How to Foolproof You Portfolio

It is quite easy to show with simple statistics that the current valuations set by retail investors in the junior mining space are statistically r*tarded. Anyway given that it is very hard to be making a mistake by buying something right now the major risks are selling. So how do you build an absolute fool proof portfolio which should also bring a lot of comfort/conviction? Well find the companies with either a) Huge skin in the game by competent people and/or third party validation from major miners. If one is not smarter than the smart money and/or major miners then it makes total sense to just follow them since they have done an immense amount of due diligence and have voted with their wallets.

Why make it harder than it is?

Why put all your money in shitcos when you can buy the highest calibre juniors at ridiculous prices?

If you are not good at stock picking and want to have good returns with little effort you can just spread bet and follow the smart money. Unless you are smarter, or know more than them, you are not making a mistake by default. Note that this does not mean that every single junior backed by smart money and/or a major miner will be a success over the coming years. What it does mean, at these prices, is that if they are right then any success could very well 5X or more. The winners pay for many losers if you hold it long enough.

Note that I do not own every single company listed below and I own a lot of juniors that are not listed below. The point is that these are some suggestions that people smart than me and/or large mining companies are suggesting to be good bets… Not some guy on the internet.

Criteria:

- Competent management with a lot of skin in the game

- And/or Third party validation

Gold

- Montage Gold

- Lundins, Barrick, Endeavor & Perseus

- Snowline Gold

- B2Gold

- Aurion Resources

- Lotan, Kinross & B2Gold

- Irving Resources

- Newmont & Sumitomo (Last add $1.23/share)

- G Mining Ventures

- Lundins and Pierre Lassonde

- Headwater Gold

- Newcrest

Silver

- Dolly Varden Silver

- Hecla Mining

- Western Alaska

- 35% insider ownership and I expect a strategic to come sooner or later

- Eloro Resources

- A lot of skin in the game

- Peter Marrone

Base metals

- Fireweed Metals (ZINC)

- Lundins + Teck

- Last add: $0.74/share

- Cashed up

- Cheap

- Zinc

- Faraday Copper (COPPER)

- Lundins + Pierre Lassonde + Murray Edwards

- Last add: $0.80/share

- Cashed up

- Cheap

- Arizona Sonora (COPPER)

- Rio Tinto

- George Ogilvie

- Arras Minerals (COPPER)

- Teck

- Brixton Metals (COPPER/GOLD)

- BHP

- Inflection Resources (COPPER/GOLD)

- AngloGold

Nickel

- Magna Mining (NICKEL+ PGMS)

- Ex FNX team

- High skin in the game

- Dundee % Mitsui

- Two semi-permitted deposits and one discovery

Specialty

- Defense Metals (RARE EARTHS)

- Big resource in Canada

- John Robbins

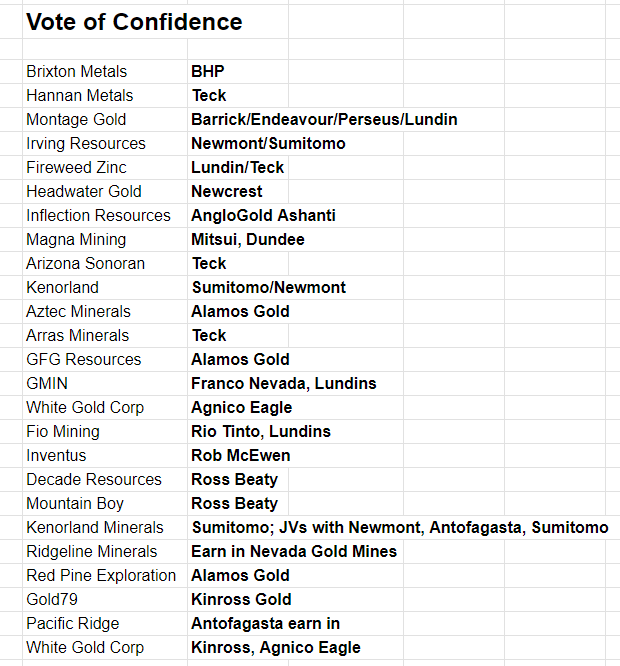

More companies that have major third party validation for your consideration/due diligence:

Note: This is not investing advice.