Novo Resources: The Impact of Technology

- Follow me on twitter: https://twitter.com/Comm_Invest

- Follow me on CEO.ca: https://ceo.ca/@hhorseman

- Follow me on Youtube: My channel

Setting The Scene

Let me start this article with a quote from a fellow forum poster by the name of “kuston” to give you some food for thought:

“…the problem is everyone is still treating Novo as a mining company. It’s not! It’s a tech company. They are developing/applying new technology to solve a problem that has foiled miners for over 100 years. Is google a library? No it’s a tech company just like Novo.”

Novo and the Pilbara deposits are quite unique, but the possible production scenarios for these deposits might be even more unique. The two big impact aspects of Novo is a) The potential scale and b) The processing technologies being tested, not just the scale, in my opinion.

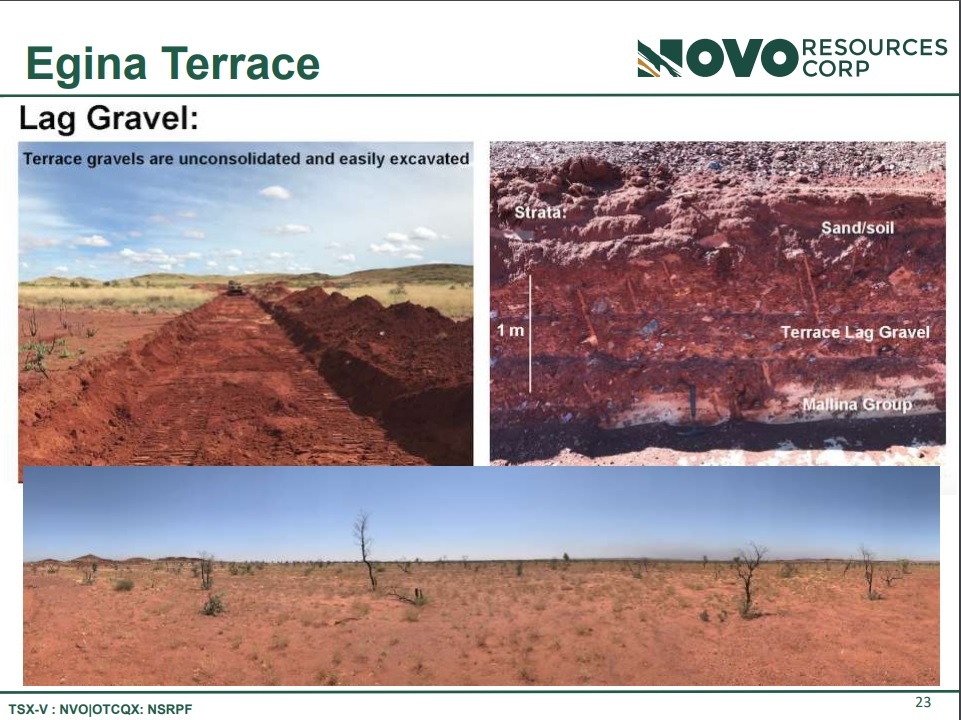

Egina delivers ore sorting results on par with Comet Well

Novo has recently done trial tests on lag gravel material from Egina with the help of Steinert at their testing facility in Cologne, Germany. They primarily tested Eddy Current Separator (“ECS”) technology but also did some early stage testing with mechanical ore sorters.

Eddy Current Separator (“ECS”)

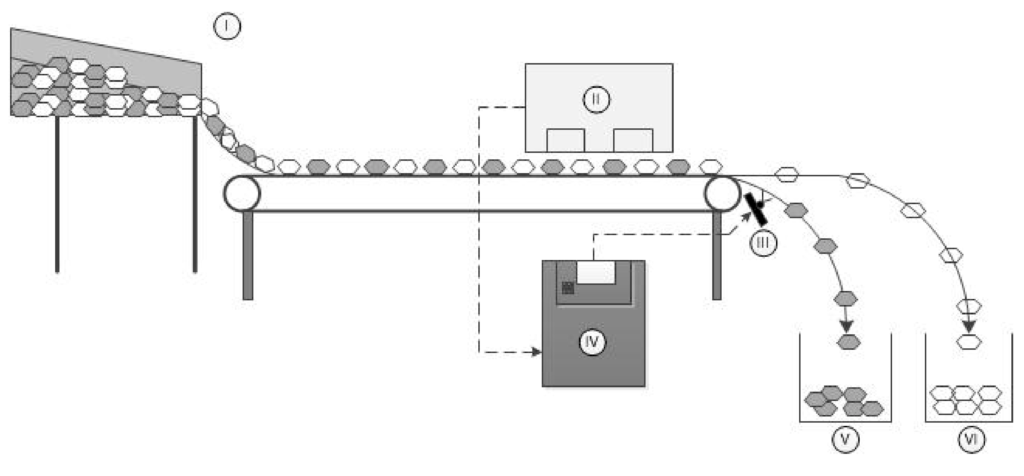

ECS description from the Novo news release:

“Eddy current separators are predominantly used to recover select metals in the scrap metal industry. Material is fed onto a conveyor, the head pulley of which contains an adjustable high-powered magnet spinning at very high rotation rates, 4,000 rpm in Novo’s tests, independent of the speed of the conveyor. This spinning magnet induces an alternating magnetic field that differentially repels non-magnetic metals such as gold. This magnetic repulsion causes gold nuggets to lift, or fling, off the end of the conveyor belt where they can be separated from waste material by a steel plate.”

It basically is a “passive” sorter that creates a magnetic field which separates the gold from the gravels:

A video showing Novo’s ECS test work done with Steinert:

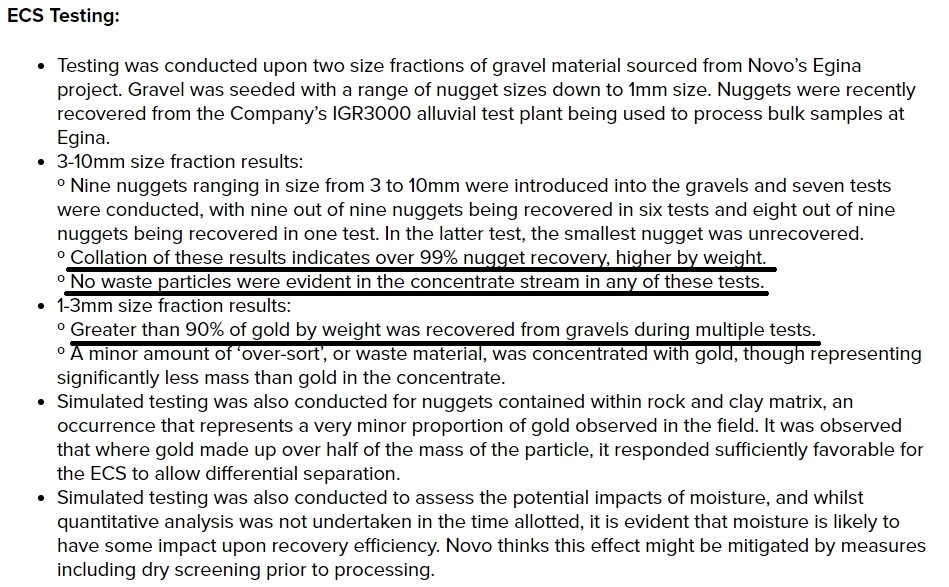

Now, lets look at the trial results:

The ECS showed superb results while sorting the 3-10mm sized nuggets. Seven tests were conducted with the ECS sorting out all nuggets in six of the test runs and 8 out of 9 nuggets in one test run. All together one could say the ECS sorted out 62 out of 63 nuggets in total, or 99% nugget recovery. With no waste particles being discernible in the “concentrate stream”, the machine basically took gravel containing a few gold nuggets and spat out a “concentrate stream” grading 900,000 gpt (assuming 90% purity). In other words it basically spat out pure gold.

ECS technology does not require a) water, b) chemicals, c) no large investment (CAPEX) and is readily mobile. The production flow sheet would be so simple it’s ridiculous. Scoop up gravel from a deposit that starts at 0.2m below surface, run the gravels through the ECS, and you get almost pure gold.

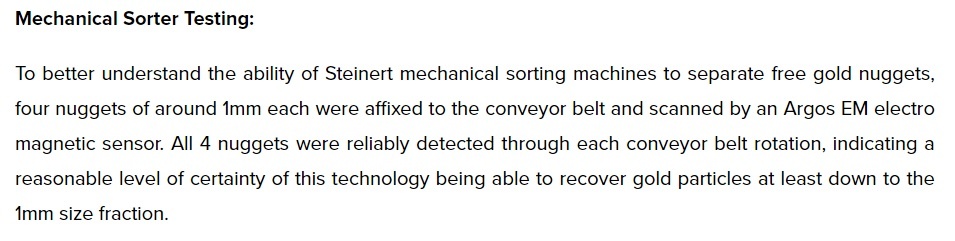

Novo also did some very early stage tests with Mechanical Ore Sorters, similar to the ones that showed extremely good results at Comet Well:

This is of course very early stage testing but I was positively surprised that nuggets the size of 1mm were “reliably detected”. Mechanical ore sorting probably works much better with moist and heterogenic material than the ECS so maybe we will could see a combo of both being used. My personal guess is that ECS works much better with fine and homogenic material, especially with higher throughput rates since it’s a “passive” sorter unlike Mechanical Sorting machines.

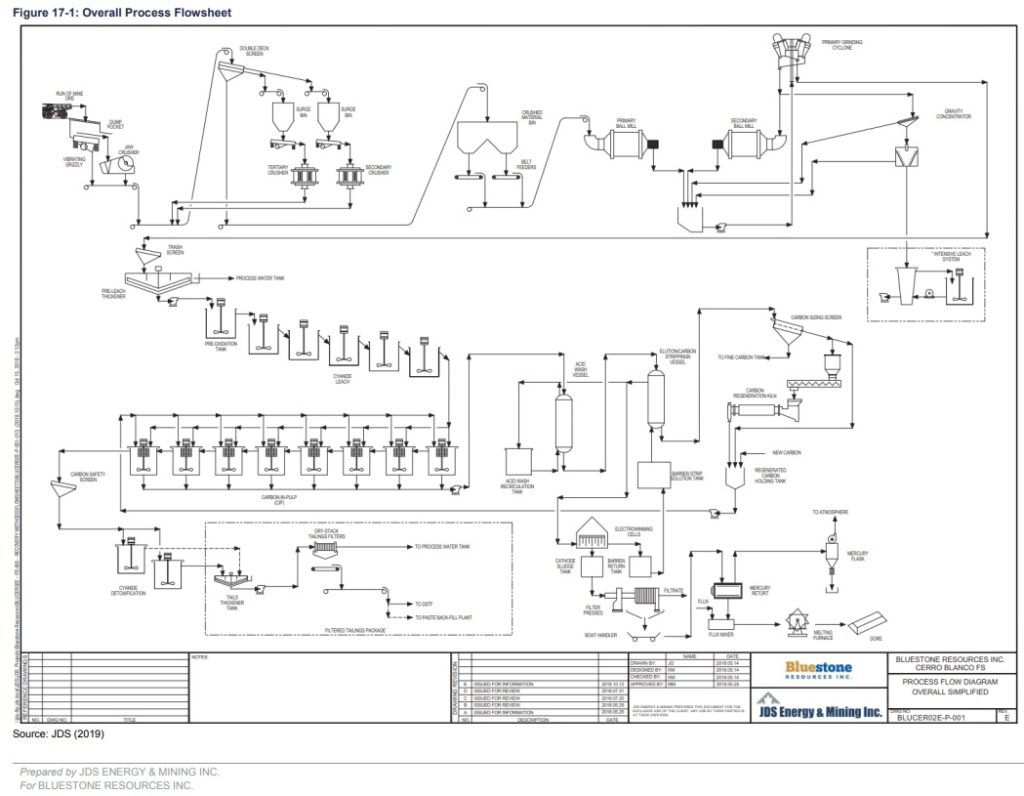

Anyway, In contrast, most mines require huge CAPEX (financing/dilution risk) and countless processing stages (operational risk) to reach say 80%-90% gold recovery. Below are some examples…

- Processing flow sheet for the high-grade underground Cerro Blanco deposit:

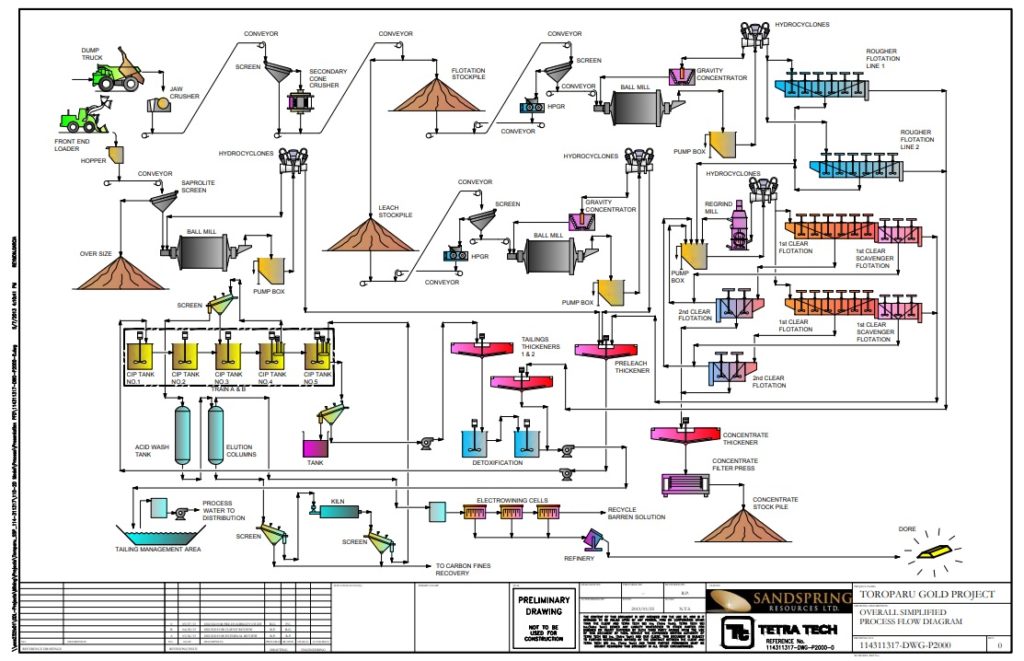

- Or how about Sandspring Resources giant, low-grade Toroparu Gold Project:

… And those production scenarios require constant water, reagents, blasting, grinding, high CAPEX and high OPEX etc. Furthermore, the infrastructure and thus the production rate is more or less fixed. If any of these companies wants to change the production rate or processing it requires capital spending and downtime (when in production). Some operations (primarily underground) can’t even readily up the production rate because the lack of space underground. So most of the world’s conventional deposits have major bottlenecks and sunk costs.

To quote an article on ore sorting:

“There are two main bottlenecks that limit production rates in mining operations. These are the two units that can only be expanded to a very limited extent or not at all, the shaft and mill. They also account for most of the total capital expenditure of mining operations.“

- Compare that to this:

- And potentially something like this:

- Or this ECS machine capturing 1-12mm material from wet gravel:

… No pit limit bottleneck. No underground workings bottleneck. And again, with benefits such as:

- Requires no water

- Environmentally friendly

- Lower OPEX

- Requires no chemicals

- Environmentally friendly

- Lower OPEX

- Requires minimum CAPEX

- No plant for tens or hundreds of millions needed

- Potentially very high IRR and low financing/diluation risk

- Scalability: Can be endlessly scaled with limited effort and CAPEX

- You just need to buy some more sorters and more dirt moving equipment

- There is no pit outline or underground workings to take into account

- Readily mobile

- The machines and mining equipment can be moved around to where ever the ore is

- There is no big stationary plant

- Technology: Easily and constantly upgradable

- Software

- Low unit cost in the case of wanting to change the main processing techniques

What do I mean with “Technology: Easily and constantly upgradable” you might ask?

Well take the new TOMRA COM XRT 2.0 mineral ore sorter for example. First, let me quote a few paragraphs from an article:

“X-ray ore sorting is already making great waves across the mineral processing industry by reducing plant throughputs, increasing head grades and cutting operating costs. One of the leaders in this growing field, TOMRA, believes its new COM XRT 2.0 sorter takes these attributes to another level.”

“This upgraded model features higher belt speed and throughput, translating directly into increased productivity in mineral processing. It also offers increased wear resistance and longer component lifetime, with quick and safe maintenance through providing easier access to replaceable components.”

““Our sorters have been operating under harsh conditions in both hot and cold climates, sorting wet and dry feed across a wide range of commodities,” Hartwig said.“

“The speed of the belt in the new design has been increased from 2.7 m/s to 3.5 m/s, while the more powerful X-ray system accommodates the sorting of larger-sized material due to better X ray penetration.“

““Higher levels of belt occupancy are facilitated by our improved data processing capacity, and this allows the particle size of the feed to be increased,” she said. “The maximum size of the particles that the TOMRA COM XRT 2.0 can handle is between 100 mm and 125 mm, depending on the material, which also contributes significantly to throughput capacity.”

“She notes these higher levels of capacity are particularly valuable for larger mines, as they reduce the number of machines required, and therefore also decrease capital and operating expenditure.”

… Do you understand where I am going with this?

If not, let me explain…

Technology incrementally gets better and better all the time and especially IT-technology. Mobile phones, software programs and computers becomes “old” in after just a few years due to how quickly the underlying hardware and coding advances. So what does that have to do with Novo? Well, as you can read in the quotes above, the TOMRA COM XRT 2.0 is better than its predecessor because of technological advances. Not only can it process information faster but the X-ray is also more powerful, which affects both throughput and recoveries. More powerful X-rays also means a miner could use a coarser crush size before sending it to the ore sorters, which reduces costs to boot. These improvements can have huge impact for miners and the technology will only get better and better, which is important to understand.

Here is another quote from the same article:

“Robben said TOMRA is continuously developing the hardware and software to improve detection efficiency, and that it is tailoring its image processing to detect “specific mineralogical features”.”

We are thus talking about a rapid and every changing performance increase for units that cost around $1M a piece. Furthermore, some improvements are simply software upgrades.

… So why might all this be so important for Novo?

Well, if you area miner that “only” uses ore sorting to upgrade some low grade material into acceptable ore then the technological advances in ore sorting technology might affect a smallish part of the overall flow sheet and profitability. I mean you will still have to grind it and process it through flotation or whatever. Basically the complicated processing flow sheets I showed earlier will more or less be the same….

But if more or less your WHOLE processing flow sheet is made up of ore sorting then any technological advances might have huge direct impact.

This is why I consider the market to be totally clueless in the way it shrugs off every positive NR that relates to this ore sorting technology. Perhaps understandably since there is no gold miner on earth (that I know of) that could potentially use ores sorting as the ONLY processing stage (after say coarse crushing at Comet Well). If ore sorting works (ECS or mechanical, or both) anywhere close to the preliminary test results then Novo could theoretically build a fully scalable mine with extremely low CAPEX and be able to constantly upgrade the processing techniques through technological leaps done by say Tomra and Steinert. I mean any one upgrade might directly affect a) Throughput, b) Recoveries, c) operating costs, and thus d) profitability. Given that the units are so cheap compared to a conventional plant, any new technology should be cheap and easy to incorporate. Compare that to a $300M mill which just sits static and will probably see limited changes due to the difficulties and CAPEX required to materially change any processing flow sheet. Furthermore, the maintenance and expansion costs should be minimal since it just means shelving or buying a few more ore sorters and earth moving equipment.

Very few people talk about this outside of Novo themselves (and Sumitomo by extension). I haven’t seen one naysayer even commenting on how impactful this technology might be for Novo. Yet, I constantly read abour more and more mining companies such as Hecla and Agnico Eagle starting to use it all the time. The market seems to be asleep at the wheel when it comes to ore sorting overall and especially in the case of Novo where ore sorting might not just be a part of the processing flow sheet but be THE processing flow sheet.

Hecla’s CEO Phil baker on ore sorting:

“The real issue with ore sorting is: what is your recovery going to be? How much are you going to lose? And, we’re still working through that (at San Sebastian). But I have high hopes for this being a complete gamechanger for the industry,” he said at the event in London.“

If it does indeed end up being a gamechanger for the industry, how big of a gamechanger would it be for Novo if ore sorting makes up the entire processing flow sheet? If you wanted to front run a disruptive technology, I guess this might be an opportunity. Food for thought.

Each software upgrade and/or new and improved sorter machine would directly affect throughput and/or recoveries which both would affect AISC. With better technology, the processing will get more and more efficient and the cost per ounce will go down and margins go up. Think about that. There won’t be a miner on the planet more directly affected by improvements in computational capabilities and algorithms etc. Conventional miners can’t replace and upgrade their whole processing flow sheet just like that, and often it will be just a part of the flow sheet that sees an upgrade once in a blue moon. Thus, technological advances by Steinert and Tomra etc will keep driving down the costs for any miner who incorporates ore sorting technology somewhere in the flow sheet, but not even close to the degree that it would drive down costs for Novo if the company ends up applying ore sorters the way I hope.

Furthermore, the advances in ore sorting technology might not only affect Novo the most, but the company’s results out of Karratha were orders of magnitude better than any other trial tests I have seen.

FWIW: Tomra’s chart does suggest they are adding more and more value to their customers:

The market (marginal buyer/seller) might not understand the implications and not care at the moment. That is irrelevant really. If this technology works anywhere close to what the trial tests show and is applied on a broad scale in Pilbara, all of the factors mentioned in this article will affect Novo’s margins and long term value proposition. Sticking ones head in the sand won’t stop ore sorting from revolutionizing the sector. Remember, most industry people have no experience with the new generation of ore sorters so how can they readily understand its implications?

Ps. Don’t use the share price as due diligence. Think about what you believe something is worth and then look at share price to see if the intrinsic value of the company is higher or lower than the price of the company. Seeing Novo’s valuation being basically unchanged (well a small drop actually) after yet another news release with excellent ore sorting results for yet another project makes more and more sure of how ridiculously inefficient the market is when it comes to junior miners (understandably more so for Novo because it’s unconventional in many aspects). Did the intrinsic value of Novo and thus the implied value of all projects go down because these preliminary ore sorting results out of Egina were excellent? I mean, really? Did the value go up? Well I think so. Yet the price of the company went down slight which made me think of this quote:

With all of the above said, the high impact factors mentioned in this article is still in the potential stage. But, given the recent results I think a higher % of said potential should be reflected in the valuation of the company since the preliminary tests were very favorable. If it actually ends up being viable as per the tests, then things will get extremely interesting. Lots of work to be done before the fat lady sings but it might be worth it in the end!

(Note: This is not a buy or sell recommendation. This is not investment advice and I am not a geologist. This article is highly speculative and I can’t guarantee accuracy. I can’t guarantee the accuracy of the content in this article. Always do your own due diligence. I own a lot of shares of Novo Resources which I have bought in the open market and am thus biased. I have not received extra compensation to write this article but Novo is a passive banner sponsor on my site. )

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Anyone who doesn’t grasp the enormity of what Novo is accomplishing here has perhaps just one, maybe two at most, working brain cells.

I think you are correct in that majority of people don’t appreciate the magnitude of the prize if Novo show proof of concept in one or more gold systems. If they make BC work, other Hardey targets should work. If they make it work near the Egina mining lease, then 100s of km2 could work. If Comet Well works, many other Mt Roe prospects might work…. And they have confirmed 1,000km of outcropping unconformity strike already…

A whole lot to think about. It seems to me that Novo will start paying dividends to it’s shareholders a lot sooner than I originally anticipated. Novo has had a lot of naysayers in the beginning but little by little it’s overcome the problems that look like it might sink it. I’m a long time shareholder and I’m thinking that the magnitude of this fine will set me up for good even if all of my other investments go belly up which is highly doubtful.

It might take a few years but potentially much sooner than most junior developers (and most will never pay dividends). Novo is perhaps the #1 most hated/disliked/ridiculed stock around. That’s a good thing since most don’t know what they are even talking about. There is no junior that I know of that has a higher absolute potential FWIW. If they unlock Pilbara, there should be enough projects in the pipeline to last for decades and more

Completely agree. Once they get multiple sorting machines, it will be effectively a license to print money. Last time I checked though, the Australian Stock Exchange doesn’t have them listed!

Because of the totally screwed up system in the U.S. where the brokerages holds them in THEIR name, I refuse to have my stock in their system there so I have my stocks in paper certificates which I’ve take to another country and placed in a private security vault to prevent the U.S. “Capital Controls” from seizing them. In today’s world you have to stay at least one jump ahead of the long arm of the feds.

love it! One of these days this rocket ship will become a SuperNova or Novo ahh see what i did there!

keep up the good work brother.

sasha san diego

Hehe I do see what you did there ;). The biggest immediate impact might be news from BC or trenching at Egina proving continuity. I just want to see them build value step by step for years and years. We got enough prospects to grow like no gold junior around if the brain trust in Novo unlocks these systems. Thanks Sasha!

Thank you for your analysis. This is very exciting. Do you know if these processes are patented or even patentable? The IP could provide a royalty stream independent of the novo properties.

You’re welcome! I do think the intrinsic value of Novo has increased quite a bit over the last couple of months. Yet the SP hasn’t reflected this, so R/R for Novo is just increasing with every NR (like this NR with excellent ore sorting results). I’m pretty sure they aren’t patented. ECS is used all over the world and Mechanical ore sorting is being included in more and more mining scenarios. I don’t think it’s important for Novo though. We might JV some land in the future though because it will take decades to prove up 10,000km2

The initial sorting test is promising. Yet to be determined is if testing will be successful in field production scale when run by typical workers. If permits are in hand and money is on tap, how about moving ahead with actual mining.

By the way, “quite unique” and “more unique” should be eliminated. Unique means one-of-a-kind and it takes no modifier.

I am a NOVO shareholder.

Yes, I expect the recoveries to be less than 99% or whatever in a full blown mining scenario. But if QH is correct on mining costs, it could be wildly profitable with much worse recoveries.