VANCOUVER, BC, May 11, 2022 /CNW/ – Nevada King Gold Corp. (TSXV: NKG) (OTCQX: NKGFF) (“Nevada King” or the “Company“) is pleased to announce results from three core holes drilled at the Company’s 100% owned Atlanta Gold Mine, located 264km northeast of Las Vegas at the southern end of the Battle Mountain Trend.

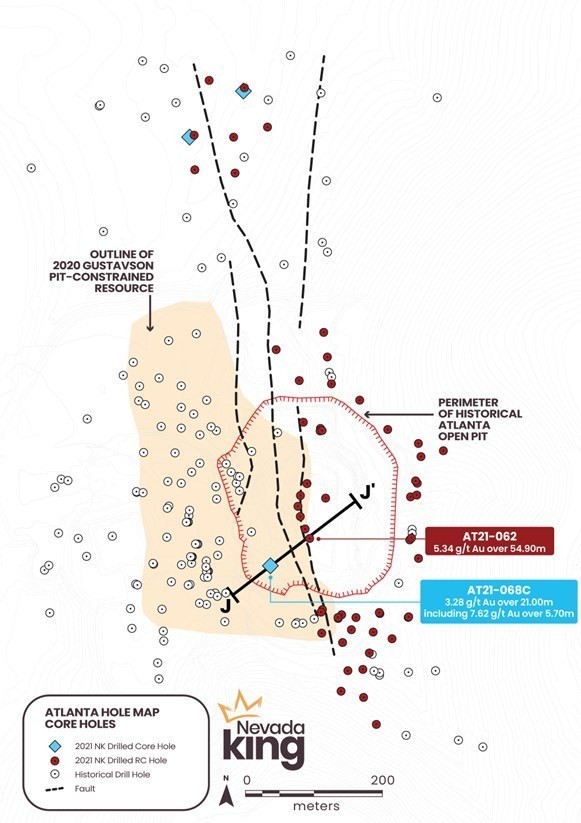

- AT21-068C intercepted 21.0m averaging 3.28 g/t Au beginning at a depth of 99.1m at the southwestern corner of the historical Atlanta pit. The entire core intercept consists of oxide material and includes a higher-grade intercept of 5.7m averaging 7.62 g/t Au beginning at 100.5m. The hole was drilled within an area of low historical drill density (see Figure 1) and was sited approximately 70m southwest of high-grade hole AT21-062, which returned 54.9m averaging 5.35 g/t Au (see Figure 2). As such, AT21-068C significantly expands upon the known zone of high-grade gold mineralization that was found at the bottom of the Atlanta Pit in 2021.

- Hole AT21-003C was collared a few metres from RC discovery hole AT21-003, (which returned 8.26 g/t Au over 9.1m, released November 22, 2021, located approximately 500m north of the historical Atlanta pit). This hole was intended to check the higher-grade gold values drilled in the RC hole, but a complete loss of circulation at 163.9m precluded such an examination. Both AT21-003C and the RC hole entered the mineralized zone at the same depth and the gold grades in each hole are very similar continuing to 163.9m depth. At the point prior to lost circulation in AT21-003C the core had intersected oxide mineralization averaging 6.95m of 4.65 g/t Au including a higher-grade interval at the very bottom of the hole grading 1.7m of 12.82 g/t Au (see Table 1).

- Hole AT21-002C was collared at a 10m offset from RC hole AT21-002 (returned 22.9m averaging 0.71 g/t Au starting at 82.3m depth, released November 22, 2021), the purpose of which was to determine the degree to which gold grades intersected in the core varied from those in the RC hole. The RC hole was drilled with water so there was some concern that water may have separated Au-bearing fine-grained oxides from the drill samples, an issue that can occur with wet RC drilling. As the Company intends to conduct wet RC drilling during the 2022 program, investigating this possibility was of key importance. AT21-002C returned 18.3m averaging 0.56 g/t Au starting at 86.3m depth and a close examination of the intercepts in both holes shows similar gold distribution. This gives the Company confidence that the probability of washed-out gold and downhole contamination is low.

- Preparations are currently being made for drill pads and road access to initiate the 2022 drill program. It is anticipated that the Company will commence drilling by June.

Exploration Manager Cal Herron stated: “Hole AT21-068C is very significant in demonstrating the extent of the known zone of high-grade gold mineralization present at the bottom of the Atlanta Pit. Consequently, the Company’s 2022 drilling program will extend northward and southeastward from AT21-068C along the wide gaps that exist between holes drilled in 2021 and the historical drill coverage, as seen in Figure 1. This will tie together the high grade mineralization encountered in AT21-062 to the shallow mineralization seen in the 2021 holes drilled along the southern end of the open pit, filling a highly prospective, glaring gap in the historical drill pattern that was caused by very poor access. This poor access zone overlies areas mined in the late 1800s to early 1900s via underground methods. Nevada King is currently improving access roads and pads within both gap areas to allow for vertical pre-collar and core drilling. Core twin holes AT21-002C and AT21-003C confirmed gold intercept lengths in their respective RC holes AT21-002 and AT21-003 and reasonably confirmed gold grades as well. More twin core holes are planned in 2022, but these initial twin tests tell us the 2021 RC results agree well with the core results. We see no evidence of downhole contamination in the RC holes that could lead to either upgrading or downgrading of gold values.”

Drillhole Details

Drill Hole ID | From (m) | To (m) | Averaged Length (m) | Average Grade (g/t Au) |

AT21-002C | 86.3 | 104.6 | 18.3 | 0.56 |

AT21-003C* | 157.0 | 163.9 | 6.95 | 4.65 |

includes | 162.2 | 163.9 | 1.7 | 12.82 |

AT21-068C | 99.1 | 120.1 | 21 | 3.28 |

includes | 100.4 | 106.1 | 5.7 | 7.62 |

Table 1. Gold intercepts for NKG’s vertical core holes drilled in 2021, one located at the southwestern end of the historical Atlanta open pit and the other two drilled 500m north of the pit. True thickness of mineralization is currently unknown and must be determined with additional drilling.

*AT21-003C lost at 163.9m in open void.

2021 Core Drilling Summary

The 2021 core drilling program utilized a track-mounted Maxi Drill operated by Harris Exploration Drilling out of Fallon, Nevada. RC pre-collars penetrated the Tertiary sediments and volcanics overlying the mineralization and coring was initiated 10m to 15m above the anticipated contact with mineralized collapse breccia hosted by Ordovician-age carbonates. The HQ size core was transported by Nevada King staff to the Company’s secure warehouse in Winnemucca, NV, where it was photographed, logged, sawn in half and sampled. Samples were placed in tagged, heavy cloth bags and transported by staff to American Assay Lab’s facility in Sparks, Nevada. Pulp standards and coarse blank samples were inserted into the sample stream on a 1-in-20 sample basis. At American Assay Lab the samples were analyzed for gold via 30gm fire assay.

Holes AT21-002C and AT21-068C drilled well and recovery within the gold zones averaged greater than 90%. The collapse breccia was strongly fractured but core recovery remained stable throughout. In stark contrast, AT21-003C penetrated the upper collapse breccia contact without difficulty but encountered open voids immediately above the high grade zone. The drill was able to negotiate a 1.2m open void at 161m depth, but the hole was ultimately lost in high-grade material with the final interval running 19.5 g/t at 163.5m within a much larger void.

The recovery problems in AT21-003C are not unusual at Atlanta. Based on an examination of existing historical core and drill logs, numerous historical RC and core holes experienced similar low recoveries within the higher grade portions of the deposit. In order to avoid the difficult recovery issues experienced in AT21-003C, the Company will be using PQ size core to do much of the high-grade definition drilling. This will hopefully eliminate some of the recovery problems, plus it allows for hole reduction down through lost circulation zones. Compared to historical drill results, there is good chance of seeing higher grades and thicknesses in the 2022 drill holes due simply to improved recovery and full penetration of the mineralized zones.

2022 Drilling Plan

Based on Nevada King’s experience gained at Atlanta in 2021, the 2022 drilling program will incorporate a high percentage of PQ and HQ core holes in the higher-grade portions of the deposit in order to ensure better recovery and accurate gold assay results. RC drilling will be used both for pre-collars and for definition of the lower grade mineralization peripheral to major structures, such as seen in AT21-002C. The total 2022 program currently anticipates a 100-hole drill program totaling 13,100m (43,000ft), comprising 10,000m of combined pre-collar and exploratory RC drilling and 3,100m of core drilling. Most of the meterage will focus on expanding the high grade zones along the Atlanta Mine Fault zone northward and to depth in order to increase both tonnage and grade.

Granting of Options

The Company has granted 3,750,000 stock options to consultants of the Company with each stock option exercisable into a common share of the Company (a “Share“) at a price of $0.60 for a period of five years and 12,500,000 stock options to certain directors and officers of the Company with each stock option exercisable into a Share at a price of $0.60 for a period of five years.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Calvin R. Herron, P.Geo., who is a Qualified Person as defined by National Instrument 43-101 (“NI 43-101“).

About Nevada King Gold Corp.

Nevada King is the third largest mineral claim holder in the State of Nevada, behind Nevada Gold Mines (Barrick/Newmont) and Kinross Gold. Starting in 2016 through to the present day the Company has staked large project areas hosting significant historical exploration work along the Battle Mountain trend located close to current or former producing gold mines. These project areas were initially targeted based on their potential for hosting multi-million ounce gold deposits and were subsequently staked following a detailed geological evaluation. District-scale projects in Nevada King’s portfolio include (1) the 100% owned Atlanta Mine, located 100km southeast of Ely, (2) the Lewis and Horse Mountain-Mill Creek projects, both located between Nevada Gold Mines’ large Phoenix and Pipeline mines, and (3) the Iron Point project, located 35km east of Winnemucca, Nevada.

The Atlanta Mine is a historical gold-silver producer with a NI 43-101 compliant pit-constrained resource of 460,000 oz Au in the measured and indicated category (11.0M tonnes at 1.3 g/t) plus an inferred resource of 142,000 oz Au (5.3M tonnes at 0.83 g/t). See the NI 43-101 Technical Report on Resources titled “Atlanta Property, Lincoln County, NV” with an effective date of October 6, 2020, and a report date of December 22, 2020, as prepared by Gustavson Associates and filed under the Company’s profile on SEDAR (www.sedar.com).

Tabulation of NI 43-101 Mineral Resources at the Atlanta Mine

Resource Category | Tonnes (000’s) | Au Grade (ppm) | Contained Au Oz (000’s) | Ag Grade (ppm) | Contained Ag Oz (000’s) |

Measured | 4,130 | 1.51 | 200 | 14.0 | 1,860 |

Indicated | 6,910 | 1.17 | 260 | 10.6 | 2,360 |

Measured+Indicated | 11,000 | 1.30 | 460 | 11.9 | 4,220 |

Inferred | 5,310 | 0.83 | 142 | 7.3 | 1,240 |

Please see the Company’s website at www.nevadaking.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

This news release contains certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable securities legislation. All statements, other than statements of historical fact, included herein, without limitation, statements relating the future operations and activities of Nevada King, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “intends”, “estimates”, “potential”, “possible”, and similar expressions, or statements that events, conditions, or results “will”, “may”, “could”, or” should” occur or be achieved. Forward-looking statements in this news release relate to, among other things, the Company’s exploration plans and the Company’s ability to potentially expand mineral resources and the impact thereon. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by Nevada King, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the ability to complete proposed exploration work given the global COVID-19 pandemic, the results of exploration, continued availability of capital, and changes in general economic, market and business conditions. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these items. Nevada King does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by applicable securities laws.