Eskay Mining (ESK.V): Something Else

Oct 18, 2021

Before diving in I will point out that Eskay Mining has become my largest holding since I have yet to sell a share and that the company is a passive banner sponsor. Therefore assume I am biased and do your own due diligence. Anyway, what follows are my personal thoughts on the case as I see currently see it and why I think the market is not fully aware of the sheer potential…

Previous articles:

Setting The Scene

The original Eskay Creek deposit had a strike length of “only” around 1 km, but was obscenely high-grade, and could possibly be worth around C$4B if found today according to John Kaiser.

Skeena Resources which has been working on drilling out the “remnants” of the Eskay Creek deposit has managed to prove up a deposit that is worth around C$1.6 B atUS$1,700/oz gold and US$24/oz silver according to the PFS which was released this year. The footprint of this deposit is around 1-1.5km I think.

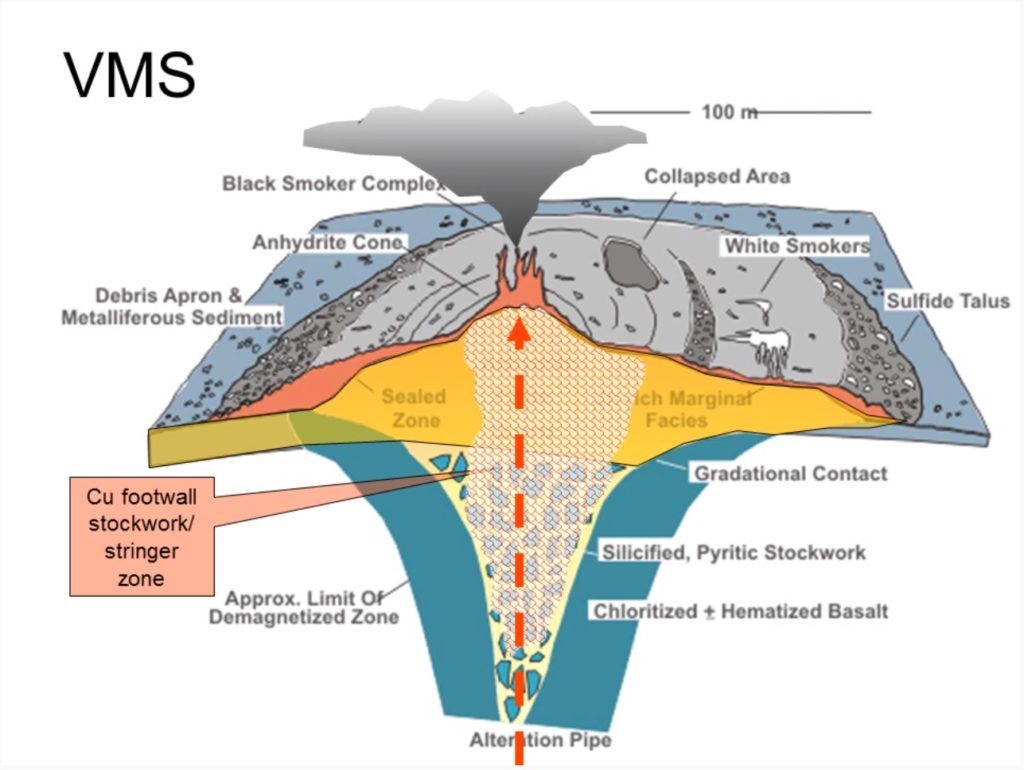

VMS deposits form in clusters, and characteristics such as grade tend to be relatively similar, meaning that some “VMS camps” tend to be higher quality overall than others. It makes perfect sense from the perspective of similar fluids, from similar sources, would have had similar metal content whilst forming multiple “VMS pods” in a region.

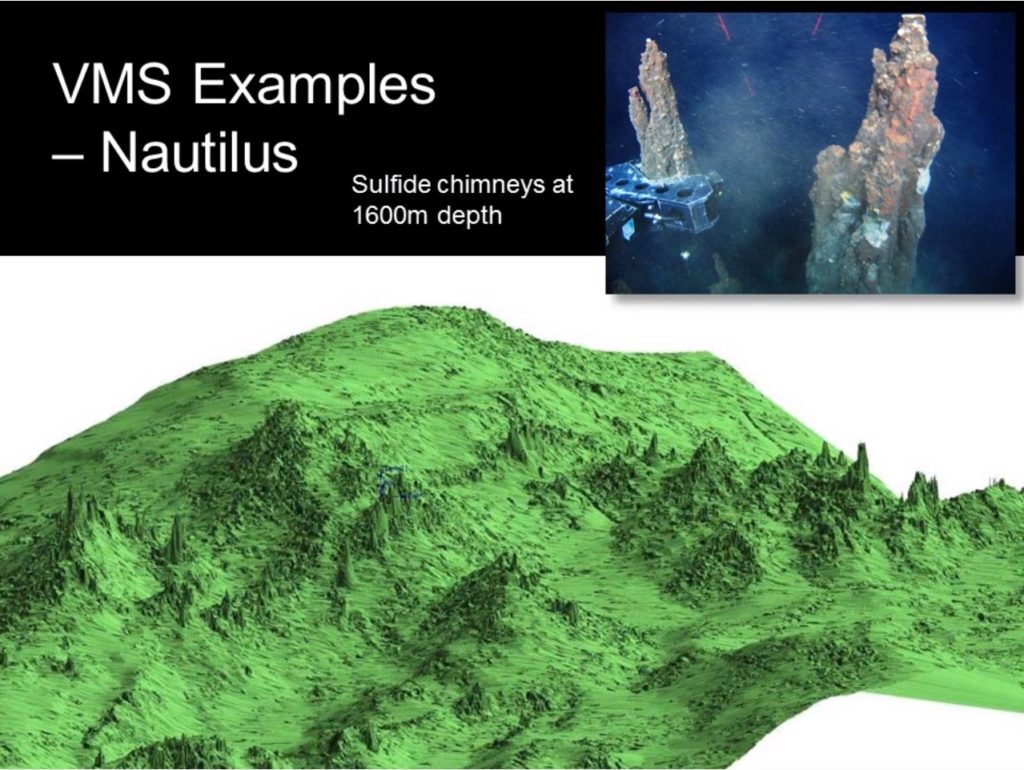

And just to recap, VMS deposits were simply formed by “black smoker” vents, which spat out metals on the sea floor long ago:

Modern example:

Black Smoker in Action today:

Enter Eskay Mining

Some Eskay Mining highlights from this field season:

- “reconnaissance ground work confirms that Scarlet Ridge hosts an extensive VMS mineralization system associated with rhyolite intrusions over a strike length of at least 1.5 km“

- “A second, lower massive sulfide body discovered in 2020 was explored further in 2021, and is located at a distinct older seafloor position than the upper massive sulfide body. These findings confirm that TV is a stacked VMS deposit similar to those in the Noranda Camp, Quebec.“

- “Several drill holes completed at the newly identified Vermillion VMS target encountered intercepts of several tens of meters of stockwork sulfide mineralization in highly chlorite-altered volcanic rocks (Figure 4). Significant sphalerite, galena, and chalcopyrite are present indicating this system is notably enriched in base metals. Arsenopyrite and silver sulfosalt minerals are observed in outcropping massive sulfide mineralization. These long mineralized intercepts coupled with extensive outcropping massive sulfide mineralization confirm that Vermillion represents a major new VMS discovery for Eskay Mining.

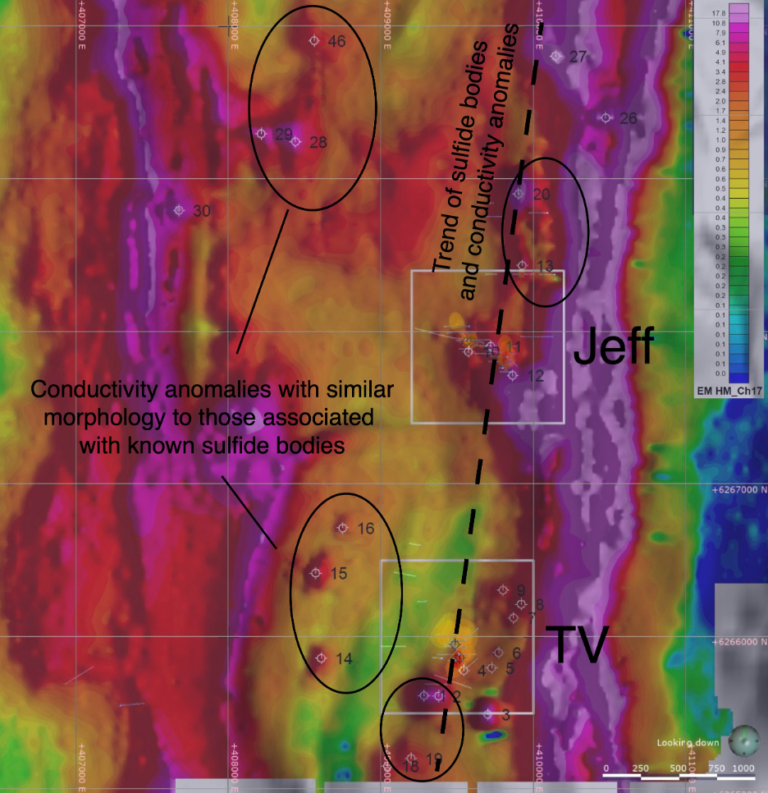

- “one of the last drill holes completed this season, TV21-81, collared approximately 300 m north of TV and 1,700 m south of Jeff, encountered an impressive 86 m (beginning at a down hole depth of 242 m) of replacement-style sulfide mineralization hosted by dacite breccia, similar to that observed at both TV to the south and Jeff to the north (Figure 3). This discovery is important as it provides the first evidence that the TV and Jeff VMS systems may be part of one larger mineralizing system. ”

- THH: Below is a paragraph from the October 16 news release of last year:

- “…data from recent Skytem, magnetotelluric and induced polarization geophysical surveys conducted by the Company show very strong evidence these prospects are likely part of a single larger VMS system, one with a footprint extending for perhaps 3-4 km from north to south. If so, this means this is potentially a much larger VMS system when compared to others in the region.”

- THH: Below is a paragraph from the October 16 news release of last year:

- Late season drilling at C10 encountered Upper Hazelton Group stratigraphy consisting of the Willow Ridge mafic unit and, importantly, the Eskay Rhyolite along with intervals of carbonaceous mudstone. This drilling also confirms that these rocks, the host rocks for the Eskay Creek deposit situated approximately 20 km to the north, occur on the east limb of the Eskay anticline. This is the first confirmation that these critical host rocks are present in this region.

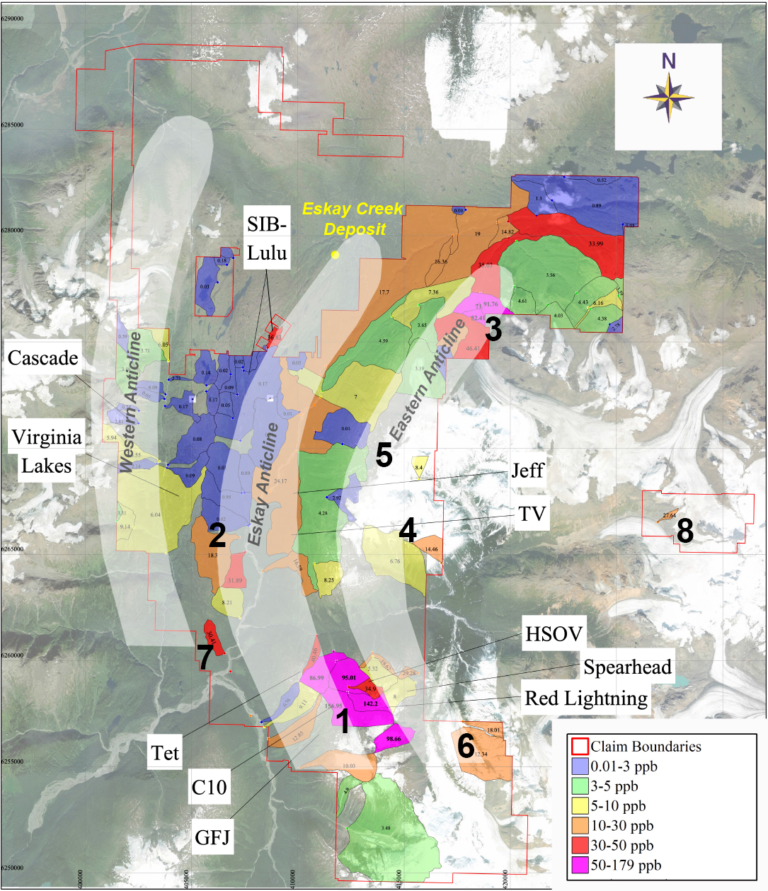

Then we have SIB-LULU, Spearhead and as far as I know Tet, GFJ and Red Lightning are live as well (but are not marked in the slide below):

(The footprint of the legendary Eskay Creek VMS deposit is see in the top of the slide)

… So I’m not even going to attempt to put numbers on the absolute blue sky potential across all those VMS targets in this district scale land package but I think you get the hit. Oh and it’s worth noting that there might very well be even more targets in light of the SkyTEM data (And this is just a close up of a small portion of Eskay’s overall land package):

Notice the scale bar and ponder the potential given that the original Eskay Creek and the Eskay Creek “remnant deposit” could be worth $1-$4 B and had/have a footprint of 1-1.5 km. I have been pondering and I really get excited about the potential in the slide above even though it “just” shows the area around TV-Jeff…

It is also worth noting that the Maiden Drill Campaign conducted last year at TV and Jeff intercepted different type of mineralization styles and none of the hits are believed to come from the stratigraphic horizon that the original Eskay Creek deposit was located in:

Recapping the “new team’s” first drill campaign at TV/Jeff:

An impressive eighteen of twenty holes from the 2020 drill campaign report significant precious mineral intercepts (Au eq = Au + Ag/65) including:

- Jeff:

- J20-39: 50.36 m grading 1.8 gpt Au eq including 14.12 m grading 4.2 gpt Au eq

- J20-38: 10.70 m grading 1.3 gpt Au eq

- J20-37: 7.66 m grading 4.9 gpt Au eq*

- J20-35: 13.30 m grading 1.8 gpt Au eq

- J20-34: 5.08 m grading 33.4 gpt Au eq including 1.59 meters grading 83.8 gpt Au eq*

- J20-33: 35.5 m grading 10.6 gpt Au eq including 9.25 m grading 33.6 gpt Au eq including 3.00 m grading 82.8 gpt Au eq

- J20-32: 3.20 m grading 3.9 gpt Au eq

- J20-31: 24.55 m grading 2.0 gpt Au eq*

- TV:

- TV20-45: 3.66 m grading 2.4 gpt Au eq

- TV20-44: 24.54 m grading 1.5 gpt Au eq

- TV20-42: 8.00 m grading 2.2 gpt Au eq

- TV20-41: 9.23 m grading 1.2 gpt Au eq

- TV20-40: 29.92 m grading 3.5 gpt Au eq including 4.10 m grading 11.7 gpt Au eq and a second zone of 65.27 m grading 1.7 gpt Au eq*

- TV20-39: 40.74 m grading 1.8 gpt Au eq including 10.50 m grading 2.9 gpt Au eq*

- TV20-38: 20.53 m grading 2.5 gpt Au eq including 10.50 m grading 3.5 gpt Au eq*

- TV20-37: 17.46 m grading 3.3 gpt Au eq including 4.2 m grading 8.0 gpt Au eq and a second zone of 54.95 m grading 1.0 gpt Au eq*

- TV20-36: 32.83 m grading 2.3 gpt Au eq including 1.5 m grading 17.4 gpt Au eq*

- TV20-35: 15.00 m grading 2.3 gpt Au eq and a second zone of 16.33 m grading 3.4 gpt Au eq*

* Previously announced in Company news releases dated September 22, 2020 and December 22, 2020

Pre-assay drill highlights from the recently concluded 2021 drill campaign:

- (Jeff) Multiple drill holes completed since start of drilling in late June have encountered significant intervals of stockwork feeder mineralization, some displaying significant amounts of pyrargyrite, a bright red silver sulfosalt mineral (Figure 1). Handheld XRF analyses from these intervals of core confirm significant silver and pathfinder element values are present.

- THH: Hole 33 & 34 that hit 35.5 m of 10.6 gpt AuEQ and 5.05 m of 33.4 gpt AuEQ are believed to have been stockwork feeder mineralization.

- (Jeff) Hole J21-41 encountered approximately 46 m of mineralization in an extension of the upper Jeff zone approximately 50 m east and down-dip of holes completed last year. This mineralization includes 22 meters of replacement-style mineralization, and 24 m of intensely silicified stockwork sulphide mineralization with tetrahedrite, a silver sulfosalt mineral, occuring in a hydrothermal breccia. Similarly, hole J21-46, positioned approximately 100 m north along strike from holes J21-41 and J20-39 (completed last season), encountered approximately 80 m of robust semi-massive replacement-style and stockwork feeder mineralization with pyrargyrite disseminated throughout mineralization. Based on these visual indications, Eskay’s team is optimistic the upper Jeff zone is expanding and intensifying in areas downdip to the east, northeast, and along strike to the north.

- (Vermillion) Several drill holes completed at the newly identified Vermillion VMS target encountered intercepts of several tens of meters of stockwork sulfide mineralization in highly chlorite-altered volcanic rocks (Figure 4).

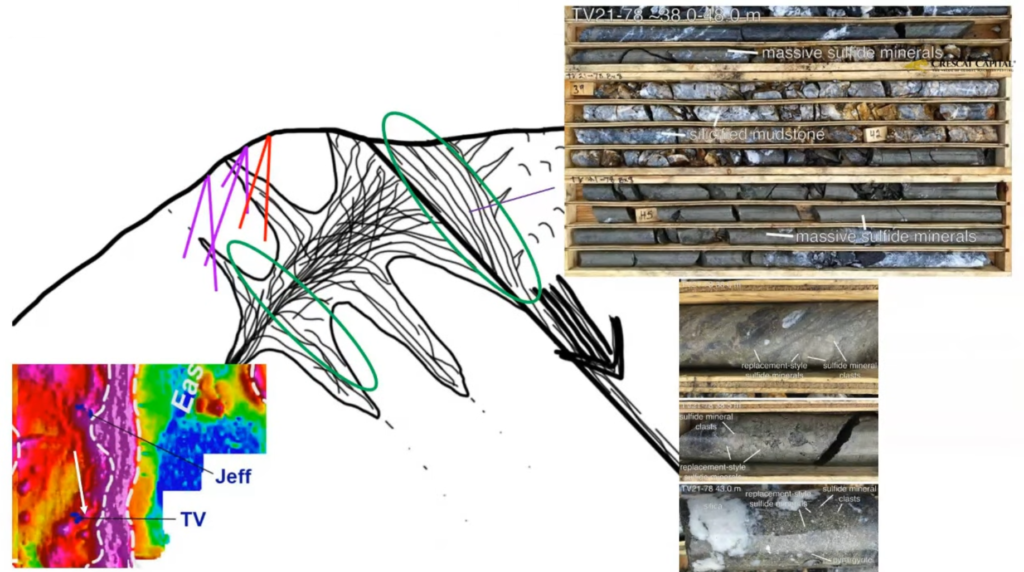

- (TV) Focused drilling at TV late in the season has led to the discovery of exhalative massive sulfide mineralization at the top of what is now recognized as an extensive VMS stockwork feeder system. Discovering such a horizon was one of the top goals of Eskay’s exploration team, having postulated such a deposit should be present based upon observations of increasingly altered and silicified host rocks high in this system. Massive sulfide intercepts were encountered in multiple holes (Figure 1). Sulfide minerals include pyrite, sphalerite and various silver sulfosalt phases, and clastic textures are common (Figure 2). Importantly, this newly discovered massive sulfide mineralization corresponds closely to a discrete conductive SkyTEM anomaly. Below this newly discovered massive sulfide body, multiple drill holes encountered long intercepts of intense stockwork feeder mineralization. This newly discovered massive sulfide and stockwork feeder system remain open along strike and down dip. A second, lower massive sulfide body discovered in 2020 was explored further in 2021, and is located at a distinct older seafloor position than the upper massive sulfide body. These findings confirm that TV is a stacked VMS deposit similar to those in the Noranda Camp, Quebec.

Now I’m not going to guess what kind of highlights this drill campaign will produce but lets just say I am quite open to the idea that the success last year was not just a lucky break but the start of a trend. And what is perhaps even more impressive is the fact that so far the majority of holes have hit mineralization in parts of the systems that are not thought to even be the “main prize”:

Watch this clip below from the most recent Crescat presentation dated Oct 15 where Quinton Hennigh talks about what the Eskay team has found out this field season:

Eskay Mining is a unique story due to several factors in my opinion;

- The Eskay Creek VMS camp hosted the highest grade precious metal deposit every found so far

- Eskay Mining has numerous VMS targets that are de-risked to varying degrees

- Some confirmed by drilling, some have confirmed VMS outcrops, some have high Au/Ag BLEG samples, some are geophysical targets (which Eskay has shown works)

- Eskay Mining has found both stacked lenses (multiple VMS horizons in the same area), stockwork/feeder zone mineralization and replacement-style sulfide mineralization

- In contrast the original Eskay Creek deposit is believed to be a debris flow deposit if I understand it correctly.

- In light of point #3 above the company has confirmed that there was more than one VMS-forming event in the district which hikes up the regional blue sky potential

Arm waving

Eskay Mining has some of the highest absolute blue sky potential of any junior explorer that I am aware and I can see the company being in a growth phase for several years. The odds of Eskay Mining finding at least one VMS deposit that could sustain the current Market Cap looks relatively good to me given the results so far and the number of targets. This creates a speculative but acceptable “margin of safety” via probabilities in my book. Furthermore there is a very realistic chance that Eskay Mining might find two, three or more VMS deposits given the amount of targets that have been generated (and some we already know are precious metal bearing VMS systems). All in all Eskay Mining is believed to control close to 85% of the entire Eskay Creek VMS district as it covers most of the three anticlines:

In short I think:

- Eskay Mining has a speculative, probability based and this theoretical “margin of safety”

- Eskay Mining has some of the highest absolute blue sky potential I am aware of

- Eskay Mining might have a growth trajectory that could last for years

Really short:

It looks like they got the tail(s) of something that could be enormously big and high-grade.

… I like cases where I don’t need to be precise. The case should be readily explainable and the Risk/Reward opportunity should be obvious. If I think there is a relatively good shot of the company proving up a deposit which sustains the current Market Cap, and there is a lot more of potential beyond it, then that is a pretty simple/obvious Risk/Reward opportunity in my book.

Lastly I would say that Eskay Mining is probably considered overvalued by many. At surface I can understand that given the fact that we don’t have even have a resource yet. With that said I fail to see how it could be considered overvalued in light of the in my opinion nosebleed level of potential (and the fact that the maiden drill results from TV and Jeff were stellar). This is why I have a huge position in Eskay and why I am happy to have the company as a banner sponsor. It is also why I am probably biased even though I think my case is quite rational.

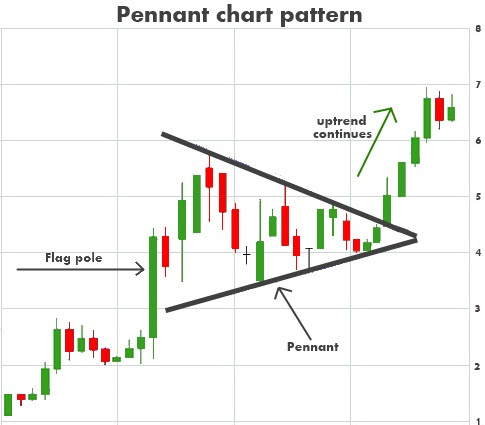

Some Amateur TA

To me it looks like Eskay Mining is forming a big, and 10-month long, “Bull Pennant” continuation pattern:

Note: This is not investment advice. I am not a geologist nor am I a mining engineer. This article is speculative and I can not guarantee 100% accuracy. Junior miners can be very volatile and risky. I have bought shares of Eskay Mining in the open market and I was able to participate in a private placement. Assume I may buy or sell shares at any point in time. I was not paid by any entity to write this article but the company is a passive banner sponsor of The Hedgeless Horseman. Therefore you should assume I am biased so always do your own due diligence and make up your own mind as always.

Best regards,

Erik Wetterling aka “The Hedgeless Horseman”

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My channel

I’m also very excited about this one. Got in in mid 2020 before the run up at about .25/share. I’ve added a lot since then but I suspect not quite enough. If Eskay can duplicate Eskay Creek deposit (now owned by Skeena) thats a homerun. But there are so many targets that look like they may turn out to be Eskay Creek deposit 2.0, 3.0, 4.0, etc….

I completely agree. I’ve been adding as well to my position, with my first 30,000 shares are at $0.10 averaged price per share! Let’s just say I’m waiting as long as it takes to prove out what they have. There are a lot of great stories like NFG, Eloro, and several others, but Eskay will be a retirement maker all on it’s own for sure sure. I bought into NFG, Eloro, Goliath, at much, much higher share prices and valuations.

10 cents a share? Way to get in early on this beast. Can’t wait for drill results. Eskay Creek mine was one of the highest grade gold mines ever (45g/t gold and 2224 g/t silver) from a single VMS deposit. Looks like (maybe) that was the northern most VMS deposit and Eskay mining now owns a handful of analogous VMS targets south of the old Eskay Creek mine. If these drill results at new targets look like what we saw at TV and Jeff last season this thing could be like NFG and really take off.