StrikePoint Gold: High-Grade Silver and Gold in The Golden Triangle

In this article I will explain why I own StrikePoint Gold (SKP.V) and why I was happy to have the company on as a passive banner sponsor.

My Case For StrikePoint Gold in Short:

- Two semi-advanced gold and silver projects in the famous Golden Triangle

- Confirmed high-grade gold and silver in both projects

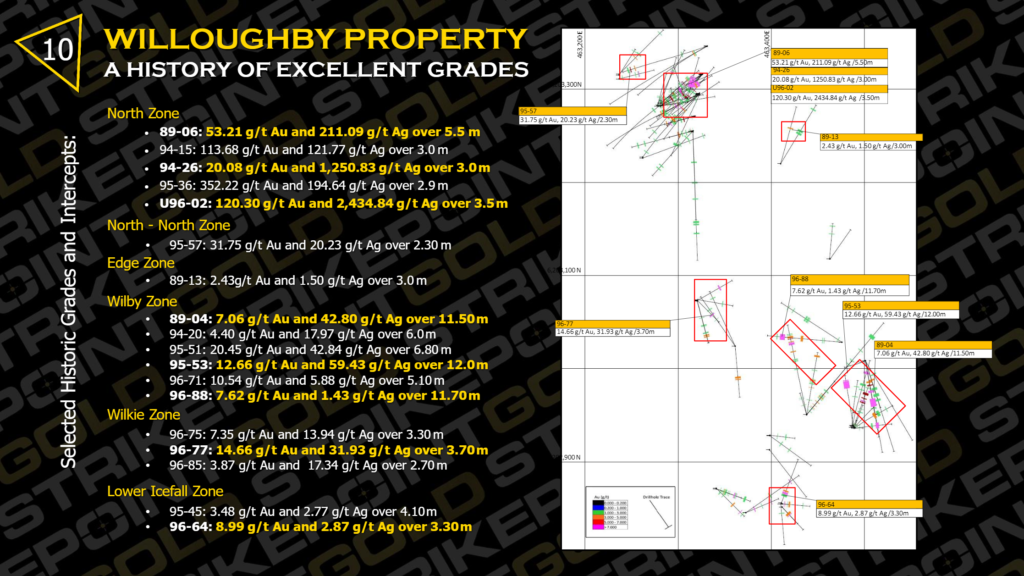

- Willoughby Project historic drilling highlights:

- North Zone: 53.21 g/t Au and 211.08 g/t Ag over 5.5 m

- North Zone: 20.08 g/t Au and 1,250.83 g/t Ag over 3.0 m

- North Zone: 120.30 g/t Au and 2,434.84 g/t Ag over 3.5 m

- Wilby Zone: 12.66 g/t Au and 59.34 g/t Ag over 12.0 m

- Wilby Zone: 7.62 g/t Au and 1.43 g/t Ag over 11.70 m

- Wilkie Zone: 14.66 g/t Au and 31.93 g/t Ag over 3.7 m

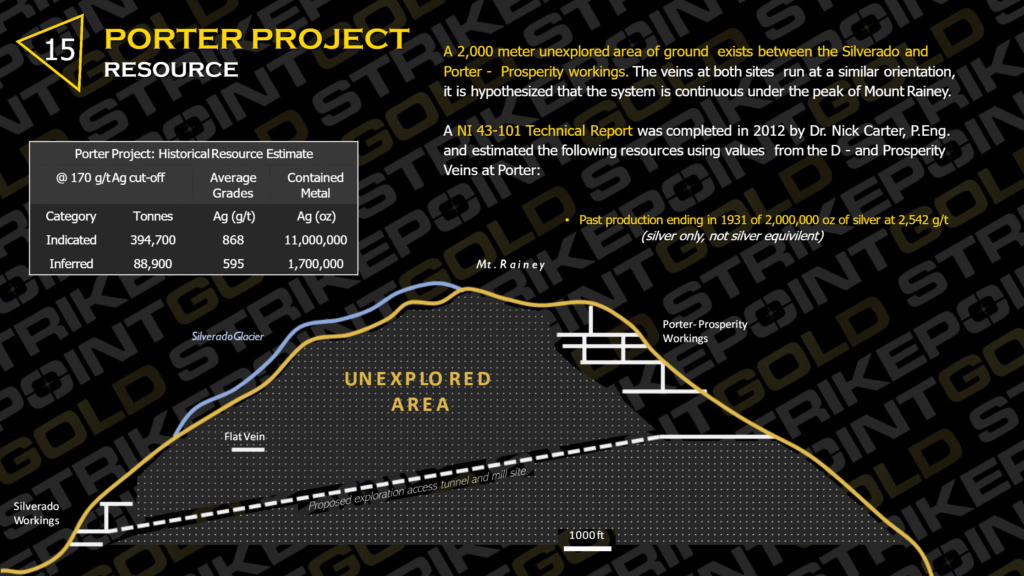

- Porter Project has a resource of 12.7 Moz of silver at very high grades (595-868 g/t Ag)

- Backed by Ascot Resources and Skeena Resources (potential future buyers)

- Owns 22 properties across the Yukon territory to boot

Bottom Line:

For around C$35 M (@ 0$0.19/share) you get around C$5 M in cash, two semi-advanced flagship projects with confirmed high-grade gold and silver endowment, and the Porter Project already has a silver resource with bonanza-grades. This means that there is meat on the bones already and Strikepoint will have beta to gold and silver. I think this is important because I hate the thought of ending up with no gold or silver in a precious metal bull market. The fact that both are located in one of the hottest and best tier #1 jurisdictions is icing on the cake. With that said it is of course exploration which is the main attraction with the company. That there is exploration potential at Porter is obvious given that each side of the mountain has seen historic mining and if the company is able to connect the high-grade hits at Willoughby then that project could get really exciting. Lastly, the company has a huge portfolio of early stage projects in Yukon which could be sold, JV’d or worked on in a hopefully red hot precious metal market.

I see StrikePoint has having some margin of safety due to already having confirmed silver resources and confirmed high-grade mineralization at both of the company’s flagship projects. If further success is made at one or both projects then there is obviously some serious upside potential from this valuation level. Having two larger companies invested in Strikepoint is a good kicker because a) Votes of confidence and b) Natural acquirers in case StrikePoint hits it big.

With a very impressive pipeline of projects it means that StrikePoint will have their hands full and not be forced to go out and acquire new projects in a potentially very hot market when valuations might be “stretched”. In this regard I salute Shawn Khunkhun for having been very pragmatic (acquired projects on the cheap during down turns) and forward looking (Loading the company with projects BEFORE the mania phase of the bull market).

Meat and Potatoes

1. World Class Jurisdiction:

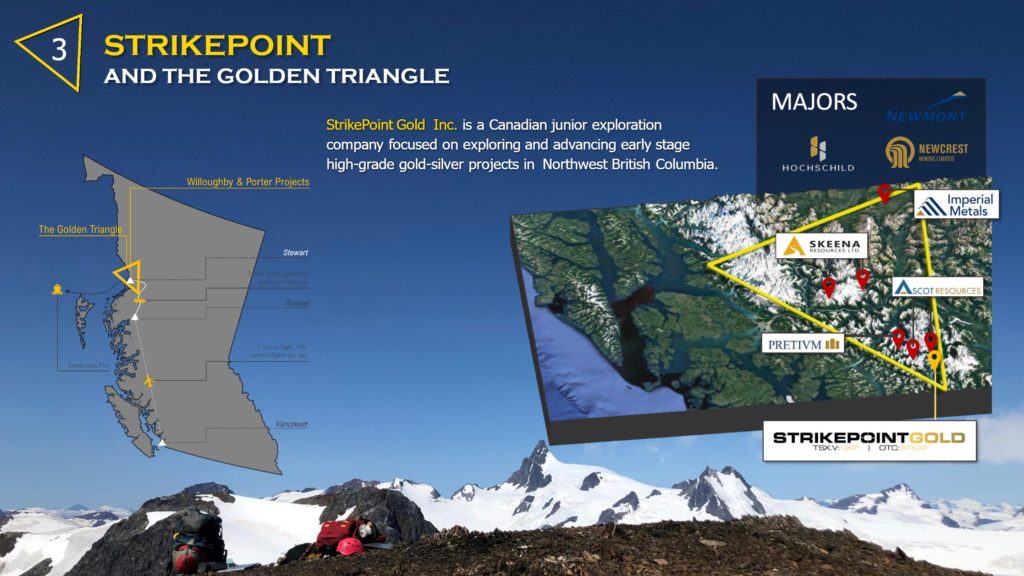

StrikePoint’s two flagship projects are located in the famous Golden Triangle district of British Columbia, Canada. This is an area that has seen a lot of mining and there are multiple mines up and running as we speak. Personally I have am relatively picky when it comes to jurisdictions nowadays so I really do prefer to invest in tier #1 jurisdictions due to a) I want to be able to keep whatever the company finds and b) I want larger companies to be comfortable acquiring (taking risk) and jurisdictional risk is obviously a big factor for a long term investment.

… As you can see in the slide above there are many players involved in this area and that includes Newmont, Hochschild and Newcrest. This signals that majors are indeed interested in mining operations in this area which is very good. It is also worth pointing out that Ascot Resources and Skeena Resources, who both owns a stake in StrikePoint, have projects nearby. This means that there should be potential for synergies if StrikePoint finds something material which obviously would hike up the implied value in terms of a take over.

2. The Art of Value Creation

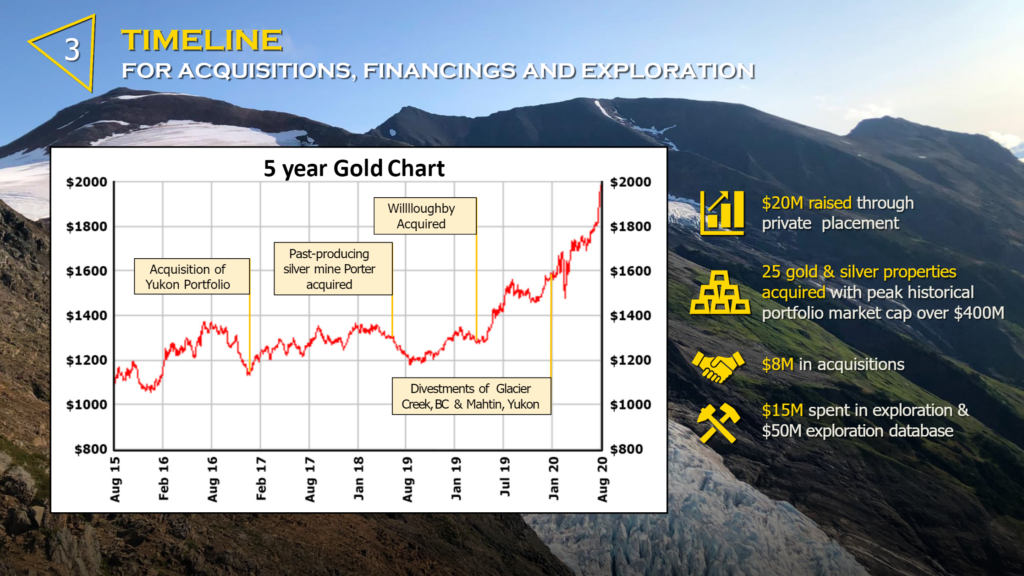

The next slide is a testament to how business savvy Shawn Khunkhun and Strikepoint have been:

… The company has been picking up projects for pennies on the dollar during short term downturns in the metal space. This is a sign of people who are well aware that their job is to create as much value as possible to shareholders. The acquisitions would have costed a lot more if they were done today. Forward looking, strategic thinking are traits one wants to see in the stewards of ones capital.

3. The Flagship Projects

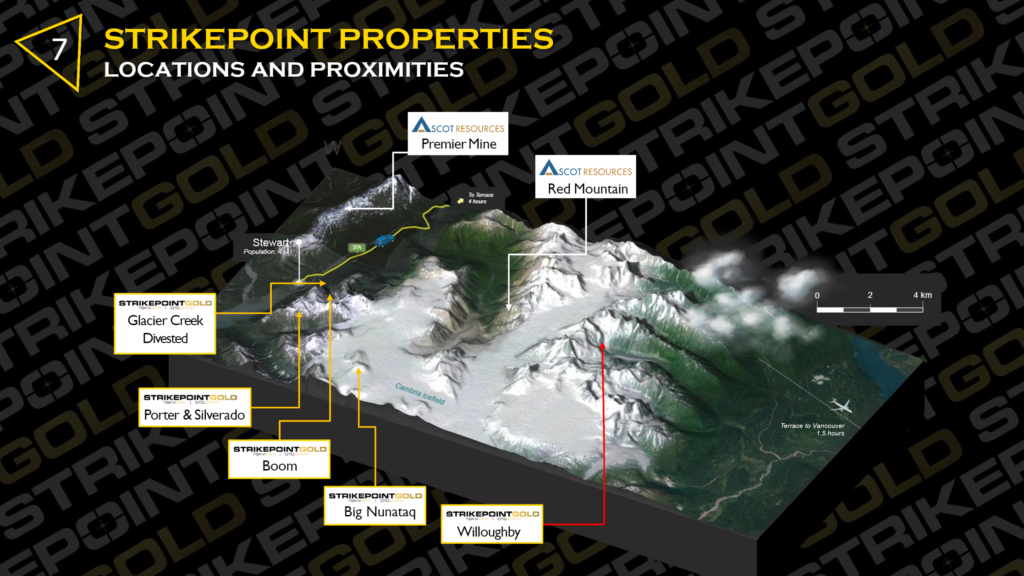

Both of StrikePoint’s flagship projects are close to one another as well as close to Ascot Resources’s Premier Mine and Red Mountain Project:

… As stated earlier this beneficial both from a strategic and tactical stand point since it increases the implied value of the projects through the potential of becoming satellite deposits as well as the likelihood of being bought in the future. Furthermore it helps from a tactical stand point to have more people working in the area.

3.1 Willoughby

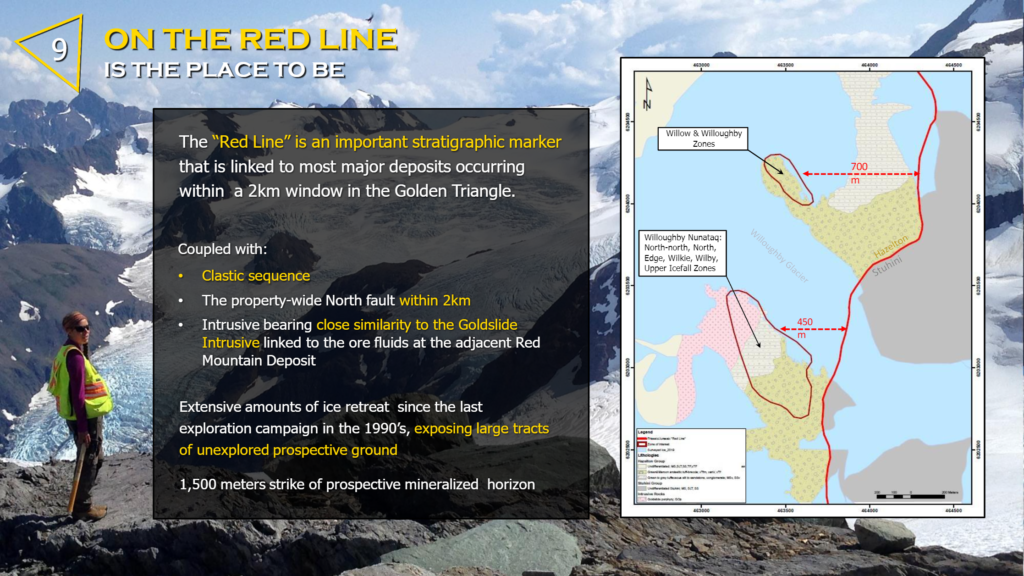

Willoughby seems to be located in the “right place” in that the current targets are proximal to an important stratigraphic marker that is “linked to most major deposits” as per:

As you will see in the slide below there have been some really great historic intercepts which hit high-grade gold and silver across multiple zones and the million dollar question is if some of these zones will end up being connected:

This following is from the September news release titled “STRIKEPOINT GOLD UPDATES 2020 EXPLORATION PROGRAM FOR NORTHWEST BC GOLD AND SILVER PROPERTIES“:

Willoughby Gold-Silver Property

The main objectives of the 2020 exploration program at the Willoughby gold-silver property has been to improve continuity of high-grade and to test broad zones of disseminated gold and silver mineralization encountered in previous drilling and surface sampling. Surface exploration commenced on July 29, 2020 and drilling began on August 10, 2020. The Property is located on the east side of the Cambria Icefield, seven kilometers east the advanced-stage Red Mountain Gold Deposit owned by Ascot Resources.

The Property is underlain by Upper Triassic Stuhini rocks and Lower Jurassic Hazelton volcanic and sedimentary rocks that have been intruded by an early Jurassic-aged hornblende-feldspar porphyry, similar to and potentially comagmatic with the Goldslide Intrusive suite at Red Mountain. Intrusive-related mineralized zones consist of strong pyrite mineralization with lesser pyrrhotite, sphalerite, galena, chalcopyrite, and native gold. Eight gold and silver mineralized zones have been identified to-date over the mineralized trend which extends onto Decade/Teuton Resources’ Del Norte Property.

Extensive surface sampling has been completed, targeting high-grade newly exposed mineralization with 262 surface samples collected, with all assays currently pending. In addition, over 1,700 meters of drilling in seven holes have been completed so-far in 2020, with all holes submitted for assay.

3.2 Porter Project

The second flagship project is the one called the “Porter Project” which contains two past producing high-grade silver mines and a historical resource:

Similar to Willoughby the million dollar question here is if the veins that have been mined on opposite sides of Mt. Rainey will prove to be connected. The following snipped is from the previously mentioned news release:

Porter Silver Property

At the high-grade Porter Silver Property, the focus of the 2020 exploration season will be linking the two-past-producing high-grade silver mines on the property: the Silverado (northwest) and Prosperity/Porter Idaho (southeast) mines that outcrop 2,000 meters apart on the opposite sides of Mount Rainey, overlooking the town of Stewart, BC. Upcoming work will include exploration for new veins that have been identified outside of the historic resources and past producing areas. The Silverado glacier has retreated significantly over recent years, with prospecting planned in newly exposed areas. In steeper locations of the Property, experienced mountaineering crews and climbing geologists will be employed to sample new exposures. A drill program based out of Stewart has been planned to target high-grade silver veins previously reported through historical stoping, drilling, surface sampling as well as recent exploration programs by StrikePoint.

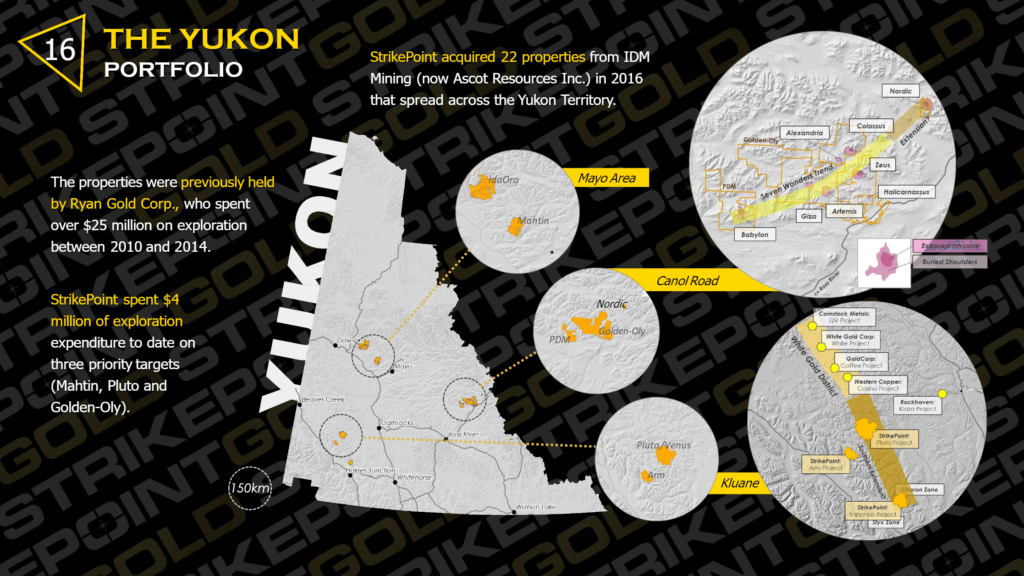

3.3 The Yukon Portfolio

StrikePoint also have a few other aces up their sleeve in the form of a very large portfolio of projects located in the Yukon Territory, Canada:

… I think none of these are reflected in the current valuation of the company and I think they might end up providing positive surprises when the market gets hot again. In other words I think there will be appetite for these projects when the bull market wakes up for real again and that Strikepoint might be able to sell, JV and/or to work on them when the time is right. I mean picture a scenario where gold, silver and miners are finally on fire. When this happens Strikepoint will be sitting on a Yukon portfolio that is big enough for multiple companies to split between them.

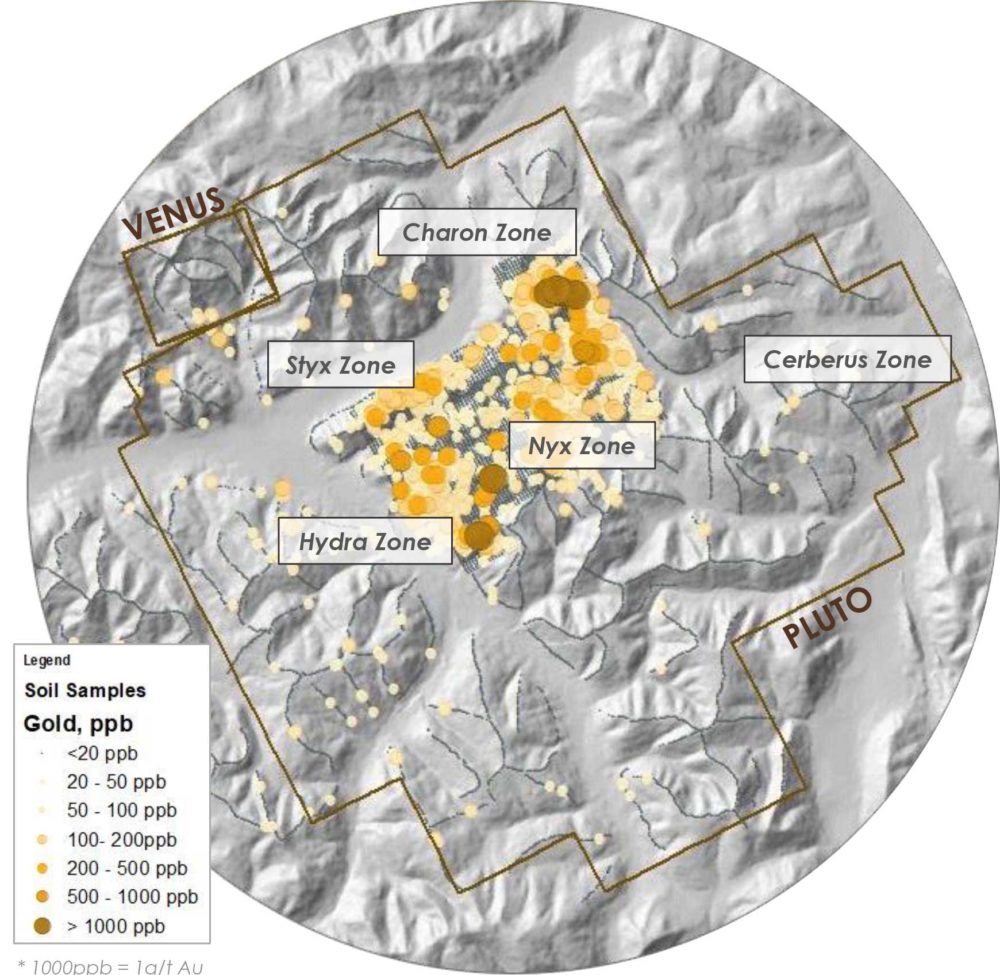

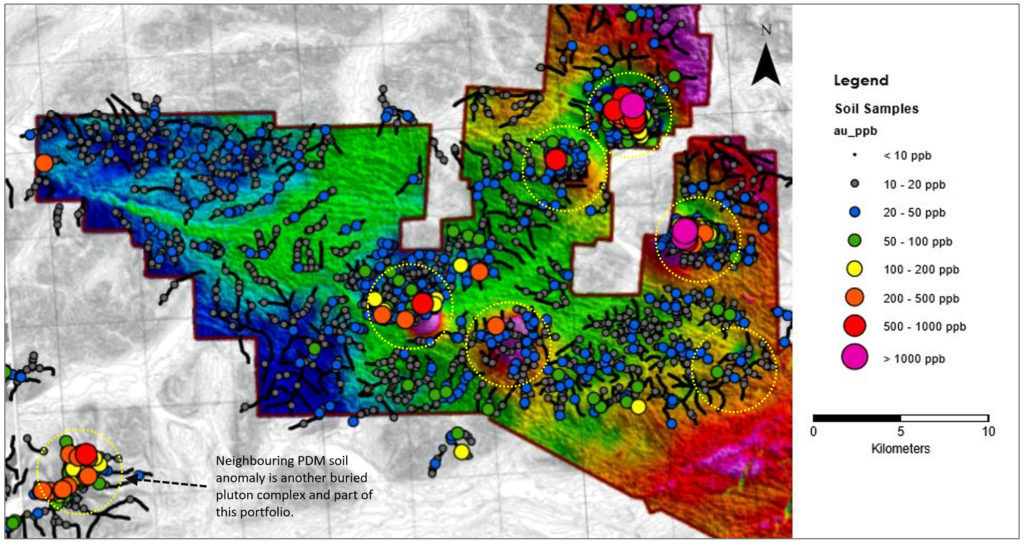

Take the massive Pluto Project for example (23 km at its widest point). This one has multiple areas with very high gold in soul numbers:

… Or how about the Golden Oly Project (note the scale):

… Again, I think nothing of the Yukon portfolio is reflected in the current valuation and that Shawn and the team will reward shareholders through value creation when the time is right. Nothing beats having a bunch of very large projects (with obvious golden smoke) in a tier #1 jurisdiction in a raging gold bull. Just because the market forgets about this side of the intrinsic value of StrikePoint doesn’t mean that you must do it as well. With that said, this value will probably take time before it is unlocked but in light of the company’s Enterprise Value which is around US$ 23 M, I reckon it could be very meaningful for current holders with a long term view.

Bottom Line

In StrikePoint Gold you get a focused team that have shown to be very smart in terms of creating value for shareholders and I know Shawn and his team will do everything within their power to make all shareholders happy. If I had to choose a few aspects of StrikePoint to press on it would be a) Both flagship projects are already confirmed to host high-grade gold and silver which decreases risk, b) StrikePoint has beta via it’s historic silver resource, c) The exploration potential at both flagship projects is obvious in terms of connecting already confirmed zones of mineralization, d) Hiden value in the Yukon porfolio which will probalby be unlocked one day, and e) Both flagship projects are proximal to other development assets held by larger companies in a tier #1 jurisdiction.

Additional things to consider:

- Backed by Ascot Resources, Skeena Resources and Eric Sprott

- Proximity to the larger companies above

- Satellite deposit potential in a tier 1 district

- Decreasing the threshold in terms of reaching critical mass

- Increases the likelihood of being monetized

- Crescat Capital (Quinton Hennigh) has given StrikePoint thumbs up which goes a long way in my book

Lastly I would say that even though I don’t necessarily see tier #1 exploration potential in StrikePoint this belief is offset by the combination of the projects being de-risked (not grassroot exploration stage), close to larger projects and being in one of the best jurisdictions around. In other words I think “even” satellite deposits in this neighborhood could end up being worth quite a bit in a gold and silver bull. Especially if Tom Kaplan is correct in terms of his theory that companies operating in tier #1 jurisdictions might end up becoming a bubble within a bubble in the future. It’s also very nice to know that the company already has high-grade silver on the books which means there is no chance of the company ending up in a silver bull without any silver at least. Furthermore I got the sense from talking to Shawn that he wants StrikePoint to be very aggressive with the drill bit in 2021.

As always there are no guarantees of success but only good or bad risk/reward. Personally I think the risk/reward in StrikePoint is very good mostly thanks to the company’s (Shawn’s) ability to pick up a bunch of projects on the cheap in preparation for the most exciting stage of the bull market. Therefore I own shares of the company. I have no idea what the coming results will be from Willoughby but I don’t base my case on any single (smallish) drill campaign and not much in terms of success is priced in right now anyway.

Lastly, make up your own mind as always and don’t put all your eggs in one basket (spread your bets).

Upcoming Catalysts

- Drill results

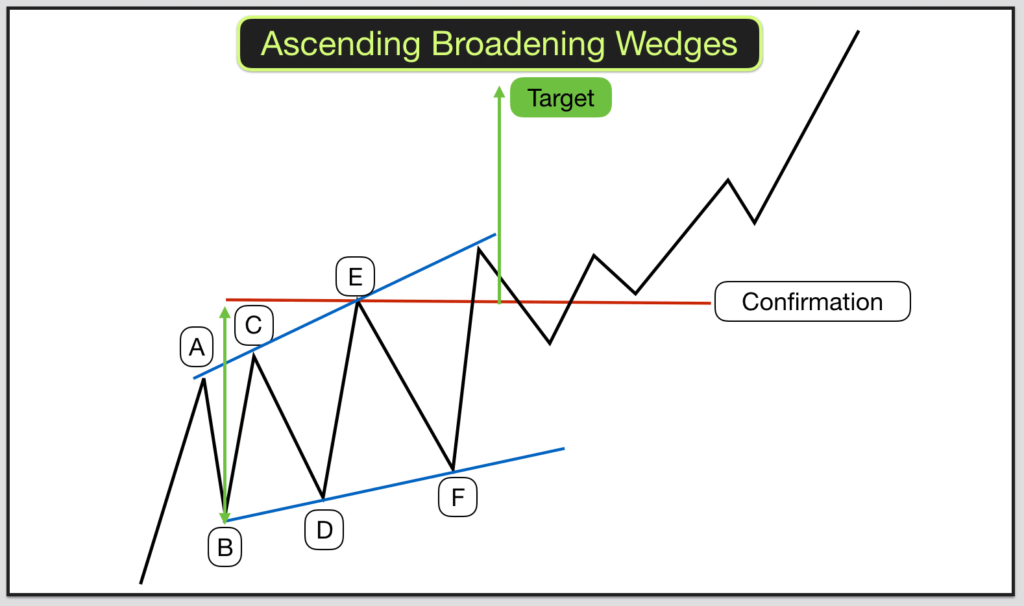

Some TA

Food for thought…

Note: This is not investment advice. I am not a geologist nor am I a mining engineer. This article is speculative and I can not guarantee 100% accuracy. Junior miners can be very volatile and risky. I have bought shares of StrikePoint Gold in the open market and I participated in the latest private placement. I can buy or sell shares at any point in time. I was not paid by any entity to write this article but the company is a passive banner sponsor of The Hedgeless Horseman. Therefore you should assume I am biased so always do your own due diligence and make up your own mind as always.

Best regards,

Erik Wetterling aka “The Hedgeless Horseman”

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My channel