sample of the total Greater Terrace (lag gravel) project.

Before we go any further I will post some sections from the most recent Egina update:

Discovery of new gold targets during MAK sampling at Northwest Egina

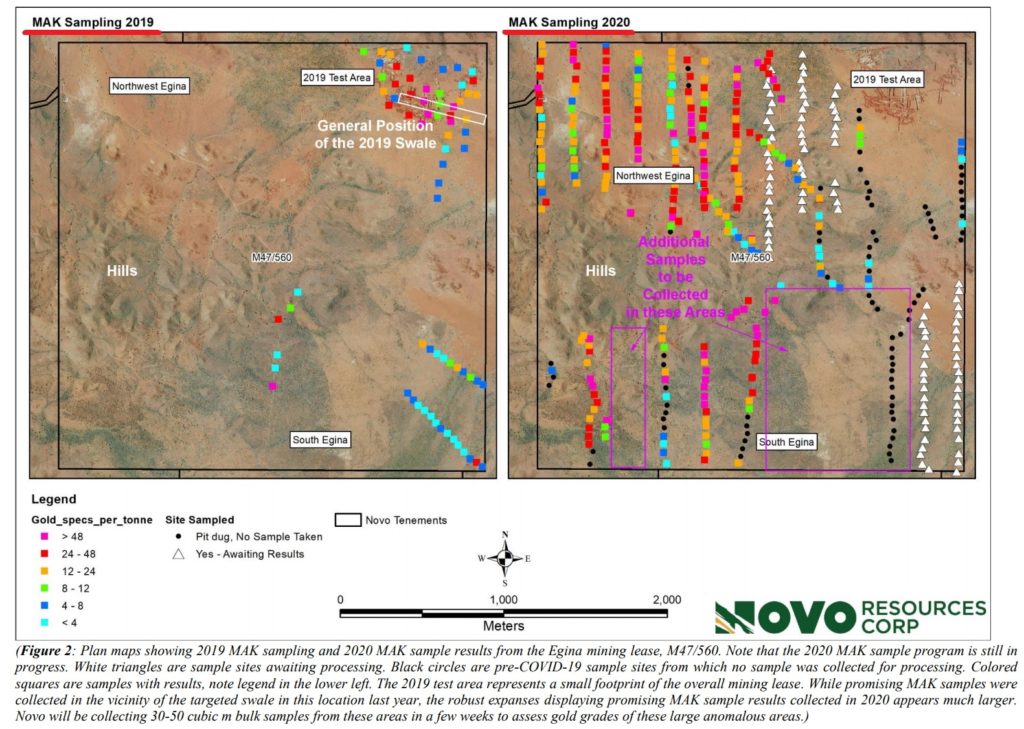

- Through MAK sampling, Novo has identified significant expanses of gold-bearing gravels in the northwestern quadrant of M47/560 immediately north of an area of low rolling hills (Figure 2).

- Gold-bearing gravels are indicatively tested by excavating approximately 1 tonne grab samples from shallow, 1-2 m deep pits dug across the gravel profile that are then processed using Novo’s MAK test equipment. Gold is reported in point counts of particles captured in concentrate.

- The next phase of exploration in this area will encompass bulk sampling of 30-50 cubic m of gravel that is then processed through the Company’s IGR 3000 alluvial test plant to quantify grades.

- Aggressive sampling work is being conducted on the Egina mining lease early in the 2020 exploration program because, given that M47/560 is a granted mining lease, the Company sees this area as a suitable location and fastest path for trial bulk extraction and processing of gravels.

Broad areas of encouraging MAK results from South Egina

- Similar to MAK sampling results from Northwestern Egina, Novo is seeing encouraging MAK samples from expansive areas within the southern portion of M47/560 immediately south of the low rolling hills mentioned above.

- MAK sample results in several locations display higher point counts than MAK samples from the 2019 test swale.

- Infill MAK sampling is on-going at South Egina and will help guide future larger scale bulk sampling in which coherent gold zones will be subject to collection of 30-50 cubic m bulk samples that can be processed through the Company’s IGR 3000 alluvial test plant. Like Northwest Egina, the Company sees opportunity for trial bulk extraction and processing of gravels at South Egina given that M47/560 is a granted mining lease.

2020 Field season plans

- Multiple additional prospective gravel targets have been identified across the greater Egina terrace gold project. Novo will conduct MAK sampling at these targets within previously heritage-cleared areas. At least 1,100 MAK samples are scheduled for completion.

- Additional new heritage surveys are tentatively planned for this calendar year, including extensions to the Paradise gold-bearing gravel target. New heritage survey areas will be further prioritized as exploration progresses. Novo is currently targeting further heritage surveys with the Kariyarra Aboriginal Corporation to begin in September 2020, COVID-19 dependent.

- Novo’s team has recently identified prospective gravels at the Aspen target on Exploration License E47/2502. These gravels are possibly linked with those discovered at Paradise, approximately 5 km to the south, earlier this year (please refer to the Company’s news release dated May 26, 2020)

- Late in 2020, Novo anticipates collecting and trucking some bulk samples to its mechanical sorting plant at Purdy’s Reward, approximately 50 km south of the city of Karratha, once commissioned. Mechanical sorting of Egina gravel material is seen as a potentially viable means of gold recovery.

- As a demonstration of best practice environmental land management, all MAK sampling pits and bulk sample sites will be progressively rehabilitated in line with Novo’s intent to demonstrate this deposit can be excavated and reclaimed to its original state in a responsible manner.

“We are seeing expansive areas within the Egina mining lease that are yielding MAK results as good or better than our test area of 2019,” commented Quinton Hennigh, President and Chairman of Novo Resources. “In comparison, the 2019 test area is now clearly small in light of what we are discovering in the northwestern and southern parts of M47/560. Setting aside the area of low hills in the west central region of the mining lease where we cannot conduct sampling, it appears that perhaps around 30% of the terrace displays MAK gold point counts in line with the 2019 test swale, and, importantly, surrounding areas display appreciable low level gold point counts similar to those seen outside the swale last year. This data gives us our first real impression of how gold may be distributed within this system, and we are very encouraged, especially given the vast size of this target. With our IGR 3000 test plant back on line, we are eager to commence large scale bulk sampling on the mining lease very soon.”

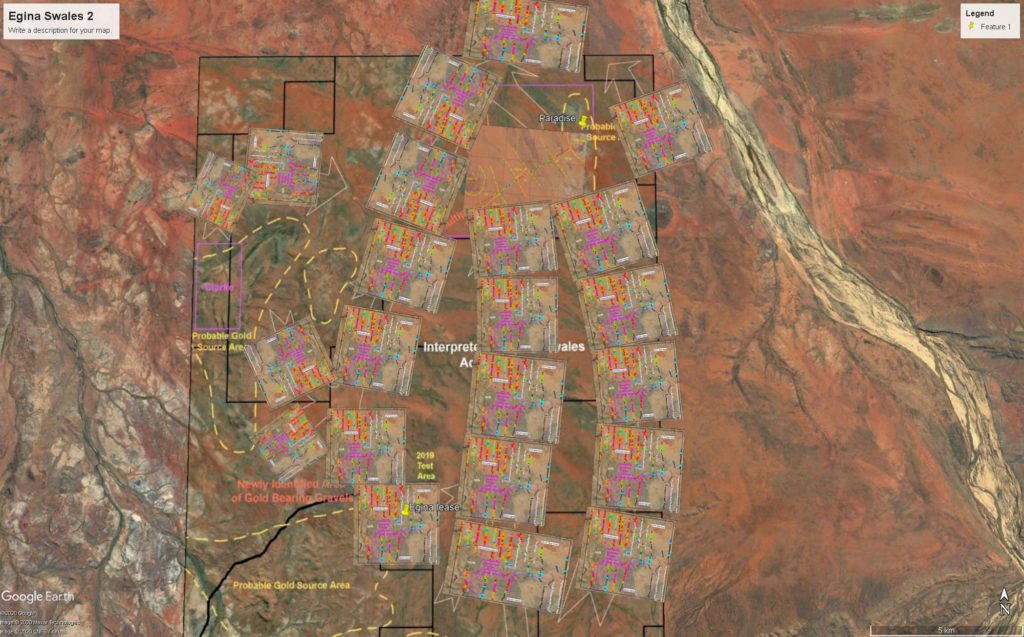

Now, lets take a look at what the new MAK sample results within the Egina Mining Lease looks like and how it compares to the 2019 samples:

Personally I was very surprised by the new MAK sample results. I thought there would be a few orange to pink gold counts here and there but not anywhere near this extensive. As a matter of fact the bulk of the MAK samples shows gold counts of 12/tonne (orange) or better. Also note how the samples looked within and around the “General Position of the 2019 Swale”. I can see both blue to pink in that area. Outside of that there are mostly blue, orange and red.

Remember the following grades that came out of the large scale bulk samples:

- Within swale: 1.7 g/m3

- Swale margin: 0.6 g/m3

- Outside of swale: 0.3 g/m3

- Average: 0.83 g/m3

- Global average for such deposits: 0.2-0.3 g/m3

Given the amount of orange or better MAK samples I could argue that the average indicate grade over the samples areas within the Egina Mining Lease could be around 0.8 g/m3 and that it approximately covers around 3 km2 of ground. Now what could the theoretical cash flow be from this “tiny” 3 km2 area of lag gravels which is just found within a subset of a subset of the Greater Terrace area?

Example Assumptions:

- Area: 3 km2

- Thickness: 1.5 m

- Grade: 0.8 g/m3

- Operating Costs: A$15/m3 (Double Barron’s estimate)

… Which translates into a net operating profit of A$239 M on an undiluted basis. This should be doable by a single continuous miner in one field season I think. Sumitomo will of course get up to 40% of that assuming they keep earning into the Egina Project (which includes the Egina Mining Lease).

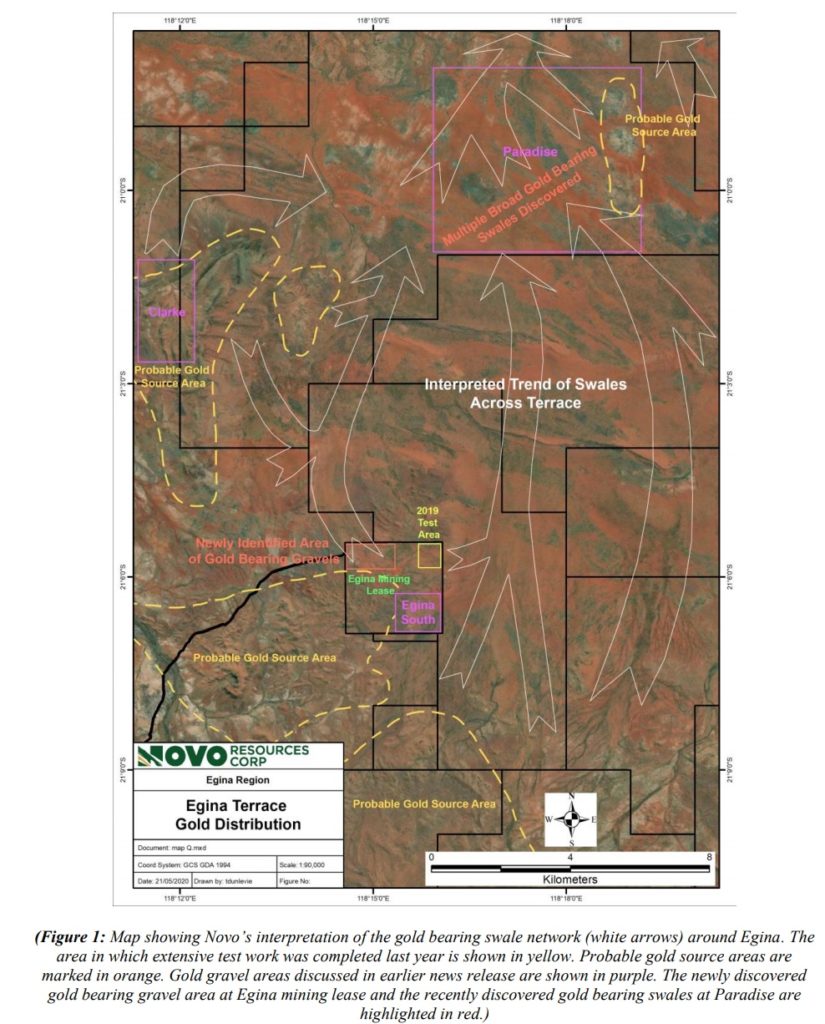

Keep in mind that the Egina Mining Lease is just the very first Greater Terrace area to be systematically sampled and that Novo’s work suggests there is an extensive network of swales in the area:

… Again, remember that the slide above is still just a subset of the Egina Project and the Egina Project is a subset of the total Greater Terrace project. With that said the swale netweork would measure around 17 km x 10 km = 170 km2. That is obviously a lot more than the 3 km2 tested within the Egina Mining Lease to date. If 3 km2 could theoretically produce over $200 M in net operating profits then… You get the picture.

If you would allow me to be a bit creative and forward looking then I could see something like this in the future:

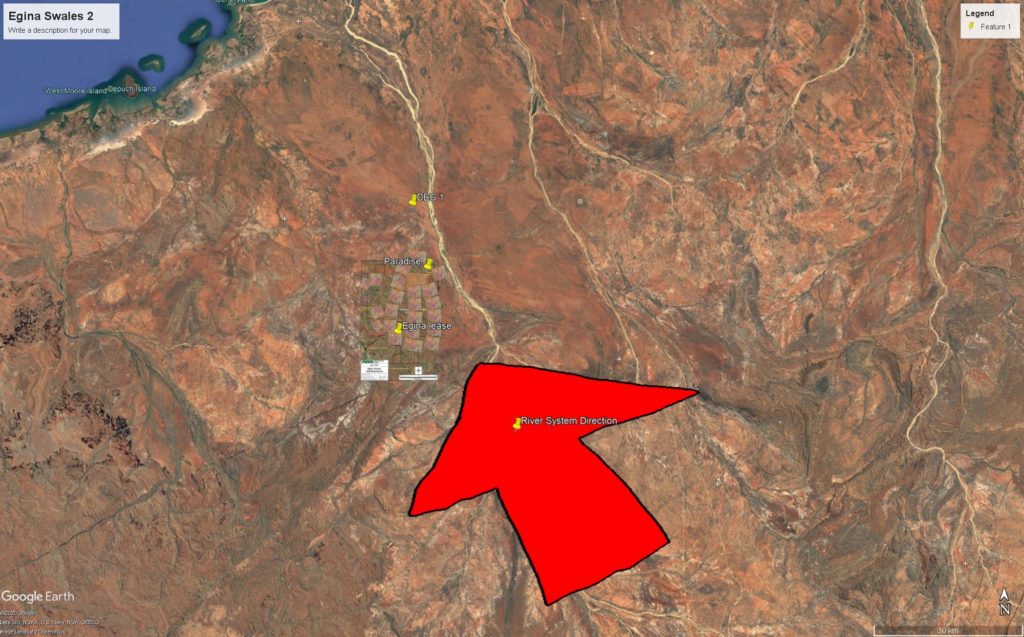

We know there are 1.9 km of cumulative swale width with Egina Swale MAK sample results up at Paradise. These were NOT surgically targeted locations but rather done along an arbitrarily located road (hence the name “Road to Paradise”). Now, given that the major erosional force is believed to be a river system starting in the South-East of Egina, and ending in the Indian Ocean, I would be surprised if gold magically jumped from Egina to Paradise. In other words swales proving to be gold bearing in the south should be mineralized all the way to where they are proven to be gold bearing further north:

… In other words I expect the swales and ground outside the swales to be gold bearing from the Egina Mining Lease area all the way up to Paradise. In turn I also expect the area between Paradise and the Aspen prospect, 5 km farther to the north, to be gold bearing as well. Assuming that is true there should tens to hundreds of km2 of gold bearing lag gravels just within the Egina Project. Given that this might some of the absolutely easiest and cheapest gold to recover I am therefore hopeful that Novo and Sumitomo are sitting on something that could be very economic and worth billions of dollars. As for the other 2/3 of the Greater Terrace… Well maybe Mr De Beers will be correct in his belief that Novo is sitting on deposits with 100-year mine lives.

Why are these MAK samples from just the “small” Egina Mining Lease a big deal?

- First of all they show further proof of concept in regards of laterally extensive gold bearing lag gravels.

- Secondly it suggests that Novo has gold bearing lag gravels within a Mining Lease that could theoretically produce over A$200 M in net operating profit.

- This de-risks and hikes up the fundamental value floor of Novo.

- I would argue that the gold found within the Egina Mining Lease coupled with Beaton’s Creek should underpin most of Novo’s current Enterprise Value

- Thus I believe the risk to the downside decreased quite a bit with this NR.

- By extension I also believe that one is not paying for any upside across the other 14,000 km2 of prospective ground as well as all the other equity stakes.

A great investment case for me is where I buy something material at or below fair value and I get any and all upside for free. Since I happen to believe Novo’s long term potential is beyond any miner it inevitably leads me to believe it’s the best risk/reward case I know of:

- + Fully permitted, high grade, open pit project in the form of Beaton’s Creek

- + Lag gravels within the Egina Mining Lease

- = Expected Value that underpins most the current Enterprise Value

- … Not paying and will get full benefit from any and all upside within:

- All Mt Roeconglomerates

- Comet Well

- Purdy’s Reward

- Contact Creek

- Etc

- All Hardey Formation conglomerates

- All upside within the wide open BC system

- Virgin Creek

- (CRA hit high grade gold in Hardey Formation 50 km down dip from Comet Well)

- Etc

- All Greater Terrace ground

- Greater Egina

- 47K Patch

- 2000 km2 of Greater Terrace ground

- Blue Spec (lode gold)

- East Well (lode gold)

- Mt. Elsie (lode gold)

- Talga Talga (lode gold)

- Any and all other lode gold targets found

- Including Hemi style targets

- Any and all other conglomerate types found

- Mallina Basin?

- Younger Fortescue conglomerates?

- Kalamazoo Resources (Fosterville type target + 1.65 Moz in Pilbara)

- New Found Gold (Fosterville type target)

- Malmsbury (Fosterville type target)

- Elementum 3D (Customers: Boeing, Lockheed Martin, NASA)

- Calidus Resources (On the way to production)

- All Mt Roeconglomerates

… If you would spine out all those assets into separate entities in this gold environment you can ponder what the sum of all those parts would be valued at. Just consider the fact that Sumitomo finds the Egina Project and Beaton’s Creek worthy of their money says it all if you ask me… And Egina makes up 1/3 of our Greater Terrace ground and the Beaton’s Creek system covers 0.1% of our land holdings. What does that imply for the total Expected Value of The Greater Terrace? Food for thought.

The market always has a hard time focusing on more than one flagship project at any point in time. The other projects get exponentially discounted. This could last a long time unless the company has ways to monetize and and all peripheral projects. Thankfully, Novo is pushing multiple projects forward at the same time. Egina (Greater Terrace), Comet Well/Purdy’s (Mt Roe) and Beaton’s Creek (Hardey Formation) are being fast tracked towards production which would give the first ever proof of concept for all three semi-craton scale gold systems. Mt. Elsie, Blue Spec, Talga Talga and East Well are all planned to be drilled as far as I know to boot. Then there is the custom made ore sorter that is being built and will be shipped down to Pilbara. This machine might unlock value for any and all of the just mentioned targets and systems.

Novo at this valuation is akin to buying Beaton’s Creek and the Egina Mining Lease at fair value and getting a project pipeline that would be enough for 20+ juniors for free in my humble (but probably biased) opinion. If just some of the projects outside of BC+Egina ML works then I expect great returns. If majority works then, yeah you get the picture. The most important thing is that barely anything is priced in and risk comes into the picture when one is buying something for a given amount that ends up not being worth much. When you don’t pay for it, you don’t take on any more risk.

To put things into perspective Calidus Resources has a gold project near Marble Bar in Pilbara which will produce 623 Koz (0.623 Moz) of gold over an initial 8 year mine life and it has a NPV of A$303 M and IRR of 77% assuming a gold price of A$2,500 (it’s A$2,600 ATM). The resource grade is 1.22 gpt which is about half of Beaton’s Creek’s grade even without the nugget effect. Furthermore BC is wide open and will prove to host a multi Moz deposit in the future IMHO… So what do you think Beaton’s Creek will be worth at the end of the day?

Keep your eye on the prize. I suspect I will never see a case like this in my life.

Ps. I’m not extremely bullish on Novo DESPITE the market not seeing what I see but BECAUSE of it. If everyone agreed with me Novo would be nowhere near 4 bucks a share and the opportunity would be worse.

Note: This is not investment advice. Always do your own due diligence. I am not a geologist nor am I a mining engineer. This article is highly speculative and it’s just my opinions. Novo is my largest position and the company is a banner sponsor.

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My Channel

Another remarkable article that gives Novo some more perspective and further surmises it’s long term opportunity to be truly a master gem in the rough.

maybe it starts latest the german sorters are at place and show-proof the leverage (end of year and first results by… letzt us say 24th dec) …

anyway, this technology is , for me, already proven by the tests done and with two firms building them.

even if you need more maintainance it makes no difference at these unbeliveable low costs.

so or so it will work. and it will be easy to finance the start as we have sum…

jmho

Please keep me on your list and informed of your opinion. Thank you. Tom

Good article. Makes me wonder why Irving is Moriarity’s biggest holding instead of Novo.