THH – Cassiar Gold (GLDC.V): Aggressive Growth Across an Immense 59,000 Ha Land Position in BC With 1 Moz For Starters

Cassiar Gold (GLDC.V) is one of the best Risk/Reward stories I think I have come across in the last couple of years. In this article I will explain why I have bought shares in the open market and why I was happy to have the company on as a banner sponsor in order to help get the story out there…

Cassiar Gold In short:

- Mega district scale land position and controls the entire “Cassiar Gold“ District

- 1 Moz at 1.43 gpt Au Inferred Resource (“The Taurus deposit”)

- Near-surface gold mineralization in a flat-lying valley

- 59,000 ha property bisected by a highway into “Cassiar North” and “Cassiar South“

- Bulk tonnage potential at Cassiar North

- High-grade Epizonal potential (Fosterville and Queensway style) at Cassiar South

- 1 Moz at 1.43 gpt Au Inferred Resource (“The Taurus deposit”)

- Has a second project called “Sheep Creek Camp“

- An analogue of the Cassiar district

- Superb jurisdiction

- Both projects are located in British Columbia, Canada

- A truly incredible team for a junior

- Ex IAMGOLD, Ivanhoe Mines, Kirkland Lake, Sabina, B2 Gold, Bema Gold, McEwen Mining & Reyna Silvere etc

- Skin the game

- 22% insider ownership

- Mine permits and a permitted 300 tpd mill

- MCAP: C$75 M at $1.18/share

- Cash: ~C$3.5 M

I don’t know if I have seen a junior that has ticked so many boxes. You have major margin of safety with a 1 Moz resource, permits, jurisdiction and a mill. You have a truly incredible team, which should provide way above sector average in terms of ROI on dollars spent, and 59,000 ha of blue sky potential that an investor isn’t really paying for. Lastly insiders have a lot of skin in the game. Cassiar is a top #5 case in terms of Risk/Reward in my book and one of few juniors which I think are worthy of being a cornerstone holding especially thanks to the Margin of Safety aspect and people involved. I do expect the company to raise some money one of these days and I hope to be able to participate.

My Case For Cassiar Gold:

- #1 Margin of safety

- 1 Moz at 1.43 gpt Inferred

- Top tier jurisdiction

- Mine permits in place

- Permitted 300 tpd mill in place

- Mature infrastructure in place with highways, access roads, power lines

- = Significant sunk costs and time savings

- #2 Probable Growth

- Cassiar North (Existing resource which is wide open)

- Near-surface, bulk-tonnage gold resource at Taurus Deposit

- 2021 highlights (downhole widths):

- 23.2 m at 3.56 gpt Au

- 13.1m at 3.53 gpt Au

- 45.5 m at 2.40 gpt Au

- 34.9 m at 2.56 gpt Au

- Cassiar South (High-grade veins around underground workings)

- Epizonal style gold mineralization akin to the Fosterville mine (Kirkland Lake) and the Queensway project (New Found Gold)

- Historical production of ~316,000 oz from four veins with recovered grades of ~10-20 gpt Au with mine dilution

- 2021 highlights (Assays from 13 out of 19 holes are still awaited)

- 4.8 m at 35.1 gpt Au

- 6.4 m at 12.6 gpt Au

- … Coupled with a true world class team with high ROI expected

- Cassiar North (Existing resource which is wide open)

- #3 High Potential Growth

- Cassiar Project: 59,000-hectare land package with multiple known targets with either bulk-tonnage or high-grade vein potential

- Sheep Creek Project: Analogue to the Cassiar Gold Project and Cariboo-Barkerville

- … Coupled with a true world class team with high ROI expected

- Most important thing: The Price is C$75 M for;

- 1 Moz of Inferred gold in the ground

- + Mine permits in place

- + Probable growth

- + any blue sky potential across 59,000 ha at Cassiar + Sheep Creek

- + Expected above average ROI on money spent due to the quality of the team

- + Permitted 300 tpd mill

… I personally think maybe >C$150 M would be somewhat of a fair, but relatively conservative, value for all the above. Therefore the Risk/Reward at the current price is just absurdly good and highlights why I love being a buyer during sentiment lows in the junior mining space. What is the value of “just” the infrastructure, permits and mill? Or the costs of drilling up a 1 Moz resource? I mean the costs for a junior to get all that, that does not have all that in place already, is probably a few years and some tens of millions of dollars at least on average (obviously very situational). These de-risking factors certainly hike up the value of any ounces already discovered, any potential ounces that are yet to be discovered, and is surely something an acquirer would pay up for (Despite the fact that Mr Market is currently not making me pay for it). I simply cannot complain if I can buy something for what I consider is way less than what it is worth AND get all upside potential for free to boot.

“A Tale of Two Stories”

What I think makes Cassiar Gold extra “deadly” is the fact that you have both the bulk-tonnage, lower grade gold potential at Cassiar North as well as potential for more high-grade, Epizonal-style gold (Fosterville & Queensway type) at Cassiar South. Furthermore, there are, as previously mentioned, mine permits in place along with a permitted 300 tpd mill located centrally within the land package. In other words, I think there are more ways to “win” for Cassiar Gold than most juniors. What I mean by that is that there is potential for the company to just keep exploring and prove up a large, multi-million ounce resource in the future, that could require quite a bit of CAPEX, but which could be acquired by a larger company. However, there is also the potential for the company to prove up a smaller high-grade gold resource at Cassiar South, which could very well allow the company to simply go into production, given that there is indeed a permitted mill nearby. In essence I think there is a remarkable flexibility present in Cassiar Gold in terms of allowing the company to go the a) Pure exploration route and/or b) Exploration as well as low CAPEX development route. With a resource in place already, an investor gets both Beta leverage to gold and Alpha opportunity through additional value creation via exploration.

In other words Cassiar is theoretically;

- An exploration company with potential for both a large, lower-grade gold deposit, and high-grade Epizonal gold deposit(s)

- A high-grade gold developer which owns a mill and mine permits

- … Or potentially both.

For some C$75 M I simply think it’s way underpriced.

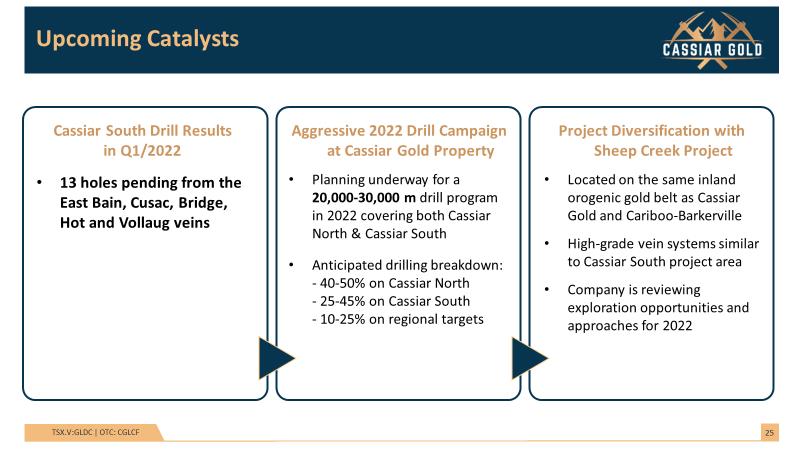

Near-term catalysts

- #13 holes yet to be reported from the “East Bain”, “Cusac”,”Bridge”, “Hot” and “Vollaug” veins at South Cassiar (The high-grade Epizonal targets)

- Announcement of 20,000-30,000 m drill program covering both Cassiar North and Cassiar South along with regional bulk-tonnage targets.

Now let’s go through the corporate deck…

Highlights in The Words of The Company:

… This slide says it all really. I mean we know most juniors will claim to check all these boxes but Cassiar can actually back it up.

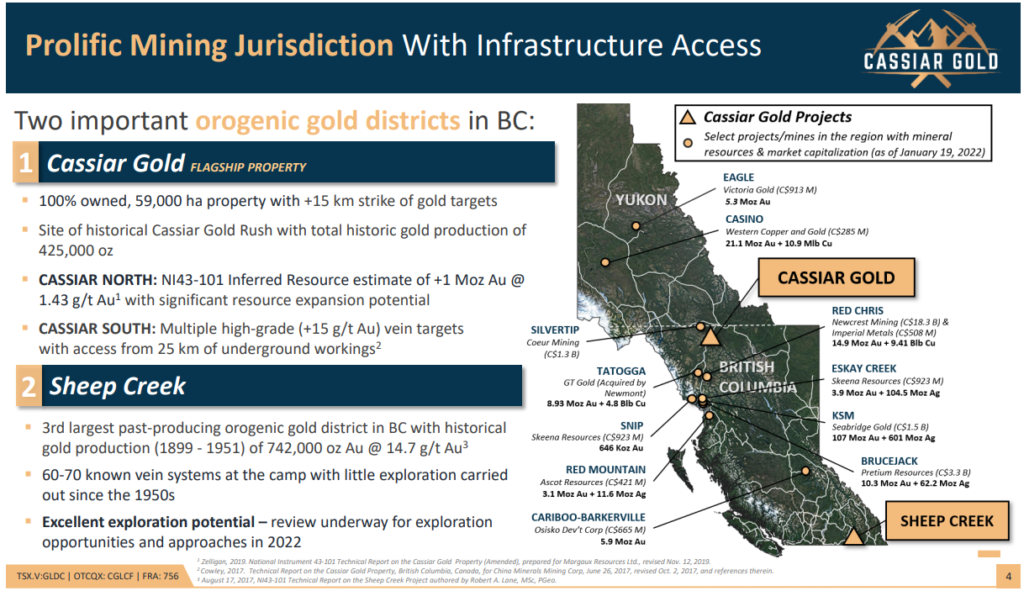

The project portfolio overview:

As many probably know British Columbia is one of the hottest jurisdictions in the world as evidenced by recent M&A activity. In fact, it might be the hottest jurisdiction in the entire world right now which proves that major miners want to acquire assets and produce gold in BC. In other words, if there was ever a place right now where success would be extraordinarily valuable, it would probably be in British Columbia. This fact will of course positively affect the ROI on dollars spent and therefore push the Reward side in the Risk/Reward function upwards. This notion coupled with the following aspect of Cassiar Gold makes the Risk/Reward increasingly attractive in my opinion…

People:

… You can see for yourself how stacked the team is. Doug Kirwin, for example, is a legendary geologist that used to work for Ivanhoe Mines and he loves the Cassiar Gold project and draws parallels to the Fosterville mine. I mean Ivanhoe Mines was famous for going after big projects so I have to ask myself what kind of blue sky potential must be present in order to get Doug Kirwin excited. They also have Dave Rhys, one of the most highly regarded and sought-after structural geologists and orogenic gold experts in the world. Dave’s client roster includes the largest mining companies in the world such as Kirkland Lake (where funnily enough he consulted on the Fosterville mine), Newmont, Agnico-Eagle just to name a few. He is not someone who will make time for just any project unless he truly sees something special, as he does here. While not actively involved internally to the company, there is also Quinton Hennigh of Crescat Capital, who’s opinion I highly regard. Given how bullish he is on Cassiar, I just impulsively know that the potential prize is large, given that Quinton is also a “go big or go home” kind of guy. All three have intimate experience with the world-renowned Fosterville mine so I think their thumbs up all point to the inevitable conclusion that there is indeed potential for a big prize (Which I imagine is a lot more than C$75 M). Furthermore, the company recently hired the “heavy hitter” Vern Shein as their new VP Exploration whose specialty is “advancing exploration programs through Preliminary Economic Assessment, Feasibility Study and into production“… Hint hint. If their suspicions are correct in terms of the merits of Cassiar Gold’s projects, then I expect us shareholders to make quite a bit of money in the coming years…

I would bet that whatever amount of money an investor would put in the hands of this team that the ROI on those dollars will be way above the average junior’s in terms of value creation. What I mean by that is: let’s say you give a poor quality team $10 M and they might end up creating $5 M in value (-50% ROI). A great team like this might take $10 M and create $30 M in value on average (200% ROI).

Remember the Importance (value) of Location, Jurisdiction, Infrastructure, De-risking and People…

These factors affect the expected ROI and by extension the Reward side of the Risk/Reward function…

- A good location, infrastructure (roads & a mill etc), de-risking (ie permits that shortens development time = increase NPV) and jurisdiction will hike up the value of every ounce of gold found ($/oz).

- The caliber of people will in turn greatly affect how many ounces on average are found per dollar spent (oz found/$ spent)

… So it’s in essence a very positive multiplier effect. Of course the quality of the system itself also, in terms of expected oz found per meter drilled, is also a multiplier. On that point I will only say that I think the people involved is a sign that these are robust systems. Both projects have either produced close to, or above, 100 gram-meter intercepts after all.

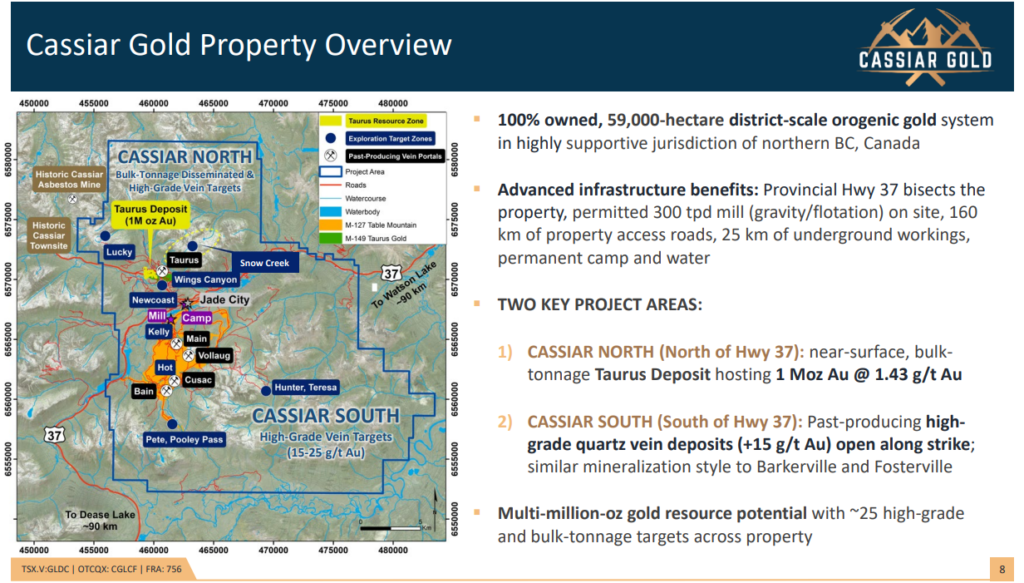

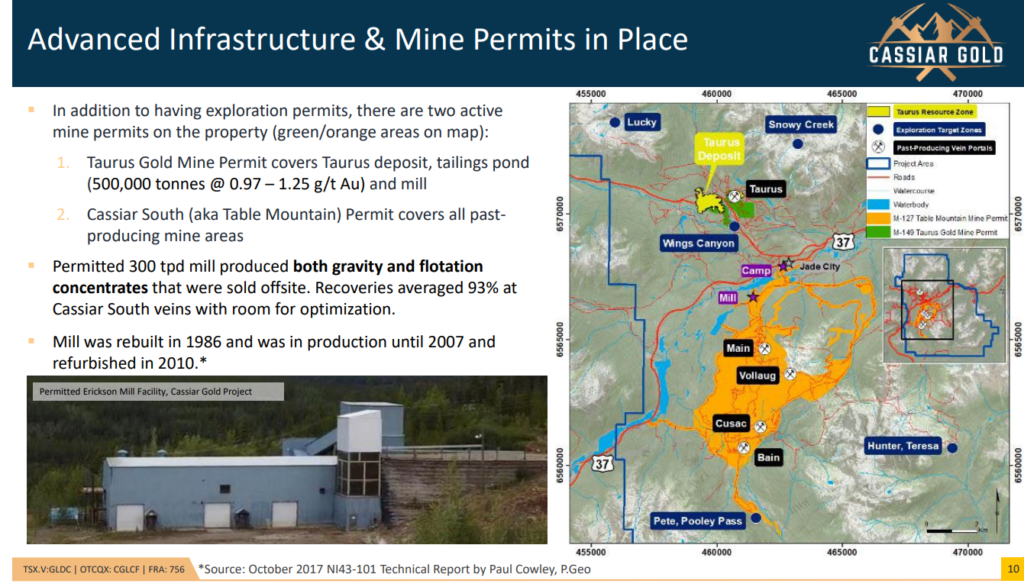

The Cassiar Gold Project:

… That’s a huge land package where the company could be exploring for years or even decades. In other words there is a LOT of exploration potential. Note that this true district scale project has a) Highway access (Provincial Hwy 37), b) a permanent camp in place already, c) 25 km underground workings and 160 km of access roads. Also note the extensive MINING PERMITS in place (Green and Orange). And don’t forget about the fact that there is a 300 tpd mill already in place:

Infrastructure is something I think many retail investors underappreciate. I remember I did it when I started investing in this sector at least. But one has to remember that the Value of an ounce in the ground is only as Valuable as the resulting margin that is left from taking the ounce out of the ground and selling it. The more sunk costs (infrastructure) that are already in place, the more valuable the ounces in the ground become, all else being equal. If this infrastructure did not exist we might be talking years and tens of millions of dollars just to put it there. And don’t forget about the permits that are already in place. Time has value and a shorter time frame to monetization of ounces the more valuable they are in the ground.

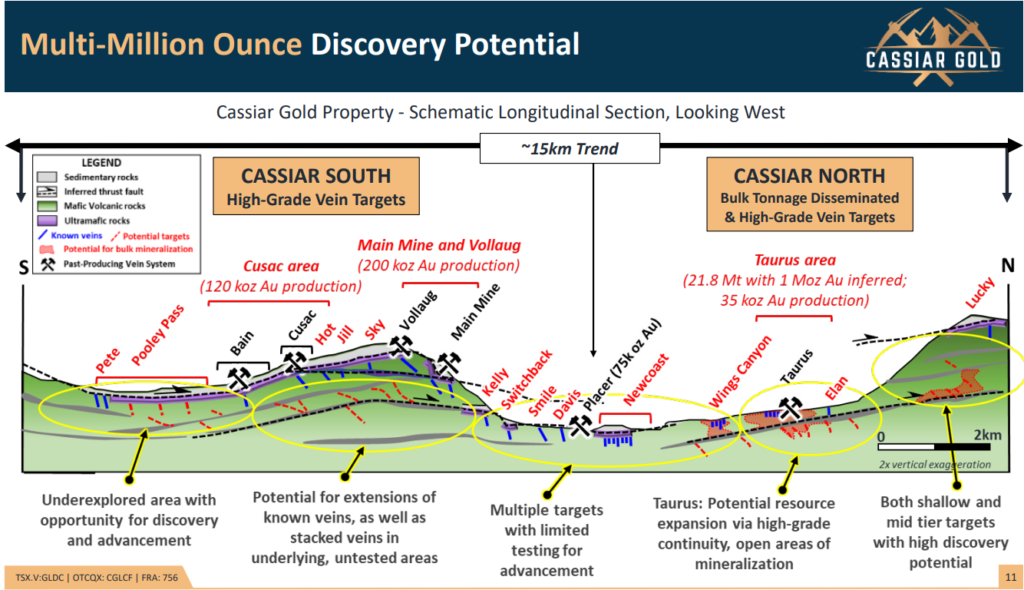

And I love this next slide which really hits home the blue sky potential across the whopping 15 km trend:

This is what I picture when I think of what “district scale potential” really means. If you really want to salivate then watch this part from Crescat Capital’s presentation of Cassiar Gold:

And here is Doug Kirwin talking about what made him get involved:

I think there are a few main take-aways here for me as an investor:

- You have some of the smartest geologists around seeing immense exploration potential at the Cassiar Gold Project and compares it to other famous Epizonal gold deposits such as Fosterville & Queensway

- And the most important thing: It’s not anywhere near priced in

Most people know that Fosterville and Queensway are literally billion dollar projects. At Cassiar’s Market Cap of around C$75 M, there could really be a lot of upside from here even if the company would reach “just” 30% of the blue sky case. If Cassiar would be valued at $300 M already then we could talk about what degree of potential is already priced in and therefore how much blue sky exploration risk one is actually taking on. Despite the fact that risk in my opinion is overpaying for something, I am still puzzled by how many investors cannot get themselves to pull the trigger on cheap juniors overall right now, “because exploration success is not guaranteed”. Hello, nothing is ever guaranteed and the only thing an investor can control is what Price one pays for the potential and by extension how good the Risk/Reward is. So what better time to place a bet than when exploration success is not priced in…?

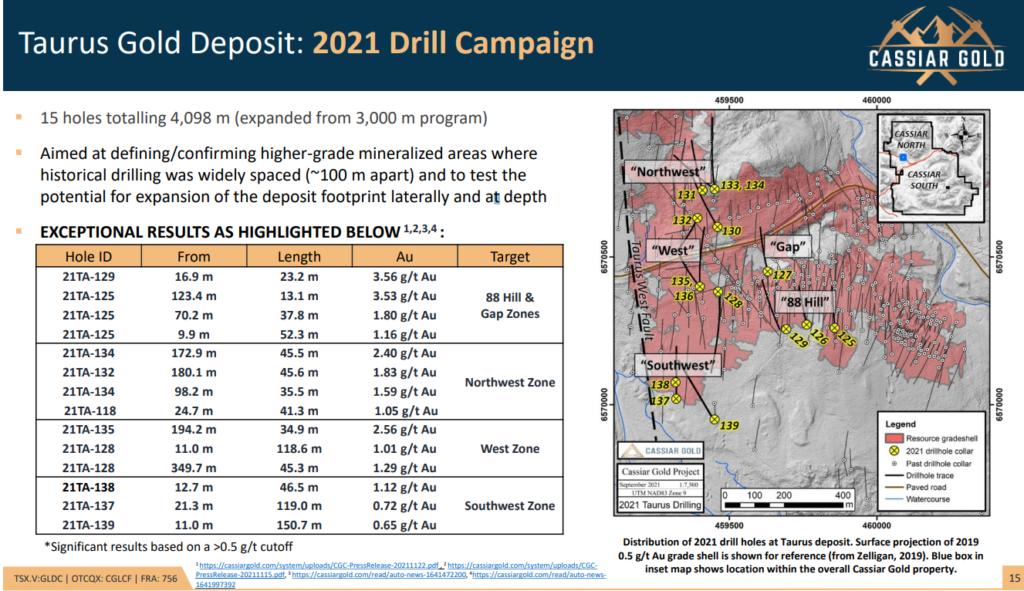

Even though the company only did a small-scale drill program at the main Taurus deposit in 2021, it still produced very impressive results for a potentially shallow, open-pit deposit:

There are a lot of cross-sections in the company presentation that I will not go through here. Suffice it to say, the Taurus deposit is pretty much only limited by what has been drilled so far, as I understand, and this area will see a lot of drilling this year. This includes targets such as Wings Canyon some 400 meters to the south-east which saw an intercept of 128.5 m grading 0.56 gpt Au in 2018. The potential for Taurus and the other lower grade targets is economies of scale if the company can prove up a couple of million ounces or more in the future.

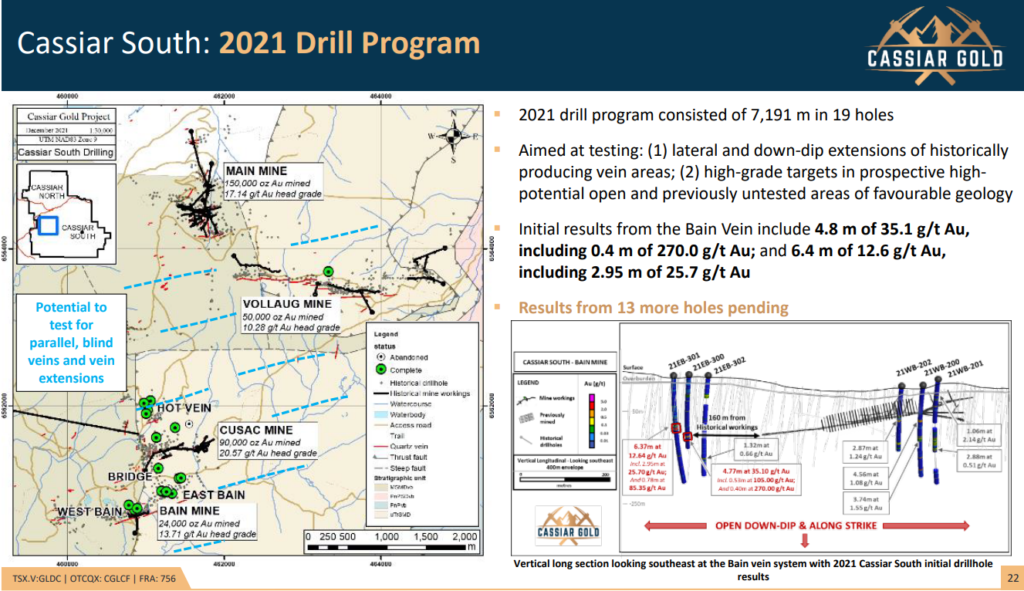

Furthermore, there were also some very impressive high-grade hits at the Cassiar South area:

After re-listening to Quinton’s and Doug’s videos a few times it becomes pretty clear that it is actually these high-grade to bonanza-grade veins that they are most excited about. I mean with grades like that it’s easy to digest why they compare Cassiar South to Fosterville and Queensway. You don’t need a lot of that stuff to have a potentially quite economic project on your hands. Especially if you already have a permitted mill nearby. Lets for example say they prove up “even” 500 Koz of very high-grade gold which would produce a profit of $500 per ounce at today’s gold price… That’s a total profit of $250 M.

To give you an idea of just how valuable high-margin, Epizonal gold ounces can really be just look at the Q3 financials for the Fosterville mine:

- “The Fosterville Mine produced 134,772 ounces in Q3 2021 based on processing 180,255 tonnes at an average grade of 23.6 g/t and average mill recoveries of 98.7%.”

- “Operating cash costs per ounce sold(1) averaged $170 versus $142 in Q3 2020 and $162 in Q2 2021.”

- “AISC per ounce sold(1) averaged $337 compared to $349 in Q3 2020 and $353 the previous quarter.”

… That gold mine is actually a “gold mine”. A Fosterville ounce might be worth multiples of an average ounce in the ground. In other words a deposit of say 500 Koz might be worth more than a 3 Moz deposit, simply due to the fact that the margins on those ounces are way higher, and thus way more valuable. And again, Quinton and Doug are more than familiar with this kind of mineralization, and how valuable it can be for a company.

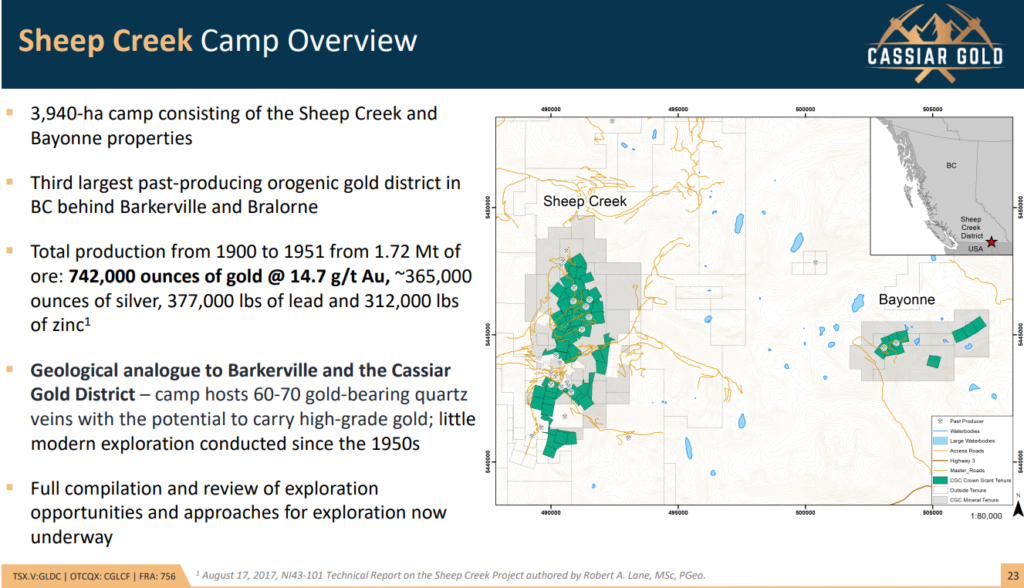

Lastly we also get the Sheep Creek property as a bonus:

The market did not really react at all to this news as could probably be expected. Peripheral assets are heavily discounted right now after all (often given literally no value put on them). What I personally love with multi-asset juniors is that a project like this, which has not been priced into Cassiar, could be spun out one day for example. What do you reckon the Market Cap could be for a junior with Sheep Creek as it’s flagship project in a hotter sentiment environment? My bet would be an easy >C$20 M given the jurisdiction, geological context and historical results. Well C$20 is 20/75 = 27% of the current Market Cap of Cassiar Gold. Thus I see some very low risk, but solid return potential, from Sheep Creek if Cassiar would decide to spin it out. Another scenario is of course that the Cassiar Gold project gets acquired and Sheep Creek is spun out to the shareholders for Cassiar Gold version 2.0. If we are lucky, we might thus have gotten a multi-bagger from the Cassiar Gold Project and will get a shot to do it again for free.

Lastly this is what shareholders can look forward to:

“My bet is that this thing will expand tremendously over the next couple of years” – Quinton Hennigh

Note again that there are 13 holes left to be reported from the 2021 drill campaign and that the company is planning a much larger drill program in 2022 covering both the bulk-tonnage and high-grade targets.

Musings

In 2016-2917 when this sector was “hot” I saw some juniors being valued higher than Cassiar’s current Market Cap after just a potential discovery hole or two. And that was without permits, a mill, a resource, a world class team and when gold was trading at $1,300-$1,400 per ounce. Lets just say I think many retail investors, especially newcomers who have mostly seen two years of decreasing sector sentiment, will be shocked by how high many juniors can run during a sentiment high. Just as a junior can trade 50% below fair value during a sentiment low it can also trade 100% or more above fair value during a sentiment high. Personally I don’t expect to see a better investing environment than this, especially in the gold juniors, for at least another decade or more.

In summary

I expect there is a low risk of me losing money in Cassiar and there being a relatively good chance of me sitting on a couple of hundred percent of returns within 24 months. Oh and by losing money I mean a permanent loss and not just volatility (paper loss in a given time frame). In the short term, anything can happen with Price as Mr. Market has shown us numerous times. In the long run, I will say that I can certainly see “>10 bagger” potential in Cassiar which also allows for a quite large margin of error to the upside. If this district turns out to host millions of ounces then I should do great with Cassiar. At the same time, if they can find say 500 Koz of high grade on top of the current resource, I might still get a multi-bagger. I like this kind of “aim big, miss, and still win” potential aka an “asymmetrical bet” in my opinion. Lastly, I expect the company to raise some money soon in order to fund the 20,000-30,000 drill campaign this year. I expect that whatever amount is raised, there will be value created that far surpasses it, and it will still be significantly undervalued in my book after the raise. Hopefully I will be able to participate and up my stake.

As always, no need to bet the farm on any single stock, regardless of how good the Risk/Reward is!

Note: This is not investing advice. I own shares of Cassiar Gold, which I have bought in the open market and the company is a banner sponsor. Therefore assume I am biased, do your own due diligence, and form your own opinion. I cannot guarantee the accuracy of the content in this article. Junior miners are risky and volatile. Never invest money you cannot afford to lose.

Best regards,

The Hedgeless Horseman