Criteria I Use to Evaluate And Trade Exploration Stories

In this piece I will discuss some of the criteria I use when evaluating junior exploration plays as well as touch a bit on how I think in terms of timing. Hopefully you will find it helpful in your own investing endeavors.

Setting The Scene

First of all the mining business is so crap that few if any producing miners will generate even acceptable returns over a full commodity cycle. It’s not only because bad decisions are made in the bull market that leads to obscene value destruction in the inevitable bear market but also because it’s so hard for (especially larger) companies to grow and replace the ounces being mined. In other words there are very few cases that could be seen as HODL cases in the long term.

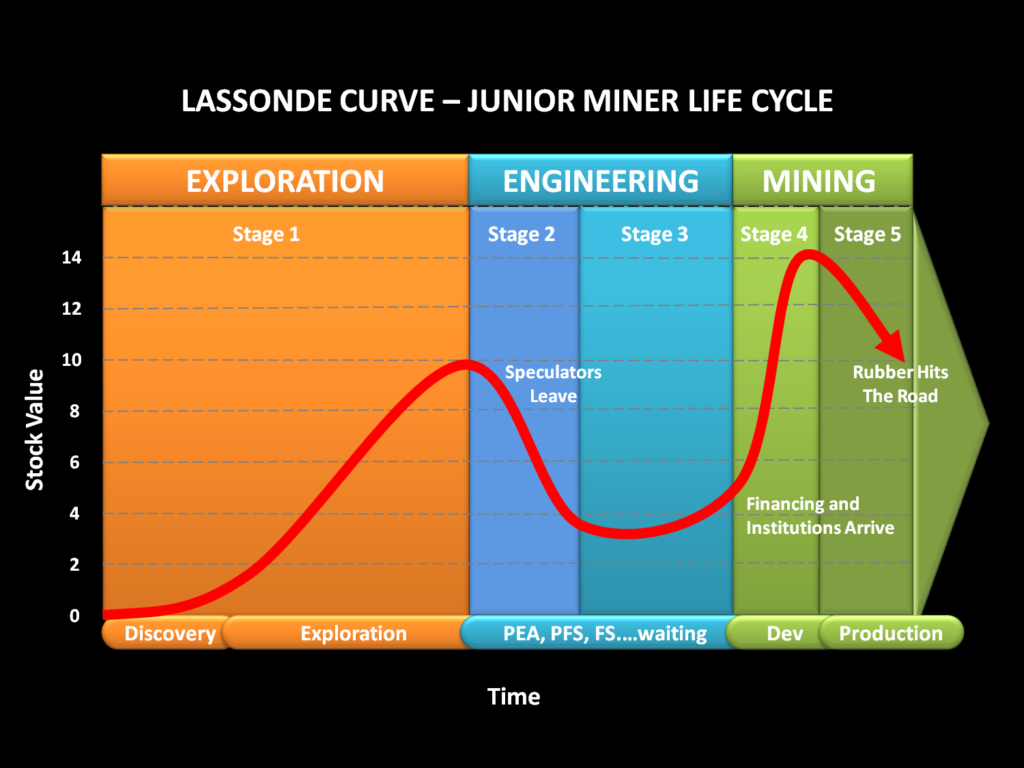

Given the above I think it really comes down to realizing and accepting that a) Majority of cases will/should just be trades in hind-sight and b) that the Lassonde Curve is the name of the game:

Even if a junior does end up finding something that will be bought out, or actually become a mine, it might 5-10 years or more…

In conclusion: If one accepts that >95% of juniors are trading vehicles at the end of the day then one also has to accept that what the market thinks/feels becomes very important at any given time. The Lassonde Curve is probably the best macro representation of what timings/stages are the most attractive from a trading stand point. The most violent and potentially most profitable one is the discovery-exploration phase which will the main focus in this article.

With the above said there are multiple sub factors that I think one should consider while evaluating exploration stories…

How much will the market care and when?

- Jurisdiction

- Infrastructure/location

- Narrative

- Characteristics of the system

- Catalyst(s) potential

- Time to said catalyst(s)

- Total Blue Sky potential

- Stake

- Price & Momentum

- Capital Structure

Why do I bring up the above points?

Well, because for better or for worse only a fraction of juniors will ever be able to a) Turn a project into a business (a mine) or b) Get acquired. I would say that in >95% of cases a junior will simply be a trading vehicle for the majority or all of its existence. Don’t get me wrong, the fundamentals and catalyst will affect the share price etc but at the end of the day there will not be a “natural exit” in the vast majority of cases. With that said, the ideal situation is obviously to pick the explorers that have the greatest chances of actually becoming a business (a mine)…

Jurisdiction

Success in some jurisdictions gets much more rewarded than the same success in other jurisdictions. This will also tie into the “narrative” or “closeology” factor. Preferably one wants to own a company that will get the most bang for the buck when it comes to potential success.

Example: 20 g/t over 10 m drilled in Red Lake will fetch more value in the market than 20 g/t over 10 m drilled in Uganda. Note that this could be offset by the Ugandan explorer starting off at lets say 1/4th the Market Cap of the Red Lake explorer.

Infrastructure/Location

This one can be a a bit tricky for an amateur to evaluate but it can really be worth the time. In short one could say that the better the location/infrastructure the more a company will be rewarded for success. If a junior has a project in “no man’s land” it might require a huge discovery for the project to have any shot of actually becoming a mine one day. I think a perhaps good example of this is how Nighthawk Gold has drilled and drilled, with pretty juicy hits, but has never really been able to gain much traction in the market. The company’s flagship project is located in the Northwest Territories and as far as I know it is pretty far away from any real infrastructure. I can’t accurately say to what degree the remote location is “punishing” the stock but I think it is meaningful.

In short: A 1 Moz deposit in the heart of Nevada has a lot better chance of becoming a mine that a 1 Moz deposit that is 100 km away from any meaningful infrastructure. In other words the threshold for success and thus value per ounce will be more favorable for the former.

Narrative aka “emotional anchor”

Narrative is a very important factor because it can greatly affect the feelings of investors and emotions/feelings affect our every decision. Everyone wants to be part of an “epic adventure”. A good narrative often comes in the form of a similar deposit/system type as legendary mine X or Y but is not necessarily a closeology play. One recent example is New Found Gold and the “another Fosterville” narrative. New Found Gold’s Queensway Project and Fosterville are located on different continents but the deposit type seems to be very similar. This means that there is an emotional context in a lot of investors minds because most will have heard about the story of how Fosterville made Kirkland Lake into one of the best performing stocks a few years back and obviously everyone wants to be a part of an epic journey like that. Another example is Great Bear Resources and the Red Lake Mine narrative.

Examples off the top of my head:

- New Found Gold <-> Fosterville

- Labrador Gold <-> Fosterville/New Found Gold (by extension)

- Eskay Mining <-> Eskay Creek

- Novo Resources <-> Witwatersrand

- Timberline Resources <-> Any Carlin deposit really

- Eloro Resources <-> San Cristobal & Potosi etc

- NuLegacy Gold <-> Goldrush, Pipeline & Post Betze etc

- Inflection Resources <-> Cadia etc

- District Metals <-> Garpenberg Mine

- Great Bear Resources <-> Red Lake Mine

- Prosper Gold <-> Red Lake Mine & Great Bear Resources

I believe that exploration stories with a strong narrative have an easier time getting paid “up front” for the future potential because “seeing is believing” and many have experienced, seen or heard about what kind of returns were generated in some legendary story that was similar to some degree. I would also argue that it does not necessarily need to be a historic mine but can be something else that is emotionally charged like a famous gold rush such as the Yukon Gold Rush (White Gold Corp). Another example is simply that a person or persons that have been involved in some world renown discoveries are involved in a story even though the targeted deposit type in a new venture might be completely different than what was discovered in the past success(es).

Perhaps the best example of narrative/”emational anchor” at work is the crypto craze. Once people saw the extreme rise in Bitcoin everyone started to look for the “next Bitcoin”. People were willing to put money into any worthless crypto currency once they had seen how high Bitcoin had risen and how many “Bitcoin millionaires” had been created (“If Bitcoin then why not Dogecoin?”). Basically once ONE crypto had proven that it could fetch a very high value everyone started to be comfortable with the idea that their alt coin of choice could do it as well (“Seeing is believing”).

Note that narratives can start and stop like we have seen in Novo Resources for example. In 2017 it was the narrative of another Witwatersrand Basin that made Novo rocket higher based on the narrative coupled with more or less a single trench video. Today said narrative is very much subdued and the stock has a hard time gaining traction. With that said I do think the narrative will be ON again, sooner or later, and when that happens I think the stock will move much quicker and much higher than most people will be prepared for. And since price changes sentiment I think it will, again, be a positive spiral due to price changing sentiment and sentiment kick starting the narrative etc.

Characteristics of The System

First of all, Higher Grade hits raises more eyebrows than Lower Grade systems, all else equal. Second of all, some systems/deposit types are easier to drill than other and the mineralizaion can be more or less forgiving. A system with shallow, disseminated gold is going to be quicker, easier and more forgiving to drill than lets say a nuggety system that starts 500m deep. Even if two deposits will have the same NPV at the end of the day one can take a lot longer to drill out and the news flow can be less exciting relative to the other.

All in all, this really is an art and not a science in terms of how relatively good/bad a target scores on this department. Obviously the best of all worlds would be something like a high-grade, disseminated and shallow system that is not structurally complex for example.

Lastly I would say that the easier the target is to drill the more comfortable I am having exposure to any given batch of assays. If a system is deep and nuggety then it inevitably leads to more “results volatility”. The characteristics of the system becomes increasingly important if one is deciding whether to sell into a pre-assay rise obviously.

Catalyst(s) Potential

What I mean by this factor is simply trying to estimate how “emotionally charged” and/or fundamentally important a catalyst might be. High impact/high potential catalysts would obviously be assays from a maiden drill campaign on a promising, early stage target (when the blue sky potential is still “unlimited”). On that note I think it really is worth pointing out that “new” is always more exciting than “old”. What I mean by that is that there are juniors out there that have acquired advanced assets, with obviously high exploration potential, and yet they can be valued at the same Enterprise Value like a grassroot explorer that has maybe a 5% chance of having the same success that is already banked in the former. I think this really goes to show just how big of a premium there can be on “imagination”.

Note that this also ties into factors such as narrative and jurisdiction etc.

Time to Said Catalyst

That speculators are impatient is nothing new since everyone wants to get rich tomorrow. Good examples of this is how explorers working in lets say Yukon, BC and Alaska usually get hammered once the field season is over and there is a “whopping” five or six months until drilling etc can kick off again. I have seen some cases where the Enterprise Values gets down to close to zero during this boring period. I honestly think that one of the least risky and best risk/reward strategies would to simply by a lot of said (cashed up) explorers around year end and just wait for a 50%-100% revaluation come spring/summer… With that said I am too much of an action junkie myself to actually employ this strategy in a meaningful way despite knowing this (which I think is a good sign in terms of why it probably works very well).

In short: The closer a company is to a “hot” catalyst the more buying pressure one will usually see, all else equal.

Total Blue Sky Potential

What I am talking about here is how many and how big are the potential “carrots” beyond the first “carrot”. If an explorer has a small flagship project, with only really one obvious target, then the “blue sky” potential might be relatively limited. Compare this to an explorer that owns a whole district sized project with showings everywhere. One current example of this is Eskay Mining which a) Has already gotten good hits at the company’s TV/Jeff target, b) Owns 85% of the Eskay “belt”, and c) Has more obvious targets than I can remember. Furthermore the very nature of VMS deposits is that they tend to actually form in “districts”. Therefore success at one target immediately hikes up the expectations of the company producing additional discoveries.

Stake

Companies that offset risk by joint venturing projects to another entity, where they give away a percentage of the project in exchange for a free carry, makes a lot of sense from a risk/reward perspective. However, it tends to kill the “greed” factor. Why? Because, again, everyone wants to get rich tomorrow and it’s the idea of a 10-100 bagger that excites speculators and makes them want to buy a junior explorer. When a company cuts that “dream” by say 30%-70% inevitably get “hot money” turned off. It’s easy to see this effect at work in project generators. One example would be Mirasol Resources which got down to an Enterprise Value of around US$4 M in December which is obviously nuts given that they have multiple JVs with big companies and that some are being drilled or are expected to be drilled soon.

In short: If you intend to front run the excitement related to lets say a drill campaign then it often pays to bet on plays which preferably have 100% exposure to the coming results simply because they should have a higher greed factor.

Price & Momentum

“There is nothing like price to change sentiment”

Personally I tend to catch a lot of falling knives since I am value focused investor/trader. If a stock goes down 50%, from already a cheap valuation, and nothing detrimental has happened to the company then I am often an aggressive buyer. If a stock goes down 50% due to intrinsic value having gone down a lot then one got a big problem. The former should be expected to revert to the mean sometime in the future and the latter might never go higher.

At the lows everyone will be talking about the risks while not realizing that perhaps a substantial portion of everything that can go wrong is already priced in. Remember, volatility is not risk. I see risk as the chance of permanently losing money and I see volatility as an opportunity (either to sell high or buy low). If I have high conviction in a case, and I think that a depressed price is mostly sentiment driven, then I tend to load up big time. I am basically front running a shift in sentiment and reversion to the mean. This is really where conviction and due diligence shines because it will often be scary to double down when everyone is panicking. Furthermore one has to be RIGHT to boot. On the other hand if something is in a nice uptrend that means that there is a bullish skew to sentiment which means if feels easier to buy.

The above goes for mining companies overall but when it comes to explorers I tend to operate like this…

If a grassroot explorer goes up a lot heading into a period when assay results can be expected at any time I will take some money off the table. If I think the R/R is fair at say $25 M and the Enterprise Value goes to $50 M before assays, from a maiden drill campaign, then I (hopefully) will be taking money off the table. On the other hand if the market does not really care about the story and it stays sub $25 M then I might hold the whole position going into assay results.

Capital Structure

Even though shares outstanding doesn’t mean anything special, in terms of valuation, a “tight” stock usually has an easier time to move higher. What I mean by “tight” is pretty much a low float and that usually comes with fewer amounts of shares outstanding overall. This can of course be a double edges sword (a stock can go down surprisingly enough). It is also preferable to have as few warrants as possible that might weigh on a rising stock. The same goes for cheap shares that become free trading.

Bottom Line

An ideal & timing would thus be:

- Jurisdiction

- Good jurisdiction where success gets greatly rewarded

- Infrastructure/location

- Close to meaningful infrastructure which increases the value of any success

- Narrative aka “emotional anchor”

- A great narrative that makes people comfortable with the idea of a high market cap

- Characteristics of the system

- Preferably high-grade, wide, easy/cheap to drill and relatively homogenous mineralization

- Catalyst(s) potential

- Getting in during the boring period but which leads up to a high potential catalyst

- Time to said catalyst(s)

- Long enough for the market to be bored so the company is cheap but otherwise as soon as possible obviously

- Total Blue Sky Potential

- Preferably the company will have a district scale land position where a discovery hikes up the expectations/implied value of the entire land position

- Preferably a deposit type that tends to form in clusters

- Stake

- 100% owned project/target gets a lot more traction since it’s the absolute upside and not risk/reward that affects greed the most

- Price & Momentum

- Either be in before an expected momentum shift higher,

- or be in when momentum is up since it means that sentiment already has a bullish skew

- … Can be a double edged sword if expectations are too high and one holds the stock into a catalyst that disappoint

- Capital Structure

- Preferably a tight share structure since the tighter the structure the easier it usually is for the stock to move

- Preferably little to no warrant overhang

- Preferably not cheap shares on the way of becoming free trading

The Simple Guide to Playing Grassroots Exploration Stocks

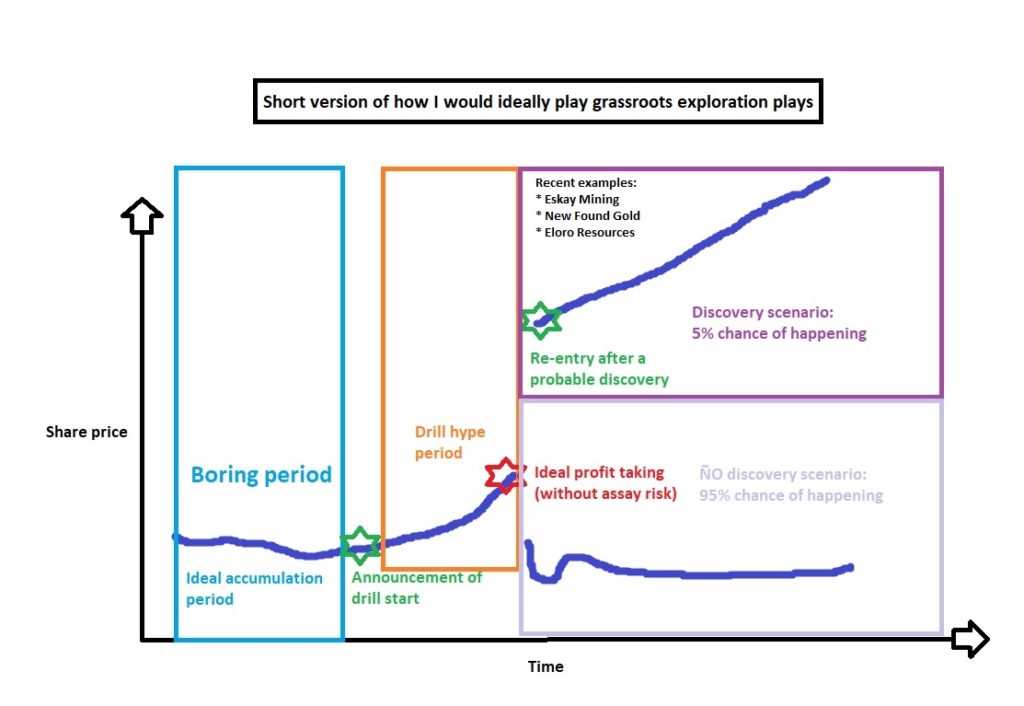

If what has been discussed in this article feels overwhelming then I think the following slide sums up the most basic overall strategy with the best risk/reward possible…

… Note that most of investors get maximum bullish right at the point which usually has the absolutely worst risk/reward, which is right before first assay results, due to Reward being lower (price has increased with no change to fundamental value) and Risk being higher (Price has increased with no change to fundamental value).

Best regards,

Erik Wetterling aka “The Hedgeless Horseman”

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My channel

Thanks very much for your views on junior explorers. Great read – very much appreciated.

Great article. I need to read it a few more times for the lessons to sink in