Cabral Gold (CBR.V): Reports Positive Preliminary Metallurgical Results for the MG Gold-in-Oxide Blanket and Drills 1.5m @ 32.6g/t Gold at MG within the Cuiú Cuiú Gold District

Vancouver, British Columbia–(Newsfile Corp. – February 24, 2022) – Cabral Gold Inc. (TSXV: CBR) (OTC: CBGZF) (“Cabral” or the “Company“) is pleased to provide preliminary metallurgical results for the MG gold-in-oxide mineralization and assay results from six diamond-drill holes testing the MG gold deposit, and within the Cuiú Cuiú gold district in northern Brazil.

Highlights are as follows:

- Preliminary metallurgical results on the MG blanket material conducted at Kappes, Cassiday & Associates (KCA) are highly encouraging. Results from bottle-roll tests of seven samples of various grades and oxide material types returned up to 97% gold recoveries over 48 hours

- DDH257 intersected 6.0m @ 8.6 g/t gold at the primary MG gold deposit from 179.4m depth, including 1.5m @ 32.6 g/t gold from 181.8m depth. This drill result further defines the high-grade zone within the primary MG gold deposit, extending the central MG high-grade zone 100m further west than previously known

- DDH256 intersected 7.3m @ 1.3 g/t gold from 199.1m depth including 1.4m @ 4.9 g/t gold from 205.0m depth

- DDH259 intersected 32.7m of 0.4 g/t gold from surface in the gold-in-oxide blanket which overlies the primary MG gold deposit

Alan Carter, Cabral’s President and CEO commented, “The preliminary metallurgical test results (bottle-roll tests) from unconsolidated material which comprises the gold-in-oxide blanket at MG are highly encouraging, and indicate gold recoveries of up to 97% after 48 hours. The next step is to subject the samples to column leach tests, and those results should be available during May. The drill results from the underlying primary MG deposit continue to outline a central high-grade core to the primary hard-rock MG gold deposit with the mineralized zones all open at depth”.

Preliminary Metallurgical Results: MG gold-in-oxide blanket

Following the initial discovery of the MG gold-in-oxide blanket in early 2021 (see press release dated April 15, 2021) the blanket grew significantly over the course of the year as a result of an aggressive focused RC drill program. By the end of the year, the blanket was estimated to have a surface footprint of 40 hectares, and is still open in several directions. The blanket extends from surface to depths of up to 60m (see press release January 6, 2022).

In late December 2021 Cabral shipped a total of 400kg of mineralized oxide material from MG to KCA to conduct heap-leach metallurgical testing. This material was collected from five diamond-drill holes, which were specifically designed to extract representative samples of oxidized mineralization for a heap-leach testing program (see press release December 9, 2021).

The initial test was a 48-hour cyanide bottle-roll leach test. Core samples from the five diamond-drill holes were subdivided into seven categories based on grade and weathered rock type, including a higher grade and lower grade sample from each of soil, transported colluvial blanket and in-situ saprolite basement. A single lower-grade sample of mineralized lake clays, estimated to represent less than 2% of the weathered cover sequence, was also tested.

KCA conducted assays on two aliquots of each sample to determine an average head grade, and then back calculated the head grade from extracted gold and tailings grade following 48-hour bottle-roll tests (Table 1). The latter is a larger sample and should be more representative of the actual head grade. Assays of average gold head grades for the individual bottle-roll samples range from 0.123 to 2.308 ppm, while the calculated head grades range from 0.276 to 2.366 ppm.

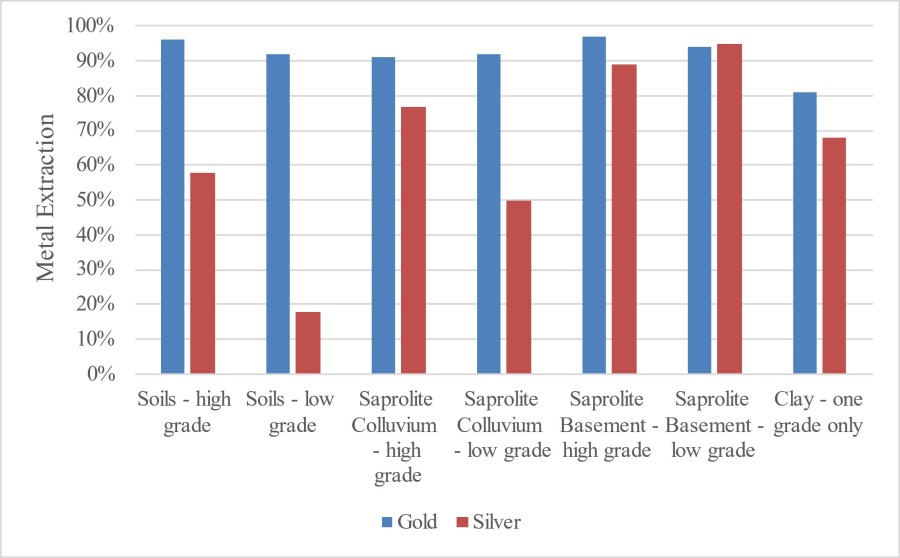

Bottle roll tests of all six of the soil, colluvium blanket and basement saprolite samples had recoveries exceeding 90% regardless of grade, whilst the seventh sample of lake clays had slightly lower recoveries at 81%. (Table 1, Figure 1). The best recoveries were from the higher grade saprolite basement sample (97%) and the higher grade soil sample (96%). Cyanide and lime consumption is considered reasonable. Silver recoveries, also shown on Figure 1, are considered unimportant and are not discussed herein (silver grades are typically low at Cuiú Cuiú: silver grades range from just 0.31 to 9.6 ppm in the samples).

The preliminary gold metallurgical results are highly encouraging. Cabral is now moving towards the next stages of the heap-leach metallurgical test work.

A single composite of the seven samples will now be blended in the approximate proportions that occur within the MG blanket-oxide deposit. The next stage of test work will focus on this composite sample. It will comprise: 1) preliminary agglomeration test work, 2) compact permeability test work, and finally 3) a 60-day column leach test. Results from this work, including the column leach tests are expected to be available in late May 2022.

The flat-lying gold-in-oxide blanket mineralization lies directly above the MG basement gold deposit. As it was not recognized until early 2021, the blanket was largely considered waste in resource estimates. Recognition of the blanket should result in lower strip ratios. While traditional processing will be required for the unweather hard-rock basement mineralization, if heap leach processing of soft, near-surface, oxidized mineralization proves viable, implementation would significantly lower initial capital investment and should significantly reduce processing costs. This should also result in lower cut-off grades for the surface mineralization, thereby increasing contained ounces. In general, adoption of heap-leach processing has the potential to significantly improve the economics for any deposit that is ultimately developed at Cuiú Cuiú.

Figure 1: Histogram of gold and silver extraction over 48 hours in cyanide bottle-roll leach tests for seven MG samples

Figure 1: Histogram of gold and silver extraction over 48 hours in cyanide bottle-roll leach tests for seven MG samples

Table 1: Summary of cyanide bottle-roll leach tests for seven MG samples

MG Diamond-Drill Results

Assay results were returned on six diamond-drill holes (DDH243, DDH244, DDH245, DDH256, DDH257 and DDH259) recently completed in the central part of the MG gold deposit (Figure 2).

Figure 2: Map showing the outline of the primary MG gold deposit (in yellow) and the interpreted outline of the overlying mineralized oxide blanket. The location of recently completed diamond drill holes (DDH243, DDH244, DDH245, DDH256, DDH257 and DDH259) are also shown

Figure 2: Map showing the outline of the primary MG gold deposit (in yellow) and the interpreted outline of the overlying mineralized oxide blanket. The location of recently completed diamond drill holes (DDH243, DDH244, DDH245, DDH256, DDH257 and DDH259) are also shown

DDH257 was drilled on section E553510 (Figure 3, Table 2) and intersected a broad alteration zone returning 12.0m @ 4.4 g/t gold from 173.4m depth. Within the broader zone was a highly altered interval of 6.0m @ 8.6 g/t, which included a particularly high-grade zone with abundant quartz veining that returned 1.5m @ 32.6 g/t gold from 181.8m depth.

Hole DDH257 intersected the same mineralized structure which was encountered in historic hole CC51. It returned 33.7m @ 0.57 g/t gold, within which was a more strongly altered interval of 9.7m @ 1.45 g/t gold, including 2.5m @ 2.8 g/t gold.

The main basement zone on Section E553510 is still open at depth. More importantly, the high-grade gold mineralization encountered in DDH257, is 100m west of Section E55610, which was the previous western limit of the known high-grade mineralization in the core area of the MG basement deposit (see press releases June 8, 2021 and January 20, 2020). This could potentially increase the strike length of this high-grade core zone by 50% within the primary deposit at MG.

Figure 3: Cross-section on line E553510 at MG through the primary MG gold deposit and the overlying gold-in-oxide blanket showing the location of DDH257 which intersected 6m @ 8.6 g/t gold including 1.5m @ 32.6 g/t gold. Note that mineralized zone is open at depth

Figure 3: Cross-section on line E553510 at MG through the primary MG gold deposit and the overlying gold-in-oxide blanket showing the location of DDH257 which intersected 6m @ 8.6 g/t gold including 1.5m @ 32.6 g/t gold. Note that mineralized zone is open at depth

DDH256 was drilled on section E553430 (Figure 4, Table 2) and intersected 7.3m @ 1.3 g/t gold from 199.1m depth including 1.4m @ 4.9 g/t gold from 205.0m depth. This hole intersected the same mineralized zone that was intersected in hole CC66 (9.8m @ 1.8 g/t gold), but the intersection in DDH256 is 60m below the intercept in CC66. The mineralized zone remains open at depth. DDH243 was drilled on the same section, it encountered 9.4m @ 0.3 g/t in the blanket, and a deeper footwall zone that returned 8.6m @ 0.8 g/t (Table 2, Figure 4). It did not, however, return any significant values from the up-dip projection of the main zone, suggesting the zone may pinch out towards surface.

Figure 4: Cross-section through the primary MG gold deposit and the overlying gold-in-oxide blanket showing the location of DDH256 which intersected 7.3m @ 1.3 g/t gold including 1.4m @ 4.9 g/t gold. Note that the mineralized zone is open at depth

Figure 4: Cross-section through the primary MG gold deposit and the overlying gold-in-oxide blanket showing the location of DDH256 which intersected 7.3m @ 1.3 g/t gold including 1.4m @ 4.9 g/t gold. Note that the mineralized zone is open at depth

DDH259 was a short hole drilled on section E553570, 60m east of DDH 257. It intersected 32.7m of 0.4 g/t gold from surface (Table 2) within the gold-in-oxide blanket which overlies the primary MG gold deposit. The depth of transported saprolite was deeper than expected in DDH259, extending to 74m downhole. As a result, the hole was drilled, within the transported saprolite, above the projection of main zone, and did not encounter any significant basement mineralization. A deeper hole, DDH271, was collared further to the north, and drilled directly below DDH259. It was designed to test for the presence of the main zone within the basement below the transported saprolite. It encountered significant alteration and quartz veining where expected (Photo 1). Assays for DDH271 are pending.

Photo 1: Drill core displaying quartz veining and alteration encountered in DDH271 – assays are pending.

Photo 1: Drill core displaying quartz veining and alteration encountered in DDH271 – assays are pending.

DDH244 and DDH245 were drilled further to the west, on section E553310 and 553395, respectively. Historic drilling in this area was wide spaced. Both holes returned a number of intriguing lower grade intervals (Table 2) that are worthy of follow-up drilling.

| Drill Hole | Weathering | Mineralized Zone | From | to | Width | Grade | |

| # | m | m | m | g/t gold | |||

| DDH243 | Oxide/Saprolite | Blanket | 0.0 | 9.4 | 9.4 | 0.3 | |

| Fresh Rock | 84.0 | 85.0 | 1.0 | 0.2 | |||

| 88.0 | 89.0 | 1.0 | 0.2 | ||||

| 104.0 | 105.0 | 1.0 | 0.5 | ||||

| 165.2 | 173.8 | 8.6 | 0.8 | ||||

| incl. | 170.5 | 171.5 | 1.0 | 3.7 | |||

| EOH | 225.3 | ||||||

| DDH244 | Oxide/Saprolite | Blanket | 0.0 | 11.5 | 11.5 | 0.4 | |

| Fresh Rock | 41.2 | 80.8 | 39.6 | 0.4 | |||

| 116.5 | 125.0 | 8.5 | 0.3 | ||||

| EOH | 200.2 | ||||||

| DDH245 | Oxide/Saprolite | Blanket | 0.0 | 5.0 | 5.0 | 0.2 | |

| Fresh Rock | 81.1 | 99.5 | 18.4 | 0.5 | |||

| 126.6 | 127.7 | 1.1 | 3.4 | ||||

| 156.0 | 173.6 | 17.6 | 0.4 | ||||

| incl. | 157.0 | 161.0 | 4.0 | 0.9 | |||

| EOH | 243.2 | ||||||

| DDH256 | Fresh Rock | 103.7 | 106.2 | 2.5 | 0.8 | ||

| 199.1 | 206.4 | 7.3 | 1.3 | ||||

| Incl. | 205.0 | 206.4 | 1.4 | 4.9 | |||

| EOH | 310.6 | ||||||

| DDH257 | Oxide/Saprolite | Blanket | 0.0 | 11.8 | 11.8 | 0.2 | |

| 105.0 | 109.1 | 4.1 | 0.5 | ||||

| 173.4 | 185.4 | 12.0 | 4.4 | ||||

| Incl. | 181.8 | 183.3 | 1.5 | 32.6 | |||

| 221.5 | 222.2 | 0.7 | 1.8 | ||||

| 289.6 | 291.4 | 1.8 | 1.8 | ||||

| EOH | 328.7 | ||||||

| DDH259 | Oxide/Saprolite | Blanket | 0.0 | 32.7 | 32.7 | 0.4 | |

| 107.3 | 110.8 | 3.5 | 0.3 | ||||

| EOH | 130.9 | ||||||

Table 2: Table showing drill results for recently completed diamond-drill holes DDH243, DDH244, DDH245, DDH256, DDH257 and DDH259 at MG

Drilling and Trenching Update

Results are currently pending on a further six diamond-drill holes at MG including DDH271 (Photo 1), and drilling is continuing.

Results are also currently pending on five diamond-drill holes at Central and drilling is continuing.

In addition to the extensive diamond-drilling program that is in progress at Central, RC drilling aimed at further defining the extent of the gold-in-oxide blanket material is also in progress. Results are currently pending on 21 RC drill holes at Central.

Diamond-drilling continues at the recently discovered mineralized zone in basement granitic rocks at the PDM target located 2.5km NW of Central (see press release dated January 12, 2022). Results on seven diamond drill holes are currently pending.

Diamond drilling is also ongoing at the MG gold deposit, located 5km SE of Central. Results from six holes are pending, including DDH271 (Photo 1).

Following recent results from surface trenches at Machichie including 5m @ 8.3 g/t gold (see press release dated February 2, 2022), a series of additional trenches are currently being developed. Results are currently pending on three additional trenches totaling 252m.

About Cabral Gold Inc.

The Company is a junior resource company engaged in the identification, exploration and development of mineral properties, with a primary focus on gold properties located in Brazil. The Company has a 100% interest in the Cuiú Cuiú gold district located in the Tapajós Region, within the state of Pará in northern Brazil. Two gold deposits have so far been defined at Cuiú Cuiú and contain 43-101 compliant Indicated resources of 5.9Mt @ 0.90 g/t (200,000 oz) and Inferred resources of 19.5Mt @ 1.24 g/t (800,000 oz).

The Tapajós Gold Province is the site of the largest gold rush in Brazil’s history producing an estimated 30 to 50 million ounces of placer gold between 1978 and 1995. Cuiú Cuiú was the largest area of placer workings in the Tapajós and produced an estimated 2Moz of placer gold historically.

FOR FURTHER INFORMATION PLEASE CONTACT:

“Alan Carter”

President and Chief Executive Officer

Cabral Gold Inc.

Tel: 604.676.5660

Guillermo Hughes, MAusIMM and FAIG., a consultant to the Company as well as a Qualified Person as defined by National Instrument 43-101, supervised the preparation of the technical information in this news release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking Statements

This news release contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). The use of the words “will”, “expected” and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Such forward-looking statements should not be unduly relied upon. This news release contains forward-looking statements and assumptions pertaining to the following: strategic plans and future operations, and results of exploration. Actual results achieved may vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors. The Company believes the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct.

Notes

Gold analysis has been conducted by SGS method FAA505 (fire assay of 50g charge), with higher grade samples checked by FAA525. Analytical quality is monitored by certified references and blanks. Until dispatch, samples are stored under the supervision the Company’s exploration office. The samples are couriered to the assay laboratory using a commercial contractor. Pulps are returned to the Company and archived. Drill holes results are quoted as down-hole length weighted intersections.