THH – Mining Investing in World of ESG, Inflation And Supply Shortages

Investing in the commodity space is really all about front running… Front running events and more importantly front running changes in perception/sentiment towards said events.

“I skate to where the puck is going to be, not where it has been.” – Wayne Gretzky

In 2022 we find ourselves in a world of ESG, inflationary pressures and commodity markets that are getting tighter and tighter due to lack of supply (Much thanks to the former two). In this article I will discuss how I think about investing in miners in light of all this. Now keep in mind that I do not have all the answers and am simply trying to theory craft as much as I can in order to maximize the returns from today until “forever”. Even if one spent a 3 months just thinking about investing and the result would be that ones long term returns went up 1% per year for the rest of our lives that would very much be worth all the work.

I am very interested to hear what you guys think might be important things to consider in light of how the world looks today and what you expect going forward. Any particular jurisdictions, stages of companies and/or types of deposits etc that make more sense than others? Please feel free to post a comment in the comment section in that case.

So lets gets into it…

Challenges

- Harder permitting due to ESG

- Value of permits go up

- Lower footprint?

- Lower tonnage?

- Remote locations?

- Higher energy costs

- Jurisdiction and tonnage becomes more important

- Higher CAPEX/OPEX due to inflation

- Favors low CAPEX/low tonnage projects?

- Higher rates

- Higher quality/margin/lower CAPEX projects?

Things to look for?

- High margins

- Preferably lower tonnage

- Cheap electricity

- Permits in place

- Private, Patented land

- Access to water

- Jurisdictions where mines can actually get built

- Increased focus on metals tied to EV revolution

- Large land packages with as many metals as possible before real estate prices go up

- (Prime ground is a very finite resource)

- Jurisdictions that might get increasing premiums in a chaotic world

Other Things to Consider

- Geopolitics (Strategic sourcing of metals)

- Friend or foe? East or west?

- Capital controls?

- Where do the major miners want to be?

- Commodities that might be deemed critical/strategic in specific jurisdictions?

- What is the stage of the company?

- For a developer where the only real value bump comes from going into production ought to be located in a jurisdiction where it CAN get into production sooner rather than later

… In theory everything comes down to expected ECONOMIC VALUE aka the risk-adjusted discounted cash flow aka Intrinsic Value.

In Practice For an Investor

As an investor our job is to BUY something that is undervalued right now or will look undervalued today sometime in the future…

Jim Grant said “Successful investing is having everyone agree with you………..later.”

Investing is basically front running events and changes in other peoples emotion towards your investment (Unless you are a strict dividend investor). I believe that the more positive changes one can front run the better…

Beta

If I buy a pure Beta mining stock at extreme sentiment lows the only real winning strategy is to wait for market sentiment to change for the better. This is basically a play on the delta which ounces are valued at during different sentiment levels. At one point a 50 Moz silver deposit might be valued at $4/oz, at another time it might be valued at $1/oz, and it will go back and fourth between those levels over time. Basically it is what is called a “trading sardine”.

Alpha

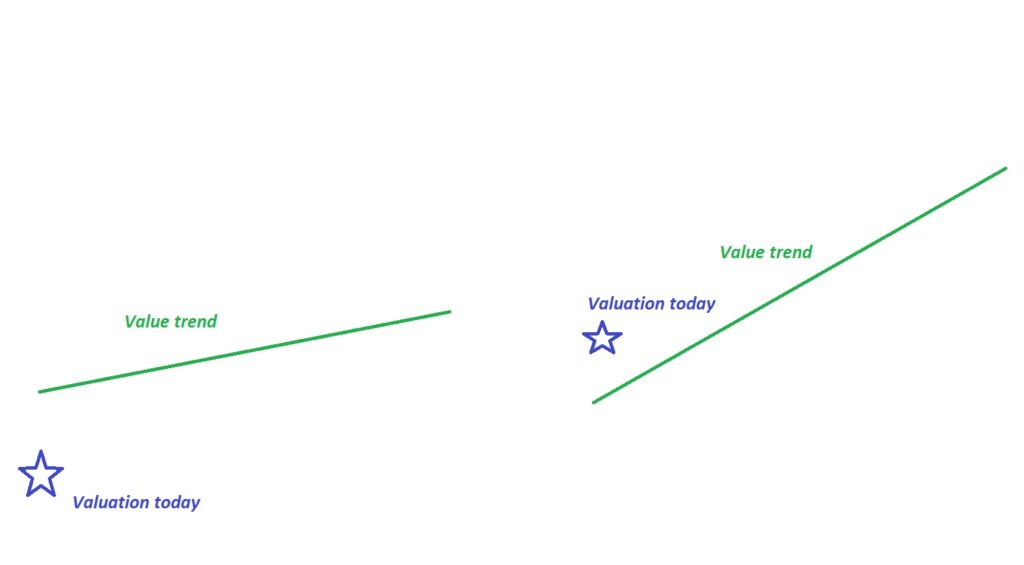

With Alpha I am mostly thinking about rapid, internal value creation by the company without the help of a rising price in metals. Typically a high growth story will look expensive based on the present but some might realize the pace of the expected value creation is so rapid that it will surpass the current PRICE in an acceptable time frame and lead to a positive Price-to-Value gap. Basically one is paying a premium on the NOW while at the same time (hopefully) buying it at a discount relative to a future that is not too far off. A visualization of this is the right graph in the chart below:

… The left chart would be more of a hybrid. Basically a stock that is undervalued based on what is known TODAY (Margin of safety aka value play) but that also has Probable Growth prospects (but to a lesser degree) and thus a upward sloping value curve in time. The former typically has better Risk/Reward given a justifiably high weighting on Risk (Margin of Safety) even though the latter

Changes in Jurisdictional Premiums?

I still remember Thomas Kaplan’s interview where he talks about the mining industry going “full circle” and that he believes the typical top tier jurisdictions such as USA, Canada, Mexico and Australia are going to get a way higher premium in the future and might even turn into a bubble within a bubble:

In the interview Kaplan airs his fear of one day waking up to the news that what he thought he owned yesterday has now been taken away from him (Nationalization). This notion of being “right” but getting the “wrong outcome aka not getting the fruits of ones labor is his nightmare. Thus he is now focused on North America and Australia. I think this is a very important point. Sure, Canada and parts of the US have higher premiums than for example Africa already. But lets say things get a lot worse from here and there is more talk of nationalization in the third world in the wake of rising commodity prices along with deteriorating economies. In that case the premium on tier one jurisdiction where private property is the most protected might see way higher premiums still…

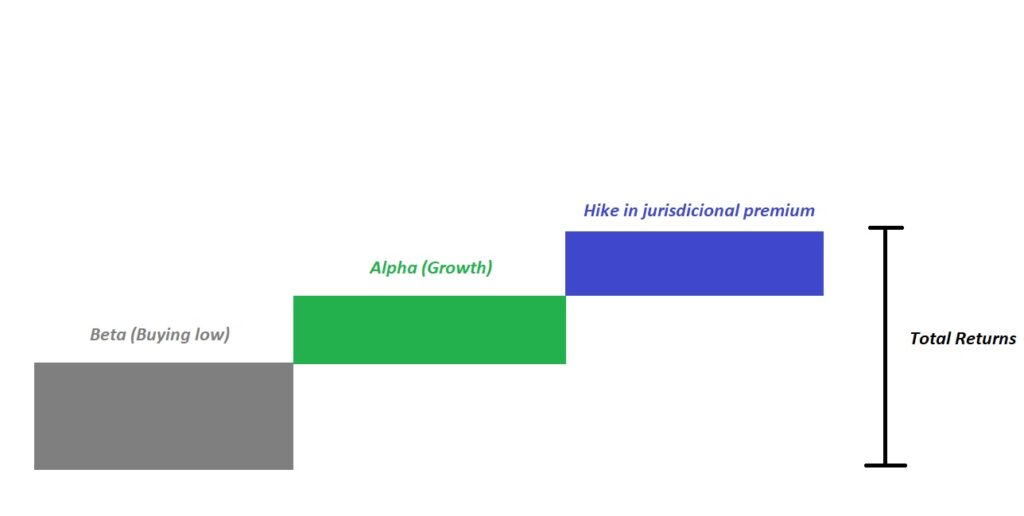

If I try to tie everything together I guess the “perfect case” would be one that;

- Is significantly undervalued relative to what is known so I have inherent BETA (And Margin of Safety)

- Has the means and prospects to increase it’s value over time (ALPHA)

- Is located in a jurisdiction where success might fetch a higher value sometime in the future (Hike in jurisdictional premium)

If I only have Beta I do not get “paid to wait” and if it is in a poor jurisdiction then the returns from the inherent Beta might be lowered due to a hike in jurisdictional discount. If I have all of the above then I would have Expected Returns from the sentiment swing, see the intrinsic value increase with time (which also leads to higher beta), and finally the current success plus any additional success would get a value hike thanks to success in whatever jurisdiction getting a hike overall.

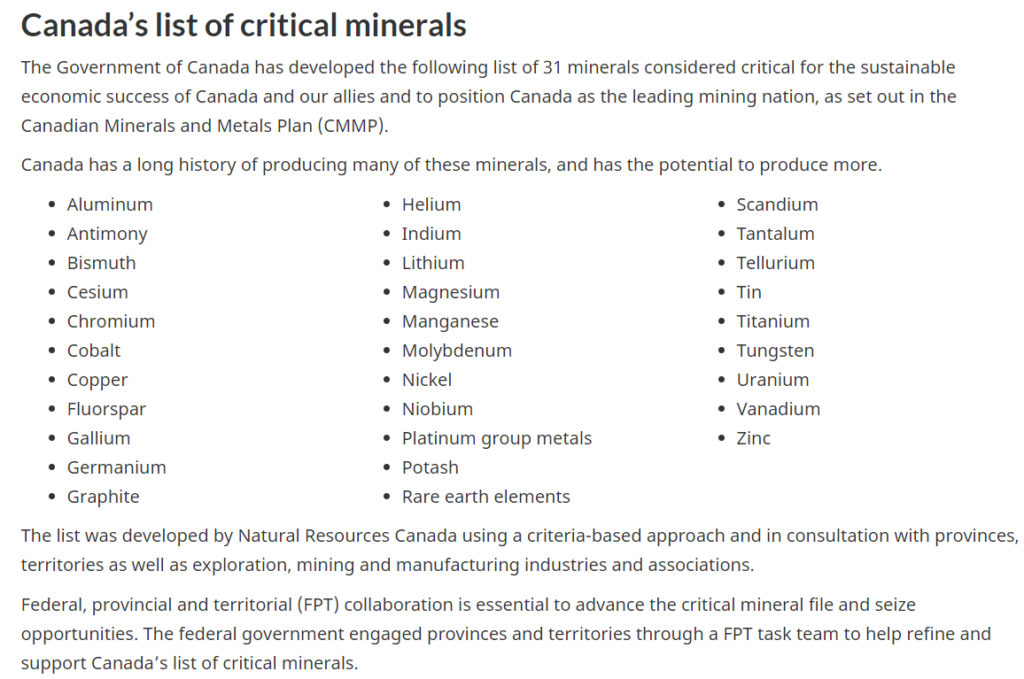

There might be even more “swing factors” to research as well. Examples would be front running some shortage in a specific metal in a specific jurisdiction. Lets say a country imports almost everything of a certain commodity and the importation of said commodity gets cut. Then said commodity would suddenly be deemed critical and get a lot of economic boons thrown its way. Kinda like some commodities already getting designated as critical:

Canada:

– Source

USA:

The United States’s definition:

“Critical minerals play a significant role in our national security, economy, renewable energy development and infrastructure,” said Tanya Trujillo, Assistant Secretary of the Interior for Water and Science. “USGS data collection and analysis scans the horizon for emerging issues in crucial supply chains, and every three years identifies the nation’s current vulnerabilities to potential disruptions.”

You can find the complete 2022 list HERE.

The US list is a lot longer than the Canadian list. With that said Copper is for example deemed critical for Canada but not the US forth what it’s worth.

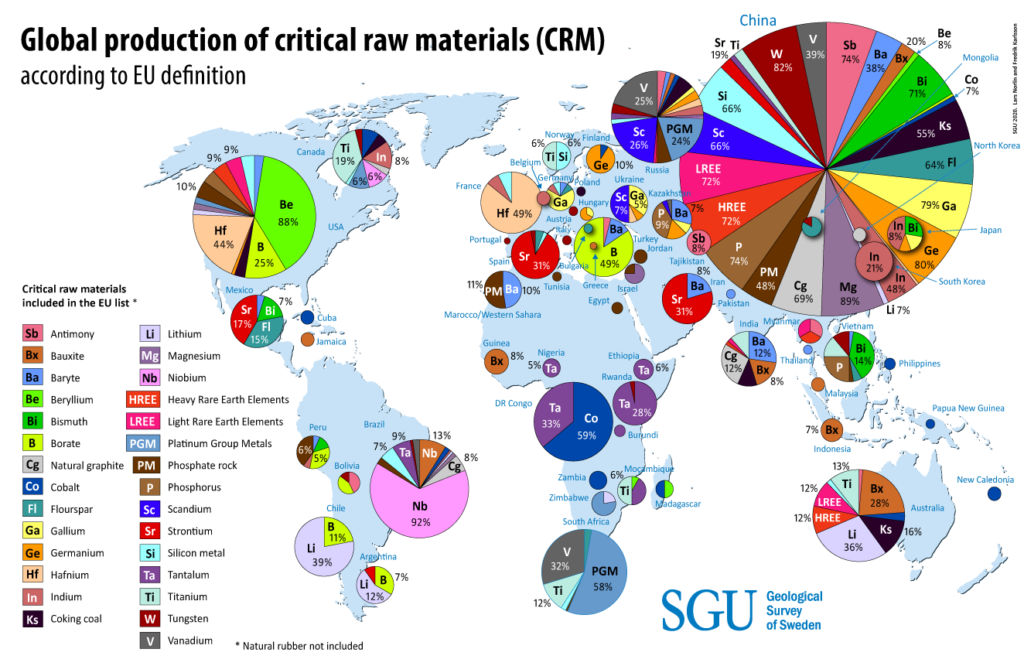

Global production of critical raw materials (CRM)

SGU of Sweden has made a world map which shows what percentage of “critical raw materials” according to EU definition is produced and where:

… If the East vs West tension escalates one can ponder what commodities would perhaps get grants and easier pathways in terms of permitting in the West if one or more “unfriendly” countries stopped their exports to the West.

On that note…

Robert Friedland on Mining in the US – Source

Reuters: Push to shorten U.S. mine permit review process gains steam

Sept 1 (Reuters) – U.S. mining companies, automakers and a bipartisan group of congressional members are recommending that the federal government cut the time needed to permit a new mine in order to boost domestic production of electric vehicle minerals.

The requests, submitted this week to a committee that will propose changes to the General Mining Law of 1872, comes amid rising pressure on the EV industry to procure lithium, copper and other minerals from domestic or ally sources.

CLICK HERE to read the full Reuters article.

Energy

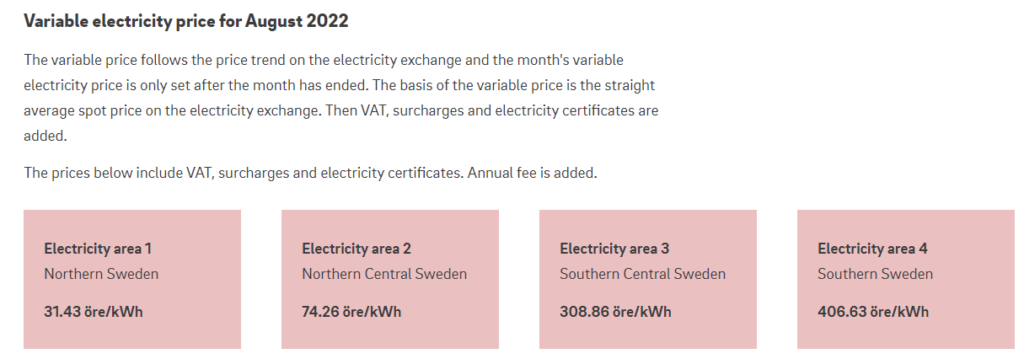

As if there was not enough things to ponder already I think it is still worth the time to consider the implications of world where some jurisdictions might see higher energy prices for years to come. All else equal a miner would rather have a mine where the the costs are $X/kwh rather than 4X$/kwh.

In Sweden for example the electricity prices in the northern parts of the country are way less than the southern parts (a lot thanks to the amount of Hydro electric power in the north). Think about the difference in operating costs of two identical mines if one was located in the north and the other in the south:

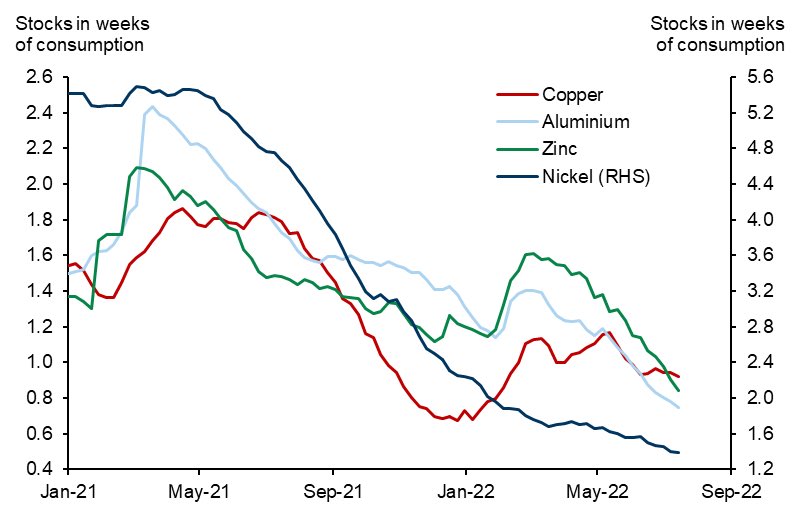

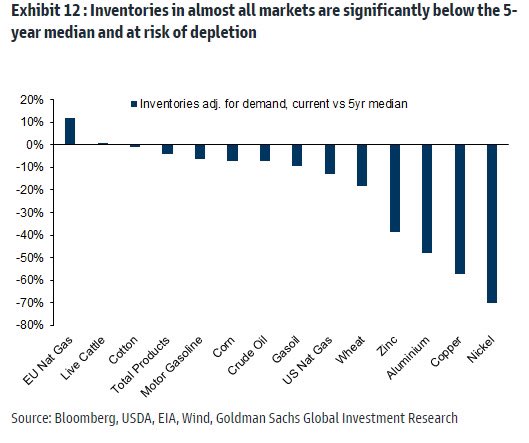

Current Supply Crunch

Inventories in a bunch of metals are very very low right now…

And COMEX gold (and silver) is currently seeing steady withdrawals:

#GOLD IS CONTINUING TO FLY OFF THE COMEX LIKE NEVER BEFORE

The 100-day and 200-day average rates of gold withdrawal have NEVER been as high as they are now and they are continuing to increase. pic.twitter.com/TSx0KTBWZ1— Michael 🏳️🌈 #silversqueeze (@mikesay98) September 12, 2022

What do the majors put focus on?

Some of the most recent transactions that I can recall:

- GT Gold bought by Newmont (BC, Canada)

- Pretium Resources bought by Newcrest (BC, Canada)

- Great Bear Resources bought by Kinross Gold (Ontario, Canada)

- Kirkland Lake bought by Agnico Eagle (Canada/Australia)

- Battle North Gold bought by Evolution Mining (Ontario, Canada)

Newmont Mining

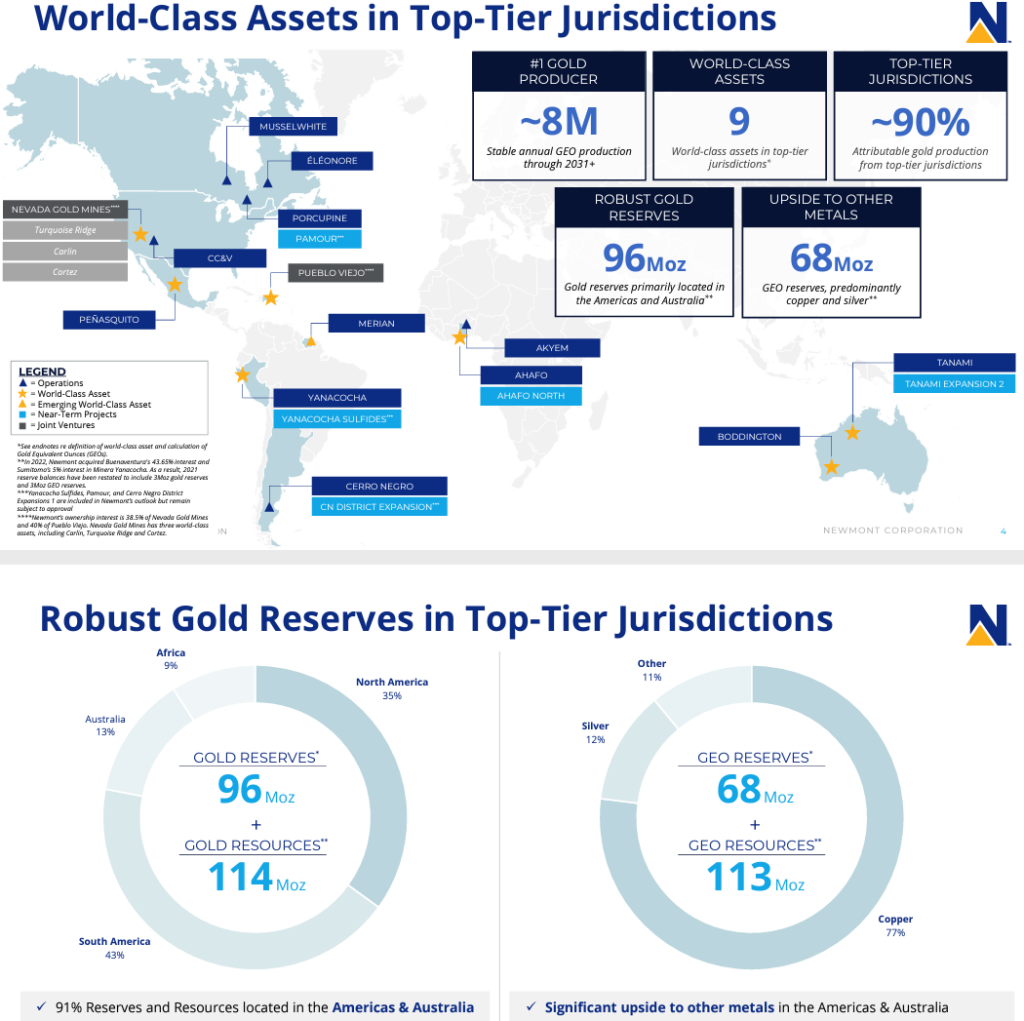

“World-Class Assets in Top-Tier 1 Jurisdictions”. Obvious focus on Americas and Australia:

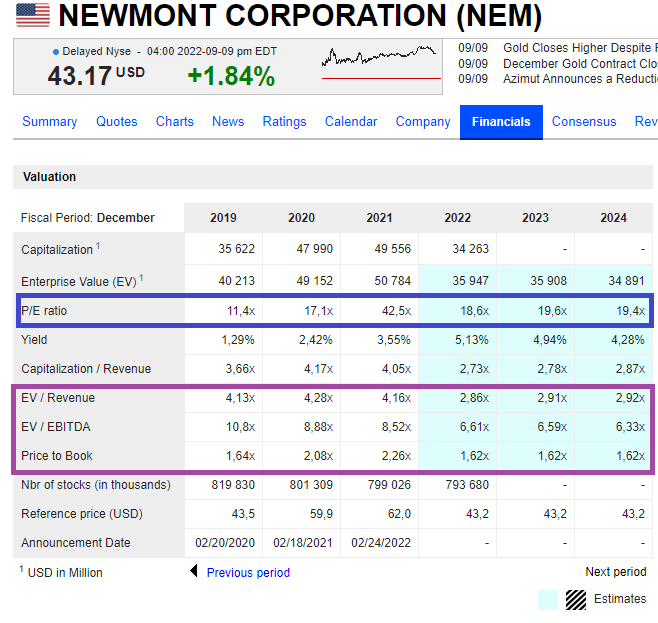

Financial metrics for Newmont which is more centered on the Americas and Australia:

Barrick Gold

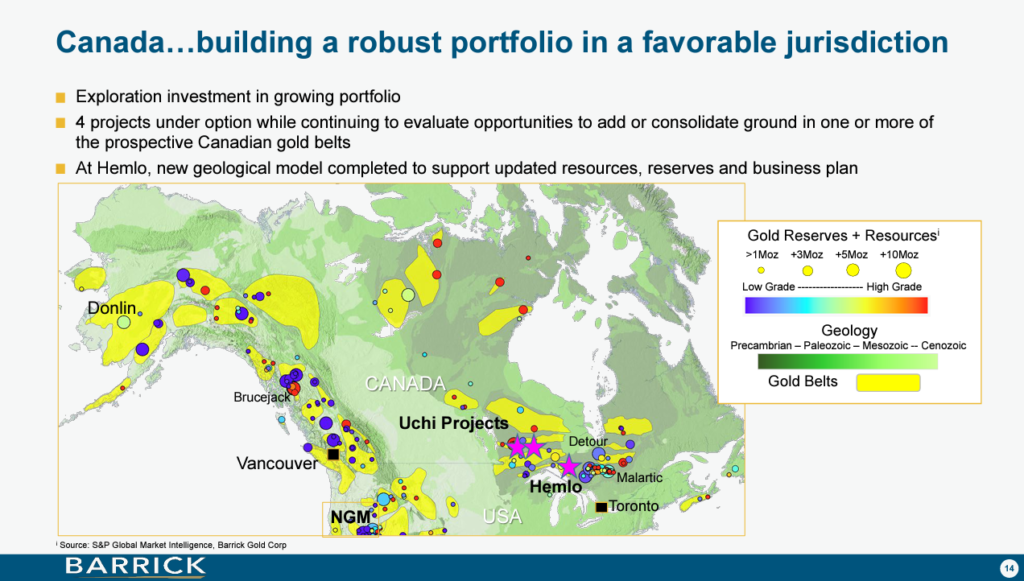

“Canada… Building a robust portfolio in a favorable jurisdiction”.

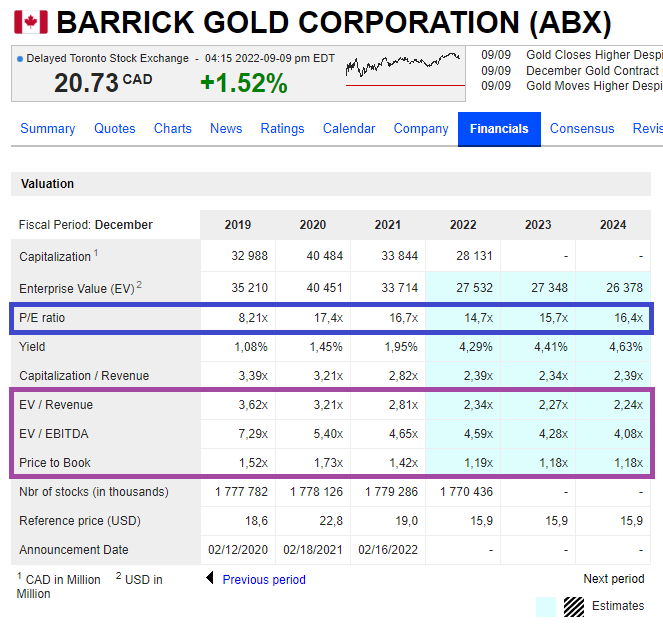

Financial metrics for Barrick Gold which has more operations in places like Africa:

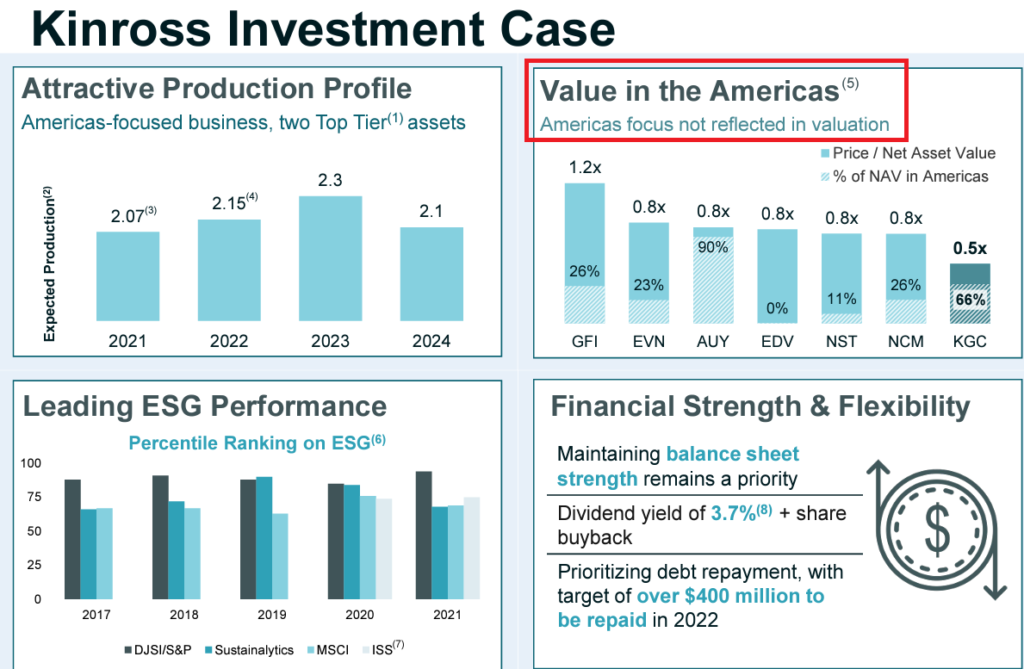

Kinross Gold

Kinross which many people probably know recently acquired Great Bear Resources for some C$1.8 B which was located in Canada is frustrated that its not getting the “Americas” premium unlike some other companies.

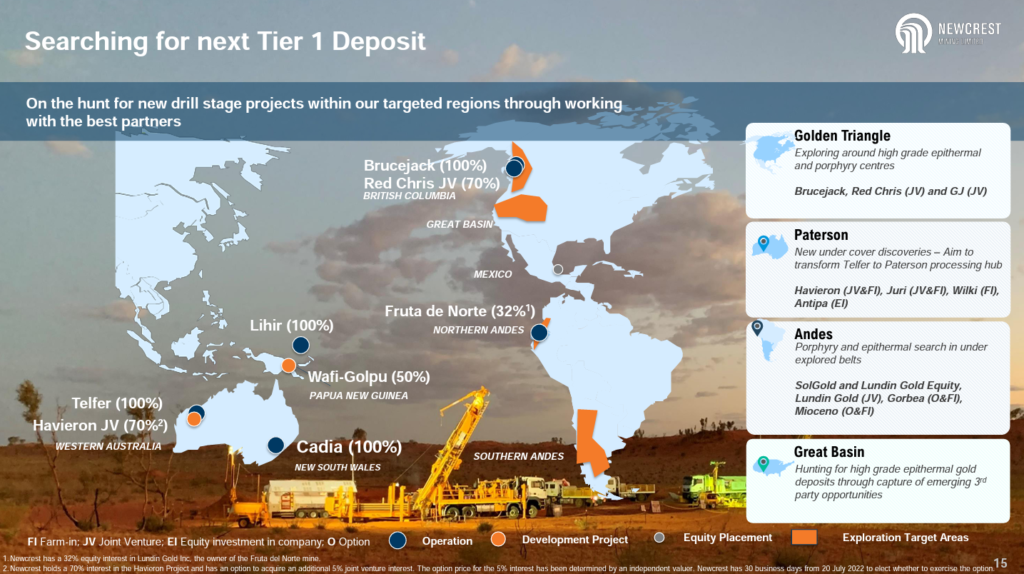

Newcrest Mining

Note “Golden Triangle” in Canada and “Great Basin” in the US which is a region that Newcrest doesn’t even have operations in yet.

Macro

I guess some jurisdictions in Canada could very well be the most attractive in the world thanks to access to water, being a first world country and that has relatively cheap power. Brazil and some African countries seems to be places where at least the permitting etc is relatively smooth and fast.

Headwater Gold

I think Headwater Gold is a good example of focusing on what end result would be valuable and then working backwards from there. The strategy of the company has been to gather a large portfolio of projects in the US which are prospective for High-Grade, lower tonnage deposits. Obviously Newcrest Mining thinks that end product would be of value so the major miner struck a deal to earn into 75% of four of Headwater’s early stage projects.

Snowline

Very high grade core which could bring very good margins. Located in Yukon where mines have been built recently (Eagle Mine).

Hercules Silver

Some important permits in place for parts of the property.

Cassiar Gold

Some important permits already in place (including a mining lease) and a small mill.

i-80 Gold

In Nevada with a lot of permits and infrastructure in place (some historic producers).

Western Alaska

In Alaska with a past producing mine on the land package. Undergound, lower tonnage and bonanza grades.

Cabral Gold

In Brazil where it appears that it’s relatively easy to actually build a mine. A new, large mine (Brazil’s third largest gold mine) is being built right next-door.

Red Pine

Historic mine with a lot of infrastructure. Mostly patented land.

Eskay Mining

The neighbor Skeena Resources appears to be moving their deposit ahead to development. Infrastructure in the area is getting built out.

Nevada King

Atlanta Gold Mine is a historic producer. All projects in Nevada.

Lion One Metals

Mining permits in place and going towards production. Potentially very large system.

Goliath Resources

Underground & hopefully high margin in BC, Canada. Potentially high margin due to gravity and favorable metallurgy. Could be very big.

Tectonic Metals

Good relations with native corporation and even has it as a large shareholder.

Event layering

- Supply crunch aka Scrambling for metals aka rise of the old economy

- Own commodities and options on future supply (Mining companies)

- Geopolitical tension -> Some jurisdictions will rise and some fall

- Strategic sourcing -> Some metals might get more help than others in any particular jurisdiction

- Nationalization in a global recession -> Tier 1 jurisdictions

Note: This is not investing advice. Assume I own shares of all companies mentioned and keep in mind that some companies are sponsors of mine. Always do your own due diligence and consider me biased!

Best regards,

The Hedgeless Horseman