Looking at Correlations Before and After the “Trump Hype” Market Rally

In this post I will present correlation tables for gold and silver along with different mining indices and a few of the most well known “primary” silver mining companies.

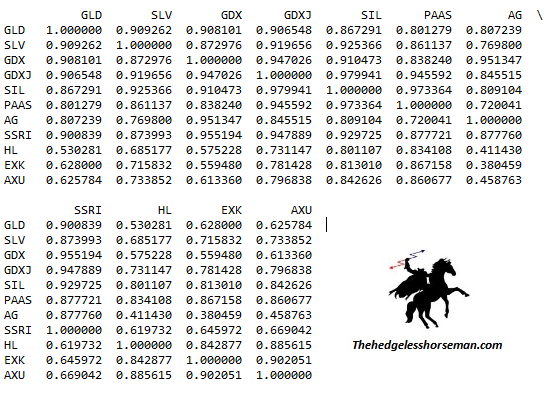

- Correlations for the 5 months leading up to the US election day:

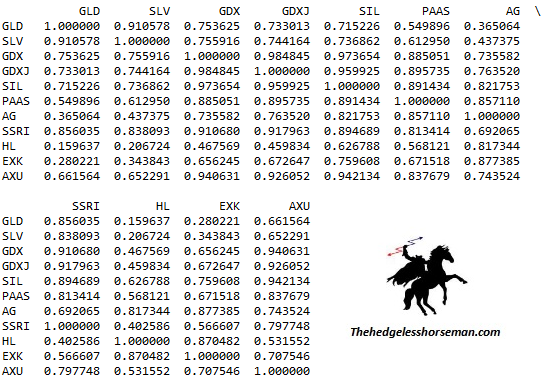

- Correlations from US election day up until April 4th:

Correlation between the miners and the metals seem to have degraded pretty much across the board. One should keep in mind that some company specific news probably have impacted the selected miners break down in correlation. With that said, the mining indices (which are a broad baskets of mining stocks) also have had a lower correlation number for the time period after election than the months running up to it. My personal guess is that we have experienced a few months of a “bearish bias” towards the metals, but especially the miners because of the stock market euphoria both in stocks (which also can be seen in the recent euphoric “soft data” numbers in the US). On top of all that, we may have seen a larger than average case of “profit taking” in light of the impressive run up in mining stocks last year as well as some additional dumping of PP shares.

Additional notes:

- GDX & GDXJ has been more correlated with silver after the election (silver & miners leading gold?).

- Lowest {single stock : silver} correlation “Post Trump” was 0.207 (Hecla) vs 0.716 (Endeavour Silver) “Pre Trump”.

- On average the correlations are a fair bit lower “Post Trump”.

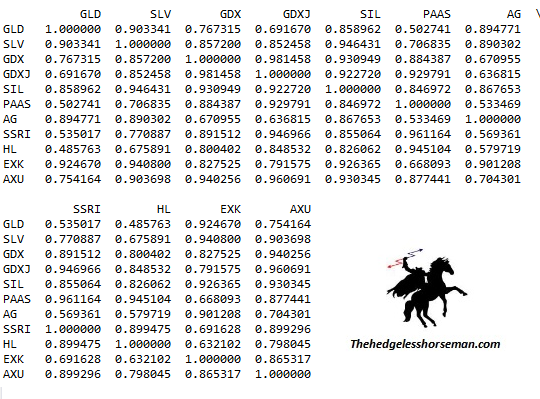

- Compare the above values with the “long term” values in the table below:

If you compare the “long term graph” above with the “Post Trump” graph you can see that since election day we have had a relatively poor relationship between the miners and the underlying metals compared to the norm. Since gold and silver have performed quite well in these last couple of months, I would argue that a correlation reversal to the mean for the miners would in this case have a bullish effect.

- For all you SSRI investors you can see that the share price has gone from a very high silver and somewhat low gold correlation (long term) to showing a higher correlation with gold than silver since at least June 8 2016. This should come as no surprise since Silver Standard has acquired both the Marigold mine as well as Claude Resources along with a dwindling silver supply in Pirquitas. With that said, all you silver bulls may now find it to be a good idea to ride another stock if you are banking to profit the most from a silver rally.