THH – Headwater Gold (HWG.CN): Silly Season

The clues as to why Tax Loss Silly Season is typically the prime hunting ground for any rational investor can be seen everywhere. You will see companies that can already be incredibly cheap go down ever more due to tax loss selling. You can see very positive news releases leading to no revaluation at all by Mr Market. In other words one can typically buy a lot of actual or implied value for free and without taking risk.

Headwater Gold (HWG.CN) is a micro cap explorer with a very deep portfolio of projects.

Management and insiders own a whopping 41% of the company. And this is not some run of the mill junior management/insider team we are talking about. The CEO is a former Senior Geologist for Kinross Gold who also has worked at NovaGold etc. Other members experience include Pure Gold Mining, Exeter Resources, GoldQuest, (many more) Kinross, Balmoral, Barrick Gold, Santa Fe Pacific and Klondex. There are no warrants outstanding but some options…

In order for these guys to make any serious money they will need to create some serious value for the company. They will east what they cook in other words.

The company has an “exploration by the numbers” approach which I love. The company has a >10 Project Portfolio and the strategy is to cheaply drill test each and every project and if there is no early success they will simply walk away from it. The balance of probabilities suggests that the chance of hitting anything decent or better while doing semi-blind, to blind, limited drilling campaigns is very small. Balance of probabilities also dictates that any good results in an early stage exploration campaign has a lot of signal value…

On November 22 the company put out a news release titled:

Highlights

New blind gold discovery made with drill hole SP21-03 which intersected 38.1 metres (“m”) grading 1.00 grams per tonne (“g/t”) gold including 9.2 m grading 2.49 g/t gold;

Four of five holes encountered significant intervals of gold mineralization beginning approximately 100 metres depth below surface;

Drill results validate Headwater’s exploration model, confirming the presence of a laterally continuous gold-bearing epithermal boiling zone below a cap of silica sinter and barren alteration occurring on surface;

Vein textures and multi-element geochemistry suggest the mineralization encountered occurs in the top of the targeted boiling horizon, with clear follow-up targets presented immediately down dip;

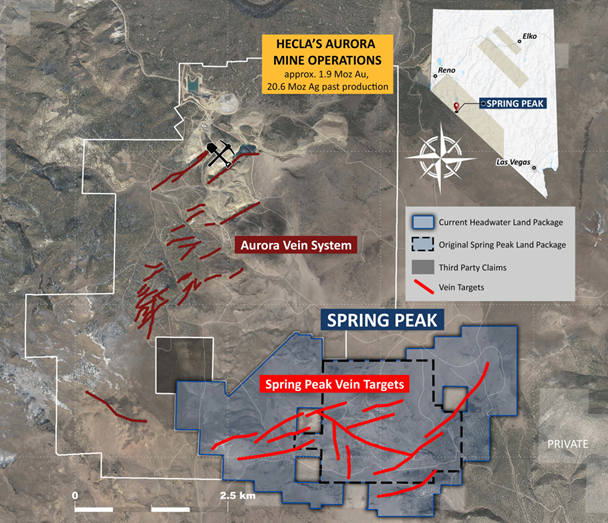

The Company has expanded the Spring Peak land position through claim staking, and approximately tripled the size of the claim block since optioning the Project from Orogen Royalties Inc.; and

Follow-up drilling is currently being planned by the Company.

For anyone who has been following this story one should be aware that the company has been able and ready to walk away ASAP from projects that doesn’t show the promise wanted (even though the drill campaigns have indeed been very limited). These are signs that the company is not “in it” to mine shareholders, unlike many juniors, and actually only want to spend money where the ROI is expected to be quite positive. This is also why one should take real notice when a company like this a) Expands a claim block by almost 3X and b) Immediately plans follow up drilling.

The Spring Peak project is right next to Hecla Mining’s Aurora complex in Nevada so you can bet that any success here will be worth a lot more than the same success almost anywhere else in the world.

I think the market is totally clueless when it comes to the signal value of hitting 38.1m of 1.0 gpt Au ( 38 gram*meters) while drilling blind and only from a five hole drill campaign for 1,350 m in total. Very very few juniors will ever do such a limited blind drill campaign and hit 38 gram*meters. But this is the least efficient sector in the world so it went way over the head of Mr Market who has totally checked out during Tax Loss Silly Season.

There are no guarantees of a discovery here that will be worth a couple of hundred millions of dollars but one would be a fool not to start paying attention to Headwater given a) The way above average success in such a limited, early stage drill campaign, b) An almost tripling of the claim block and immediate follow up drilling planned which was decided by a company where 41% of it is owned by management/insiders.

This is still a high risk/high reward, early exploration story but it just got a lot better in contrary to Mr Market’s total lack of response… Yet.

The current Market Cap is C$10.66 M (@$0.21/share) and I think the company still has around C$2 M in cash.

Ps. Never bet the farm on any single junior no matter how cheap it might be.

Website: LINK

Note: This is not investing advice. I own shares of Headwater Gold and the company is a banner sponsor. Therefore assume I am biased, do your own due diligence and make up your own mind. Junior miners cna be very risky and volatile. Never invest money you cannot afford to lose.

Best regards,

The Hedgeless Horseman