New Found (NFG.V): Intercepts 51.3 g/t Au over 3.20m and 53.3 g/t Au over 3.10m in Step-outs to Depth at Lotto

Vancouver, BC, March 23, 2021: New Found Gold Corp. (“New Found” or the “Company”) (TSXV: NFG, OTC: NFGFF) is pleased to announce recently received assay results from two holes drilled at the Lotto Zone (“Lotto”). These holes were completed as part of the Company’s ongoing 200,000 m diamond drill program at its 100% owned Queensway Project (“Queensway”), located on the Trans-Canada Highway 15 km west of Gander, Newfoundland.

Highlights

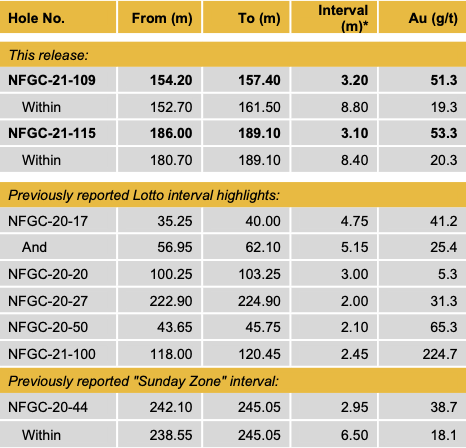

- These drill results are summarized below:

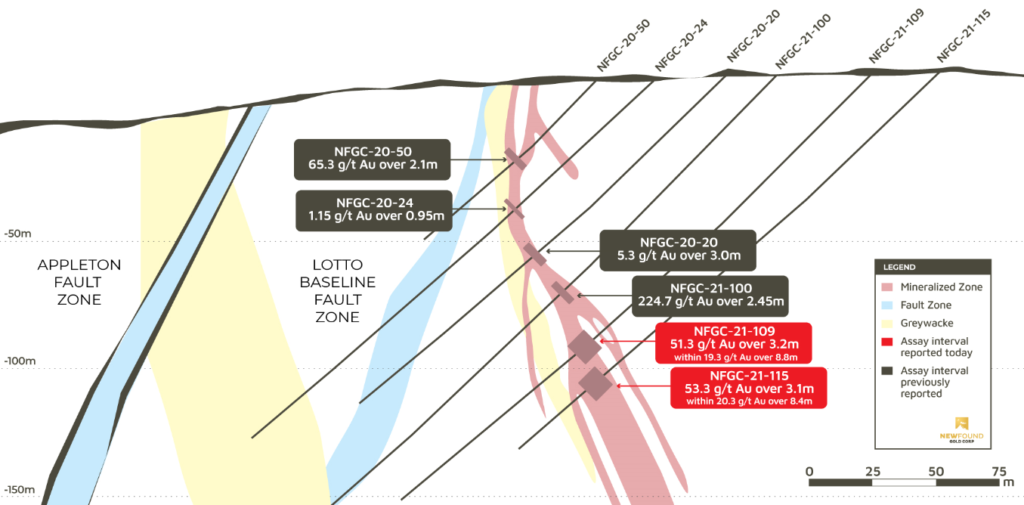

- As illustrated in Figure 1, the intercepts in NFGC-21-109 and NFGC-21-115 confirm good continuity of high-grade gold mineralization to a vertical depth of approximately 130m where it remains open.

- These intervals occur in an interpreted north-south striking vein set, one of a network of multiple secondary north-south striking vein sets interpreted to date over a 300m x 200m area and open (see Figure 2).

- High grade interpreted to be focused on fault splays and structural intersections in plan view. Drilling to date indicates similar patterns in cross section, with spays in veining also interpreted in the vertical direction.

- Continuity is also developing along strike. The high-grade intervals in the Company’s original Lotto discovery hole (NFGC-21-17, which returned 41.2 g/t Au over 4.75m starting at 35m down hole and 25.4g/t over 5.15m starting at 57m down hole) are interpreted to occur in the same north-south vein set along strike to the north.

Denis Laviolette, President of New Found, stated: “We are very excited by the continuity of high-grade gold now developing on this north-south striking vein set at Lotto. The two reported step-out intervals were drilled below the high grade interval in Hole NFGC-21-100 (224.7 g/t Au over 2.45m, see February 23, 2021 news release) confirming the high grade mineralization to 130m vertical depth where it remains open. In fact the veining appears to be broadening and strengthening with depth, and drilling to step out further to depth will commence shortly. To date we have interpreted approximately 300m of north-south strike on this vein set which appears to bisect the Lotto Baseline fault zone, as illustrated in Figure 2. Drilling will also continue to step out along laterally along strike to further test in this direction.

Bigger picture at Lotto, as shown in Figure 2 we have interpreted multiple other north-south striking secondary veining and we will continue to drill test these other vein sets for similar high-grade gold mineralization. One of these interpreted north-south striking vein sets approximately 100m to the west returned 18.1 g/t Au over 6.5m (Hole NFGC-20-44) where it intersected the main Appleton Fault (see January 14, 2021 news release), confirming the potential for additional zones of high grade gold in this parallel veining. Finally at Lotto we are also targeting the more primary Lotto Baseline fault and the Appleton faults. The Lotto Baseline fault appears analogous to the Keats Baseline fault which is host to the high grade discovery at Keats and we are utilizing our developing understanding of the controls on mineralization at Keats in targeting gold mineralization the Lotto Baseline fault.”

Drill-hole Details

Table 2: Summary of results reported in this release

Table 3: Details of drill holes reported in this release

Sampling, Sub-sampling and Laboratory

True width of the mineralization is uncertain, but host structures are interpreted to be steeply dipping implying true widths in the range of 70% of reported intercepts. Selected intervals are submitted on a rush basis including the reported intervals for NFGC-21-109 and NFGC-115. Additional assays for these holes will be reported once received. Assays are uncut, and calculated intervals are reported over a minimum length of 2 meters using a lower cutoff of 1.0 g/t Au. All HQ split core assays reported were obtained by either complete sample metallic screen/fire assay or standard 30-gram fire-assaying with ICP finish at ALS Minerals in Vancouver, British Columbia or by entire sample screened metallic screen fire assay at Eastern Analytical in Springdale, Newfoundland. The complete sample metallic screen assay method is selected by the geologist when samples contain coarse gold or any samples displaying gold initial fire assay values greater than 1.0 g/t Au. Drill program design, Quality Assurance/Quality Control and interpretation of results is performed by qualified persons employing a Quality Assurance/Quality Control program consistent with National Instrument 43-101 and industry best practices. Standards and blanks are included with every 20 samples for Quality Assurance/Quality Control purposes by the Company as well as the lab. Approximately 5% of sample pulps are sent to secondary laboratories for check assays.

Qualified Person

The technical content disclosed in this press release was reviewed and approved by Greg Matheson, P. Geo., Chief Operating Officer and a Qualified Person as defined under National Instrument 43-101. Mr Matheson consents to the publication of this announcement dated March 23, 2021, by New Found. Mr Matheson certifies that this announcement fairly and accurately represents the information for which he is responsible.

Filing of Short Form Shelf Prospectus

New Found is pleased to announce that it has filed a preliminary short form base shelf prospectus (the “Base Shelf Prospectus“) with securities regulatory authorities in Alberta, British Columbia and Ontario. The Base Shelf Prospectus when made final will qualify the offering of up to $100 million of New Found’s common shares, warrants, subscription receipts, units, debt securities and share purchase contracts during the 25-month period that the Base Shelf Prospectus remains effective. The Base Shelf Prospectus is intended to give New Found the flexibility to take advantage of financing opportunities when market conditions are favourable. The terms of such future offerings, if any, will be established at the time of such offerings. At the time any of the securities covered by the Base Shelf Prospectus are offered for sale, a prospectus supplement containing specific information about the terms of any such offering will filed with the applicable securities regulatory authorities.

Marketing Agreement

New Found also announces that it has retained Future Money Trends LLC (“FMT”) to conduct marketing services for the Company. FMT is an affiliate of Gold Standard Media LLC (“GSM”). As noted in the Company’s October 2, 2020 news release, GSM has also been retained by the Company to provide marketing services. FMT and GSM are headed by Kenneth Ameduri, who manages a marketing team headquartered in Austin, Texas. FMT has been successfully marketing public companies since 2010. The term of the agreement is for six months ending September 16, 2021. FMT will be paid US$200,000 in advance for these services.

About New Found Gold Corp.

New Found holds a 100% interest in the Queensway Project, located 15 km west of Gander, Newfoundland, and just 18 km from Gander International Airport. The project is intersected by the Trans-Canada Highway and has logging roads crosscutting the project, high voltage electric power lines running through the project area, and easy access to a highly skilled workforce. The Company is currently undertaking a 200,000-m drill program at Queensway, with a planned increase from the current six drill rigs to eight drill rigs in Q1, 2021. New Found currently has working capital of approximately $68 million. On closing of the $15 million flow through offering financing announced March 18, 2021 the Company would have an estimated $83 million of working capital.

Please see the Company’s website at www.newfoundgold.ca and the Company’s SEDAR profile at www.sedar.com.

CLICK HERE to read the full news release.