Investing Should Not be THIS Easy

When Mr Market is depressed he can offer assets for ridiculous prices.

When Mr Market is happy he can offer assets for ridiculous prices.

Mr Market is currently depressed and when I have been adding shares in juniors across the board over the last several months I feel like I am performing daylight robbery.

For every additional day of a correction there is someone that throws in the towel and sells something that is worth a LOT more than the price he/she gets in the market.

Examples:

We know Great Bear Resources is one of the big success stories over the last couple of years and it has been a quite popular stock. STILL, when the offer by Kinross came out one realizes that Mr Market was off by a whopping 50% just two months prior to the bid. In other words a major miner believes that Great Bear was worth at LEAST 100% more than it was value at by Mr Market shortly before the bid. That should tell you something.

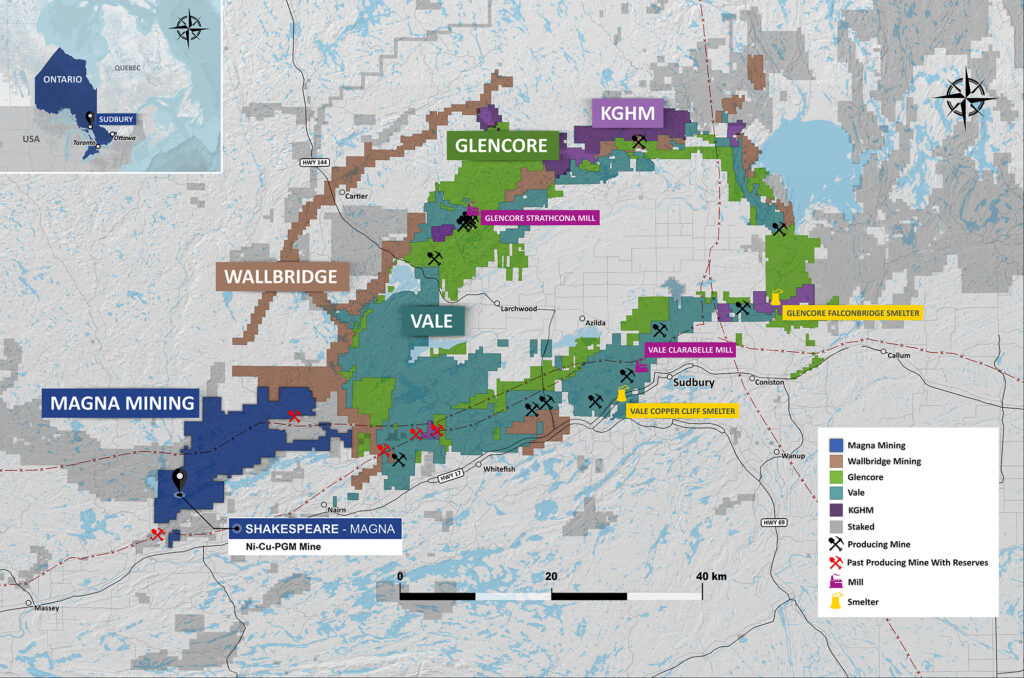

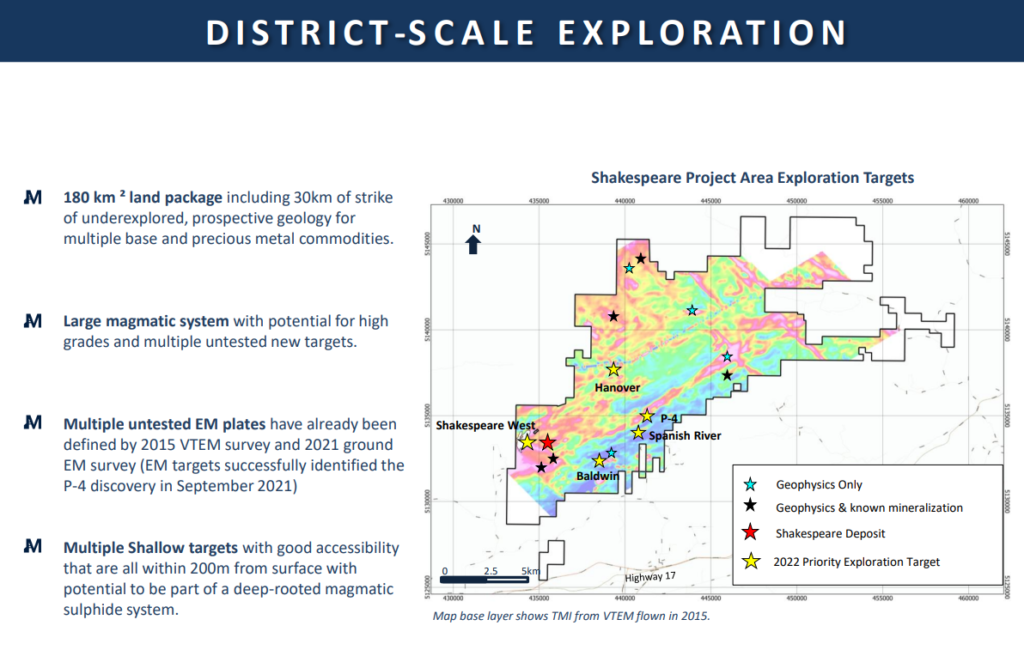

Or how about Magna Mining (NICU.V) the Nickel junior. Less than two weeks ago the company releases the following:

The MOU with Mitsui puts an IMPLIED VALUE of $64-$100 M on the Shakespeare mine ALONE (Alone as in none of the many targets that Magna has) right now.

Oh and btw Mitsui is a circa $50 B company. Maybe they see something that the (hopeless) Mr Market does not? Maybe this is the first step of something bigger that would be worth their time?

In contrast: What is a depressed Mr Market offering up the mine AND all the rest of the district scale land package (in Sudbury no less)?

… $28.7 M for the whole shebang:

Talk about margin of safety and getting all exploration potential for free to boot. I mean you can’t make this up. One should almost feel guilty for robbing Mr Market like this right now. I mean it’s not like Magna is the only junior that is selling at some >100%-200% below fair value but it’s a perfect example to use since a giant company actually put numbers on it and made it all too obvious.

You see why I keep buying week in and week out?

… Why I call this the most obvious opportunity I have seen in the junior space in the last seven years at least?

In what other sector can I find >100%-200% Expected Returns just spilling all over the table?

I literally believe that every dollar I have invested over the last several months will have an average return of 200% within the next 24 months. One only needs some common sense and patience to realize that Mr Market has lost his god damn mind. The thing is that Mr Market will one day go from FEAR to GREED and you can imagine what some of these juniors will be trading at when that happens. On that note I see a lot of belly aching on twitter and it is typically the same story: “Only been in space for 2 years”… Meaning people got in when miners had been going higher for months and months just in time for the next correction. It would be a shame to sell out at these ridiculous valuations after getting dragged across concrete for 18 months. This is a time for people to learn how hard yet simple it is to buy low and just be infinitely patient.

If one is just aware of the enormous Price-to-Value gaps in the junior sector right now one has NO RIGHT to complain about the market being hard. The opportunities are so disgustingly obvious that it should be criminal for a market to be this inefficient. But then again if Dogecoin can get a $37 B valuation then real stuff like mining companies can be so cheap that a monkey throwing darts could outperform simply by having patience.

Expect me to sound like a broken record, until this sector is at least fair valued again, regardless of how long it takes.

Note: This is not investing advice. I own shares of Magna Mining and the company is a banner sponsor. Do your own due diligence.

Best regards,

The Hedgeless Horseman

Thanks again for your story about mister market