Irving Resources: There is Nothing Ordinary About Omu

There are a couple of things that make Irving Resources (IRV) and the Greater Omu Project quite unique in my eyes…

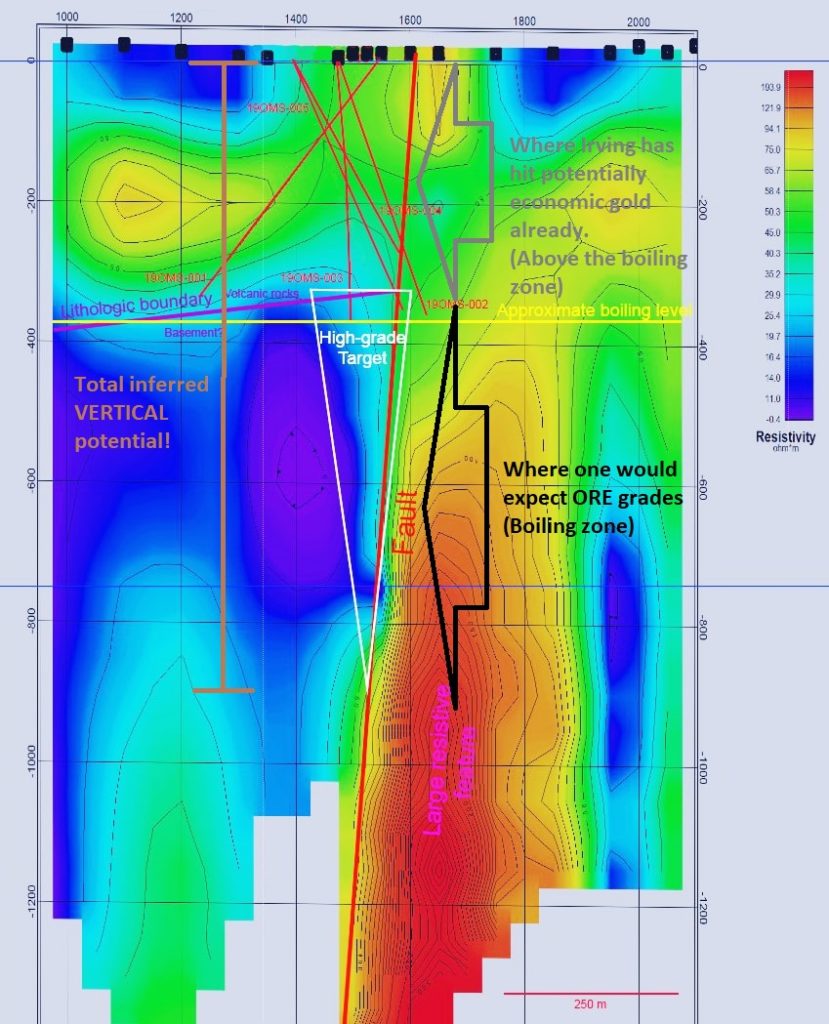

#1 Vertical potential of payzone (“First Dimension”)

Typically, the ORE ZONE in a low sulfidation epithermal system is the BOILING ZONE, and this can be anything from 50-800m thick, with an average of around 300m. This is the interval that would typically have grades that are high enough to be economically viable to mine.

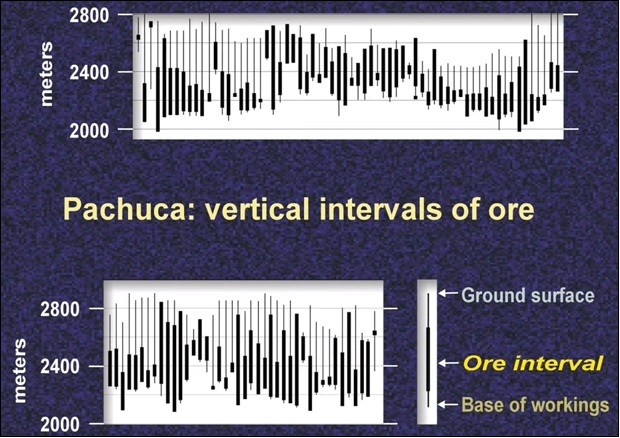

Example 1, Pachuca:

… The BOILING ZONE aka the ORE INTERVAL at Pachuca varies a lot but averages around 400m in thickness. In other words this is the vertical extent (vertical dimension) of the deposit.

Example 2, Silvercrest metals:

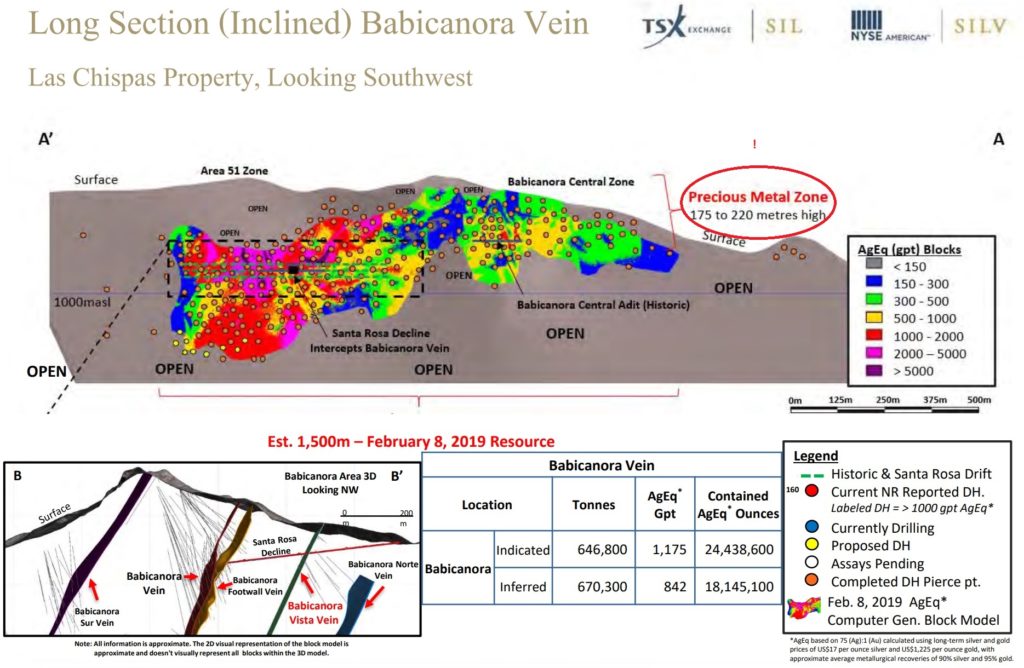

… Here we can see that the “Precious Metal Zone” for the Babicanora Vein is described as being 175-220 metres high. The slightly lower than average thickness is offset by the very good grades. And together with the other veins that have been explored so far, it does result in a very good project, which is the reason why SilverCrest Metals has a Market Cap close to C$1B. Now, the crazy thing about Omu is that medium, to high grade, to bonanza grade gold and silver mineralization has been intercepted above of the boiling zone. Not only that but all the way up to surface. Below is a cross section from Omu Sinter (which is just one of the three current targets):

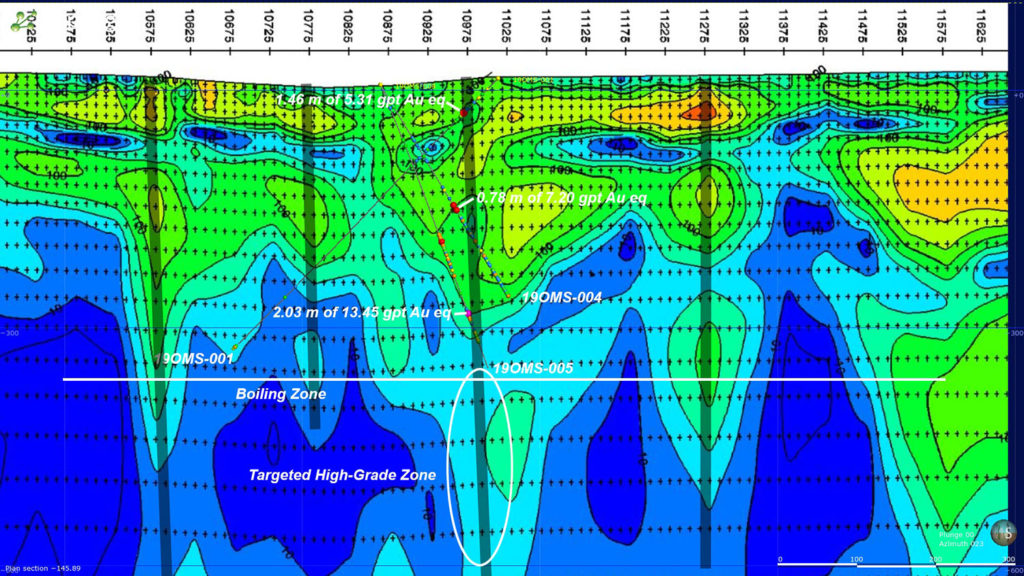

… As you can see, there is a vein (or veins) that has been hit over a vertical extent of around 300m already, with decent to good grades. This is a mind blowing result given that all of these intercepts are ABOVE the BOILING ZONE and these were “blind” holes. In other words: Not only did Irving hit potentially economic grades where a typical low sulfidation epithermal system would not have this kind of mineralization but they did it right off the bat while drilling blind. There is pretty much no way that these will be the best intercepts at those depths since Irving did not have the CSAMT readings in hand to help guide the drill bit. Case in point: The first drill hole at Omu Sinter which was started in early January, and which was now guided by CSAMT, “has encountered several intervals of high-level banded vein quartz, some of which display ginguro“. Suffice it to say that Irving will henceforth be able to better hone in on the areas with the best inferred potential.

With the above said, we are still not even in the BOILING ZONE yet. In other words, all those potentially economic hits over a vertical distance of say 300m will probably turn out to be the gravy on top. Now, if the boiling zone is a few hundred meters and contain high-grade mineralization as well, then the inferred vertical potential makes Omu Sinter really stand out.

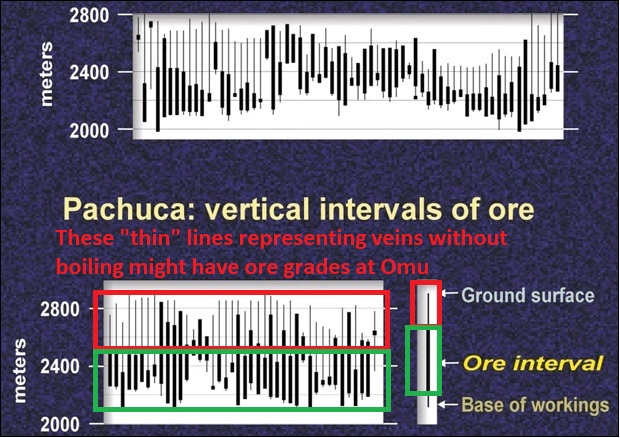

Lets use the slide on Pachuca as an example:

… Instead of the “Ore Interval” only being the intervals where the primary boiling took place (thick bars) the prospects within the Greater Omu Project could potentially have an “Ore Interval” all the way from the start of the boiling zone all the way up to surface. The slide below is a slide on Omu Sinter which helps visualize this as well (drawings by me):

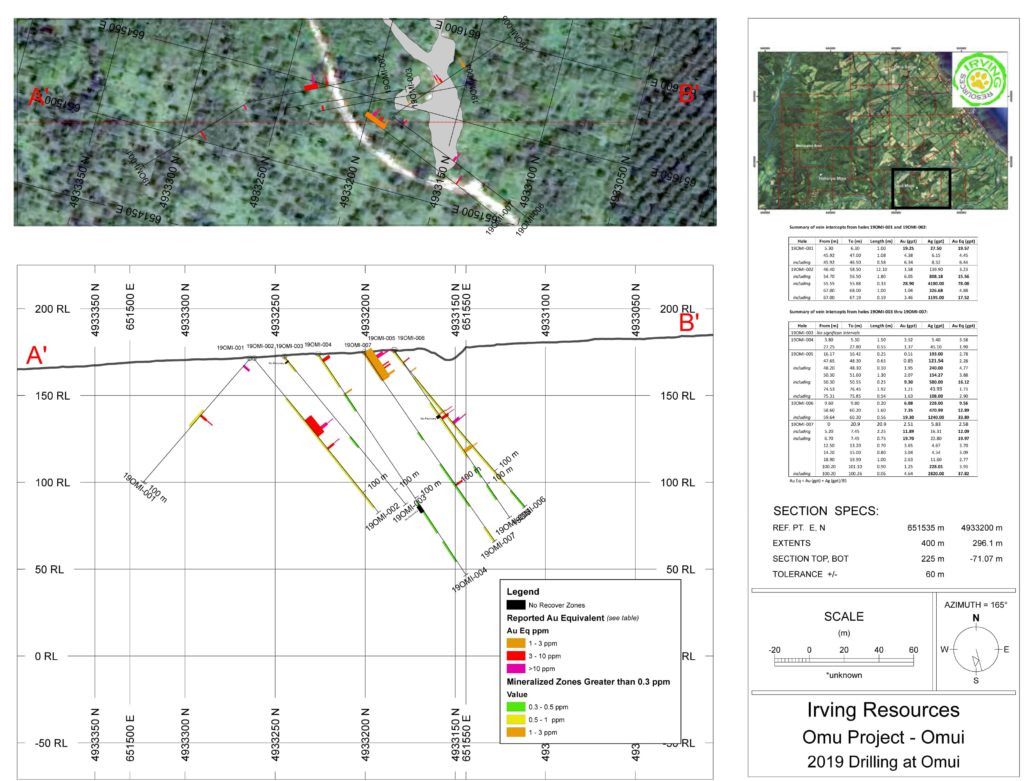

… This abnormal and exciting potential is fortunately not only limited to Omu Sinter, but is evident at Omui Mine Site as well:

The assay results from Omui Mine Site saw grades over 20 gpt AuEQ at depths on only 5m. Again, these are abnormal results given that a) These were the first holes, and b) That this is nowhere near the boiling zone which is expected to START at depths up to 350-380m below surface.

This is what Quinton had to say during his presentation at Metals Investor Forum when he showed a slide which contained assay results from the shallow drilling at Omui Mine Site:

“Once again, look at those numbers… You don’t see grades like that in normal systems...”

Bob Moriarty put it bluntly in his recent interview with Proven and Probable:

“The high-grade gold should not be at surface… It should be 350 metres deep…”

In other words, we might be looking at a “roided up”, district scale, interconnected low sulfidation epithermal system, where this abnormal vertical pay zone might be present in at least two areas (Only Omu Sinter and Omui have been drilled so far):

Further evidence that the epithermal system(s) within the greater Omu Project might simply be much more well endowed than a typical epithermal system is that the sinter terrace at Omu Sinter is absolutely massive. I think Quinton has said it was up to 12m high and the largest he has ever seen. This points to massive amounts of fluids having been pumped up in that area and/or that the system was long lived which led to “fossilized” silica being stacked very high over it’s life time. I mean the abnormal vertical extent of high-grade veins might be explained by Omu being just “weird”, but when you factor in the abnormal sinter terrace, it simply points to an extremely robust system.

There are examples of low sulfidation epithermal systems having a very thick pay zone due to the boiling zone “telescoping”. In other words the boiling zone shifted vertically at times and deposited gold and silver over a longer vertical extent. We also know that Irving belives that there were two main events at Omu. One early event that was silver rich and a later one which was more gold rich. In light of this, @Exploratory had some good speculative thoughts:

“What I think of as the “main” (and first) system presents as a huge, deeply interconnected, Hishikari-like low sulfidation gold and silver bearing epithermal system of district scale whose ancient surface (when active millions of years ago) was likely at or about the present Hokkaido surface today. The ore zone for this “main” system, as is typical for such systems world-wide where they occur (and as many here have noted), would normally be predicted to begin about 300 meters (give or take, depending on local conditions and circumstances, ore fluid composition, etc.) below its surface (I’m leaving out water table to keep it simple). Certain rock types called silica sinters, which form only at the actual surface, and which are reported at Omu, serve to positively identify the ancient surface (at least locally where and at the time when such sinters were forming). A subsequent or second system, which I think of as the “upper” system, likely followed and intruded into the main system under unknown circumstances (the surface perhaps being submerged under the ocean or being covered by a now long-since eroded away overburden). I speculate that it was this “upper” system that left ore-grade veins at and near the main system’s surface, including among various sinters, at a system level and in a place where they do not normally form, and are not normally found. I also speculate that at least some of the gold and silver may have been re-mobilized from the ore zone of the main system (the top of which at Omui mine location is about 350 meters below the surface there). Note that the bottom of the ore zone is typically well below that, for a vertical ore zone interval commonly on the order of 300 meters or 1,000 feet, and that the veins may extend laterally for many hundreds of meters or even for kilometers. At Omu, virtually continuous economic veins may even ultimately be found to extend at depth all the way from Omui mine to Omu sinters, and otherwise offer opportunities for very large tonnage and long mine life. (We can all hope!!)”

What is intriguing is that there has been no talk of Irving seeing the typical boiling textures in the high-gade, near surface vein intercepts. So, are the systems really stacked vertically or did the primary boiling really take place deeper down, for both events? Whatever the answer is, Omu is an abnormal low sulfidation epithermal system, in a very good way. Then we also have the theory that the second gold rich event might not have been able to use the same “plumbing” as the first silver rich event, at least at Omu Sinter. Thus, there is a possibility that the bulk of the gold rich fluids from the second event might have been trapped deeper down. This makes it even more intriguing given the grades that are already being seen at very shallow levels…!

After having gone through the first abnormal dimension of the greater Omu Project, the vertical potential, lets look at the next one…

#2 Lateral potential of the system(s) (“Second Dimension”)

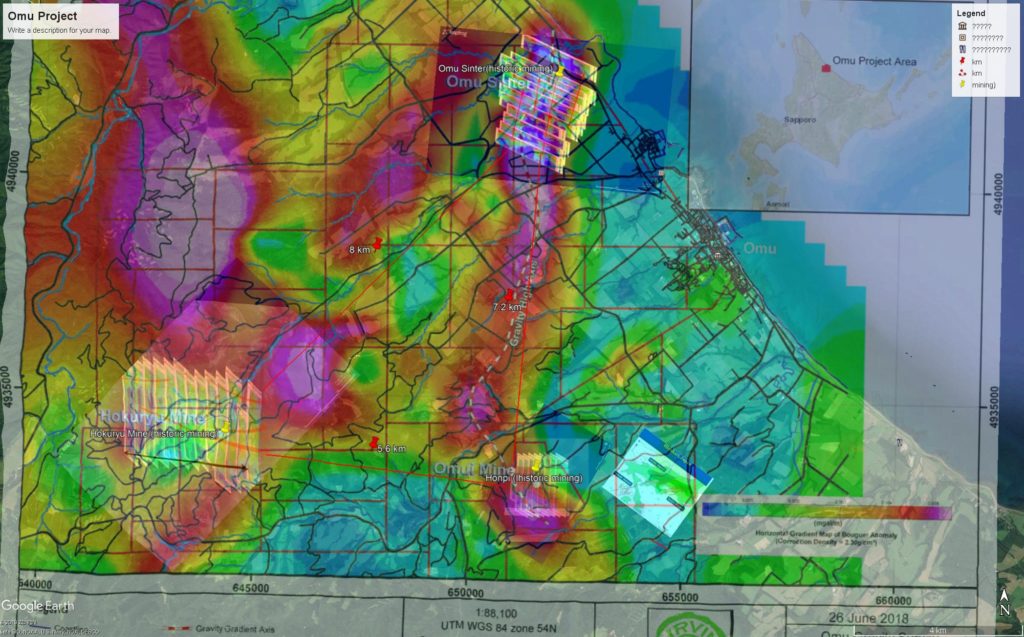

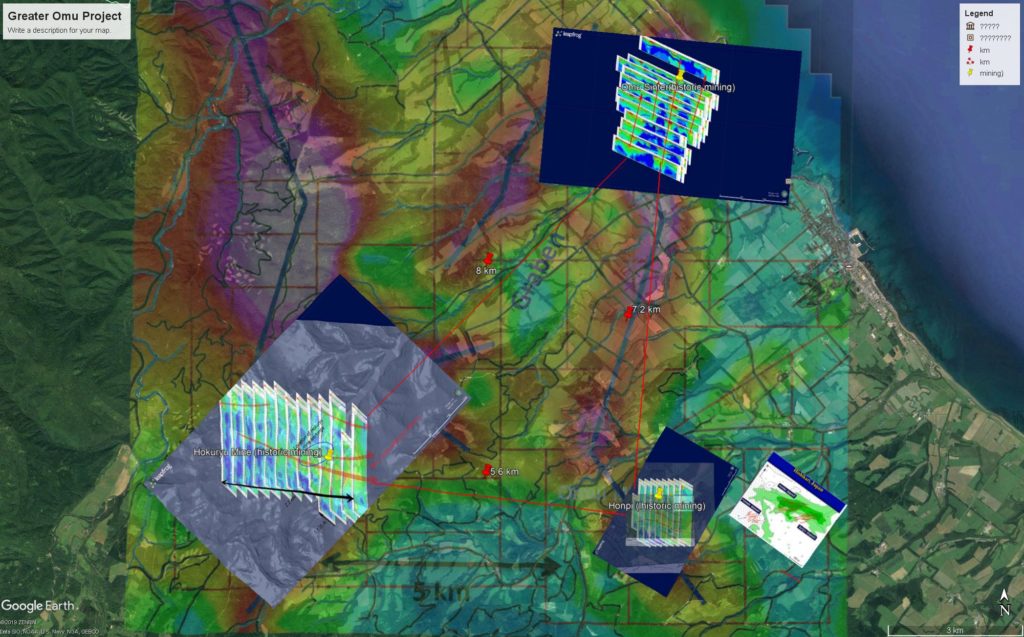

If the seemingly abnormal vertical potential wasn’t enough, the main targets within the Omu Project also shows signs of an abnormal lateral strike. First of all, drilling at Omu Sinter has already confirmed that the hydrothermal system is at least 2km long, and this is backed up by the CSAMT readings. The latter is important because both drilling at Omu Sinter and Omui Mine Site is indeed suggesting that the CSAMT survey is a good proxy for where we might expect to find mineralization. This fact coupled with the CSAMT survey readings over Omu Sinter, Omui Mine Site and Hokuryu paints an, again, abnormal picture:

… What you see in the picture above are CSAMT surveys and a gravity survey superimposed on Google Earth (done by me). As you can see, there are multi kilometer trends of deep rooted and high CSAMT reading at each of the three main prospects (Omui, Omu Sinter and Hokuryu). Not only that, but NEITHER of the CSAMT surveys were able to cover the full extent of the trends at either prospect. In other words we have no idea how long the inferred strike is at either prospect. Not only that, but the systems are suggested to be interconnected and as you can see, the trends are trending towards each other. This is pretty insane when you think about it. Some of the world’s best epithermal systems have a strike of around 1-2km (Fruta Del Norte, SilverCrest Metals). Each of Irving’s current prospects show CSAMT readings suggestive of multi kilometer strike potential… Yes. Each. And until proven otherwise there is still potential that large parts of the areas between the prospects which have not yet had CSAMT surveys done on them are mineralized as well. Crazy thought.

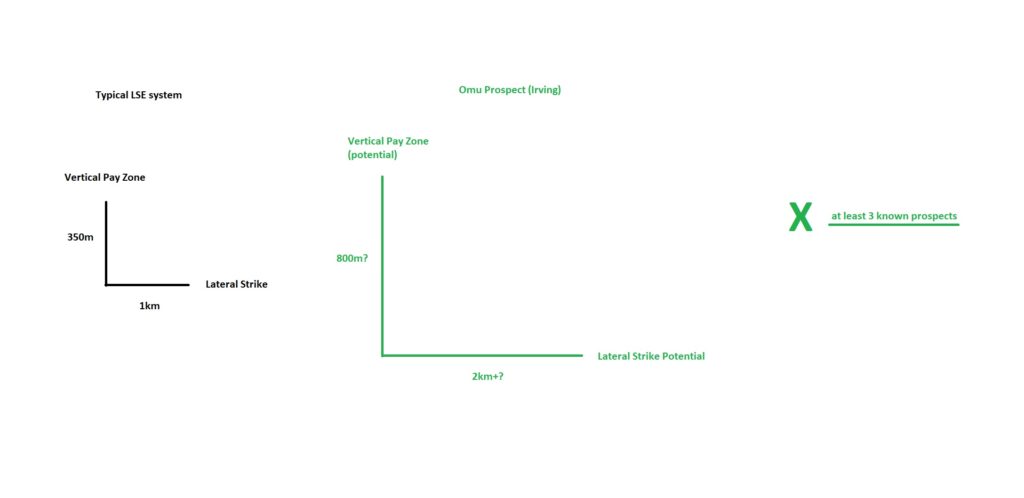

Thus, I see each prospect as having both potentially much larger vertical and lateral potential than any low sulfidation epithermal systems that I know of (FWIW), and Irving has at least three prospects:

To Sum Up

We know vertical strike looks abnormally good. We know lateral strike potential looks to be multiple kilometers at each prospect…

… Then add the fact that hole #10 hit “vein after vein” and that the first hole guided by CSAMT at Omu Sinter “has encountered several intervals of high-level banded vein quartz, some of which display ginguro”.

… Thus, not only does VERTICAL and LATERAL look abnormal but there might be multiple veins present which would jack up the the gold endowment both per VERTICAL and LATERAL meter.

#3 “The Third Dimension”: Grade

We have yet to see if the Omu prospects also show abnormal grades. Well, we already know the grades are abnormal above the boiling zone, but does it extend to depth as well?

One thing to note is that any of the abnormal dimensions might be enough to create abnormally good value for Irving. In other words: If vertical extent and/or lateral strike is abnormally good, then that would probably be enough for a world class project already. If it’s high-grade as well then we are in Nirvana. I mean if a couple of the veins encountered in #Hole 10 show decent widths and very good grades (10-20 gpt?) then that would suggest that Omui Mine Site and the rest of the prospects might host many millions of ounces.

I personally would only be disappointed if any and all veins showed a grade of say 5 gpt (unless they were thick as well). In other words, even though superficial expectations might be high right now, I think the bar is set very low given everything else we currently know about the prospects in this district. If it would turn out to have close to Hishikari-like grades of say 30 gpt, then I would expect all hell to break lose. With that said, there is zero chance of hole #10 being the best or the worst hole. It will however put a “floor” on grade since we will know what grades are achievable within the upper portions of the boiling zone at Omui Mine Site. Since hole #10 only “clipped” the upper portions of the boiling zone, I think there is a possibility for grades being even higher further down (but that’s amateur speculation on my part).

Suffice it to say that I think the bar is low for hole #10 and that it only really needs to show that at least some veins within the boiling zone at Omui Mine Site does show economic grades.

So, why do I have a huge % in Irving even at a Market Cap of C$203 M?

- Well what do you get for C$203 M?

- First world jurisdiction

- Top tier management

- World class backer in Newmont (and Sumitomo perhaps?)

- A very big pipeline of projects

- Bulk sampling revenue

- Three prospects with tier 1 potential within their first project

- Mining Permit at Omui Mine Site

- Great infrastructure

- Close to ports (ship to smelters)

Lets look a bit closer…

Pipeline of projects

Irving has 6 additional projects in the pipeline after the Omu Project. They range between 4,850-18,880 Ha in size and one could thus say that these are all district scale sized projects. Given that these were selected by Quinton Hennigh and Takaoka Hidetoshi etc, I would argue that each one of them is a tier 1 grassroot project. This first/second mover advantage supported pipeline of projects guided by some of the worlds best geologists is enough for Irving to be busy for decades to come.

… OK, but what intrinsic value could one put on this project pipeline? That is impossible to answer but lets compare it to Japan Gold. Japan Gold has many projects, larg and small, all around Japan. So far they haven’t “de-risked” much of anything so I would argue that the company is still in the pure potential phase. Still, this potential is valued at C$32 M.

Given that I consider Irving to have superior management and superior geologists I would take Irving’s pipeline over Japan Gold’s and if we play with the thought that Irving would spin out each and every project with some cash, I would argue that the cumulative Market Cap for each spin out would be over C$32 M. But anyway, let’s be conservative and say that the 6 district scale projects are worth C$32 M at this point in time.

Bulk Sampling Revenue

Irving should sooner rather than later ship their first bulk samples. They were able to collect several hundred tonnes of vein material before the snow came and they have stated that they will “Complete bulk sampling at the Omui mining license. Bulk sample will be shipped to Kushikino mill. (Summer and Fall)”. Now, I don’t know how much material they will ship but suffice it to say that Irving could probably cover all their exploration costs with bulk sampling revenue as soon as it is up and running for real.

What would that be worth?

First of all, that could mean that Irving would be able to avoid dilution whilst proving up value. This would make Irving a truly rare breed since 99.9% of juniors continuously dilute the upside while trying to prove it up. In other words, any incremental success for Irving would benefit Irving shareholders more than success would to for shareholders of a typical exploration junior.

What could the NPV be in that case when all is said and done?

I don’t know but it could be a LOT. Let’s say the bulk sampling exercise is worth at least C$30 M, but honestly I think it might end up being worth multiples of that. Just think about what for example a 5% dilution would “cost” shareholders at $1B… 5% of $1B is C$50 M and if the greater Omu Project ends up being as good as it currently looks, one might have to multiply that number. In other words, the ability to ship bulk samples for revenue will go up in value the more success Irving has.

Lets break it down further

Market Cap: C$203 M

– C$32 M (Pipeline of projects)

– C$30 M (Bulk sampling)

– C$ 8 M (Cash)

= C$133 M for the exploration potential within the Greater Omu Project alone

Now, we know there are currently three main targets. Omu Sinter and Omui Mine Site has been confirmed to host abnormal grades at shallow levels already. Furthermore, the CSAMT surveys suggest that the trends might be multiple kilometers (and are wide open). Lastly, we know Hokuryu looks to be potentially the biggest of them all.

… So if we take C$133 M and divide it by 3 we get C$44.3 M.

In other words one could argue that despite all the remarkable characteristics which have been described in this article, the current Market Cap is currently putting a maximum value of C$44.4 M on each of the (only) currently known prospects within the Greater Omu Project. This is why I consider Irving to be cheap even at the current Market Cap and why I consider the risk/reward to be incredible. That’s also excluding the value of management, backers, mining permit and jurisdiction. In other words, I think Irving is still very much undervalued and I can see each of the three current prospects being worth more than the current Market Cap sooner rather than later (heck, the implied value of Omui alone is probably already higher than Irving’s current Market Cap). This is at least my view and the reason why I have been adding for weeks even though share price has gone higher.

I mean, just think about it. Hishikari which has a footprint similar to perhaps ONE of Irving’s prospects is a 27 Moz behemoth that produces gold at an AISC of US$300-US$400 per ounce (obviously worth multiple billions). Or how about Fruta Del Norte which is “only” 1.2km long. Or how about Silvercrest Metals which has a “Precious Metal Zone” of around 175 to 220 m? Anyway you slice it, the implied potential (vertical and lateral) of Irving’s prospects dwarf most of the modern success stories and if the potential gets translated into reality… Then you can guess what the valuation might be in a few years.

Lastly, I would say that hole #10 pales in comparison to the overall context we already know of (The abnormal dimensions). BUT, if the first ever hole into the boiling zone shows good grades, then the implications should be staggering given that it has a multiplier effect (Vertical x Lateral x Grade = Value). As always, make up your own mind, I know I have. You and you alone are responsible for your own money and this article just contains the thoughts of some dude from Sweden and I might be wrong on everything!

Be sure to watch Quinton’s presentation on Irving Resources during the Metals Investor Forum for additional context:

(Note: This is not a buy or sell recommendation. This is not investment advice and I am not a geologist. This article is highly speculative, forward looking and I can’t guarantee accuracy. Always do your own due diligence. I own a lot of shares of Irving Resources which I have bought in the open market and am thus biased. )

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Hey “Some Dude from Sweden ” ,

Your more like “The Dude from Sweden”.

Do we have any time frame on hole 10 results?

I called Irving investor relations yesterday, haven’t received a call back.

This is getting super exciting! Nice work as usual.

Alaska Dude, Craig

Hey “Some Dude from Sweden ” ,

Your more like “The Dude from Sweden”. LOve IT!!!

Absolutely love reading some of your breakdowns, makes it easier to understand. And yes Ive watched Quintons presentation! He sounds like he wants to jump for JOY but tries to contain himself. (funniest part of that presentation was the very end when Eric Coffin tells Quinton that the last slide should be another (Forward Looking statement) and Quinton goes “ohh yeh good idea thanks”

Keep up the great work DUDE! I think the fun is just beginning on this one!

DUDE from San Diego -Sasha k