Novo Resources: Sorting Out Pilbara

- Follow me on twitter: https://twitter.com/Comm_Invest

- Follow me on CEO.ca: https://ceo.ca/@hhorseman

- Follow me on Youtube: My channel

Synergies & Outcome Leverage

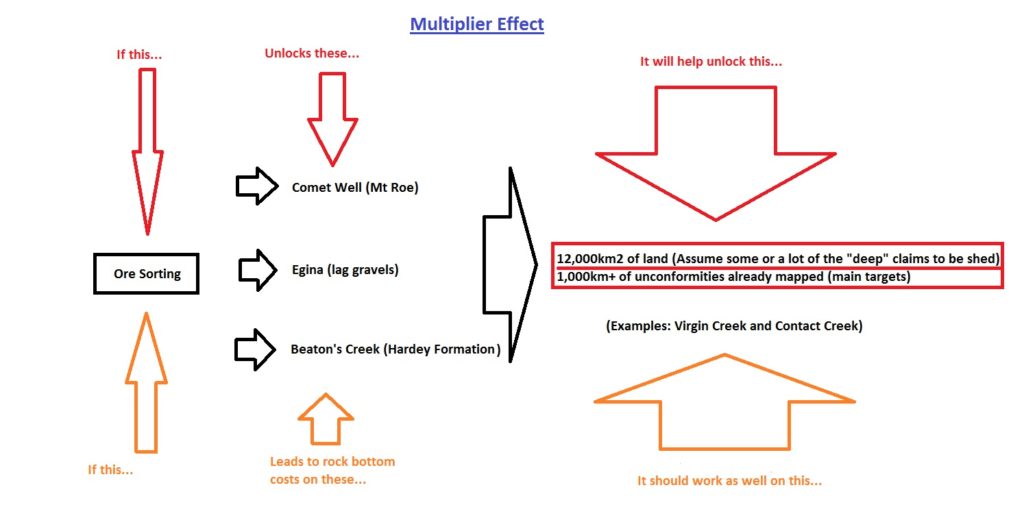

With the recent realization that ore sorting might not only be applicable to Egina type lag gravels but also Mt Roe conglomerates and Hardey Formation conglomerates, the potential impact of ore sorting is hard to quantify when it comes to Novo. Having this technology work on one deposit is good, but too potentially see it used on no less than three semi-craton wide targets is another thing entirely. The inherent Outcome Leverage from this development compounds and will perhaps be the main reason for Novo being able to unlock the already extreme Outcome Leverage in the form of proof of concept in either semi-craton wide system affecting all other prospects of similar type…

Proof of concept at Beaton’s Creek will affect and revalue (through derisking) all other Hardey Formation prospects, current and future. Proof of concept at Comet Well will affect and revalue all other Mt Roe prospects, current and future. Proof of concept at Egina will affect and revalue all other lag gravel prospects, current and future…

Proof of concept for ore sorters might in turn affect and revalue each prospect and in turn thus affecting and revaluing all three potentially semi-craton wide systems. If ore sorting unlocks Egina, then this technology will affect and revalue all other lag gravel prospects for example:

… In other words, I don’t consider any incremental success when it comes to ore sorting at either flagship project to only affect that project, but rather affect all current and future prospects of that respective project type. In reality it seems that this might be conservative since Novo now believes that being able to sort material as small as 0.4mm might in fact impact not only Egina, but Comet Well and Beaton’s Creek as well. In turn it will thus probably affect all current and future Mt Roe, lag gravel and Hardey Formation prospects. Again, this is a multiplier effect on steroids which is unique to Pilbara.

In other words, if this can be processed by sorting:

… Then this should be able to be processed with sorting:

Now I hope people understand why I have been harping on about how crazy I find it that the share price is still stuck in this range. The market participants seem oblivious to the unparalleled Outcome Leverage that these quantum leaps in ore sorting technology entails. The difference between sorting down to 1mm and 0.4mm or even 0.4mm to say 0.3mm might have extreme consequences for Novo over time. Not only will it affect recoveries, cut off grade and thus profits, but it might be the single biggest factor in unlocking the entire craton and all its nuggety prospects. This is what I consider to be the forest,and it seems only a small group of investors and newsletter writers (Bob etc) who have followed the story every day over the last year or so are able to see it.

If Egina is 0.4, 0.7 or 1,0+ g/m3 or Beaton’s Creek’s current resource being 0.9Moz, 1.2Moz or 1.4Moz pales in comparison. For example, what does it really matter if Egina is 0.5, 0.7 or 1.0 g/m3 if the cut off grade would be 0.2g/m3? Sure, higher grades lead to higher profits per m3 but 0.5g/m3 would already be a mind blowing success in that case. Or how about Beaton’s Creek? If ore sorting is applied there it might lower the CAPEX and OPEX considerably and it will not only affect the currently delineated resource but all future ore as well and again, it will impact all other similar prospects. In other words, ore sorting success should have much more impact to Novo’s intrinsic value than the difference between Beaton’s Creek currently containing 0.9Moz or 1.2Moz or more. With that said, one can never know when the market will realize it’s folly and stop (over) reacting to single bulk samples (the trees) and realize that currently, ore sorting probably is the main value driver by far as it relates to Novo… The better ore sorting works, and thus operating costs decrease, the marginal benefit of higher-grades will decrease with it.

Paraphrasing a quote from our dear CEO, Rob Humphryson: “Grade isn’t king. Margins are king”.

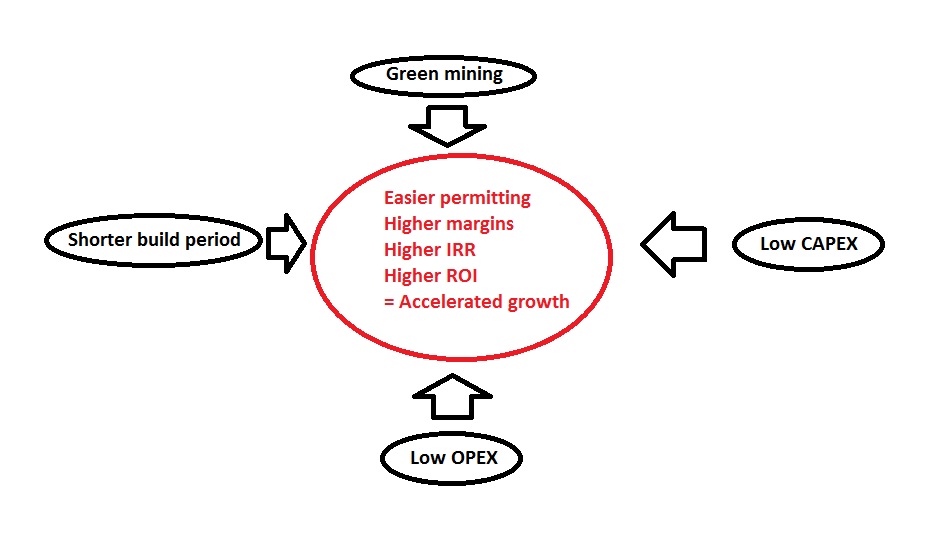

With all the above said, lets look at some reasons why ore sorting might impact the long term intrinsic value of Novo in such a degree:

- Potentially portfolio wide homogeneous processing technique:

- Extremely low CAPEX

- ~$1M/machine

- Extremely low OPEX

- Sub $1/tonne

- Shared advances in technology and techniques

- Intellectual property and technology can be transferred to and upgrade multiple projects

- Extremely low footprint

- Small mobile units instead of a large stationary plant

- Completely Green

- No chemicals

- Easier and faster permitting

- less input costs

- No water requirements

- Easier and faster permitting

- Less input costs

- Readily replaceable

- Easy and cheap to replace a unit

- Readily up gradable

- Software upgrade

- Low cost if needed to replace entire “fleet” with new machines

- Extremely flexible output

- Incremental unit addition (or subtraction)

- Continuous advances in technology

- Sorting technology for mining has taken leaps and bounds just in the last year

- Will continue to get better and better which will affect recoveries and costs in a positive way

- Possibly Real Time production statistics

- Count the amount of pixels

- Possibly very fast exploration

- Scoop dirt/rocks and immediately get the gold out with high recoveries

- Low transportation costs

- No need to truck all ore rock to a stationary mill

- Less need for infrastructure/haulage roads

- Low manpower requirement

- No manpower needed to operate a plant

- Safer work environment

- Smaller processing operation with less moving parts

- Decreased risk for things to go wrong

- Reduced Bottlenecks

- No plant that could suffer from hiccups in the much longer flow sheet that could stop production

- Fast and green reclamation

- Waste rock can be left where it was dug up

- Waste rock won’t have any chemicals

- Significantly reduced build time

- No need to build a capital intensive plant over 12-24 months

- Much lower payback time

- Potential for extremely high IRR

- No big CAPEX requirements or long time table until “first pour”

- Able to readily re-invest profits in growth

- Extreme compounding opportunities

- Dividend Potential

- Extremely Low CAPEX and OPEX

- Extremely Low development costs (Egina)

- Potentially very low AISC that makes room for dividends

- Extremely low CAPEX

Unique Leverage

Some of the above mentioned benefits of ore sorting would not be possible if it wasn’t for the characteristics of the Lag Gravels and Conglomerates:

- Nuggety gold

- No need to sort for pathfinder elements or host rock

- Gold is concentrated and can be directly sorted with little to no waste rock

- Extremely low mass pull

All mining operations that currently utilize ore sorting only use it in the front end as far as I know. This means that these operations use it to high-grade the ore before it receives conventional processing. No operation uses ore sorting as the one and only solution and thus does not receive nowhere the amount of benefits that Novo’s gravel and conglomerate deposits might enjoy.

(Recommended Reading: “The Curse of karratha: Also its Greatest Strength?”)

In simple terms one could say that there could be multiple factors that work together and might lead to faster monetization and a higher growth speed relative to conventional mining companies:

… And the above picture would still not account for all synergies but will not be in play until Novo reaches cash flow and also assumes ore sorting works as well as it looks of course. In other words, it’s very hypothetical at this stage but is something that should not be taken lightly for long term investors in my opinion. Egina would for example be the poster child of this since the deposit(s) are at surface and thus readily accessible on top of not needing any crushing, drilling or blasting (unlike lode gold and hardrock conglomerates).

Closing Thoughts

With all the oozing hype that you have just read, you might ask yourself why the market has not reacted or discounted all this to any degree? Well, I think that simply boils down to almost no one having any prior experience with ore sorting (Heck, even Steinert didn’t even know that they could sort down to 0.4mm until it was tested just a few weeks ago for example!). It’s just in the last few years that some select, more well known miners, have started to dabble with ore sorting for real (with great success as far as I know I might add). Thus, almost no one has any reference in terms of impact. Certainly not ye run of the mill basher, trust me, it’s literally impossible. Furthermore, the operations that use ore sorting today primarily use it to high-grade some low-grade ore before it gets shipped to a conventional plant. No company on earth is using ONLY ore sorting to recover the gold. In other words, it’s just PART of the processing flow sheet. This of course means that there are conventional plants, chemicals and water required as per usual. This might not be the case for Novo and if so, there is no miner on earth that could capture the same amount of ore sorting benefits as Novo. We’re talking NO plant, NO or little water usage, NO chemicals and a completely GREEN processing flow sheet.

On top of that the junior mining sector is in a depression and gold has been in a down cycle lately.

Lastly, I will of course remind readers that everything is theoretical until proven, which is also why the risk adjusted implications of ore sorting is not reflected in Novo’s enterprise value (in my opinion). But I will also say that if this technology delivers and is applicable on a broad scale, then I expect Novo to become a multi billion enterprise in a few years, with a project pipeline that is much larger than any gold company that I know of. In other worse, if it unlocks one or more projects, then I expect Novo to unlock many more projects in the future and just “grow and grow” as per Quinton Hennigh. My blue sky scenario is for Novo to become a major, high-margin gold producer in the future with ever increasing dividends. This is why I personally love the current risk/reward, perhaps more than ever, and why Novo is my single largest holding by far.

Additional Reading:

“Novo Resources: The Impact of Technology”

This and smaller is detectable by the Steinert Sorter. pic.twitter.com/sx7NXVLTKq

— TheHedgelessHorseman

(@Comm_Invest) 29 oktober 2019

(Note: This is not a buy or sell recommendation. This is not investment advice and I am not a geologist. This article is highly speculative, forward looking and I can’t guarantee accuracy. Always do your own due diligence. I own a lot of shares of Novo Resources which I have bought in the open market and am thus biased. I have not received extra compensation to write this article but Novo is a passive banner sponsor on my site. )

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Well spoken Horseman !

Thanks JP :))

I like two things in my investments: 1. honesty and 2. integrity. it seems that novo management

Quinton could have taken Edgina for himself ….he didn’t. Novo is my only holding and I will probably

increase it a lot …. I,ve invested for years with some success and believe this story and those

involved. Their actions speak for them and thanks to Bob M and THH I became aware of this special

group. THANKS!!!

That’s the main reason I dare to have such a position concentration as well. I just know the guys running Novo are good people and are not looking for ways to shaft shareholders for their own benefit. With that said, holding ONLY Novo sounds a bit risky since there can always be a black swan :P. You’re very much welcome Gary, and I hope we will see Novo flourish over years and years to come!

Every “game-changer” technology is met with skepticism and disbelief. That’s because 99% of the human race has the IQ of a squirrel and the attention span of a gnat. They didn’t believe the steam engine. They didn’t believe the internal combustion engine. They didn’t believe radio. They didn’t believe television. They didn’t believe the integrated circuit. They didn’t believe the internet. What makes you think they’re going to believe THIS? This Greatest Show on Earth has an audience of moth-minded, Not-Invented-Here imbeciles who wouldn’t comprehend the magnitude of this breakthrough if it fell over on top of them. In the immortal words of Bill The Cat , “THBBFT!”

Very good points Theo. This is also why the returns for early birds in such cases can be obscene… Simply because it’s doubted as “too good to be true”, but if it’s not too good to be TRUE, then the revaluation can be breath taking. What I do like is that most people, even industry insiders, have almost no clue about the implications so they will be on even footing with the rest of us. Perhaps we might even have an edge since I guess there is a possibility we are less set in our ways and open minded. /HH

Incredible article. I love your leverage concept. It’s undeniable. I’ve been an investor for several years and will indeed be around to reap that much higher share price and the “ever expanding” dividend.

Thank you Kevin! I know there are a lot of things (details) that I don’t know, but I have always tried to focus on the big picture (what’s most important). I don’t need to be a geo or a mining engineer to appreciate that the leverage potential for this technology is probably the most important thing… Less focus on the trees and more focus on the growing forest seems prudent. /HH

Its very comforting to have your insights published especially knowing your success record and on site analysis.

thank you for the heads up.

Peter Bazinet

Thank you Peter. Glad to hear it! Nothing is guaranteed, but thankfully Novo’s Enterprise Value is nowhere near pricing in the risk adjusted potential for this technology coupled with Novo’s deposit types IMHO. /HH

I think this will be the best 75 cent stock of my life.