Critical Elements: Magna Mining & Defense Metals

Rare Earth Elements and Nickel are on Canada’s list of critical minerals:

Nickel – Magna Mining (NICU.V)

- Magna Mining is still working through a definitive agreement with Mitsui (Multi billion dollar company), which if/once completed, would bring in +$8 million of cash into the treasury for a 10-12.5% interest in the Shakespeare Project.

- Magna’s Shakespeare project is the only nickel project in North America that is permitted for the production of nickel concentrates and owned by a TSXV listed company.

- Management and Directors own 30% of the company and Dundee is a 19% shareholder.

- Managaement has had billion dollar success in the Sudbury region before (FNX Mining)

… How on god’s green earth does Mr Market value this company at C$18 M?

The MOU with Mitsui implies a value for the Shakespeare project alone at multiples of that. Why do I love the Jr mining sector? Because there are times like we are in now when it becomes almost impossible to be overpaying for even high quality stories. Magna is trading like it is a run of the mill, early stage exploration story even though it is an advanced developer story with permits in hand and interest from a multi billion dollar company. Oh and it’s

Rare Earth Elements – Defense Metals (DEFN.V)

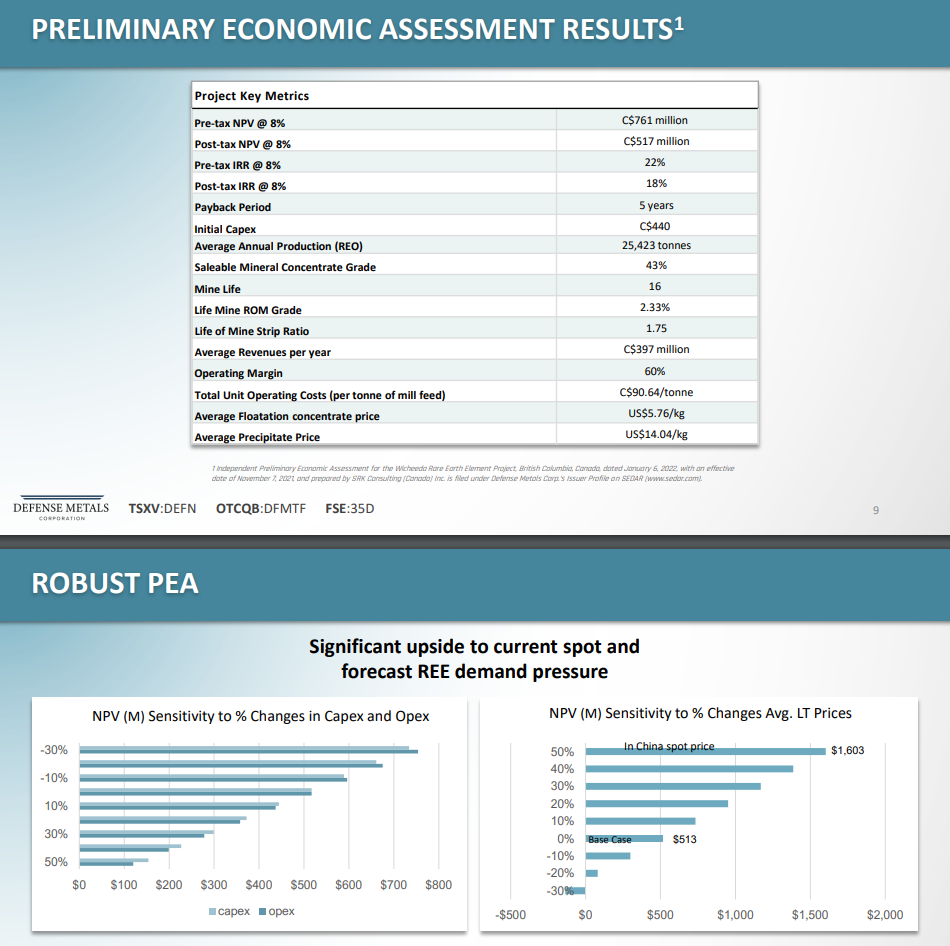

Given the balkanization of the world we are seeing/hearing more focus from both Canada and the US in regards of securing strategic metals/minerals sources closer to home. On that note Defense Metals has a very large REE project called Wicheeda in BC, Canada.

“U.S. wants to end dependence on China rare earths, Yellen says”:

https://www.reuters.com/markets/us/us-wants-end-dependence-china-rare-earths-yellen-2022-07-18/

The project already has a PEA which puts the after tax NPV at C$517 M:

… Defense Metals is currently valued at C$34 M by Mr Market.

Now, my main focus is gold (and silver) but I am happy to have some exposure to undervalued stories in other metals/minerals. If it’s cheap it’s cheap and I get the added benefit of diversification. Right now I see a Mr Market that has no clue about what is going on in the real world which includes more and more (positive) tailwinds for nickel and REE projects in North America.

Anyway, I don’t know what more a buyer could wish for than an entire junior mining sector selling at levels that makes overpaying for anything of above average quality a real challenge. Consider me biased as I own shares of both companies and they are both banner sponsors. Don’t forget to diversify and never invest money you cannot afford to lose!!

Best regards,

The Hedgeless Horseman