New Found (NFG.V): Intercepts 28.4 g/t Au over 13.8m and 25.0 g/t Au over 10.3m at Keats, Provides Exploration Overview

Vancouver, BC, February 11, 2021: New Found Gold Corp. (“New Found” or the “Company”) (TSXV: NFG, OTC: NFGFF) is pleased to announce recently received assay results from drilling at the Keats Zone (“Keats”), part of the Company’s ongoing 200,000 m diamond drill program at its 100% owned Queensway Project (“Queensway”), located on the Trans-Canada Highway 15 km west of Gander, Newfoundland.

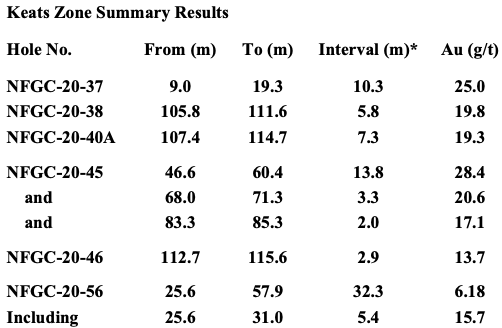

Highlights

- Highlights from these results are summarized below and in Figure 1.

Note that the exact orientation of the veins is uncertain but believed to be steeply dipping thus implying true widths of the high-grade zone to be in the 70% to 80% range of reported drill lengths.

- At Keats while mineralization remains open in all directions, we have observed a clear trend in the highest grade material forming a zone with a shallow plunge to the south along the Keats Baseline Fault.

- High-grade assay intervals received to date at Keats have correlated directly with the observation of significant visible gold in drill core. The Company is utilizing the observation of visible gold in drill core as the primary method to guide step-out drilling at Queensway.

- Assay results received from drilling to date have outlined an approximate 115m strike length of a thick, high-grade zone of gold mineralization at Keats. Logging and interpretation of drill core in step out holes to the north and south of this 115m interval have expanded the potential continuation of this zone to at least 260m of strike. This target zone remains open in both directions along strike and to depth.

- To the north the high-grade zone daylights at rock surface (under approximately 10m of glacial till), where broad intervals of near-surface high grade gold have previously been reported. Hole NFGC-20-41 for example was drilled in this area and returned two near surface intervals: 22.5 g/t Au over 10.4m and 31.4 g/t Au over 15.9m, with the first interval starting at 11.7m down hole (see the Company’s January 11, 2021 news release).

Denis Laviolette, President of New Found, stated: “Drilling to date at Keats is delineating a high grade, near surface zone with significant extent and size potential. We are continuing to step out on it to the north, to the south, and to depth. At the Lotto Zone 2 km north of Keats, step-outs from hole NFGC-20-17 (41.2 g/t Au over 4.75m and 25.4 g/t Au over 5.15 m, see the Company’s October 2, 2020 news release) appear to be delineating a new zone of near surface, high-grade gold. The Company believes that historical exploration at the Knob prospect located 2 km south of Keats which includes a historical resource outlined by Noranda has significant room for expansion and drilling is scheduled to start on this target shortly. Additional drills are being mobilized to the site to double the rig count from four to eight with the increase focused on exploring some of the more than fifteen high-grade gold zones along the Appleton and JBP faults and the many kilometers of strike along these fault zones that have not been drill tested to date. Numerous high-grade boulders and float samples located along the parallel JBP fault, 5 km to the east have yet to be sourced and recent geophysical interpretations are pointing toward a number of targets along a twelve kilometer section of this fault that warrant drilling.”

All these juicy new holes and yet the stock price is flat. Must be frustrating for the company. It certainly is for the shareholder

It’s like the market responds very well to some stocks like Eskay Mining, which I’ve watched go up recently to 23X my cost. And others, like Irving, Novo, White Rock Minerals, Scottie just poke us in the eye when they have incredible results.

I think the test of our patience will be paid back many times, as it > 10 times.

Kevin

I think timing has a lot to do with that. Eskay had a drilling campaign and hit paydirt. With good promotion the word got out and blew the price up.

Irving and Lion One seem like good stories but…zzzzzzz… when is the last time anything happened? Come on guys let’s get going

Gold companies don’t like to share their wealth [ poor dividends] Make a quick buck on them and then drop them like a hot potatoe Early exploration or takeover targets are their attraction.