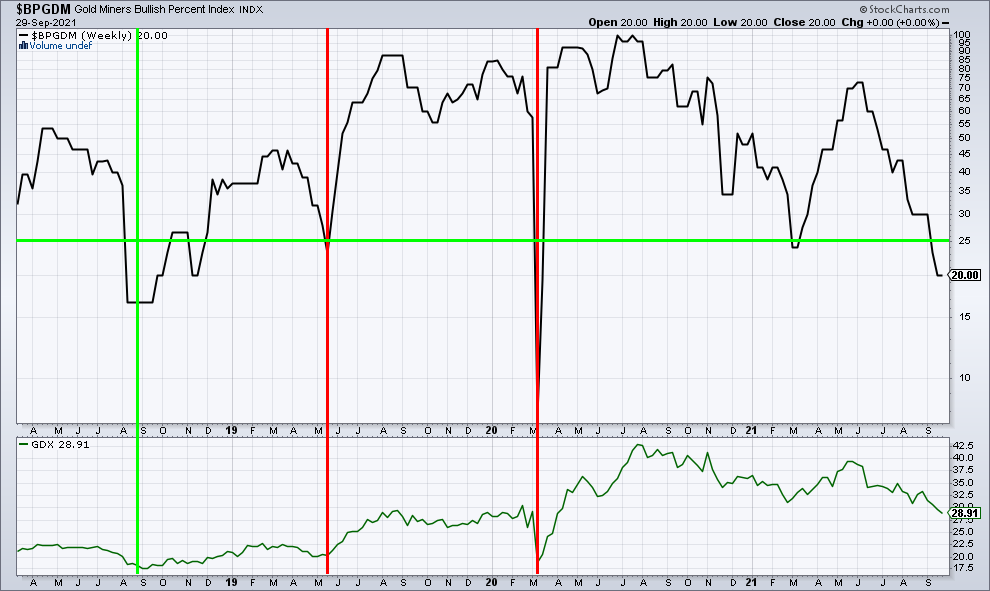

Gold Miners Bullish Percent Index

Gold Miners Bullish Percent Index:

Times when the Index had a reading of 25 or lower overlain on GDX:

Bonus chart: NDX (Nasdaq)/GDX and GDX:

Gold Miners Bullish Percent Index:

Times when the Index had a reading of 25 or lower overlain on GDX:

Bonus chart: NDX (Nasdaq)/GDX and GDX:

Just watched Gary Savage’s lastest video on gold. He thinks the gold price is likely to undercut the recent triple bottom and head below the $1680 level. Ooof. Sounds likely to have a bounce there, or at least at the triple bottom level, which could start the next intermediate cycle up. While my metals and mining portfolio has been decimated in the past 14 months, there’s no reason to sell here. However, once that intermediate cycle runs up ($1900? $1920?) I’ll be ringing the register hard on everything before gold rolls over again and goes for a lower low. Particularly if that intermediate top coincides with the parabolic phase of the stock market bubble as forecast by David Hunter. If that plays out in the coming few months, I’ll be going all cash and ducking for cover for at least a year. Everything – and I mean everything – will be sold in a flight to the dollar and T-bonds in that crash scenario. IF this plays out (who the hell really knows?) then there will be bargains in metals and miners that make today’s valuations look expensive. It seems we could be in for some interesting times ahead….good luck to all.

Hi Tyler,

I am watching Garys Videos too, since many years. He is a trader (a very good one).

So it is very important for all of us to know what timeframe and what strategy we have.

As a Long Term Investor I am aware of the „Risk“ that Gold and the mining stocks can go lower. I am prepared, mentally and with some cash to buy more good assets for bargain prices. As Gary pointed out in the same video you mentioned, the bubble phase for Precious metals will come in the next years. When? Perhaps when many of the „gold bugs“ give up.

All the best for you! ManuelK