Idaho Champion Gold Mines (ITKO.CN): Two De-Risked Gold/Silver Projects With Blue Sky Potential in Idaho For $US8.5 M

My Case For Idaho Champion

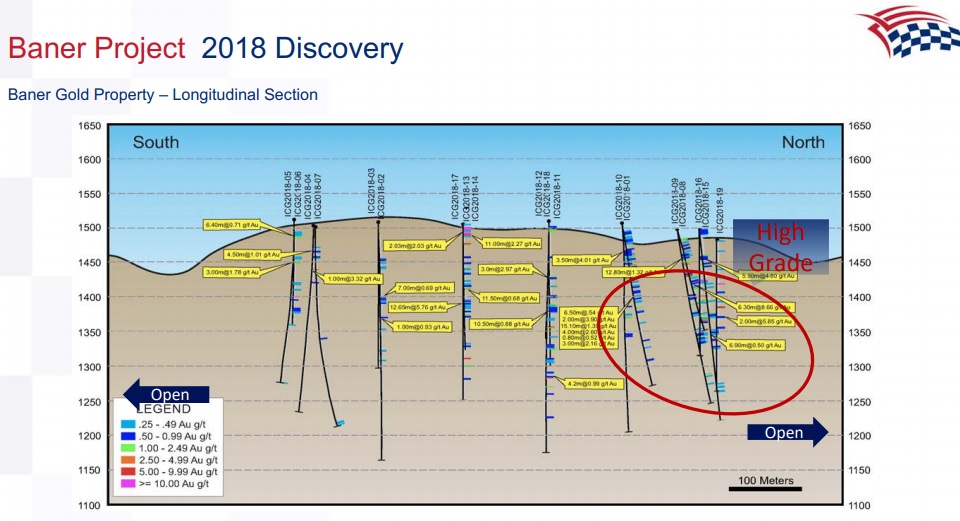

My case for Idaho is made simple by the fact that the company has an Enterprise Value of around US$8.5 M. For that miniscule amount I get two good looking projects located in Idaho, USA. One is a project called the “Baner Project” where the company made a discovery of near surface and oxidized gold mineralization a couple of years back (Assays up to 6.3m of 8.66 gpt Au). The second one called the “Champagne Project” is the most interesting one in my opinion. This gold/silver project was mined in 1990-93 by Bema Gold as an open pit, heap leach mine. It’s a fairly large project that hosts a large number of historic mines, veins, adits and artisinal pits which is why the company believes that Bema Gold might just have scraped the surface. This notion is supported by the very recent IP survey results which showed very large IP anomalies at depth (below and adjacent to the past producing pit).

Management, insiders, friends and family ownership is over >30% which means that the people steering the ship have a lot to lose (and a lot to win). This is a big positive in my book since it means that the management team should be highly motivated in terms of creating value (in contrast to management teams that just works for a salary). The fact that Patrick Highsmith is a Director of the company is another big positive in my eyes. Patrick has worked for more majors than I can even remember and I have a lot of respect for him both in terms of competence and honesty. In other words I see the high Insider Ownership coupled with the people involved to guarantee that I will not get screwed over as a shareholder.

… All of the above left me with no other option than to consider Idaho Champion to be ridiculously cheap which is why I have bought shares and was happy to have the company come on as a banner sponsor of The Hedgeless Horseman. It’s so cheap that I don’t see the need for any specific catalyst to revalue shares higher. Either the market gets a brain and/or sentiment will return one day and when that happens I expect a low risk double from these levels. If nothing else I think that “drill hype” will kick in when we get closer to the company drilling the big IP targets at the Champagne Project.

My Short TL;DR case for Idaho Champion:

Two de-risked projects in Idaho, with multi million ounce potential, for ~US$8.5 M (@0.165/share).

To Sum Up:

- Two semi advanced gold/silver projects in Idaho

- Baner Project: Growing discovery

- Champagne Project: Big blue sky potential

- Managament with a lot of skin in the game

- Cashed up

- Low Market Cap

- Extremely low Enterprise Value

- … Very good Risk/Reward at these levels in my opinion

Personal Expectations:

- Low risk 50%-100% return as we get closer to drill start (if not sooner).

- Long term blue sky potential obviously very high with a Market Cap of a mere C$15.3

Further reading:

The Case For Idaho Champion in The Words of The Company:

… The only thing missing is the most important thing in my opinion: How incredibly cheap the company is in light of all the above.

Setting The Scene

Idaho has become one of the hottest jurisdictions in the United States over the last couple of years. There are currently multiple companies operating within the state and there are a couple of operating mines as well:

As the saying goes; “The more the merrier”. Further success at each and any project will hike up the attractiveness of the region overall in the eyes of a major. This is simply because any sunk costs could have a higher ROI in the case that there are multiple potential sources of future feed to a mill. In other words one should be rooting for every player here since any success will hike up the Expected Value for the other players as well.

Now lets look closer at the two flagship assets starting with the Champagne Project…

#1 Champagne Project

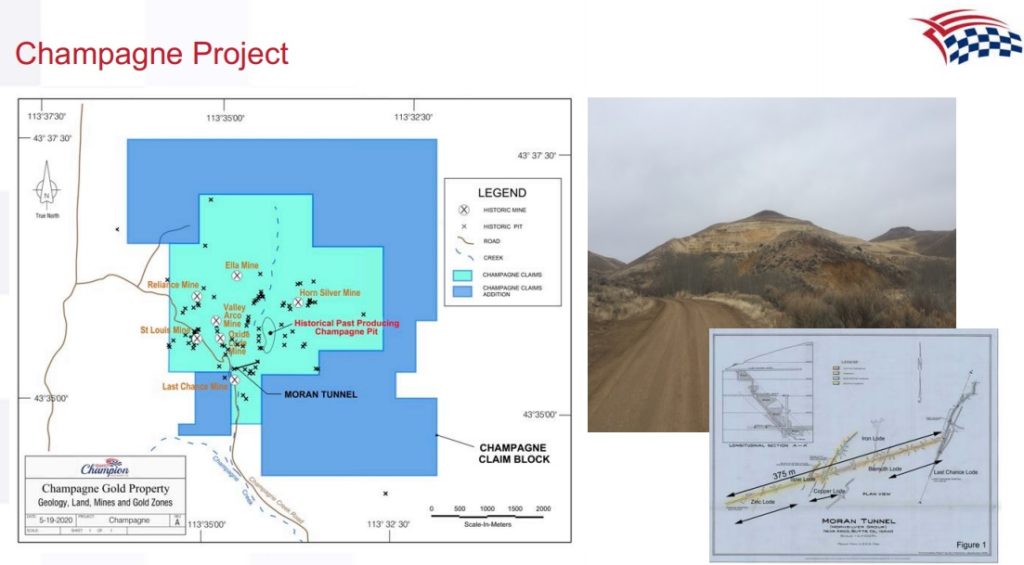

There is a lot of smoke at Champagne which is evidenced by the numerous, historic mine sites in the area:

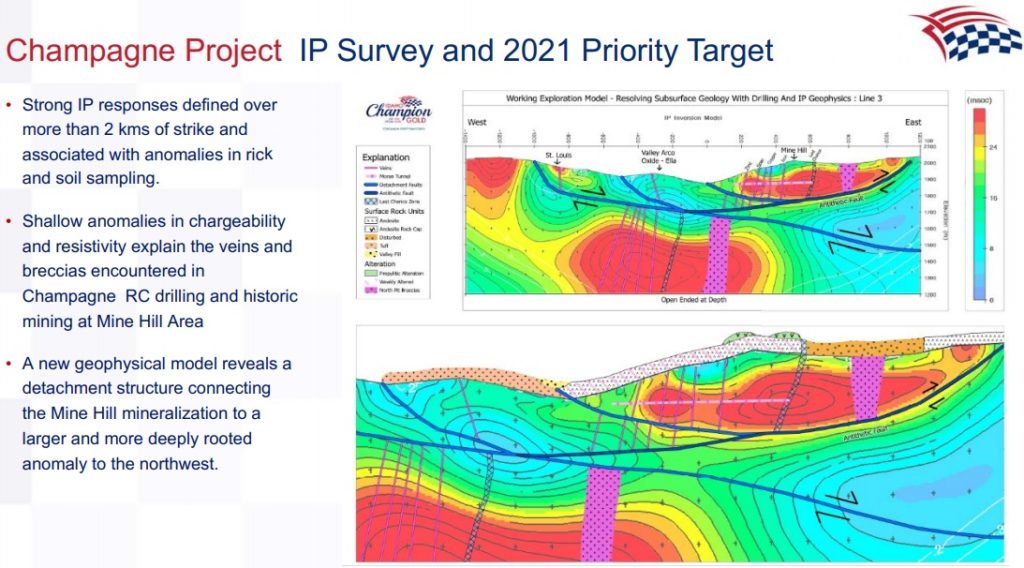

… As CEO Jonathan Buick has stated in a few presentations the amount of showings at Champagne makes it look like this could really be a new “camp” and the company has been very excited in regards to the potential at depth. I mean all the stuff on surface came from somewhere. On that note the company recently got back the results from the recent IP Survey and thankfully it put more fuel on the fire in terms of there potentially being something very big at depth:

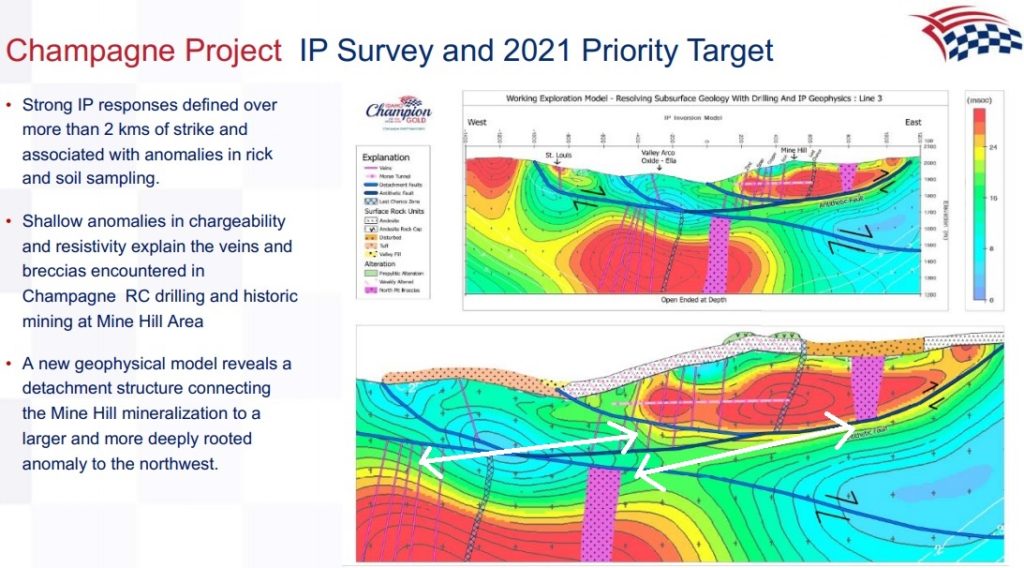

There are a few things to note in the slide above. First of all the historic mining activity seems to line up pretty well with the shallow IP anomalies. In other words mineralization seems to correlate with the high IP responses. This in turn makes the very large IP anomalies at depth extremely interesting. What the company believes has happened here is that the near surface anomaly and the deeper anomaly were once connected, and formed one coherent system, but was later cut off from each other and moved apart a bit. As the company has outlined above the idea is therefore that the veins and breccia (pink unit) seen on surface could very well be present, and continue, in the larger and more deeply rooted IP anomaly:

(white arrows added by me)

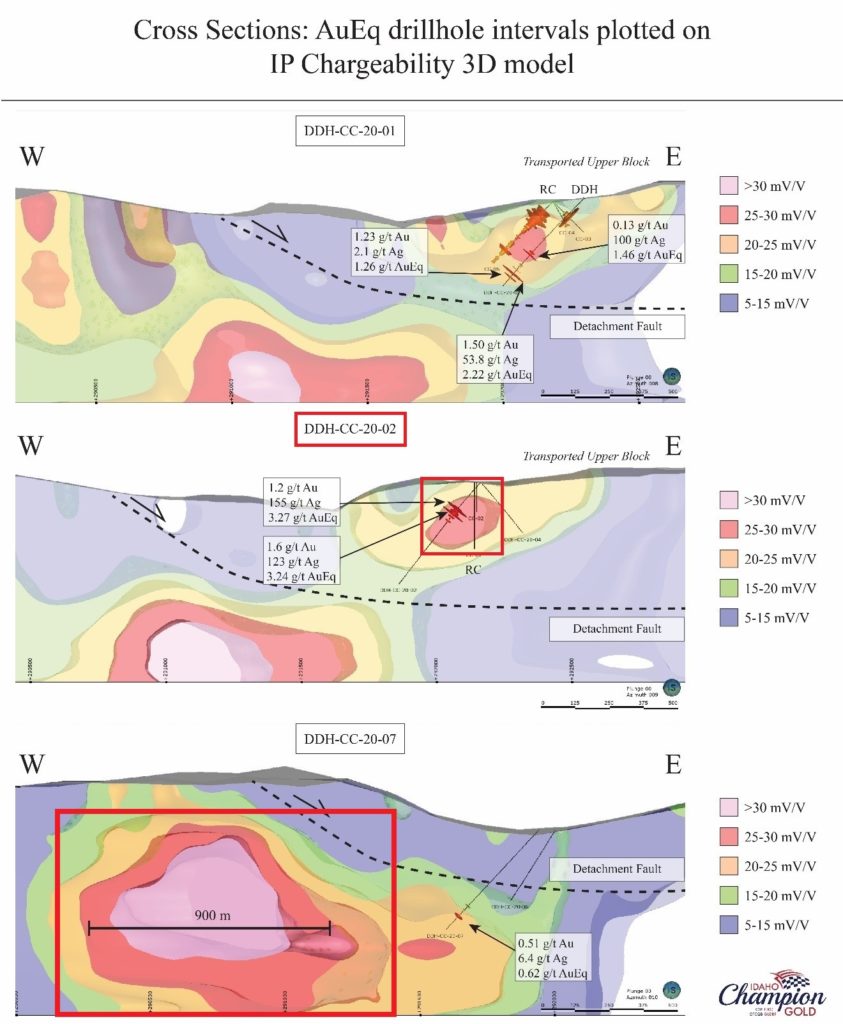

The company recently announced results from its 2020 drill campaign at the Champagne Project. Seven holes were drilled and this was done WITHOUT guidance of the recently completed IP survey. Despite these being a bit of “wildcat” holes there were some very encouraging results such as 1.04 gpt AuEQ over 42.98 m in hole DDH-CC20-02. What is very interesting is that this hole, which had the best intercept, lined up very well with the IP survey results in hind sight:

(red boxes added by me)

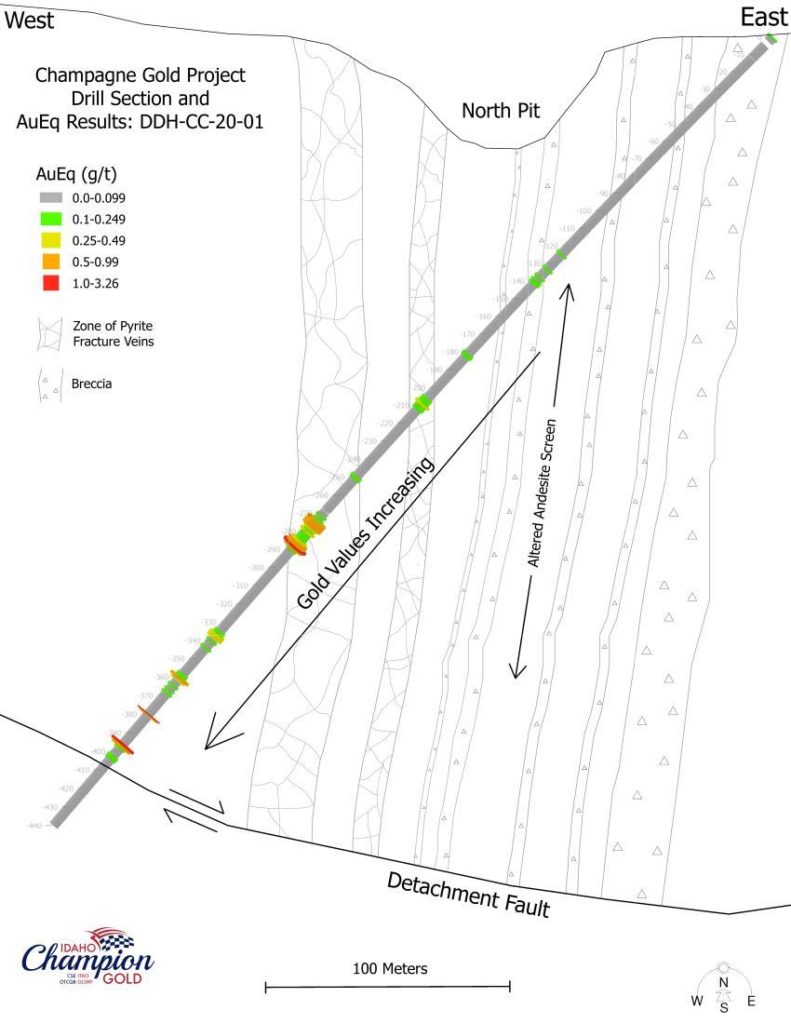

… Again, the best mineralization lined up with the high IP readings. In light of this the very large IP anomaly at depth (900 m wide as per the slide above) naturally becomes a high priority target. If that is indeed the displaced continuation of the mineralization at surface then there could be some huge tonnage here since the presentation mentions “Strong IP responses defined over more than 2 kms of strike…” . Furthermore it seems that the mineralization is intensifying at depth as per hole DDH-CC-20-01:

… The blue sky picture is therefore quite exciting given the size of the anomaly coupled with some evidence that the system gets stronger at depth. Another important thing to note is that there looks to be relatively shallow mineralization between the old pits where Bema mined its gold as per the recent NR that came out on February 16:

2020 Champagne Drilling Highlights:

- Drill hole DDH-CC-20-02 intersected 1.04 g/t gold equivalent (“AuEq”) for the interval 123.14-166.12 m (42.98 m core length), including 1.22 g/t AuEq for the interval 123.14-157.06 m (31.93 m core length).

- Drill hole DDH-CC-20-02 was collared at Mine Hill in the approximate center of the unmined 300 m interval between the North and South Pits (Bema Gold c. 1989-90).

The following comments are from CEO, Jonathan Buick:

“The promising mineralization from the program demonstrates there is gold in the system below the historic mined pits where we are confident that we can identify additional resources. Our evolving geologic model indicates that the base, or roots, of a larger system that may have been the feeder for all mining in this district lies off to the west. This large body of anomalous chargeability will be drill tested in 2021.”

To sum up I am very excited about what might be found at depth at the Champagne Project and I believe there is potential for more near surface mineralization such as what Bema mined. The best part is that I would say no chance of success is even priced in when I consider what the company already has going at the Baner Project. This kind of risk/reward should not be present in this sector when gold is at $1,800 in my opinion. Therefore I am forced to say thank you and take advantage of it.

CEO Jonathan Buick talking about the IP anomaly at Champagne:

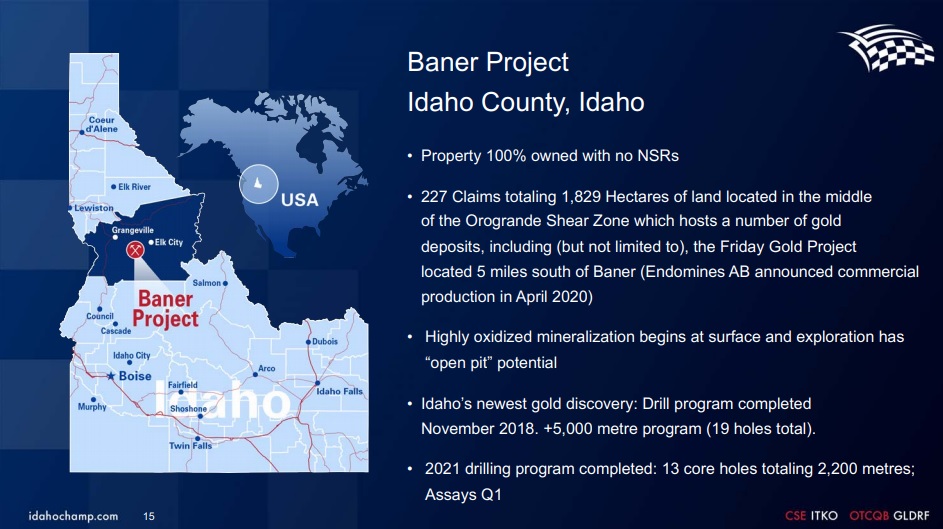

#2 Baner Project

The Baner Project is the most de-risked project since it is already a discovery with multiple drill hits. This asset is what I consider to be back stopping more than the entire Enterprise Value of Idaho Champion:

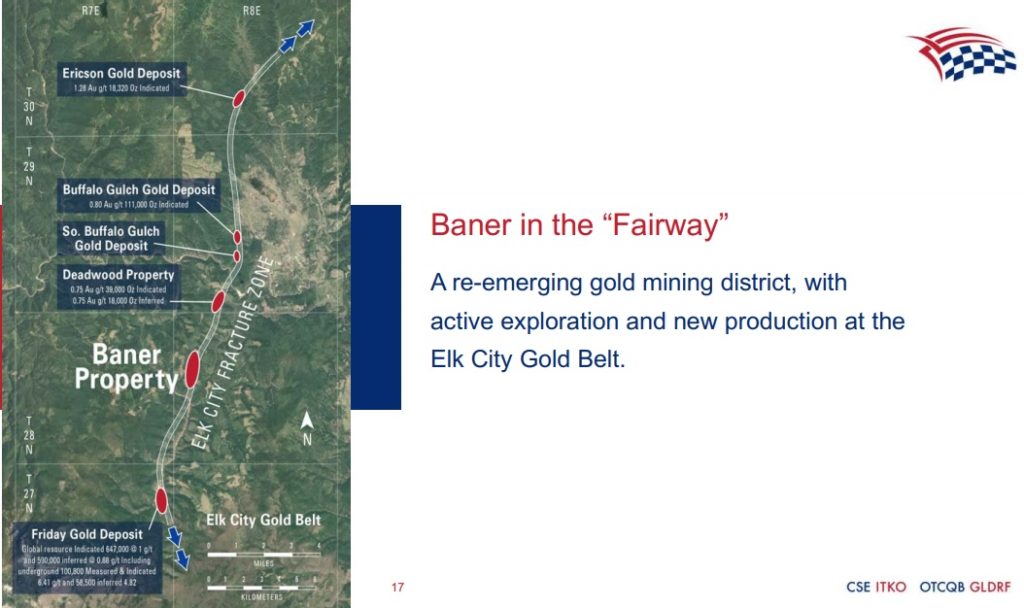

The area around Baner is sparsely populated but there is quite a bit of exploration activity going on as well as a recently opened gold mine being present:

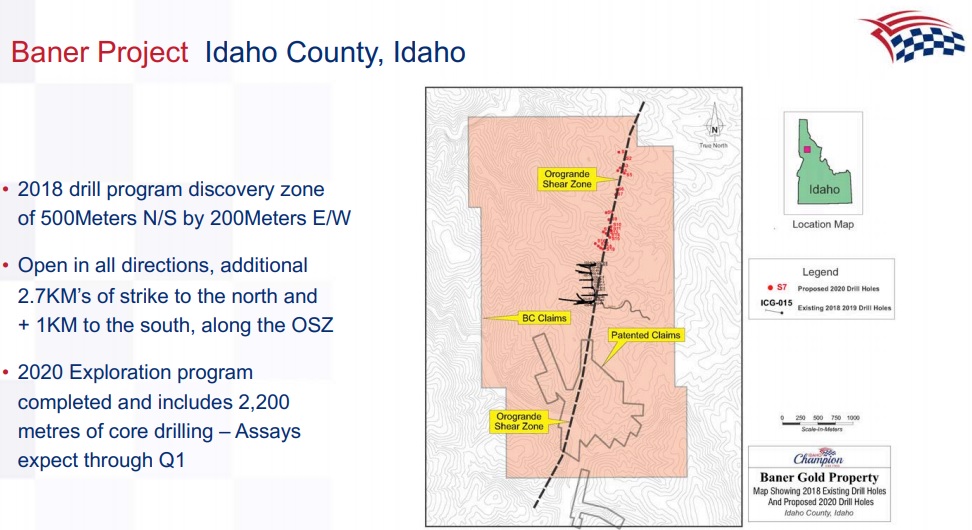

The fact that this is sort of “gold country” is a positive since community acceptance is a critical thing for any explorer. The original 2018 discovery saw drill hits along 500m of the multi kilometer long Orogrande Shear Zone that is under Idaho Champion’s control. The system is open in all directions which includes 2.7 km of strike to the north and >1 km to the south. In other words the Baner Project very much has the potential to get a lot bigger:

It should be noted that there are assay results from the 2020 drill campaign expected shortly. If the company announces some decent-to-good hits then this second drill campaign has the potential to significantly increase the strike as per the slide above. A very interesting take away from the 2018 drilling is that the high grade zone found was located in the most northern part of the drilled strike and the 2020 drilling was indeed focused on extending the strike to the north:

Bottom Line

At US$8.5 M in Enterprise Value one could say that there is a 4.25% chance priced in that either one of the two projects could be worth $100M. At today’s gold price there are sub 1 Moz deposits out there with a NPV of over US$200 M. Would I think there is just a 4.25% chance that either of the projects could be worth at least US$100 M? No. First of all the Baner Project is wide open with 500m of strike already. Secondly, the Champagne Project has a very big IP anomaly below a historic deposit. In other words I simply think the Risk/Reward is way too skewed in my favor for me not to invest as I see it pretty much being an impossibility to be overpaying for both projects. This valuation is more in line with a single asset grassroot explorer in my opinion. The Baner Project might not need to grow substantially before a vision of a low CAPEX, heap leach operation might start to materialize. Furthermore the Champagne Project’s IP anomaly is for all intents and purposes currently a target with some impressive blue sky potential in my opinion. If the >2 km long IP anomaly ends up being well mineralized then that could be a really big deposit given it’s inferred volume. Again, the company is valued like there is only a very small chance of either of the projects to be worth even US$100 M. Therefore I see serious multi bagger potential and I got two serious “shots” at it.

I can see drill hype speculation take hold once the company announces that the drills are turning at the Champagne Project in order to test the large IP anomaly at depth. My current plan is pretty much to ride my full position for a relatively low risk 50-100% return and evaluate from there. The strongest selling point as I see it is simply how little is priced in. Could Idaho get even cheaper? Sure, anything can happen in the short term and I would simply just buy more since the R/R gets exponentially better. Do I think it “should” go lower? No, as I think fair value is probably at least 100% higher and that might be conservative.

As always I don’t bet the farm on any single stock and given the upside potential I think that even a small position could obviously do wonders if at least one of the two projects ends up looking like it could become a decent mine at >$1,700 gold.

Some TA

To me it looks like Idaho Champion is forming a rounded bottom. There is evident bullish RSI divergence as well. That coupled with the ridiculous valuation made me think I got to take advantage of the opportunity. To get back to the high seen as recently as May of last year the stock would need to go up 166% from here…

Note: This is not investment or trading advice. I am not a geologist nor am I a mining engineer. This article is speculative and I can not guarantee 100% accuracy. Junior miners can be very volatile and risky. I have bought shares of Idaho Champion Gold Mines in the open market. I can buy or sell shares at any point in time. I was not paid by any entity to write this article but the company is a passive banner sponsor of The Hedgeless Horseman. Therefore you should assume I am biased so always do your own due diligence and make up your own mind as always.

Best regards,

Erik Wetterling aka “The Hedgeless Horseman”

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Follow me on Youtube: My channel