Jay Introduces the title for the show, provides sponsor updates and Michael will opine from his technical viewpoint on the dollar’s future and precious metals.

Continue reading » August 18, 2021 admin Gold No Comment Tom welcomes Michael Oliver back from Momentum Structural Analysis. To subscribe to our newsletter and get notified of new shows, please visit http://palisadesradio.ca Michael discusses the bubbles in the equity markets, and the S&P indicates a top while momentum is waning. Bear markets typically begin...

Continue reading » August 16, 2021 admin Gold No Comment Mark Bristow, CEO of Barrick Gold, discusses with David Lin, anchor for Kitco News, why our current environment may be similar to that of 2008’s, when gold initially lagged and then spiked three years later. Bristow comments on second quarter financial results and provides guidance...

Continue reading » August 16, 2021 admin Gold No Comment The gold market — at least the paper gold market — has seen a lot of volatility recently. Gold lost about $80 between August 5 and August 8 before rebounding. Gold gained over $22 today, by the way, to close at $1,753. Many gold investors...

Continue reading » August 13, 2021 admin Gold No Comment During corrections as we are seeing now there are a lot of people who get nervous and sell out due to fear that miners could go lower (get cheaper). At the same time we know that the macro and fundamental backdrop for mining is very...

Continue reading » August 9, 2021 admin Gold, Uncategorized No Comment July 8, 2021 This correction in miners have “finally” been able to take down the more advanced juniors in the space. The ones that have a lot of banked success which would take years and often cost tens of milliomns to replicate. Today many are...

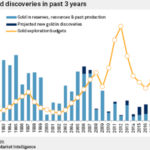

Continue reading » August 8, 2021 admin Gold No Comment With each passing day the supply/demand function gets more favorable with or without the debt bubble collapsing… Production has been trending up… Major new discoveries are way down… … ALL currently operating gold mines will be run out of gold one...

Continue reading » July 25, 2021 admin Gold No Comment Since I have been on a site visit I haven’t followed the market that closely but I did read that yesterday was a slaughter. I checked some individual names and some were down like -18% even though gold was only down -0.9% and silver down...

Continue reading » July 17, 2021 admin Gold, Gold & Silver Stocks, Investing Strategies 5 Comments “Warren Buffett’s deputy grew his retirement account from $70,000 to $264 million in 29 years, ProPublica reports” https://markets.businessinsider.com/news/stocks/warren-buffett-ted-weschler-roth-ira-retirement-account-taxes-propublica-2021-6 $70,000 into $264,000,000 in 29 years. “All” it took was a Compounded Annual Growth Rate (CAGR) of 32.84%… Yet many (most) out there are putting a...

Continue reading » July 12, 2021 admin Gold 1 Comment July 1, 2021 By Matthew Piepenburg June 28th has come and gone, which means the much-anticipated Basel III “macro prudential regulation” to make so-called “safe” banks “safer” has officially kicked off in the European Union (as it will on July 1 for U.S. banks and January 1,...

Continue reading » July 4, 2021 admin Gold No Comment