Lion One Metals (LIO.V): On Path to Become a Gold Producer in Q4

March 31, 2023

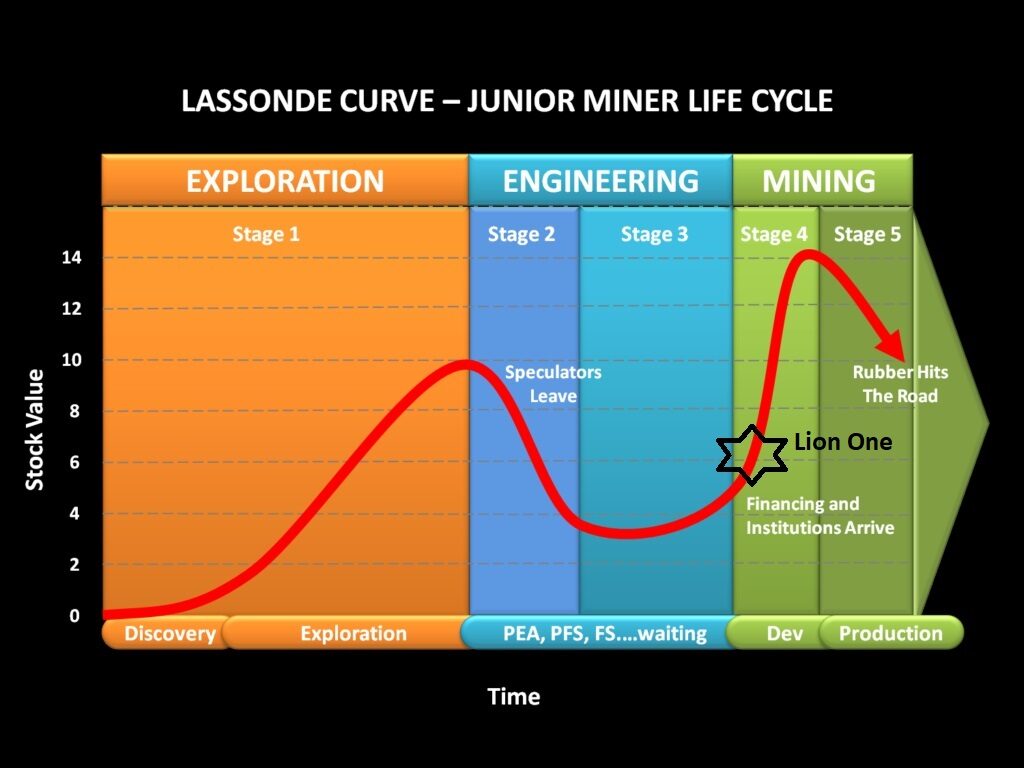

Lion One has become somewhat of a sleeper story for various reasons in my opinion. Firstly, Fiji basically got locked down when COVID hit which slowed down work as one can imagine. Secondly, the perception of the company turned from an exploration play to a developer play, and as such the market cared less and less about the flood of impressive drill results. It makes sense given that as a company gets closer to production, the success of the enterprise will depend more on execution of the mine, rather than drill results. Thus one should consider Lion One to be somewhere in the second low of the Lassonde Curve:

Furthermore investors in the junior mining space have seen numerous juniors trying, but failing, to successfully get into production over the last 18 months. The reasons for this might be anything from cost inflation, labor shortage to faulty technical studies and anything in between. Naturally the amount of negative examples will stick in investors minds and makes them more and more risk averse when it comes to junior developers. Then add that there is on some debt involved to get into production coupled with the abysmal sentiment in the sector overall and you come up with a Mr Market that could set irrationally low prices on a story like this.

This article will include a lot of personal opinions. I own shares of Lion One Metals and the company is a banner sponsor. Therefore assume I am biased, do your own due diligence and form your own opinion.

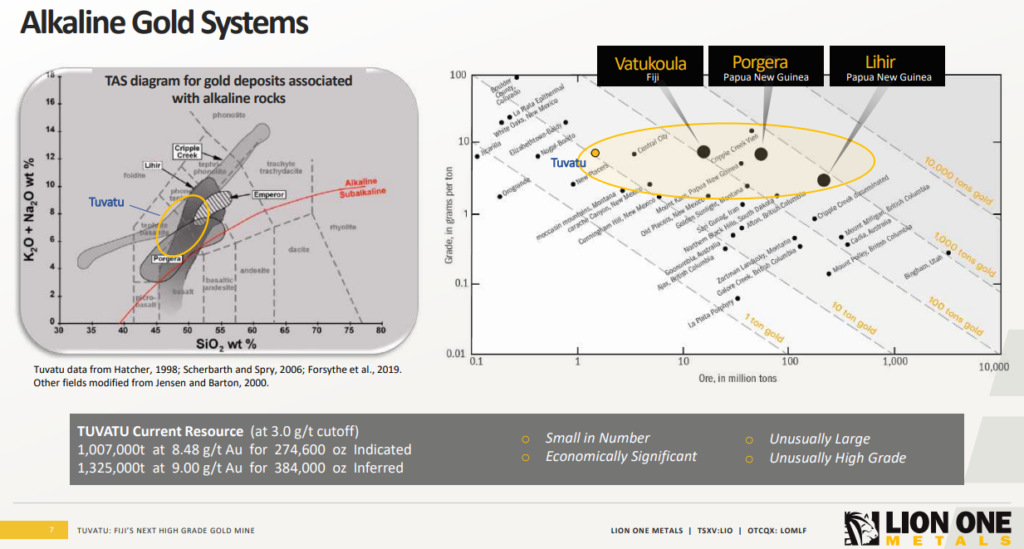

The Case in Short

Lion One Metals is planning to be in production by Q4 of this year and has a rare Alkaline Gold system by its tail. I would argue that the market is currently pricing in a low chance of the company being able to profitably mine even the starter resources (which will soon get bigger). If Lion One shows that a) The high-grade Tuvatu deposit can be profitably mined and b) The current deposit is just the tip of the ice berg then there could potentially be a major revaluation to the upside happening over the coming years.

Upcoming Catalysts

- Continuous drill results

- 8 rigs

- Updated resource estimate

- 60,000-65,000 m of drilling since last resource

- Including the 500 Zone

- New PEA study

- Hopefully start of production in Q4

- First stage: 300 tpd “pilot plant” operation

- If successful the plan is to eventually scale it up to at least 500 tpd and beyond

- CSAMT infill survey

Recommended Presentations

The conceptual prize – K92 Version 2.0…

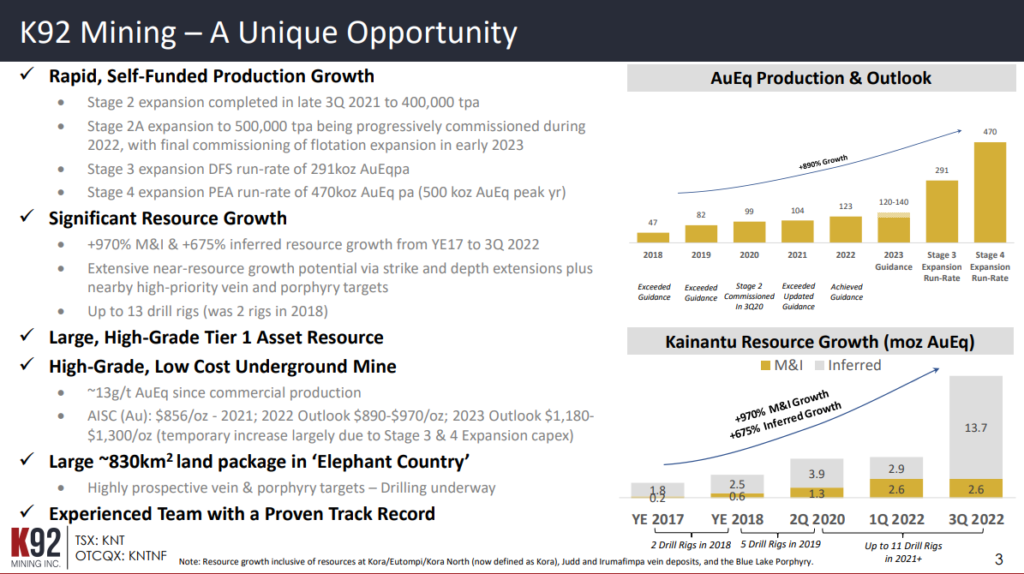

K92 Gold is a junior gold miner which one of few juniors that found an Alkaline gold system and put it into production in Papua New Guinea. Just like what Lion One is trying to do K92 started off small, with just 0.6 Moz of Indicated Resources, at the time the company was able to start small scale production in 2018. From then on the company has just grown its resources and production profile organically step by step and went from producing 47 Koz of Gold in 2018 to 123 Koz of Gold in 2022:

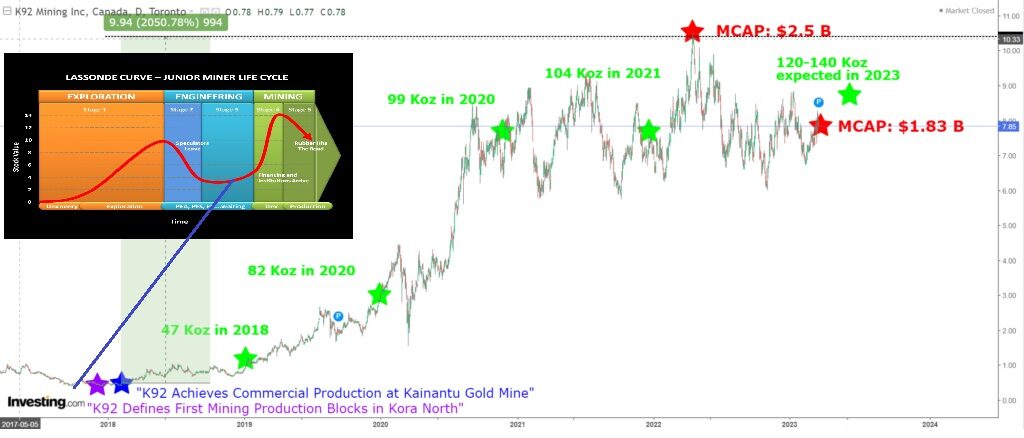

As you can see K92 was able to get into small scale production and has been scaling up ever since while also growing the resources substantially. What was the payoff for investors in this success story? Well for started it looks like the market was quite nervous about the junior trying to get into production as the share price was in a negative trend during ramp up and into commercial production (Same as for Lion One now I would say). But K92 was able to get into production at the end of the day and what followed was a >2,000% return for any shareholder that was able to hold the stock for the next four years:

Interestingly K92 went up 1,000% from achieving commercial production before the company even crossed the 100 Koz/year mark. As always, ounces in the ground are only as valuable as the economic value left over after retrieving them. Not only did K92 become a profitable producer but the amount of (hopefully profitable) ounces in the ground kept increasing as well. This is why you can have a 100 Koz producer that might not even make any money trading at <$200 M while K92 was worth over a billion dollars and counting. Now Lion One does not have exactly the same type of ore body as K92, and there is no guarantee Tuvatu will be as profitable on a $/ounce basis, but it shows just how valuable a big profitable gold deposit is. I would also argue that Fiji is a better jurisdiction than Papua New Guinea.

Moral of the story

K92 is obviously a success story that led to incredibly abnormal returns. Why? Because it started off as being heavily doubted and cheap. When theory turned into a reality, which was better than the initial perception, there was a major Price-to-Value gap that would eventually close. As time passed and perception became more positive it appears to have led to a “Ketchup effect” and the revaluations to the upside got easier and more violent. With a return of 2,000% over four years, which is orders of magnitude higher than the general markets average per year, it obviously means that K92 was incredibly mispriced in 2018 (in hindsight of course). Therein lies the rub. In order to have abnormal returns one must start off by being bullish when the market is overly bearish. In a worst case scenario the market is right and one ends up losing money (up to -100%). However, if the market turns out to be wrong, the rewards will in turn be abnormally large for the contrarian investor. If everybody knew K92 would be the success story it became, then it SHOULD have traded hundreds of percent higher in 2018 already, and with it the future returns would have been materially lower.

In Summary

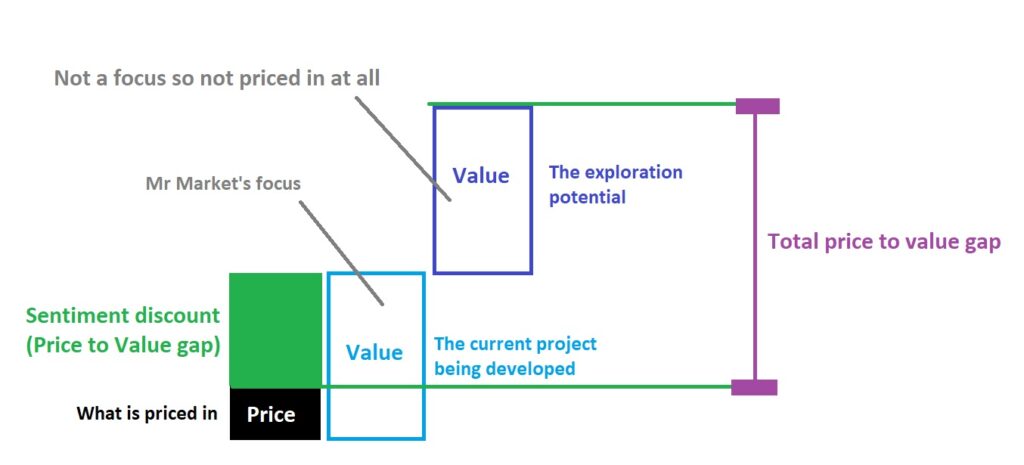

As some might be aware of the market, with its limited attention span, can only really focus on one thing at a time. This is why multi-asset juniors tend to mostly price in the flagship asset while the peripheral assets can be bought at typically heavy discounts. In the case of Lion One Metals it is quite obvious that the market is focusing on the development aspect of the company and therefore exploration results have received a subdued response by Mr Market. It makes sense when you consider that investors/speculators who are mostly interested in exploration tend to stick to pure exploration stories and those who prefer producer/developer stories tend to focus on the production aspect. I therefore believe that when you have a case which is both a production (developer) story, as well as an exploration story, you might pay for the main story while getting the other story for free. Why I like Lion One is because right now even the main story (development) can be bought at a good discount, due to the sector sentiment, while the exploration story can be bought for free. If this was a mature developer, with little to no growth potential, then it might be cheap to begin with. But when you add the material growth potential, since it is an alkaline gold system after all, then the Risk/Reward really shines as I see it.

So we know the current price of the company is silly from a sunk cost perspective and we can thus conclude that the perception is very negative. The market is in no way pricing in Lion One Metals being able to do anything even remotely close to what K92 was able to do which would be a) Get into smalls scale but profitable production, b) grow production over the next four years, and c) find more ounces that can sustain production for many years to come…

Do we know Lion One will be able to do all of the above akin to K92? No.

Do we need to know that? No.

The market might be pricing in a 10% chance of that happening right now. If there is a 30% chance then Lion One is very undervalued right now. If there is a 50% chance then Lion One is incredibly undervalued right now. The point is that there are no certainties in investing it is all about Risk vs Reward. We take on risk, sometimes significant risk, in exchange for abnormally large returns in cases where things play out the way we hope (which typically takes years of Holding btw). Again, if people believed K92 would for sure become a huge success, the market would never have provided the opportunity to get in cheap and get such abnormal returns in the first place. Anyway in reality we do not know the true blue sky potential, the true chance of success, or even what the gold price will be tomorrow or let alone a year from now…

But we have derive some crude probabilities from the signal value of things such as;

- Nebari giving Lion One a US$37 M financing facility which includes a royalty on some production

- I doubt they would do this if they believed the chance of success of LIO getting into production was sub <50%

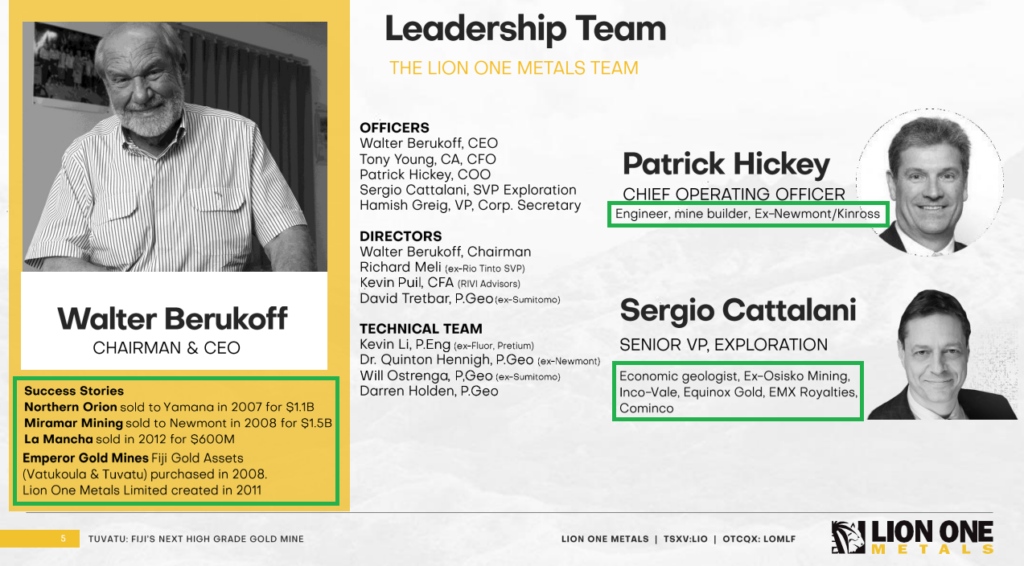

- The company being able to attract Patrick Hickey and Sergio Cattalani

- I doubt they would bother getting involved if they thought LIO had a slim chance of working out

- Obviously the chance of success for LIO is in turn also hiked up by having such competent people involved

- The Vatukoula Gold Mine, which is also located in Fiji, produced gold from narrow veins over many decades

- The Tuvatu system has produced some absurd gold intercepts (Especially where the veins converge at depth)

- If/when the company reaches that zone it should be almost impossible not to make a profit from that ore

- Lets say there is at least 100,000 ounces that could be mined with an AISC of US$700/oz then that would be 100,000 * $1,200 = $120 M in pre-tax profits alone

So lets say there is a 50% chance that Lion One will make it into positive cash flow, commercial production within the upper portions of the Tuvatu system after an initial ramp up period. In that case we have proof of concept that the team is able to profitably mine this narrow vein gold system just like they did over at Vatukoula. Then we can surmise that we will get a big re-rate just from that and then the market, like in the case of K92, will shift its focus to growth again (Exploration growth and the idea of future production growth). Thankfully these Alkaline Gold systems in the Ring of Fire can be absolutely huge with decades of gold production:

Food For Thought

- How many Alkaline Gold systems, which can be >10 Moz, with high grade to bonanza grade gold are you aware of?

- How many gold juniors have all the permits to build a mine after they have been able to find a deposit?

- How many gold juniors have an alkaline gold system, permits to build a mine and are expected to be in production within 9 months?

That list is as short as it can get.

It has taken over 10 years for Lion One Metals to reach this stage. Only a handful of juniors will ever reach this stage with such an asset, and if they started from scratch today, it would probably take them 10 years.

Sunk costs, in the form of permits and CAPEX in a time of inflation and ESG (Permitting hardships), have probably never been more valuable in the history of mining. Yet I have seen explorers in “hotter” sectors get valued higher than Lion One before drilling a single hole. Make no mistake, a lot of juniors are cheap, but some are simply cheaper than others. I personally am not too big of grassroot exploration stories lately given that juniors with considerable SUNK COSTS are typically much cheaper on a relative basis.

I mean think about what would need to be done in order to retrace or re-engineer Lion One’s current status…

There was an article from October 2022 titled “Lion One Sets The Bar For Those That Follow, Says President“. It contained a lot of praise for the company as per these snippets:

Fiji’s Head of State yesterday said he was impressed with the management of Fiji’s next gold mine.

President Ratu Wiliame Katonivere met with landowners, staff and management of Tuvatu’s alkaline gold project at Sabeto, which is owned and operated by Lion One Metals, a Canadian-registered company that is listed on four stock markets.

A conservationist with previous interests in Aquilo Gold, Ratu Wiliame said he understood the complicated balance between the environment and development.

But more to the point it also stated:

Lion One has invested over $145 million in the alkaline gold project, which is under construction as it prepares for production late next year, after which it hopes to realise returns on its multi-million dollar investments.

… Lion One’s market cap just happens to be C$147 M today at $1.03/share.

Think about this for a minute. All of what Lion One has done over many years is today offered for C$147 M by Mr Market and it required about the same amount to get to where Lion One is today. In other words the company is straight up valued the same as the sunk costs at face value. It is like there is no value creation at all attributed to the many years it took to get here, the risks and hurdles that would need to be overcome to get here, the time value of money (discount rate) or the fact that they were able to get a mining lease etc etc. Imagine if someone told you that for >$145 M (What it cost to get here) you could go and set out to try to do what Lion One took years to accomplish or you can buy it after the fact for the same price. That doesn’t make much sense to me. The market is basically saying that no net value has even been created and that Lion One has just been treading water even though it is one of the most advanced gold juniors around with grades that most juniors would kill for.

I mean if I gave you $145 M today would you be able to even find, drill, permit and get one of these Alkaline Gold systems close to production anytime soon (if ever)? Would you rather gamble on pulling that miracle off or pay the same price and have it all delivered right now to your door step?

Sunk costs, in the form of permits and CAPEX in a time of inflation and ESG (Permitting hardships), have probably never been more valuable in the history of mining. Yet I have seen explorers in “hotter” sectors get valued higher than Lion One before drilling a single hole. Make no mistake, a lot of juniors are cheap, but some are simply cheaper than others. I personally am not too big of grassroot exploration stories lately given that juniors with considerable SUNK COSTS are typically much cheaper on a relative basis.

Don’t get me wrong. There are always risks and risks should be priced in but lets just say I think the depressed retail market might be overly nervous. The ultimate risk is always -100% but the reward increases the cheaper something is. If Lion One is able to get into production and keep drilling these nice high-grade hits then one might be owning a self funded, major exploration story within 12 months.

Looking Ahead

Lion One is working on their first resource update in a long time and more importantly the last resource was done before the 501 zone was discovered. Furthermore the company is also working on an updated PEA.

“See the future early” is my favorite Eric Sprott quote. Our job as investors in the mining space is to appreciate future value drivers, today, when nobody appreciates it yet. I dare say I see a potentially large delta between how people look at Lion One today and how they might look at Lion One say within 12-24 months from now…

Before this year is over the market should have the following things to consider and digest:

- Continuous drill results

- 8 rigs

- Updated resource estimate

- 60,000-65,000 m of drilling since last resource

- Including the 500 Zone

- New PEA study

- Hopefully start of production in Q4

- First stage: 300 tpd “pilot plant” operation

- If successful the plan is to eventually scale it up to at least 500 tpd

- CSAMT infill survey

If the incredibly pessimistic market is right one will lose money from here. If the incredibly pessimistic market is wrong one might make a lot of money from here.

Macro factors to consider

- The sector sentiment is near a major low

- Gold is close to breaking out to new ATHs in a giant cup and handle formation

Blue Sky Scenario

- Gold breaks out of $2,000 and starts going towards the bubble phase over the coming years

- Sector sentiment goes from abysmal to euphoric over the coming years

- Lion One Metals proves it can get into profitable production

- Lion One Metals proves the Alkaline Gold system is a lot bigger than the current version of Tuvatu

- … Larger production and more ounces on the books allows for upscaling of the operation

If all of the above things would happen over the coming years you have the perfect revaluation-multiplier storm.

The gold price breaking out would hike up odds of an imminent sentiment change [#2] as well as hike up the odds of Tuvatu becoming a profitable mine [#3]. Once into profitable production, the gold price and sentiment is in a bull market, the exploration and growth potential would start running the show with full torque.

While the last couple of years might have been frustrating for shareholders, from a share price perspective, the past is the past and investing is always about the future. I would argue that TODAY is possibly the best Risk/Reward setup ever in the history of the company due to the simple fact that a) None of the five factors are currently priced in, b) Some of the factors correlate, and c) All of the factors might be in play within just the next 12 months.

Lion One’s Goal According to Sergio Cattalani:

“To deliver a multi-million ounce, high-grade resource, eventually feeding a scaled up plant” – Source

… Yes that does sound like what K92 was able to do and is in no way shape or form priced in.

Why They Could Pull it Off

The People

If there is one thing where “the trend is your friend” is important it would be the people involved with a company. The trend of Walter Berukoff, Chairman and CEO, has been to end up selling his companies for $600 M to $1.5 B. One of these big, rare successes might be chalked up to luck, but when you have done it multiple times, it is statistically beyond luck and should be seen as a trend. It is obvious Walter has a nose for value and what larger companies want and if he has stuck with Tuvatu and Lion One for this long I think there is a good reason for it. I also think there is a good reason why he was able to attract the likes of Patrick Hickey and Sergio Cattalani. Right now the mining sector overall has a lack of manpower so if I had to guess I would think that these guys could go work for almost any junior they would want. Well they wanted to work with Walter and Lion One so my bet is that they see something which the market is currently not seeing.

As I discussed earlier I would say that the market is pricing in a low chance of success in terms of Lion One a) Ever being able to get into profitable production and/or b) growing the resources in a meaningful way. I simply have a problem seeing that these guys would get involved if that perception was not faulty.

The Grades

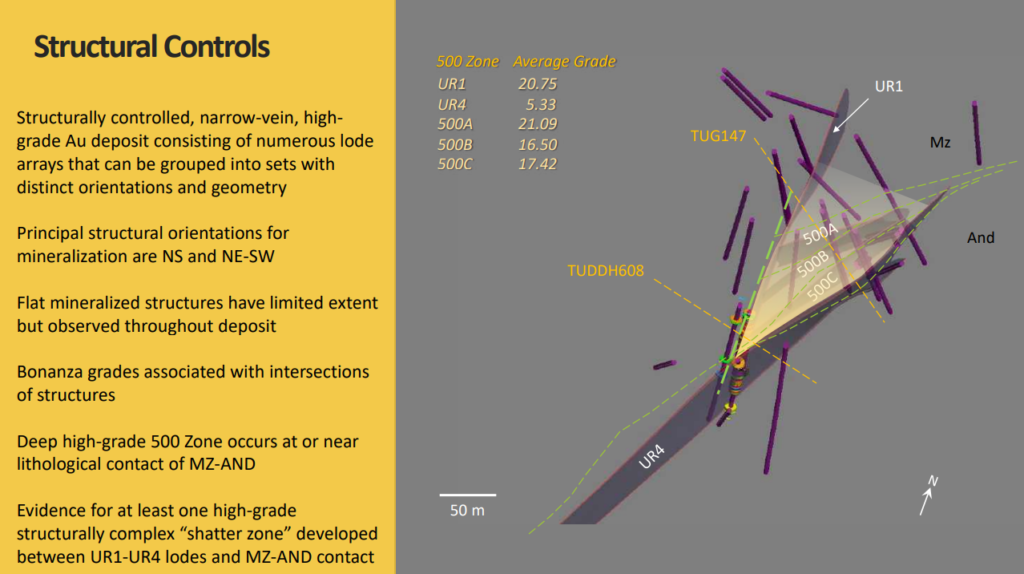

Tuvatu is quite unique given it is an alkaline gold system. It is also quite unique due to the gold grades. Why Tuvatu could possibly turn into a high-margin mine is primarily thanks to the abnormally… high grades. The lodes at Tuvatu vary in grade but quite a few are exceptionally high margin on an undiluted basis:

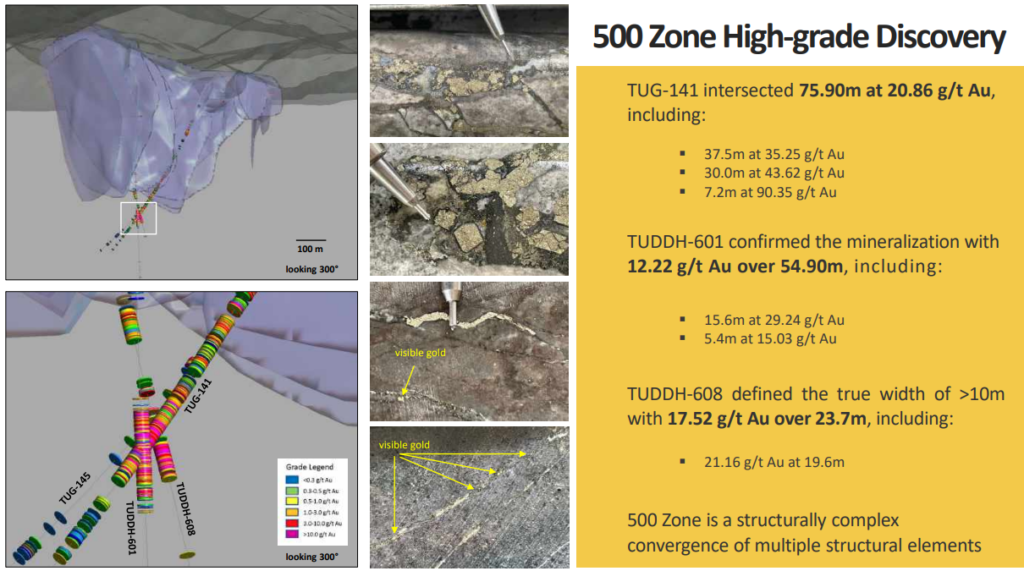

The 500 Zone, where several lodes converge, has produced some truly spectacular “barn burner” intercepts:

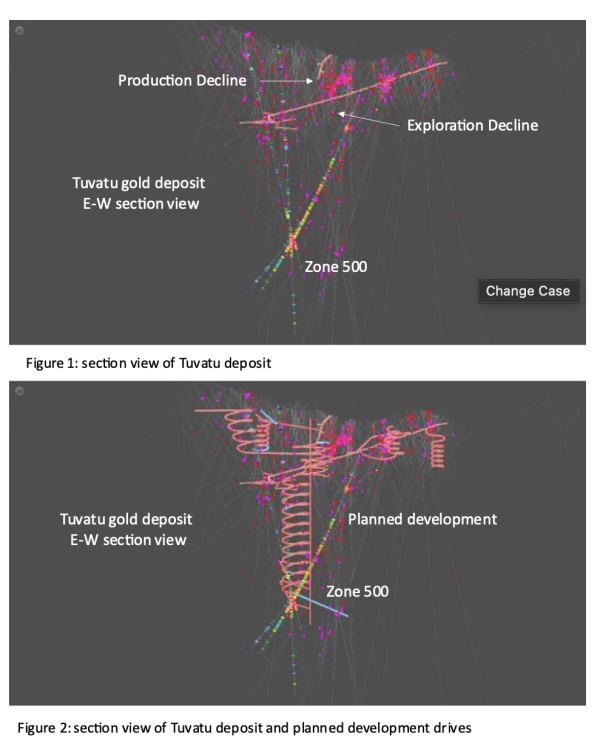

So although Tuvatu has very high-grade gold near surface but I think it could get really fun if/when they start mining the 500 Zone where the grades might be 2-3 times higher and with good widths. In other words Lion One will not start out mining the best zones first so the cash flow potential might be a bit back-loaded given that the company will not get into the 500 zone immediately:

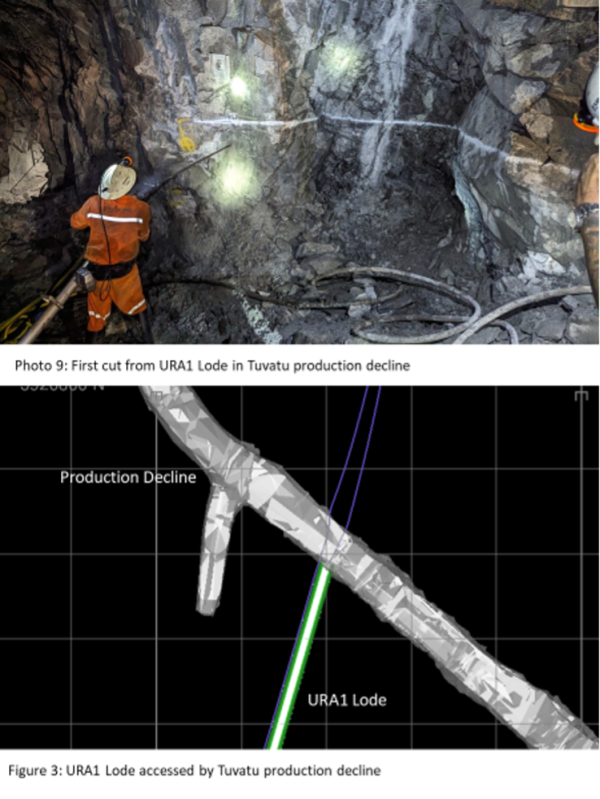

… But there is little doubt in my mind that if/when Lion One reaches the 500 Zone this mine ought to be incredibly profitable if not before that. As things stand today Lion One is already into the ore zone of the URA1 lode and getting ready for first production:

The blue sky potential

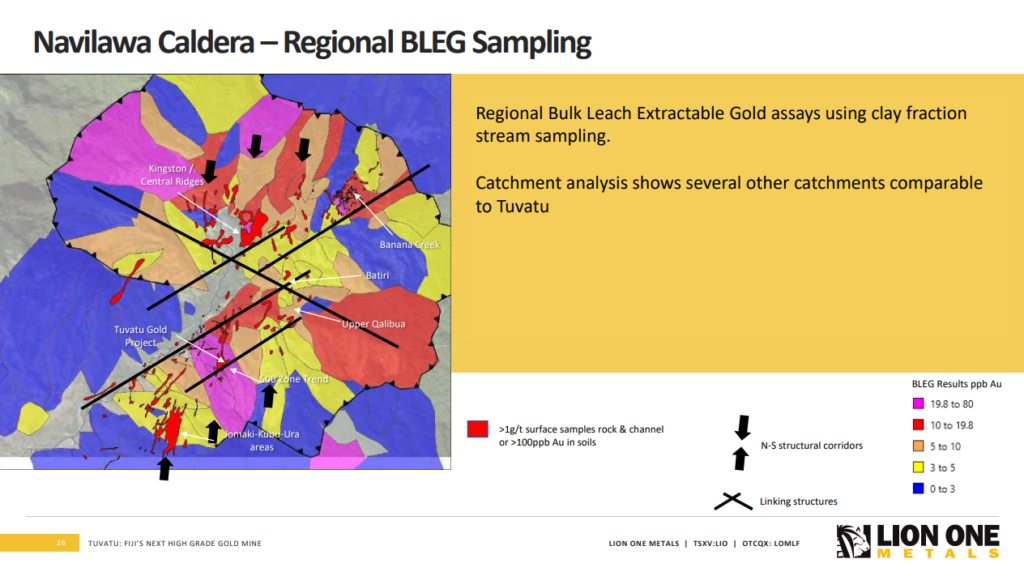

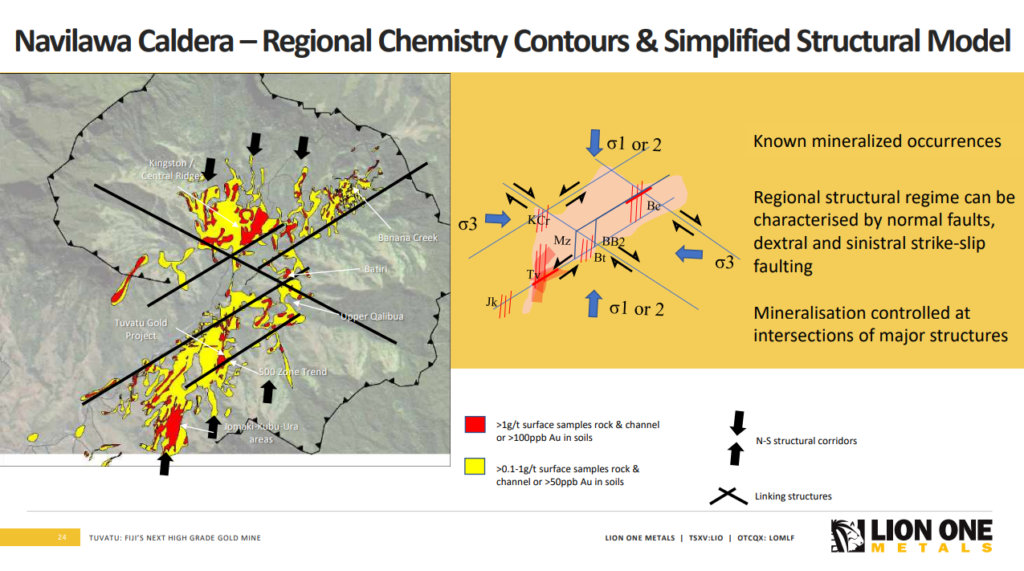

In order to get the salivating K92 returns for shareholders the company will not only need to show that Tuvatu can be profitably mined but also that the system is a lot larger than what is proven today. Thankfully the Tuvatu deposit footprint is just a postage stamp within a 7 kilometer in diameter caldera which is showing highly anomalous BLEG readings all over the place:

As the company has learned more and more about the structural controls of mineralization there are several hot spots that show both high gold readings as well as proximity to regional structures:

I would say there is about zero chance that Tuvatu is the only significant gold deposit within this caldera. Obviously Tuvatu itself is also still wide open and I expect that to grow as well.

The proof of concept within Fiji and within the region

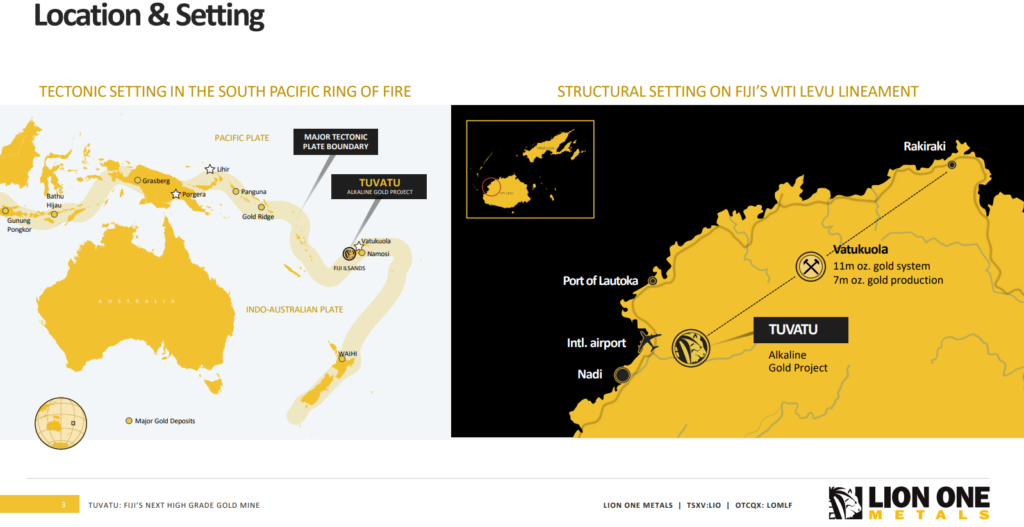

There are absolute monstrous alkaline gold systems in the ring of fire and one >10 Moz deposit called Vatukoula, which was made up of narrow veins, is located IN Fiji:

Lihir, Porgera and Vatukoula are all alkaline gold systems with 10-40 Moz endowments. Lion One sometimes gets flak for hitting a lot of narrow veins (Unlike the 500 zone where it blows out to vein swarms measuring tens of meters wide). Anyway, Vatukoula which is located to the north-east of Tuvatu has seen 7 Moz of production from… Narrow gold veins:

Thus we not only have proof of concept in terms of blue sky potential for these systems overall but also that narrow vein mining has worked in Fiji of all places for decades.

Bottom Line

I would say that the market is currently not pricing in that even a majority of the KNOWN system will be profitably mined, and certainly not that anything more will be mined at Tuvatu, nor any other potential discoveries within the 7 km Navilawa caldera. Although we do not know what will happen in the next few to several years we do know what the current Market Cap is. If Tuvatu never becomes a profitable mine we will lose money. If Tuvatu becomes a profitable mine and grows there might be something similar to the K92 chart in store for shareholder who hold it long enough.

In a world where permitting is one of the biggest hurdles for mining companies I would argue that Lion One could be a very rare commodity if the company makes Tuvatu work and can start to show that the blue sky exploration potential is for real. A profitable, high-grade mine, with perhaps several decades of cash flow ahead, is one of the rarest things in the world.

If/when Lion One shows proof of concept in terms of being able to mine Tuvatu with positive cash flow I think the revaluation would come quickly. Why? Because then comes the 500 Zone which is even better and it opens up the entire 7 km caldera. Assuming the company is able to ramp up production to at least 500 tpd from the starter plant then the gold production ought to be close to what K92 mined throughout 2018 which coincided with a solid revaluation share price.

Note this is not investing advice. I am not a financial advisor. I own shares of Lion One Metals and the company is a banner sponsor. Therefore consider me biased. I cannot guarantee the accuracy of the information in this article. Do your own due diligence. Junior mining companies are very risky and volatile. Assume I may buy or sell shares at any time without notice. Always form your own opinion. Never invest money you cannot afford to lose.

Best regards

Hi Eric,

I like the story and the people behind it and I will definitely get some shares of it.

The parallels to Vatukoula make me hesitate a lot, because I owned a lot of shares of canadian zinc, who bought Vatukoula Gold mine a couple of years ago.

Vatukoula never became profitable and I lost a lot of money with Canadian zinc, later called Norzinc, who own the famous praire creek mine of the hunt brothers.

Today I had a look and the new owner of Vatukoula still has not started the mine yet.

Is there a difference between the ore bodies, or is it just a matter of the people involved?

Ps.

Happy to see magna moving again…

hopefully novo saw the lows as well

regards from Germany Hubi

Hi Hubertos,

I do think it is one of those stories that could benefit more than others if gold is indeed going to break out. Firstly, it increases the chance of profitable production and of course it would also increase any profits. I have heard that the Tuvatu lodes are expected to be easier to mine than Vaukoula but of course I cannot confirm that. The 500 zone ought to be wildly profitable if nothing else. Vatukoula has been mined on and off for many decades if I remember correctly. I would just assume that it started out as a pretty good mine given that gold prices decades ago would have been very low compared to today. Maybe, like most mines, the best parts of that system were mined long ago. This at least sounds logical to me.

Yes, some are waking up to Magna. Novo might need a bit more tangible results in order to get the market excited.

Note that these are only my 2 cents.

All the best,

Erik

Cool, thanks for sharing all your thoughts. Still deep in the red.Was a little overexcited when novo started beatons creek and got hosed.

Now the tide seems to chance and some new positions in the greens

It sure was not ideal that COVID had many Jrs get serious delays and more problems. In a few years some of these deep red juniors could very possibly go up several 100s %. Some wont. Some will go up more. What I do know is that one needs to hold even the best performers for a long time in order to have big returns.