Musings March 01: District Metals, Timberline Resources & Eloro Resources

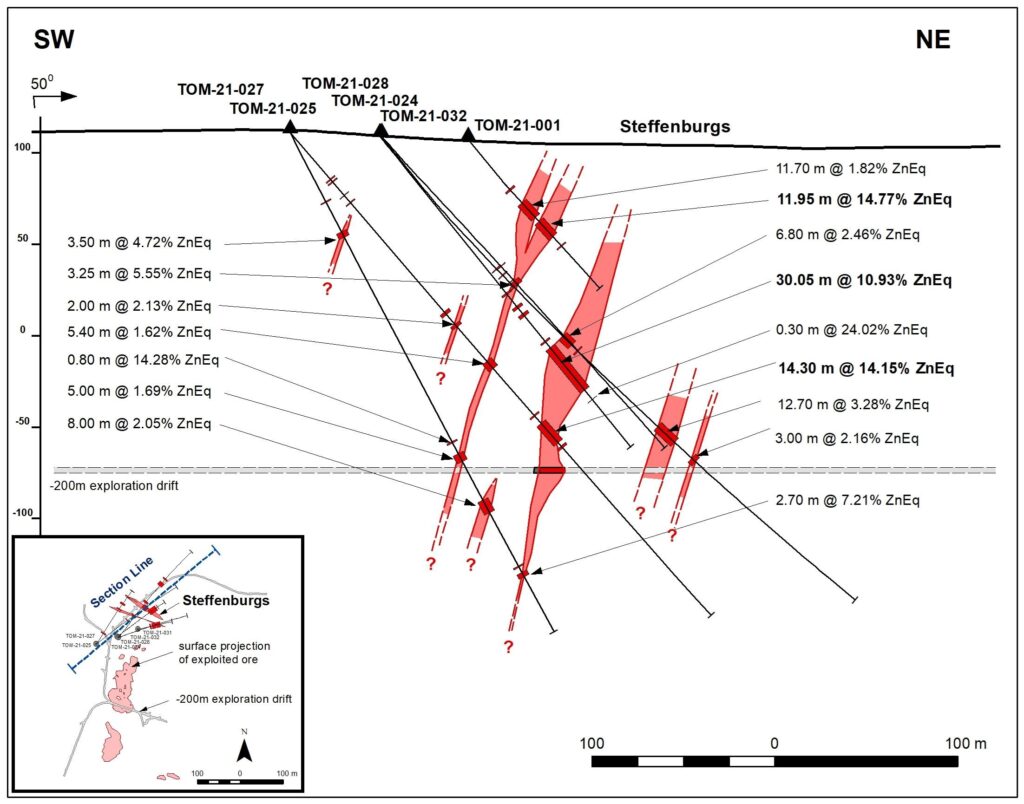

District Metals (DMX.V): hits widest high-grade intercept from the Tomtebo flagship project yet:

Garrett Ainsworth, CEO of District, commented: “The Steffenburgs zone is showing great promise that is most recently highlighted with a wide intercept of strong polymetallic mineralization in hole TOM21-028 that has returned 30 m at 10.9% ZnEq1. Elevated gold values were observed above and below the massive sulphide intercept in hole TOM21-028, which supports the occurrence of successive mineralizing events that opens up additional targets at Tomtebo. Assay results from hole TOM21-027 show us that the polymetallic mineralization at the Steffenburgs zone remains open, and it appears that this hole clipped the northwest outside edge of the plunging massive sulphide lenses encountered by holes TOM21-001, -025, and -028. Our next phase of drilling at Tomtebo is planned for early-April and will focus on the Steffenburgs zone where targeting will be finalized based on the BHEM and whole rock geochemistry interpretations.”

It’s worth pointing out that the nearby underground Garpenberg mine used US$32/tonne as cut-off in 2020. That is equivalent to around 0.55 g/t Au for said underground mining operation in this part of Sweden.

- Current Market Cap: C$18 M

- Flagship project: “Tomtebo”, Sweden

- Number of additional projects: #5

- Price per project: C$3 M

In my book District Metals remains absurdly undervalued.

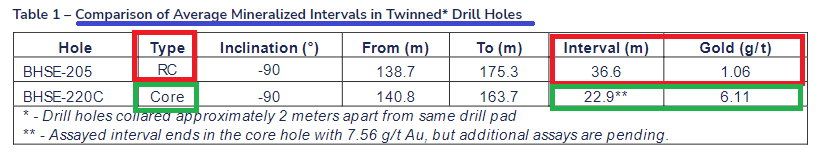

Timberline Resources (TBR.V) recently put out the first (partial) assays from the first twinned diamond core hole into the Water Well Zone.

The results were way above my expectations.

But first things first. Lets look at what a Twinned Hole is and what the context is in this case…

Well Timberline Resources suspected that RC drilling might have UNDER-estimated the actual grades in the Water Well Zone due to the fine gold being partially lost during recovery of the rock chips. In other words it was believed that when using RC drilling some of the gold got washed away by the water used to get the rock back up the hole. In order to test this thesis the company drilled a Diamond Core hole (the twinned hole) right next to an RC hole in order to compare the results. If the Diamond Core, which pulls up much more intact rock samples, proves to be higher grade then one can surmise that gold has indeed been lost (and grades been under-stated) in the RC holes. Well it turns out that this suspicion looks to be more than correct given that the Twinned Diamond Core so far has produced grades 5.8 TIMES higher than the nearby RC hole:

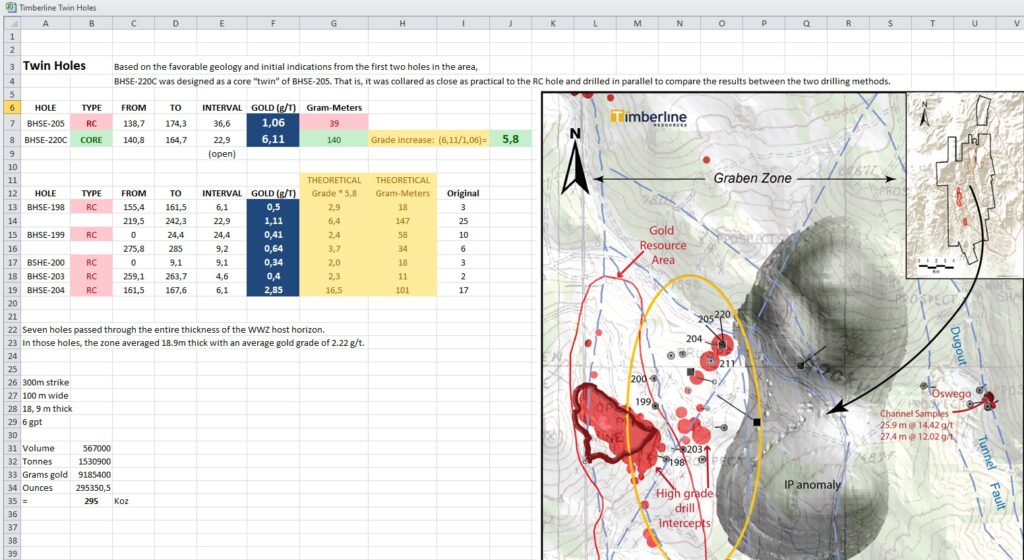

The RC hole produced a gram-meter intercept of 39 while the nearby Diamond Core hole producer a whopping 140 gram-meter intercept. Also note that there are still more assays to come from this hole which means that it is likely to end up being even better given that the last assayed part came in at 7.56 g/t Au.

This might be a game changer for Timberline and the Eureka project.

Why? Because most of the drilling so far on the project, and especially the Water Well Zone, has been done with RC drilling. In other words I think there is a good chance that the existing resource as well as all the RC drilling done at the Water Well Zone is actually higher grade than anyone thought up until now. On that note I just played around with some theoretical number in regards to what some recent RC holes might actually grade in light of the results out of the first twinned hole:

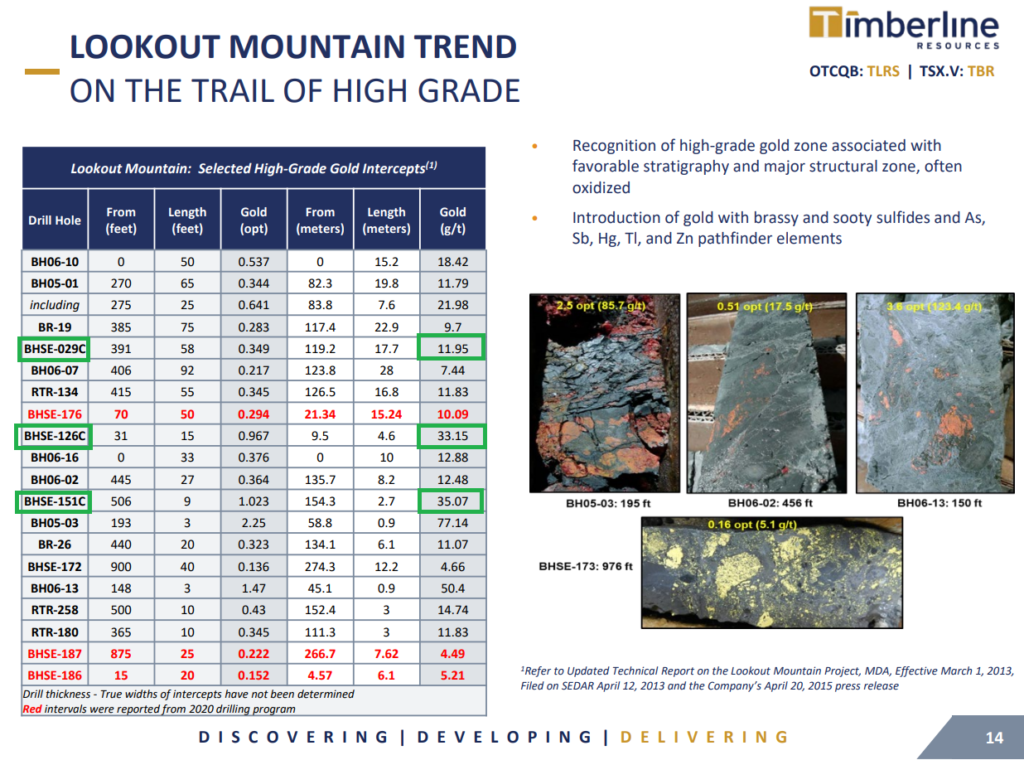

More food for thought… Consider this slide with drilling highlights from the Lookout Mountain Trend (Which includes the resource area):

If we assume that, which I think is correct, more of the drilling done at Eureka has been RC drilling then it is quite interesting to see three Diamond Core holes in this highlight list. And whereas the bonanza intercepts of 77.14 gpt and 50.4 gpt appears to be from RC drilling they are still sub 1m intercepts which potentially brings in the “nugget effect”. After that the third and fourth highest grade intercepts appear to indeed be Diamond Core holes (“C”) with 2.7-4.6 m widths.

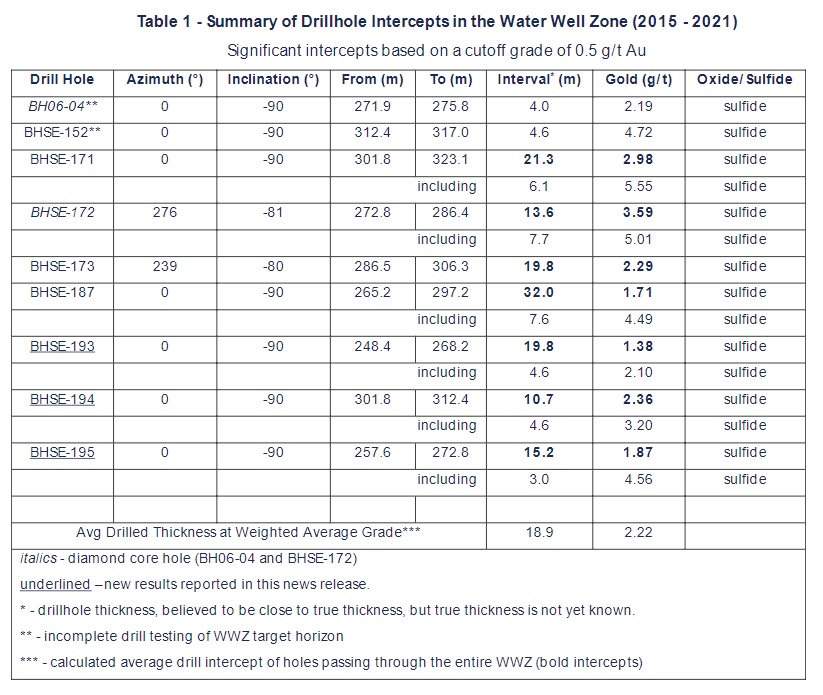

Furthermore, remember how this first twinned Diamond Core hole at the high-grade Water Well Zone graded 6.11 gpt over 22.9 m, and is still open with end of hole grading 7.56 g/t? And this was right next to the RC hole grading 1.06 gpt? Well consider what the ACTUAL grades and gram-meter results might be from these RC holes previously drilled at the Water Well Zone:

If some of those holes would in reality under-represent the real grades on the order of what the first twinned hole showed then some of those holes would go from decent/good to obscene…

Theoretically at 5.8X the grade:

- 21.3 m at 2.98 g/t Au could be closer to 21.3 m at 17.3 g/t Au

- 13.6 m at 3.59 g/t Au could be closer to 13.6 m at 20.8 g/t Au

- 19.8 m at 2.29 g/t Au could be closer to 19.8 m at 13.3 g/t Au

- 32 m at 1.71 g/t Au could be closer to 32 m at 9.9 g/t Au

Those would be world class gram-meter intercepts and sounds like something coming out of the famous Carlin deposits in Nevada. Now, is there a guarantee that all these holes, or even the bulk of RC holes around Lookout Mountain, have actual grades that are close to 5.8X higher than reported? Of course not. Some might be very accurate but I would be extremely surprised to see that it is just a coincidence that the twinned Diamond Core Hole came out with much higher grades than any of these RC holes. More importantly the results out of this twinned hole suggests that there might be significant “risks” to the upside for Timberline going forward. I mean given that Diamond Core drilling gives more accurate measurements it pretty much means that the RC results so far are Worst Case scenarios and it should only get better with Diamond drilling really. I mean even if the true grade is double instead of 5.8X it would still have an incredible effect on the implied value of Timberline.

Again, this might be a game changer for Timberline. But more importantly it is a game changer for the Risk/Reward, since this means that there is potentially significant reward, but with little to no risk (Again, the true grades should mostly surprise to the upside if RC makes some of the gold wash away). It also means that the banked resource might in reality be higher grade, with more ounces, and therefor worth a more than previously thought. I mean in my mind any 1 g/t intercept from RC drilling has a chance to be a high-grade result until proven otherwise really. The most important thing is that I don’t think I am paying for this newly discovered potential.

So just how much might this “revaluation” be worth on a risk-adjusted basis for the company?

$10 M? $30 M? $50 M? $100 M?

It is of course impossible to know for sure but I reckon that the risk-adjusted, Expected Value for Timberline at least went up 50% of the Market Cap ($15 M)… And honestly that sounds low to me given how insane the results in the Diamond Core hole really was.

“See the future early” – Eric Sprott

… I can see more incredible >140 gram-meter intercepts coming over the next 12-24 months and I can only imagine what happens with the share price if/when that turns into reality (Even in a crap market like this). I have recently added to my position and I see it as me front-running said potential future while the market has yet to grasp the implications of this latest news release. Personally I think the implications of this news added more than 50% of the current MCAP in implied value. Hence why I have added more shares.

Note that this is just airing my thoughts about how I view Timberline after the last news release and one should always do ones own due diligence.

- Current Market Cap: C$30.7 M

- Flagship Project: Eureka Project, Nevada USA

- Total Resources: 649,000 Ounces

- Additional projects: #2

Quinton Hennigh on the implications of Timberline’s news release:

Eloro Resources (ELO.V) put out a “game changer” today.

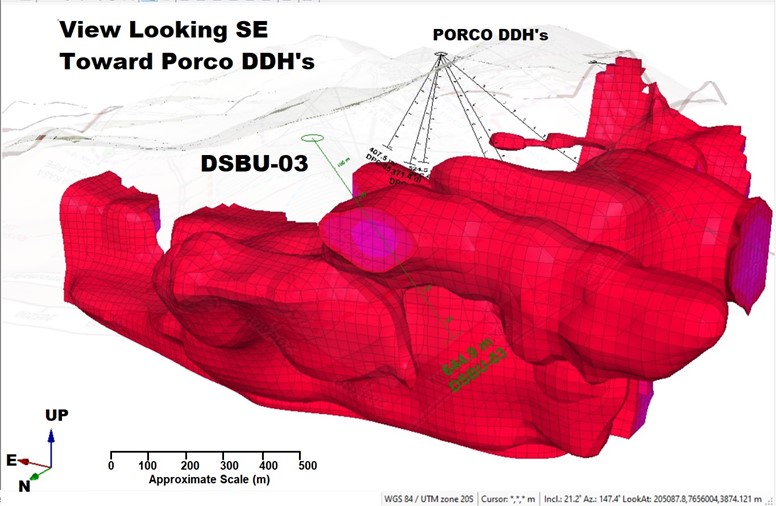

Remember that massive Magnetic anomaly that suggested there might be something big at depth that a previous hole only “clipped”? Well the company just released assays from the first hole that went through it and it was a “barn burner”:

Eloro Resources Intersects 171.57 g Ag eq/t (12.04 g Ag/t, 0.29% Zn, 0.22% Pb and 0.22% Sn) over 373.40m in Southern Part of Santa Barbara Target at Iska Iska Silver-Tin Polymetallic Project, Potosi Department, Bolivia

- Includes higher-grade sections of

- 401.81 g Ag eq/t (31.46 g Ag/t, 0.19 %Pb and 0.61 %Sn) over 28.58m from 192.72m to 221.30m,

- 261.83 g Ag eq/t (4.91 g Ag/t and 0.43% Sn) over 95.16m in underground drill hole DSBU-03.

Do you see the size of that friggin thing? Then add the fact that the this first hole through it had a large amount of tin and to put it into gold terms this hole ran >2 g/t AuEQ over 373.4 m(!). Even if one accounts for pretty hefty recovery losses that is one whopper of a drill hole. I mean the slide suggests this anomaly might have >1 billion tonne potential. Blue sky for the tin alone in this context would be some $100 Billion in gross metal value (Note: Gross as in situ value and not pure economic value). The polymetallic Iska Iska system looks almost ridiculously large and it seems to be growing with every news release.

Comment by Dr. Oswaldo Arce:

“The entire package has been subjected to later deformation and remobilization which has substantially altered many of the primary relationships. The southern area of Santa Barbara where we already have two impressive holes with 300m+ long intersections and southeast to the Porco area appears to be the potential centre of the porphyry-epithermal system. We are now on our 81st hole and all holes reported to date have multiple reportable intersections, which is remarkable. The system remains open along strike to the northwest and to the southeast. Geological mapping and diamond drilling suggest that the potential strike length of the entire system may be as much as 4km, the width up to 2km, with a depth extent of 1km or more.”

I have no idea just how big Iska Iska will be at the end of the day but right now I am very much open to the possibility of this being one of the single largest discoveries in decades. And yes this is still relatively early and we do not know the metallurgy etc but to have such an insane intercept in the first real test of this anomaly is truly a game changer. It de-risks the entire anomaly and is basically Proof of Concept that the Magnetic anomaly might indeed be a proxy for significant mineralization. This might be the single most important news release since the discovery hole at the Santa Barbara Breccia pipe. I think this news release single handedly added >$100 M in risk adjusted, implied value to Eloro. Hence why I bought more shares immediately at the open today. I almost couldn’t believe that the stock just opened up some +3% on this news even in this crappy sentiment environment.

Just FYI Eloro is breaking out of a year long consolidation to boot!

Note: This is not investing advice. I own shares of all companies mentioned and they are banner sponsors. Therefore consider me biased and do your own due diligence. Juniors are risky and volatile. Never invest money you cannot afford to lose.

Best regards,

The Hedgeless Horseman