Kuya Silver Corp (KUYA.CN): Planning on Fast Tracking a High-Grade Silver Mine to Production And Then Grow

This will be my introduction article on Kuya Silver which recently came on board as a banner sponsor of The Hedgeless Horseman. I own a lot of shares along with some family members and friends. I actually had a decent stake due to owning shares of Miramont Resources which then became shares of Kuya Silver. However I have increased my share count by 220%, from $1.5/share and lower, ever since Kuya Silver started trading just a few weeks ago and it is currently a top #5 position in my portfolio for reasons which will be explained in this article. I thought it was cheap when Kuya was supposed to have a 80% interest in the Bethania mine and just a few days ago it was announced that the company entered into an agreement to acquire 100% interest in the Bethania Silver Property.

Kuya Silver in Short:

- Ticker: KUYA.CN

- Website: LINK

- October Presentation: LINK

- Video Presentation: LINK

- Market Cap (@$1.20 and 100% ownership): US$33 M (C$ 43.2 M)

- Cash Position (after acquiring 100%): ~C$8 M

- Enterprise Value (@$1.20 and 100% ownership): US$27 M (C$35.2 M)

- Flagship Project: The Bethania Silver Mine

- Historic resource of 8.3 Moz of silver

- plus lead, zinc, copper and gold

- = 11,7 Moz AgEq

- Pure silver grade: 573 g/t (!)

- Silver EQ grade: 834 g/t (!)

- Historic resource of 8.3 Moz of silver

- Notable Shareholders:

- Management: 29% (!)

- CEO David Stein owns 27% (!)

- Eric Sprott: 6%

- Yours truly

- Management: 29% (!)

- Skin in the game:

- Yes, management has extreme skin in the game

- No one will be working harder to turn Kuya into a full blown success than David Stein the CEO

- Expected Catalysts:

- Exploration drilling, relatively soon

- 43-101 compliant resource, 2021

- PEA, 2021

- Acquisitions

- Production, 2021+

My Case For Kuya Silver

As some might know I have been rather cold towards silver juniors in general simply because most of them seemed to trade at such a premium relative to gold juniors. Well, Kuya Silver happens to be incredibly cheap in my opinion. There are in my opinion three primary reasons for the current opportunity as I see it; 1) Partly because it’s unknown due to only being listed for a couple of weeks, 2) partly tax loss selling and 3) partly because some shareholders of Miramont Resources might have been selling for whatever reason after the company became Kuya Silver. These “special situations” is something I constantly look for because uninformed and/or motivated sellers can sometimes pave the way for a real steal. The fact that few have heard about Kuya Silver is another positive, from a buyer’s stand point, since it means that there are less buyers out there to keep the valuation/market “honest”. Anyway, those are some potential factors I see for Kuya Silver having presented me with one of the best risk/reward cases I have seen over the last couple of years.

Kuya Silver is one of few juniors out there that I think fit the following criteria:

- Undervalued right now

- High probable upside in the short to medium term

- Very high potential upside in the long term

- CEO has extreme skin in the game

Nothing Pays Like Growth

The biggest returns comes from growth stories. Be it growth through a) exploration, b) acquisition and/or c) bringing more mines online. Another well known revaluation catalyst is when a junior takes the successful step from being an explorer to becoming a producer. What I love about Kuya Silver is that the company intends to do ALL of the previously mentioned things:

- Kuya has the formerly producing Bethania silver mine which the company intends to put back intro production in 2021+

- The Bethania mine is (was) a very high grade mine and the system is wide open

- These kinds of systems in this region of Peru can reach depths of up to 1 km and Bethania has only been mined to a depth of around 120 m

- It also has completely untested lateral potential between the Bethania workings and another area that has seen historic mining

- In other words the Bethania system could have X times the currently known depth potential as well as Y times the currently known lateral potential

- The company does also intend to grow through additional acquisitions

To put it in another way:

Kuya Silver intends to GROW through a) Exploration, b) Acquisition and is aiming to become a silver producer as fast as possible. The plan is to start with a small scale plant, then prove up more resources, and after that probably build a larger plant down the road. The real beauty is that the CAPEX for the mill is expected to be ONLY around US$10 M (!). Furthermore, Bethania is so high grade that it is expected to produce silver at AISC of ONLY US$11/oz which theoretically could amount to a bit under the current Enterprise Value of the company in free cash flow per year. This would in turn open up a lot of organic growth opportunities and hopefully lead to Kuya becoming a true compounding growth story for years to come.

- Growth through exploration

- Growth through acquisitions

- Revaluation through becoming a high margin producer

- With very little capital required

- Revaluation through increasing the production profile at Bethania

- Long term organic growth funded by internal cash flow:

- More projects

- Build more mines

- Rinse and repeat

All in all, this is one of the most exciting long term investment cases I currently know of, and that’s why I have bought enough shares to put Kuya Silver in my top #5 largest holdings category.

The Final Kicker

Current Enterprise Value is around US$27 M (including acquiring 100%)… Sometimes this sector is just too easy.

Opportunities like this tend to only show up in “special situations” and given that; a) Kuya Silver just started trading coupled with b) Some ex Miramont shareholders are probably selling first and asking questions later after having their shares in a trade halt for months, I see this as a double whammy!

If Kuya is able to execute on its first step then I expect to be sitting on a multi bagger in the not too distant future.

When comparing it to the rest of the companies in the silver junior sector I think a share price closer to C$2.5/share would be justified for Kuya Silver at this time.

The Meat and Potatoes

I could literally have ended the article already, because the case should already be pretty obvious, but lets look at a few slides from the company presentation…

1. There Are Not Many Silver Juniors Around

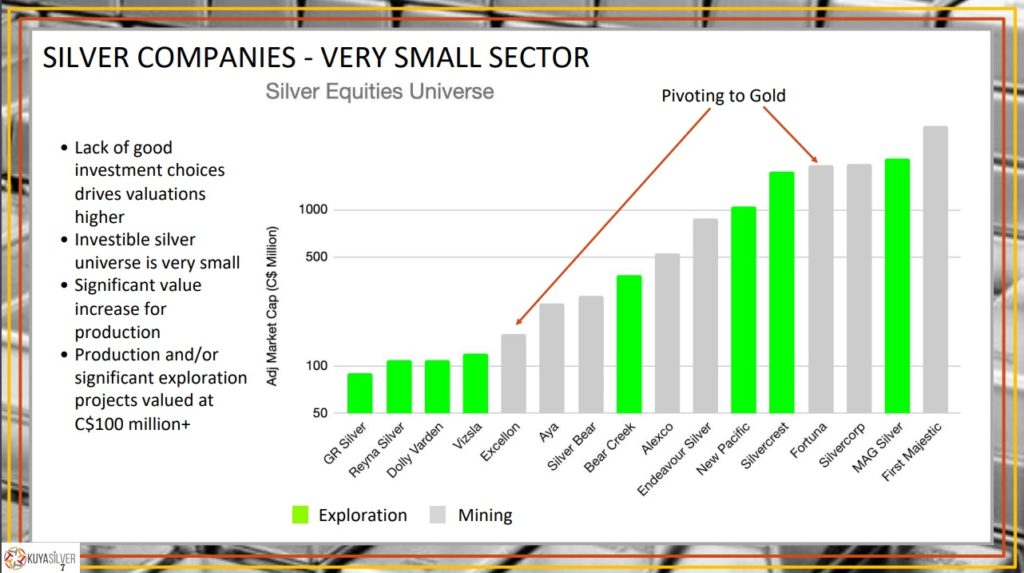

As many will know the silver sector has been decimated since the silver price topped at $50/oz in 2011. Very few primary silver producers have been able to make much money in the last several years. This has led to more and more companies, that used to be silver focused, switching focus to gold:

… The list of PRIMARY SILVER producers grows thin. This is typical bear market behavior and as Rick Rule likes to say; “Bear markets are the authors of bull markets”. This in turn of course means that when “the flood” comes there will be a lot of money bidding on a tiny number of companies:

We are not even anywhere near all time highs in the silver price and yet silver juniors tend to be very hot. Even hotter than the gold juniors despite the price of gold hovering around all time highs at the present moment. In light of this one can only imagine what the tiny number of primary silver juniors could do when silver catches up, and probably surpasses, the rise of gold.

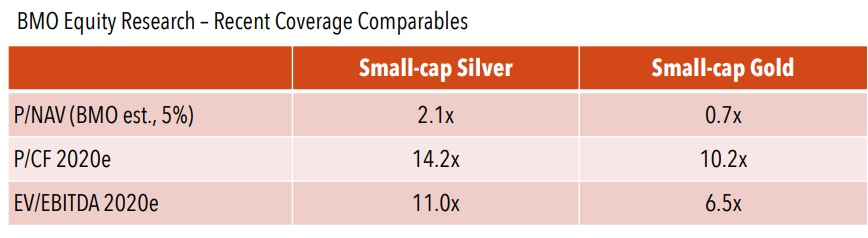

If you want more evidence for primary silver companies already being hot then I present you with this slide from a previous Kuya presentation:

… Those are some incredible premiums bestowed up small-cap silver juniors relative to their golden peers.

Do you want to know why I love the previous slide?

Because if Kuya gets into phase-1 production at Bethania and produces lets say 1.7 Moz (which was Cormark Securities estimate in a new report) of pure silver per year, at an AISC of US$/11 per ounce, then the annual EBITDA from the mine could be over US$23 M/year at $24/oz silver. If we then take BMO’s valuation benchmark at face value then Kuya Silver could fetch a value of around [11.0 x US$23 M] = US$253 M (!). If it’s lets say 2 Moz per year instead, that would translate US$26 M/year, and potentially indicate fair value around US$286 M. Even if the company dilutes the shares a bit, in order to raise more money for the tiny ~US$10 M in construction CAPEX, then that could leave a 4X revaluation for shareholders. And that’s “just” based on the company getting the Bethania mine up and running and being able to add some ounces that extends mine life…

Just FYI:

- Impact Silver which is a small primary silver producer in Mexico has a Market Cap of around C$123 M and the company produced 660 Koz (0.66 Moz) of silver last year (And has barely made any money at all in the last several years.)

- First Majestic which is a multi-asset primary silver producer is expected to produce C$122 M in EBITDA for 2020 and has a Market Cap of C$3.1 B.

- Alexco Resources is scheduled to start producing at a run rate of 4.0 Moz of silver per year in 2021 and currently has a Market Cap of C$453 M

… Starting to see what revaluation potential I see for Kuya Silver which currently has an EV of US$27 (C$35 M) and a Market Cap of US$33 M (C$43 M) if just Bethania phase-1 works out?

Even if we assume that the C$8 M in the bank is fully spent on exploration to extend mine life etc and we dilute the Market Cap by lets say 30% to get Kuya into phase-1 production. That’s still only around US$45.5 M (C$60 M) and in that case it’s still 5.6x (253/45.5) to reach the benchmark valuation of 11.0 times EBITDA (and 30% dilution was used as a pretty extreme example)…

This is the kind of opportunity present when you got an advanced asset that a) Is almost fully permitted, b) requires miniscule CAPEX, and c) is very high-grade with potentially very good margins.

Anyway, How is that for potential returns from a phase-1, starter operation?

Even if the market for some reason would ONLY grant lets say a multiple of 5.5 x EBITDA then that’s still 2.8 X from the theoretical scenario which assumes 30% dilution.

“We Have Only Just Begun”

The plan is to then just keep growing beyond this. I have talked to David Stein and the main thing I wanted to know is what ambitions he had for Kuya Silver. Suffice it to say I got the feeling that he seriously wants to build the next big, successful growth story and that’s why the following slide is included in the company presentation:

Now I don’t think any of the companies in the slide above started out with a deposit grading 573 g/t Ag plus lead, zinc, copper and gold credits. Neither did they start out with a silver price at around US$24/oz. In other words I think Kuya Silver has an incredibly solid starting position on its journey to become a household name in the silver space and no one wants to make sure that Kuya succeeds more than the largest shareholder which happens to be the CEO David Stein. With Kuya having plenty of cash and several years of preparation as a private company I am fairly certain that there is already a well thought out game plan for growth (beyond Bethania) that will soon start to be revealed. With that said, I think the Bethania mine itself will prove to be worth a lot more than the current valuation given that there appears to be significant growth potential around the “legacy” workings…

On that note here is Quinton Hennigh talking about how large these types of systems can be in this region:

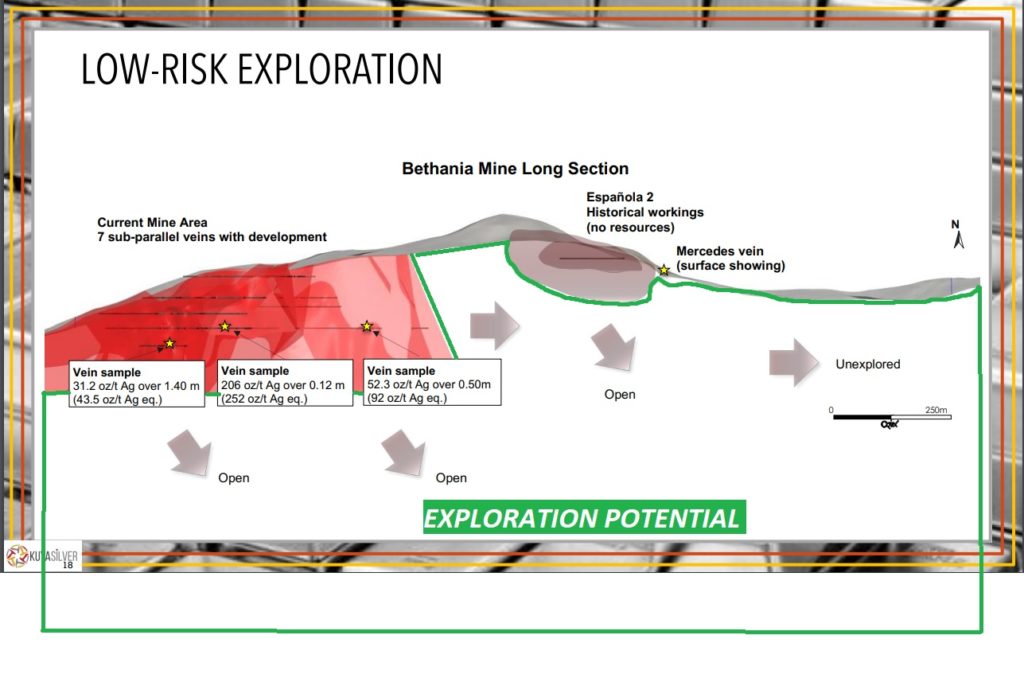

In order to get a better grasp of how much more potential there might be in the Bethania mine, outside of what the previous operators had mined, I will try to visualize it in this next slide:

(Drawings added by me)

The lower limit drawn by me would indicate a total vertical potential of around 750 m. With that said, there are systems of this type that are known to extend to depths of 1+ km. The main point is the total footprint of the historic mine workings and non compliant resource could fit many times over within the area I outlined in green. Also keep in mind that Quinton stated that the grades can be consistent throughout these systems. Imagine if a good part of the area in green contains 573 g/t (834 AgEq) material. That could lead to many many years of high margin production even at silver prices lower than today. In other words Kuya could be producing lets say US$23 M in pre tax cash flow, for many years just from the phase-1 Bethania operation alone, and the current Market Cap is US$32 M (!).

Furthermore, I would like to point out the grades from some of the underground vein samples;

- 43.5 oz/t AgEq = 1,353 g/t AgEq

- 252 oz/t AgEq = 7,837 g/t AgEq

- 92 oz/t AgEq = 2,861 g/t AgEq.

For what it’s worth the following is what Cormark Securities had to say:

“Exploration Upside: Exploration by past operators was capital constrained and production focused, limited to areas near existing workings with no step-outs. By 2021 Kuya intends to conduct exploration aimed at extending the known veins (11 in total, 2 major) along strike and at depth where they remain open, as made evident from observations underground. We see the potential for the ~500 m long major veins to extend across the entire ~1.5 km concession as well as at depth, noting that deposits of this type have been known to extend over >1 km deep (current resource depth ~330 m). We consider this relatively low-risk exploration“

Note that all of the above is from the very first flagship asset which Kuya will own 100% of. It is also important to remember is that for example 40 Moz of silver at a permitted mine site with a mill will be worth a lot more than 40 Moz belonging to an explorer than may be years away from monetizing said ounces (if ever). Thus, any exploration success with the drill bit for Kuya Silver in this area should create significantly more value relative to its pure exploration focused peers. In other words every 1 Moz of silver delineated might be equivalent to a pure exploration company delineating an additional 3 Moz. It makes total sense when you consider the fact that an ounce of silver in the ground should be worth what it is expected to produce in profit (risk and time adjusted). And if you got a permitted mine up and running then those ounces in the ground will, again, have a much higher value than ounces that are 10 years away from being turned into profits (or never).

This would create a very fortunate feedback loop:

- Mill and permits –> Increases the value of every ounce discovered

- Ounces discovered –> Should affect the PE multiple in a positive way since it increases mine life at a fixed production rate

- Cash flow –> Ability to delineate more ounces without dilution

Bottom Line

If management estimates prove to be somewhat accurate then Kuya Silver could be producing around US23M in pre-tax cash flow per year once they spend ~US$10 M on building the phase-1, starter operation. Even if we double the current Enterprise Value of the company to US$52 M it would be ridiculously cheap (granted they at least grown the resource a bit from current levels).

THEN you add on the following revaluation opportunities:

- Blue sky exploration potential around the Bethania resource which is wide open both along strike and at depth

- Potential self funded mill expansion following exploration success

- Even higher EBITDA per year to slap on for example a 11.0x multiple on

- Acquisitions

- Self funded growth through exploration and new mine development

- Rinse and repeat until it hopefully becomes a multi mine silver producer

If a US$35 M Market Cap company was to be able to do some or all of the above then there is obviously some multi, multi, multi bagger potential. Heck, if the company just gets Bethania up and running as well as adding some mine life then it could be a 5+ bagger or more at the current price of silver (I never want to assume a rising commodity price in order to make an investment case). That’s a pretty low bar compared to the what the ambitions of the company are. With David Stein, the CEO, having close to C$11 M at risk personally you know that he will move heaven and earth to create as much value as possible for this company. Having Quinton Hennigh as chairman of the company and Eric Sprott as a backer is almost overkill!

This is simply one of the best risk/reward cases I have seen in quite a while and it is potentially a serious growth story to boot. As I see it I think there is a good chance that Kuya will “multi bag” on Bethania alone and then it might multi bag again through accretive acquisitions and Bethania blue sky unfolding. If even the phase-1, starter operation goes according to plan then Kuya might currently be trading at a forward looking EV/EBITA ratio of around 2 (including dilution to build the mill). In other words I see lets say 3-4 bagger potential based on Bethania phase-1 from the current market valuation. And again, this would just be the very first step on the journey to become a multi-asset silver focused producer.

A cheap junior, with near term production potential as well as serious exploration potential is very rare to begin with. To find one in the silver space, where companies usually trade with large premiums, is rarer still. I simply don’t think this opportunity would be present if it wasn’t for Kuya Silver being the newest silver junior around coupled with ex Miramont shareholders selling their shares now that they can. Sad but it’s their loss.

The most important thing to remember is that there are no guarantees of anything. There is however risk/reward. As I see it I “only” need Bethania phase-1 to go somewhat according to plan in order to make lets say 2-3 X on my Kuya Silver shares from this level.

Margin on Safety

Given the high-grade nature of Bethania the company might theoretically only need a few years of mine life to earn back the current Market Cap and the ounces needed for that are probably in the historic resource already. Since further exploration success and extension of mine life looks very probable I think it is relatively easy to say that Bethania could be producing for quite some time and the best part is that only the construction permit remains. This permit is allegedly relatively easy to get so I don’t see that as a major hurdle. The Environmental Impact Study is a big deal however and Kuya announced that it had been approved on August 24. With the CEO having a huge amount of money at risk, coupled with the backing of Eric Sprott, I see Kuya reaching phase-1 of production as highly likely. Add the extremely low CAPEX and you got yourself one of the lowest risk developer stories around (especially since Bethania was a producing mine not long ago). All in all, I consider Kuya to have a valuation floor that is more solid than most while also being at a stage that few juniors will ever reach.

The Upside Potential

I’ll tell ya that I have not come across many juniors where I see the “low ball/short term target” resulting a relatively probable 2-3 bagger and perhaps more. If I had to guesstimate some return ranges in the future it would go something like:

- Within 6 months: 100%-300%

- Within 12 months: 300%-500%

- After that it would be too much speculation

The Margin of Safety characteristics combined with the Probable- and Potential Upside characteristics puts Kuya Silver in the top #5 of cases, in terms of Risk/Reward, that I have seen in the last 4 years. Therefore I view any additional selling from Miramont holders to, probably unknowingly, be bringing gifts.

As always: Do you own due diligence and make up your own mind. I have accumulated a lot of shares from around $1.50 and down to the current levels. I also got some family members and friends into Kuya and the company is a passive banner sponsor. Thus assume I am somewhat biased.

Some TA

To me it looks like MONT/KUYA is forming a major Head and Shoulders bottoming/reversal formation which would indicate a first target of around $2.56/share once $1.50 is taken out:

When fundamentals dictate a “fair value” along the lines of what the chart suggests could be the first stop then I am very intrigued.

Note: This is not investment or trading advice. I am not a geologist nor am I a mining engineer. This article is speculative and I can not guarantee 100% accuracy. Junior miners can be very volatile and risky. I have bought shares of Kuya Silver in the open market and I was able to participate in a private placement. I can buy or sell shares at any point in time. I was not paid by any entity to write this article but the company is a passive banner sponsor of The Hedgeless Horseman. Therefore you should assume I am biased so always do your own due diligence and make up your own mind as always.

Best regards,

Erik Wetterling aka “The Hedgeless Horseman”

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My channel

Interesting, but unfortuately cannot buy them, because they are only covered by PURE and that is not supported by Dutch brokers!