Eloro Resources (ELO.V): Some Common Sense

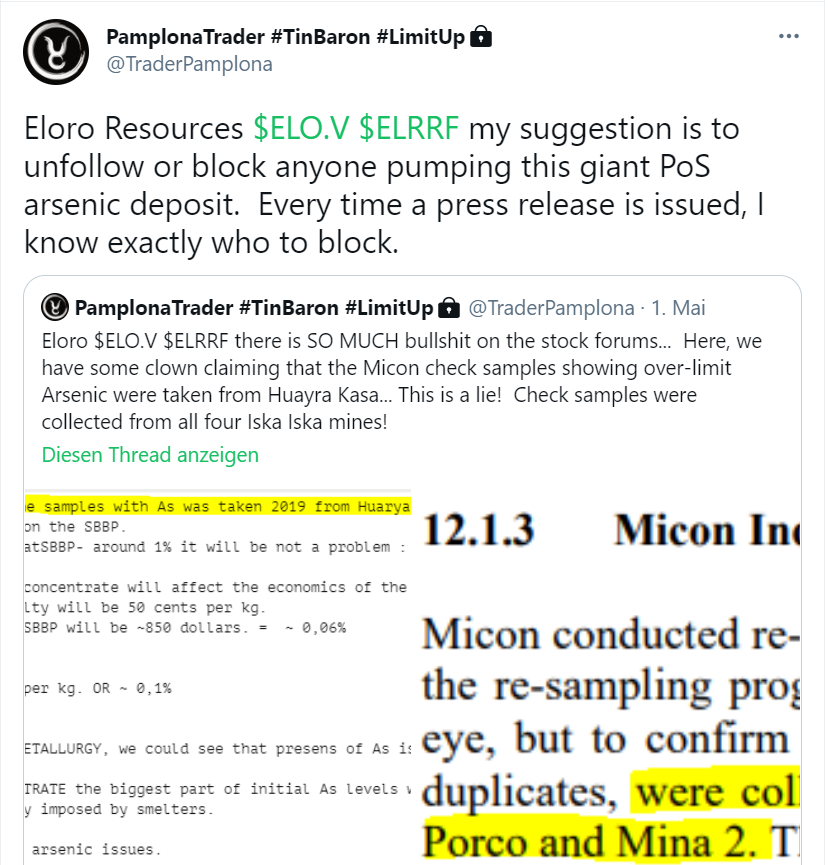

Stuff like this has been making the rounds since a few weeks and I have gotten many questions about it:

I am getting tired of answering questions about this so I thought I would just make a post on it…

This is from an email conversation with Tom, the CEO of Eloro Resources:

This is a general response(below) from Dr Osvaldo Arce as to Iska Iska and the apparent heightened arsenic level in a portion of the Huarya Kasa samples taken in the summer of 2019 that is totally blown out of proportion.. there were some heightened arsenic counts in a few samples that carried some gold and bismuth from channel samples recorded in the initial 43-101report.

Useless concentrate? Where do these people come from?Are the major polymetallic deposits such as Cerro Rico and San Cristobal producing useless concentrate?Micon Intl is working on a metallurgical study which will be part of our upcoming NI 43 -101 mineral report ..It is expected to show a very economic concentrate with minimal deleterious elements overall.The fact is that we are outlining a huge economic deposit especially with the latest drill holes that we are presently witnessing…I suggest telling some of these concerned investors not to worry so much and wait for the metallurgical report.

Lets engage some common sense…

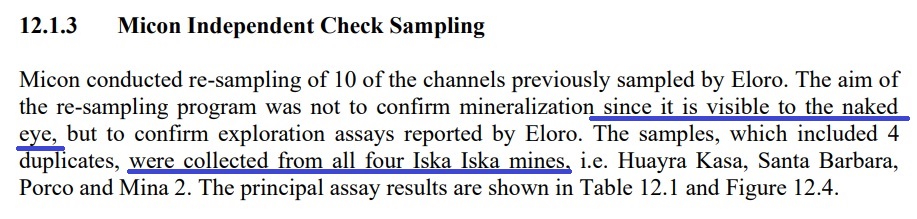

This is from the Technical Report which was mentioned in the tweet:

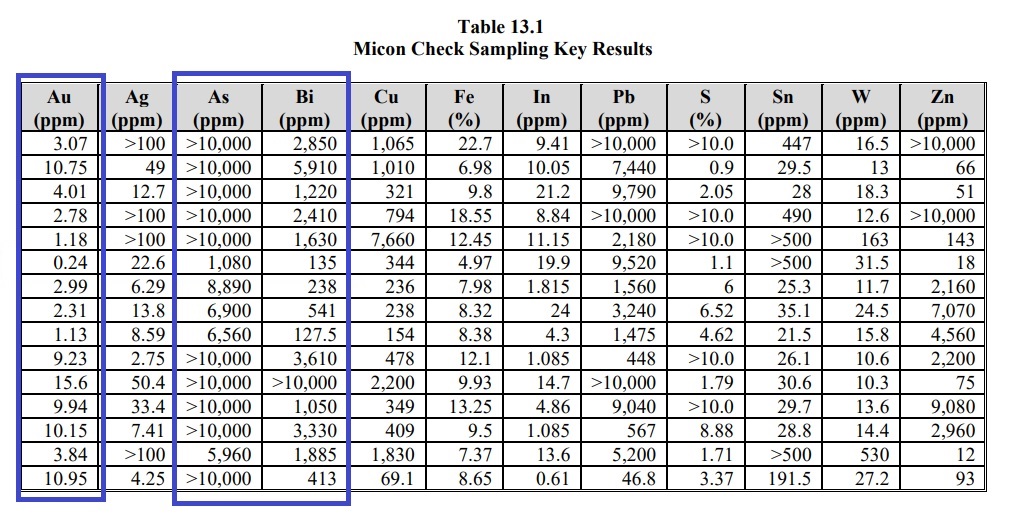

These are Micron’s Check Sample results:

… It doesn’t say which samples were taken from what specific old mine. My bet is that the samples with high arsenic and gold values were mainly from Huarya Kasa as per Tom’s response.

I would point out a few things:

- These samples are from OLD workings (“mom and pop” operations)

- The report states the mineralization is “visible to the naked eye”

- The samples in these channels pretty much all show high to very high gold values (which I will come back to soon)

… Well what conclusions can one draw?

First of all these old timers obviously didn’t drill and do assays. They obviously followed the type of mineralization which was VISIBLE TO THE NAKED EYE. They were not bulk mining a breccia. They were probably following some high grade veins or at least a zone which was high grade and easily identifiable. In other words there is obviously extreme selection bias simply due to how old timers identified a specific type of mineralization. Second of all the sample with the lowest gold grade had the lowest Arsenic value. Now lets look at some LONG BULK MINE TYPE intervals which Eloro Resources has put out…

From May 5:

- Hole DCN-01 intersected multiple mineralized intercepts including 196.09 g Ag eq/t (150.25 g Ag/t, 0.10% Sn and 0.05 g Au/t) over 56.2m and containing 342.98 g Ag eq/t (274.0 g Ag/t, 0.16% Sn and 0.16 g Au/t) over 27.53m, from 252.84m to 309.04m in Hole DCN-01.

- Recently completed hole DSB-10, drilled from a platform at the SBBP, encountered over 500 m of continuous sulphide mineralization in a position several hundred meters below mineralization encountered in hole DCN-01. Assays are pending.

From Today (May 26):

- 22.66 grams silver equivalent/tonne (“g Ag eq/t”) (35.05 g Ag/t, 0.72% Zn, 0.61% Pb, 0.11% Sn and 0.06 g Au/t) over 123.61m from 236.60m to 360.21m including 205.74 g Ag eq/t (92.30 g Ag/t, 0.57% Zn, 0.85% Pb, 0.18% Sn and 0.07 g Au/t) over 32.32m, from 317.21m to 349.53m.

- 105.41 g Ag eq/t (8.55 g Ag/t, 1.01% Zn, 0.48% Pb, 0.06% Sn and 0.38 g Au/t) over 173.58m from 449.87m to 623.45m including 199.77 g Ag eq/t (21.90 g Ag/t, 1.18% Zn, 0.93% Pb 0.12% Sn and 0.94 g Au/t) over 39.08m, from 551.19m to 590.27m.

- 146.19 g Ag eq/t (1.70 g Ag/t, 0.00% Zn, 0.01% Pb, 0.42% Sn and 0.02 g Au/t) over 10.20m from 171.60m to 181.80m in the oxide zone indicating potential for significant Sn mineralization in this strongly leached nearer surface zone.

… Does that sound like the high grade gold mineralization which was sampled that the old timers could VISIBLY spot and MINE or does it sound like some different big tonnage stuff? Remember, there seem to have been multiple events and mineralization types at Iska Iska. Yet the old timers likely only mined some high grade areas (that they could identify) which is just a small piece of what looks like a giant pie.

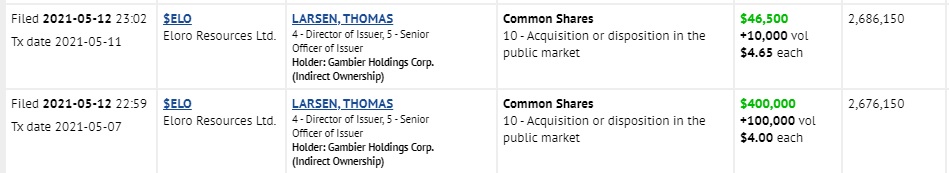

Is Tom putting his money where his mouth is?

Well yes, in a big way, just 14 days ago:

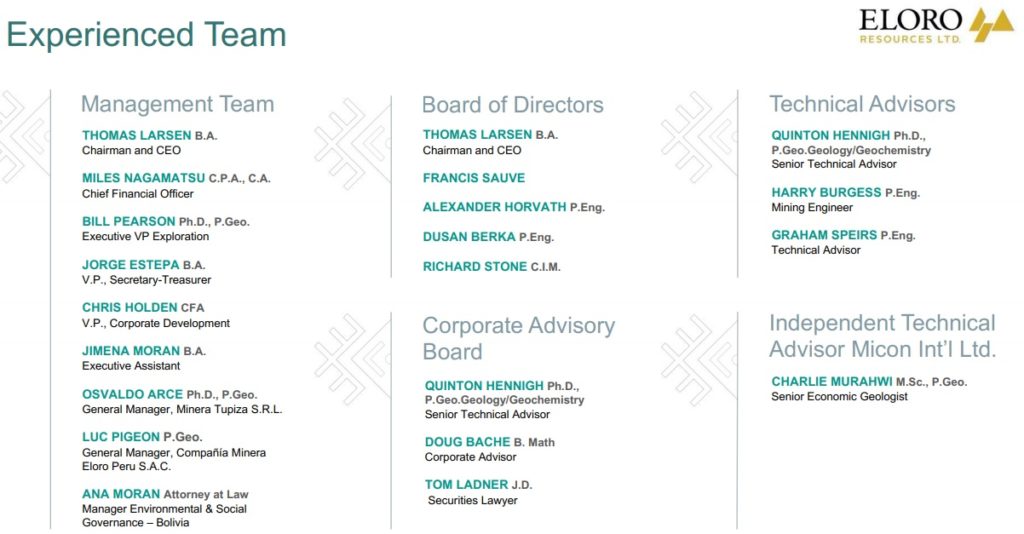

And these are the people advising him:

Are Dr. Osvaldo Arce, who is Mr. Bolivia himself, and the rest of the Phds in the picture above clueless (This is a rhetorical question)?

To sum up

15 check samples were taken from a few OLD MINES with specific mineralization characteristics which allowed old timers to identify and mine some high grade zones. This is obviously selective sampling. Yet, some are making a mountain out of a mole hill even though common sense dictates that it’s NOT the big picture, huge tonnage mineralization that is the main prize. These high grade zones sure can have some high arsenic values or whatever but the company believes that Iska Iska will have good minerology and work as good as any of the other giant deposits of this type which have been found in Bolivia. The high grade zones, with potentially higher arsenic values could simply be blended with all the lower grade bulk tonnage stuff which is not expected to have high amounts of arsenic etc.

Drawing any form of conclusions about a multi-event system, with different mineralization types, based on a few check sample results from historic mines which implies selection bias, is irrational to say the least in my book.

I personally think Iska Iska is a giant and could be a real behemoth. This is why Eloro is one of my largest positions.

Note: This is not investment advice. I own a lot of shares of Eloro Resources and the company is a banner sponsor. Therefore consider me biased.

Best regards,

The Hedgeless Horseman

I was in Skeena for the big run up from $.20 that started in 2019 (too bad my initial buy in was at $1.00 that went down to $.20). I bought more at times going forward from the bottom on the constantly good news flow from the company. Great news coming out every press release with drilling results from both Eskay and Snip but it just couldn’t get a big move up that it seemed it should be getting on those types of results. There were people with rumors on how much deleterious material was in the deposit from the original mine and that therefore with the lower grade that had been left it was going to be turned down by refineries for having too much bad material in the ore and it would never turn into a mine. This was all BS as the bad rock was primarily in the ore that hosted the high grade gold that was already mined out 20 years ago. What was left had some pockets with some amount but easily able to blend in with the rest that was mostly clean. The refinery issue has disappeared over the last year and a half, but it did enable these people to push the stock around for a period of time and keep it lower than it should have been.

No different than what is happening here with Eloro. Just some people taking advantage to try and push the stock around to make money on their shorts that keep generating higher losses on constantly good news flow from the company. This thing is going to be a monster of a deposit at the end of the day.

Amen to that!