THH – StrikePoint Gold (SKP.V): Increasing Bang For The Buck With an EV of US$12.7 M

Feb 03, 2022

Just thought I would check up on one of my holdings (and banner sponsor!) in BC, Canada named StrikePoint Gold. As is typical at sentiment driven lows the valuations in the junior mining sector can get absurd for a while. Every previous sentiment low I have seen in this space produced absurd valuations where one could not make a rational case for many juniors to be as cheap as they were. Every time it also seemed that nobody wanted to buy them regardless of how undervalued they OBVIOUSLY were. At times like that I just simply realize that the valuations are unsustainably low and that when Mr Market gets out of his depression these valuations will not last. Thankfully this has worked every time, with cheap becoming not so cheap, and later even became overvalued (and then vice versa). I think StrikePoint has gotten pretty absurdly cheap where I can’t make a believable bear case for it to be overvalued. This is obviously a very good sign since my greatest fear is overpaying for something that should go down in PRICE and more importantly STAY DOWN. On that note I almost see nobody selling or holding off buying juniors right now because they think they are overpaying… No, they are fearful because they think PRICE can fall farther as in cheap getting cheaper. The main problems I have with that mentality is that a) You’ll never buy low and perhaps might even sell low, and b) Something that already is way undervalued will go up as soon as SENTIMENT changes… And you know what, sentiment always changes. The thing is that one needs patience and that is the one thing people hate.

Price we are paying (MCAP): C$21..8 M @ $0.105/share

OK so we know what we are paying for the company and all of its assets in the market today…

What does one get for C$21.8 M (US17.2 M$)?

Higlights:

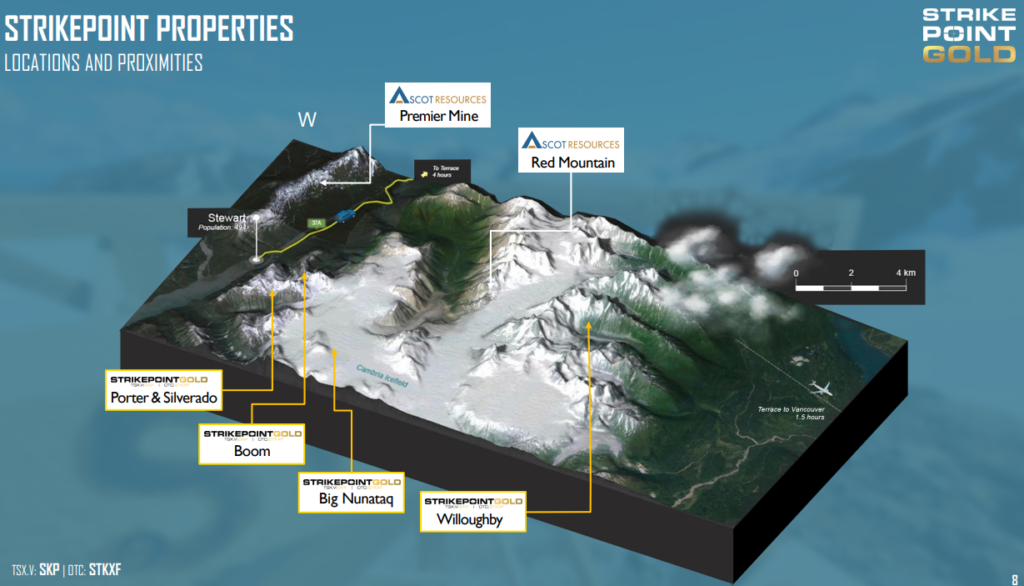

- 9 standalone projects in BC and Yukon, Canada…

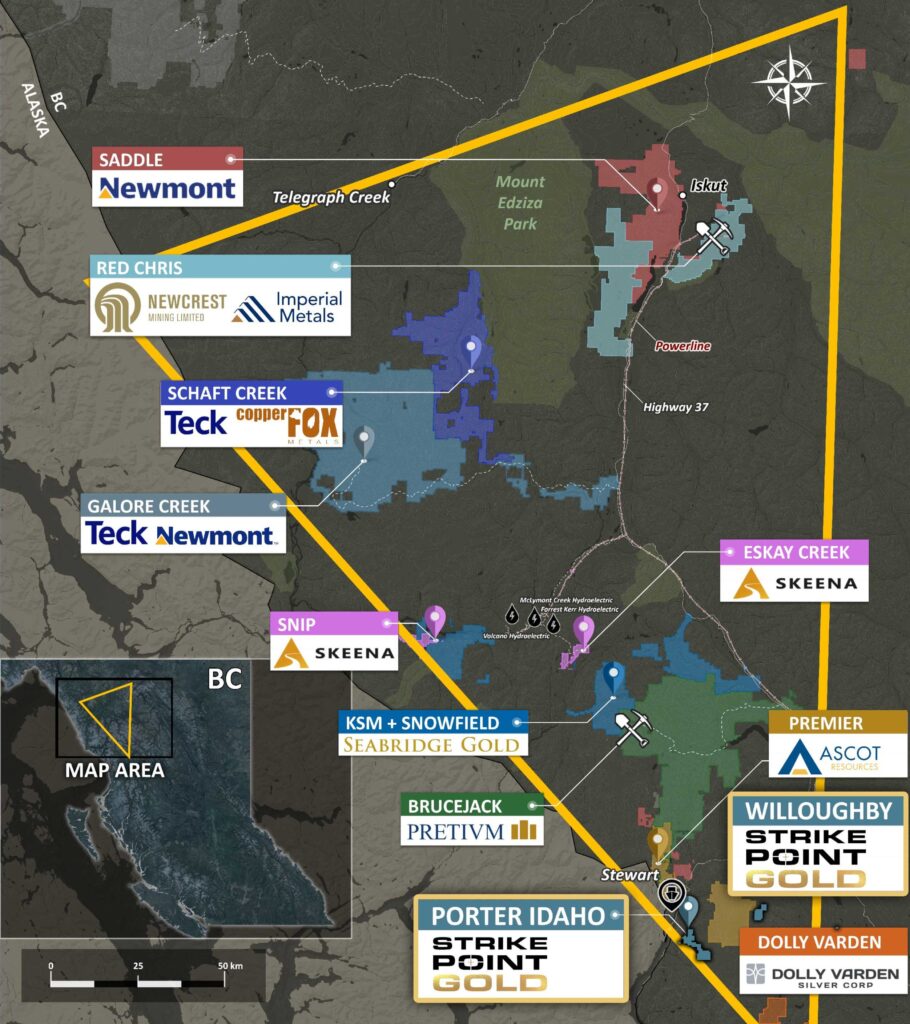

- Flagship #1 – “Willoughby Project”, BC

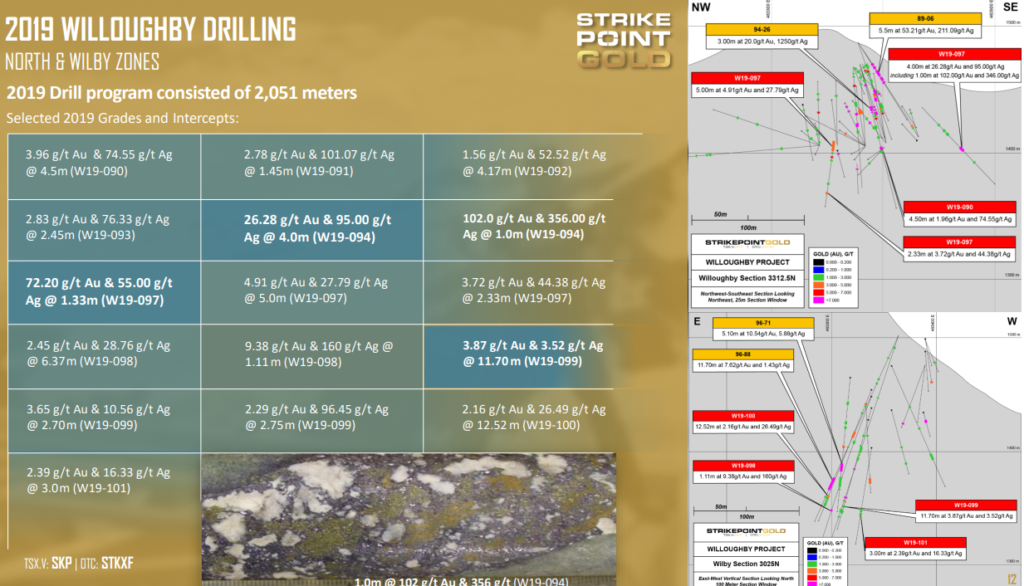

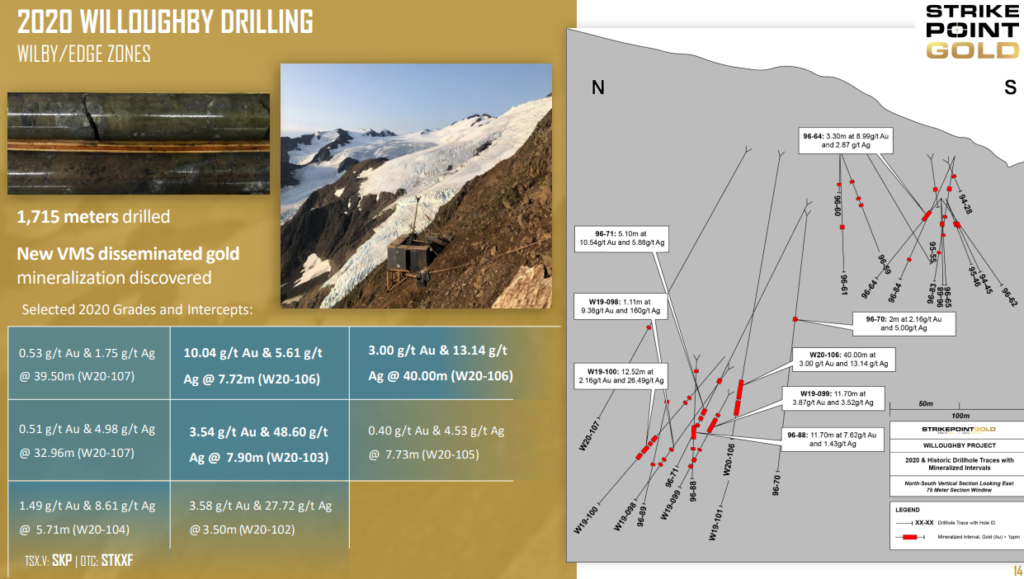

- Drill results include:

- 53.21 gpt Au & 211 gpt Ag over 5.5 m

- 3.00 gpt Au & 13 gpt Ag over 40.0 m

- 31.75 gpt Au & 21 gpt Au over 2.3 m

- 7.06 gpt Au & 43 gpt Ag over 12.0 m

- 72.2 gpt Au & 55 gpt Ag over 1.33 m

- 26.27 gpt Au & 95 gpt Ag over 4.0 m

- Drill results include:

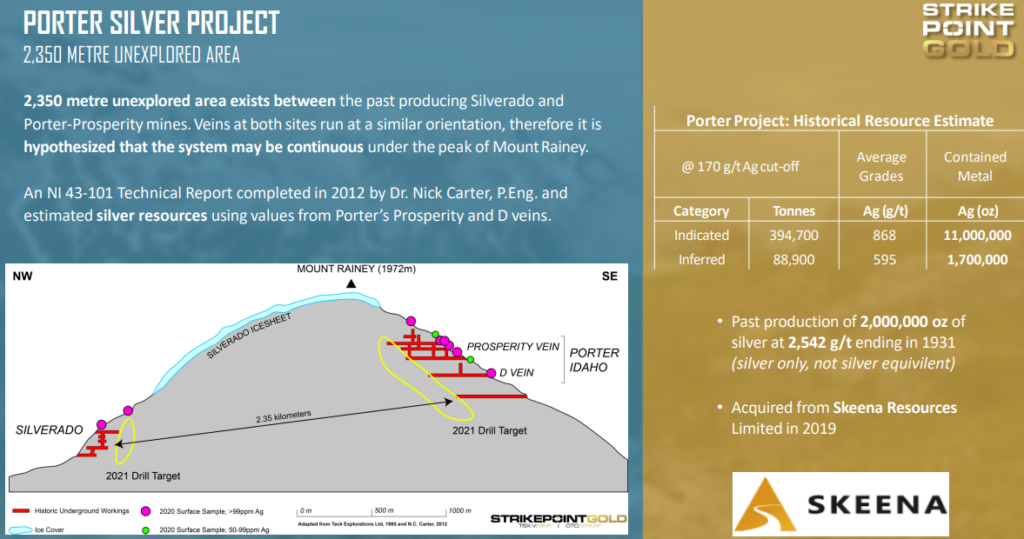

- Flagship #2 – “Porter Silver Project”, BC

- Historical resource of 12.7 Moz Ag

- 11 Moz @ 868 gpt Ag(!)

- 1.7 Moz @ 595 gpt Ag (!)

- Assays from maiden drill campaign by StrikePoint Gold is awaited

- Historical resource of 12.7 Moz Ag

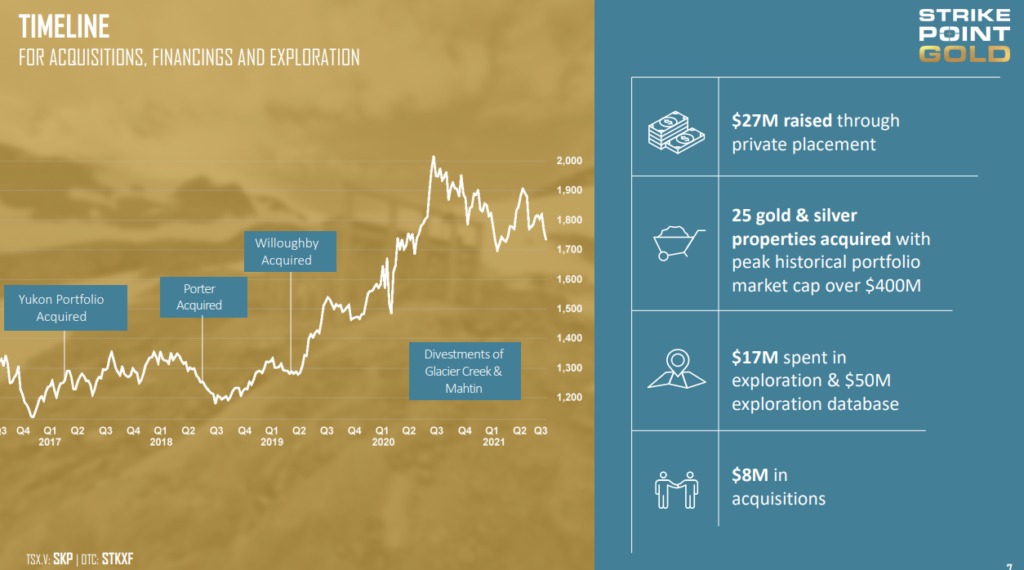

- Sunk costs:

- $17 M spent on exploration and $50 M exploration database

- Cash:

- C$5.7 M

That’s an Enterprise Value of C$16.1 M or US$12.7 M) for the company…

Mr Market is currently so depressed and bored that one can buy all StrikePoint’s assets and all potential within said assets for US$13.5 M… Come on man. If this was Q1 of 2016 when SENTIMENT was good, and all assets would have been spun out, I bet the combined Market Caps would be like >$100 M easy. Ps. Those sentiment levels we come again.

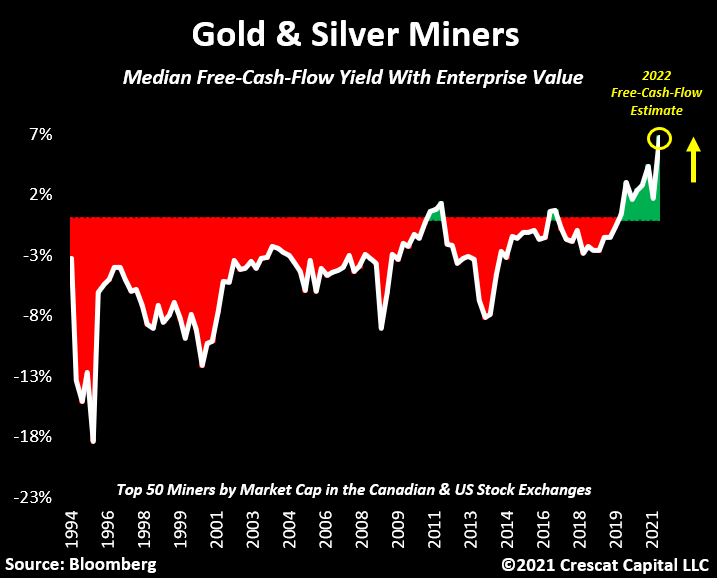

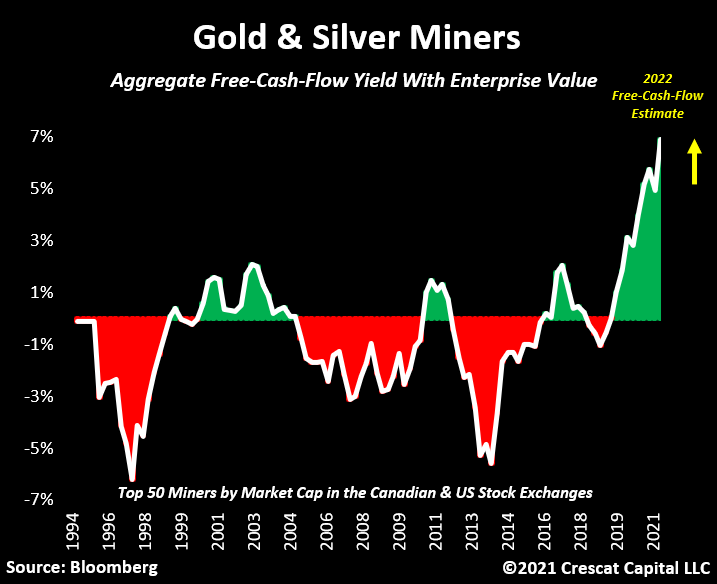

… Anyway, can you see why valuations like we currently see in StrikePoint Gold at the moment are ridiculous and unsustainable? If the market is “efficient” and junior companies are “fairly valued” then it would mean that the gold and silver business is almost worthless right now…. And/or if these valuations are correct they are suggesting the gold/silver mining sector is going to go away soon. Yet…

(Via Crescat Capital)

The reality is that gold and silver mines have been more valuable recently than they have been in decades. Furthermore high-grade deposits have an advantage in an environment where energy and input costs are rising. The Porter Silver Project for example happens to have bonanza silver grades and the system might be much larger than the currently known footprint:

What is the current high-grade resource and the risk-adjusted potential for the 2.35 km of strike between the old workings worth? $1 M? $5 M? $10 M? $20 M? More? What’s the 12.7 Moz of high grade- to bonanza grade silver worth? $10 M at least? The EV for the entire company is $US12.7 M and should reflect the intrinsic value of not only Porter but Willoughby and all the other projects. Including this…

Also should reflect the value of work that has been done (sunk costs):

Maybe not a ton of value but everything costs… And the work led to some serious smoke generation which was followed up with:

…And:

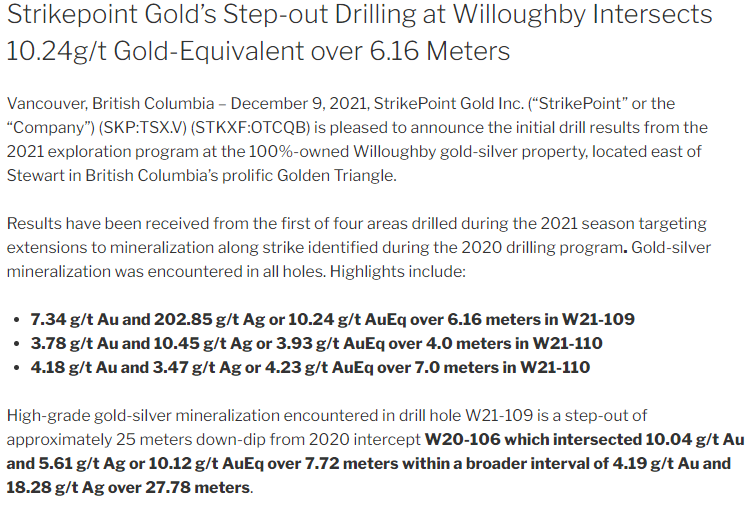

And in December the (slow) assays from the 2021 campaign started to trickle out:

Note that there are more drill AND channel samples awaited from both Willoughby and Porter from the 2021 campaign.

So again, what is the Willoughby and Porter Silver projects worth given what is known, the work that has been done, the potential that is still there, the historic resource at Porter and the fact that it’s in perhaps the hottest jurisdiction in the world right now?…

More than US$13.5 perhaps if we allow us to use common sense..?

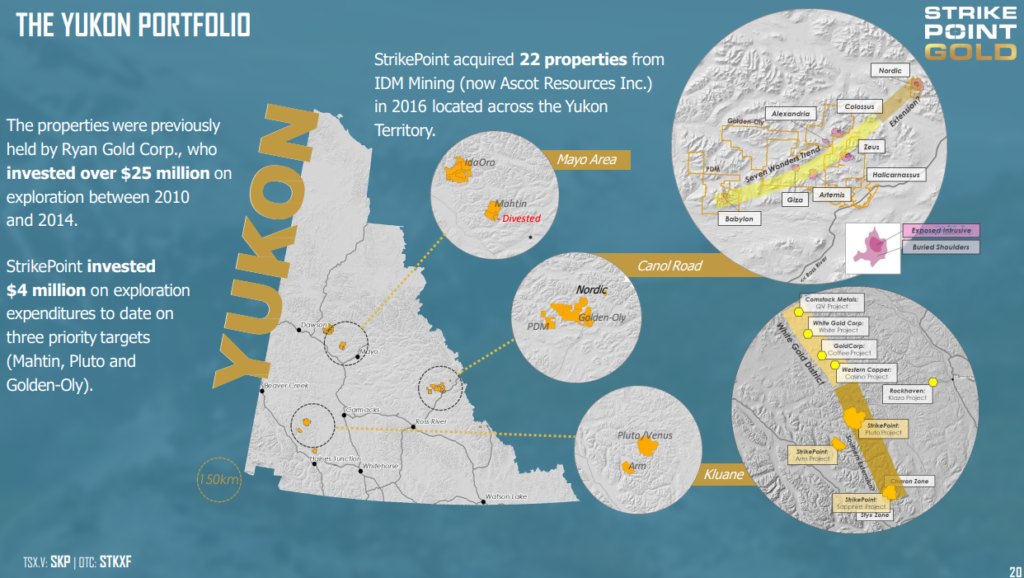

For good measure lets thrown in a bunch of precious metals project in The Yukon that comes with $25 M worth of historic work and another $4 M of sunk costs put in by StrikePoint:

I have a 99 problems like everyone else but having a hard time finding mind numbingly cheap juniors like StrikePoint Gold ain’t one. In fact this sector is almost boring right now, not because it’s “not been going up in price”, but rather because it is becoming almost impossible to overpay for anything (make a mistake). Risk in my book is overpaying for something that SHOULD go down in PRICE and more importantly STAY DOWN… With that said how do I even make a rational bear case for StrikePoint? Am I guaranteed to get hundreds of percent in return owning StrikePoint? No, but that’s because there are no guarantees. There are only better or worse Risk/Reward cases. Is a lot of success for StrikePoint at ANY project priced in with an Enterprise Value of $US12.7? Is Mr Market pricing in even a shot in hell that any project could become a mine? I don’t think so at least. This sector is just ridiculously cheap right now and one day it will be expensive like in Q1 2016.

Now I am not “all in” on StrikePoint regardless of how no brainer cheap it is. But at these levels I am very happy to have it as part of my well diversified growth focused portfolio. It’s still high risk/high reward like most juniors but fortunately so little in terms of reward is priced in so the Risk/Reward is way better than it “should” be if Mr Market was indeed “efficient”.

Closing Thoughts on StrikePoint And Investing Theory

By now it should be obvious just how much sentiment and flow of funds dictate the pricing environment in this sector. Juniors like StrikePoint are irrationally cheap right now simply because “the herd” don’t want to buy juniors right now for whatever reason. The delays in assay results sector wide has not helped and I would argue a meaningful portion of the current discount is simply du to boredom and that investors now more than ever have little to no patience. The thing is that this will change unless the virus and the lockdowns stay in place forever. I doubt that and therefore I consider my buys over the last several months to be front running this change and that this “patience arbitrage” is boosting the future returns in this sector. How? Well if juniors are say 20% cheaper than they would have been without any assay delays, all else equal, then that 20% discount should lead to an increase in future returns…

Let me explain:

StrikePoint hit a high of $0.325/share during the sector sentiment peak last year…

StrikePoint is currently trading at $0.11/share during this sentiment low…

If there were no sector wide assay delays, which affects StrikePoint as well, then the sentiment might have not gotten THIS bad. So lets say the PRICE would instead be $0.14/share right now if there had been no assay delays (added boredom discount). If we assume that StrikePoint will reach at least $0.325/share at next sentiment high then the future returns from this level ($0.11/share) would be 195%. Now theoretically, If there had been no assay delays and the stock would be trading at for example $0.14/share, then the upside for a buyer would be 132%. In other words I think that investors who are currently buying shares of StrikePoint and other juniors, that are being sold by people who’s motivation for selling is boredom, are getting outsized future returns because they have patience and the common sense to know that things always change… “This too shall pass”. Note that this does not mean that PRICES of these companies can go lower before they inevitably head higher on average.

“To beat your enemy you must understand your enemy”

… If you know why people are selling you also know why you should be buying. If the enemy is making a mistake due to boredom and lack of patience one must be patient in order to take advantage of it. If the enemy is selling because they fear prices might go lower one must realize that regardless if they go lower at first they will inevitably head higher in the future. Seriously have you even read a single forum post about someone selling out because they think the price of a junior is too high right now? No? Of course not. It’s extremely hard to make a bear case for any junior worth its salt right now and people simply sell because “They are not going up”. Guess what, they will, and the more people sell out for emotional reasons the irrationally cheap they become. This sector sentiment we are seeing now is where one sows for a big future harvest. So what if it would would take another year to get a >200% return? The stock market averages 9% per year and 95% of people do not even beat an index over the long term. Think about that.

One of the absolutely best examples of just how much SENTIMENT dictates price levels and opens up the opportunity to front run shifts in sentiment is Bear Creek Mining. Bear Creek Mining has been a “trading sardine” for year with little changes to the company’s fundamentals. The company has a lot of silver and it’s just been sitting there for a decade or so. Therefore the changes in Price naturally have less to do with changes in company fundamentals as compared to most juniors. OK silver was a bit higher a bit more than a year ago but it does not explain the fact that shares of Bear Creek Mining were trading at a level 270% higher than where they are trading currently:

Long story short: We are extremely low sentiment levels. When we get to extremely high sentiment levels again the average junior will go up >200% in price in my opinion. Can they go down more first? Of course. But it would be to even more unsustainable levels and the reversion to the mean might result in future price jumps of >300% instead. We are waaay past the point of selling since the sector is selling at fire sale prices ALREADY in my opinion.

Note: I own shares of StrikePoint Gold and the company is a passive banner sponsor. Therefore consider me biased and do your own due diligence. Junior miners are volatile and risky. I cannot guarantee the accuracy of the content in this article. Assume I can buy or sell shares of StrikePoint at any point in time. Always make up your own mind because we share neither returns or losses.

Best regards,

The Hedgeless Horseman