THH – Cabral Gold (CBR.V): #2 Deposits, #5 discoveries, #5 Drill Rigs… And Misunderstood

Cabral Gold (CBR.V) is a very interesting story from multiple angles. It’s one of the more “complex” exploration stories since the company has been drilling more targets than I can remember the names of within the company’s huge land package in Brazil. Not only that, but the company has made Three discoveries of so called “oxide blanket” mineralization at/near surface. These oxide blankets are basically loose material at surface with gold in it that was eroded from bedrock (gold) sources over the eons. It’s not the “sexiest” form of a gold deposits but my hunch is that these oxide blankets could be wildly economic as well as easy and cheap to recover gold from. I mean they start at surface and some parts of them show pretty damn good grades (higher than probably is required for most conventional open pit deposits). The strip ratios could be minimal, it’s probably free digging and the production flow sheet could be very simple.

(Ps. I own shares of Cabral Gold and the company is a banner sponsor so assume I am biased!)

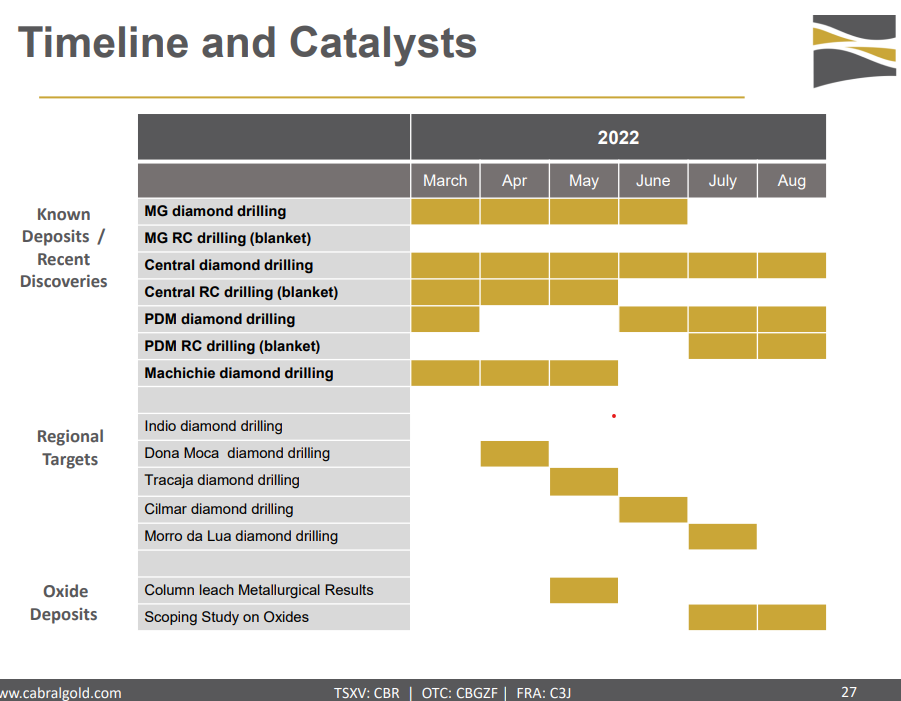

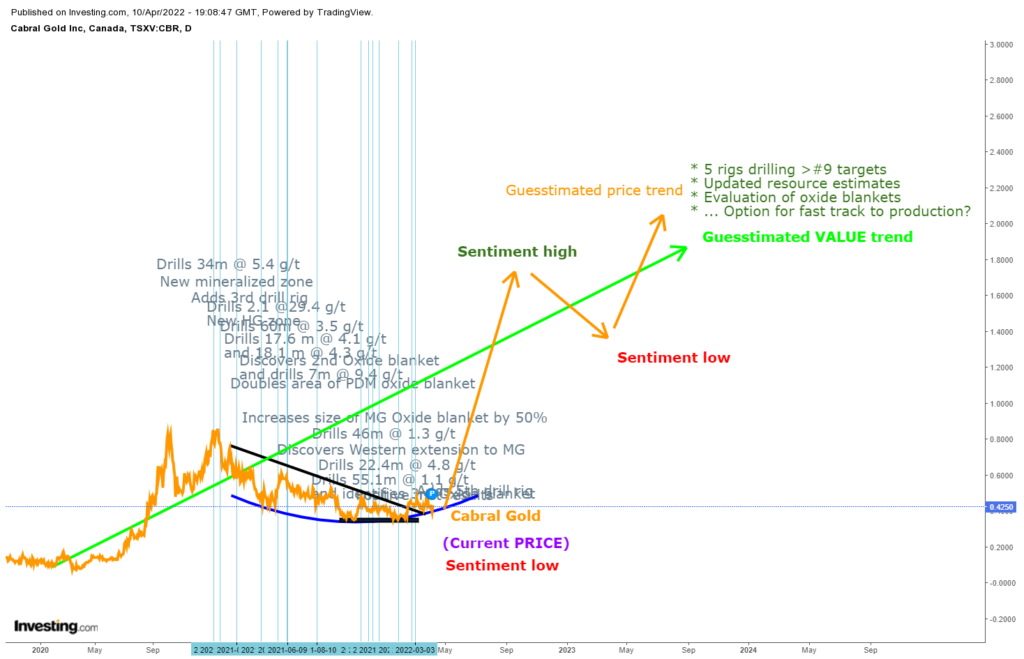

Cabral has been one of the most active juniors around and has put out more exploration updates than almost any company I can think of. PRICE of the company has basically gone the opposite way of the fundamentals in my opinion (Perhaps not surprising given that junior sector sentiment has declined for well over a year). Now, the company has not put out bonanza intercepts in every news release but they have been hitting decent, to good, to very good intercepts all over the place. Then add the UNEXPECTED discovery of not one, not two, but three oxide blankets and Cabral recently announced the addition of a FIFTH drill rig. You obviously do not rack up that many drill rigs if things have not gone WELL…

In the words of CEO Alan Carter who has personally invested $1.7 M in Cabral:

“Just in the last 18 months or so we have made five new gold discoveries… We already have two gold deposits here” – Alan, April 7, 2022

To show how large the disconnect between the fundamental (VALUE) trend and the share PRICE trend I created the following chart where you can see some of the many news releases since the share PRICE topped last year:

(Note: This is not updated with recent NRs and I did not include all past ones)

I’ll be honest, there is so much stuff happening across more targets than I can wrap my head around that I find myself actively underappreciating Cabral. Given the Price to Value dislocation I think this goes for the market overall even though one must be aware that we Cabral mostly just followed the downtrend in sentiment like most juniors have over the last 18 months or so (Yes, the market is driven by emotion, especially the junior miners). Just look at this chart where I have included my two favorite proxies for Jr Miners and Jr Mining Sentiment:

(Purple line = Strategic Metals, Pink line = Bear Creek Mining, Orange line = Cabral Gold)

These companies have nothing in common except that investors have FELT like selling juniors overall rather than buying over the time period seen in this picture. The fundamental trends for the three companies are completely different, their businesses are completely different and yet the PRICE trends have been very similar… Yep for better or for worse the junior mining sector is like this in the short to medium term. It’s almost impossible to overpay for any junior right now (especially the good to great ones)… It’s like investing with training wheels. The junior mining sector will wake up one day and push all juniors higher and the market will wake up one day when it comes to Cabral Gold and push it higher than the average junior I think.

As a re-fresher to just how big of a runway for growth there might be for Cabral’s Cuiú Cuiú project:

“I think you’ll see mining here… for 3-4 generations or something… It’s truly a world class camp hiding in plain sight”

– Quinton Hennigh, Aug 20, 2020

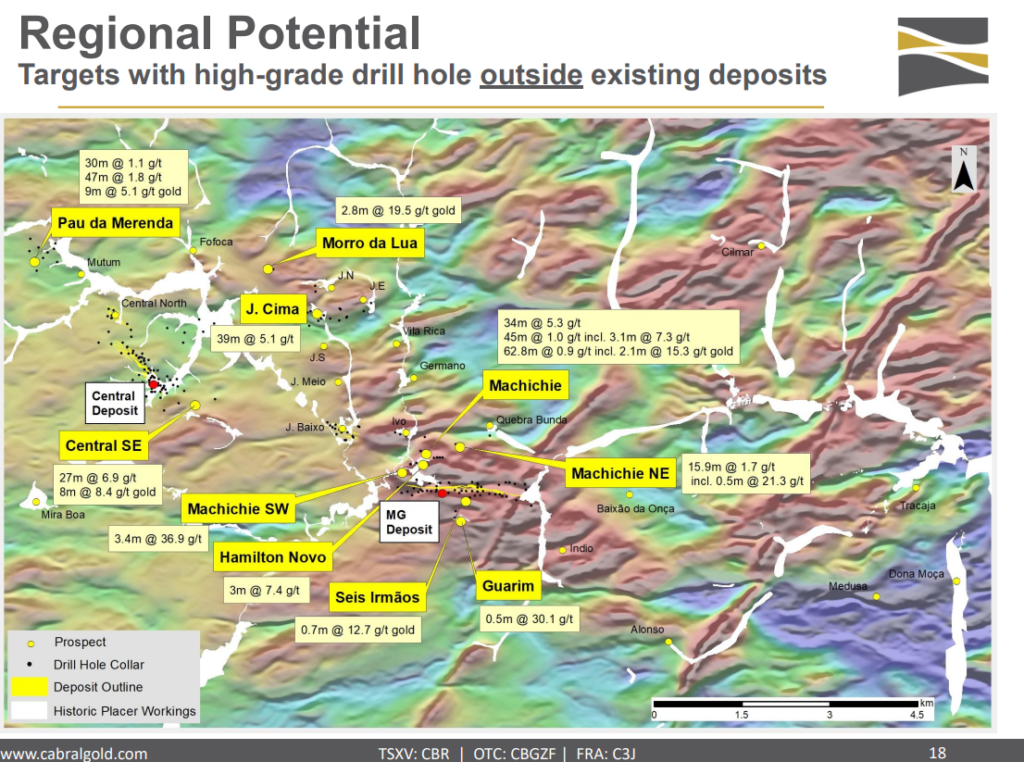

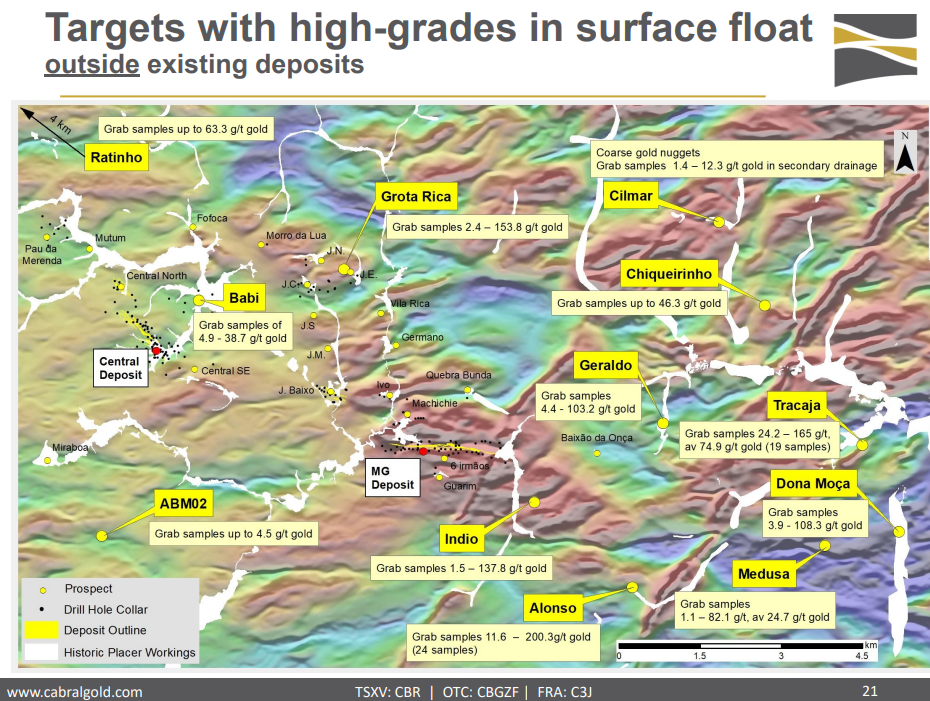

Regional targets:

More targets:

As I see it one basically gets an entire Brazilian gold camp in Cabral. I am sure there will be even more oxide blankets discovered along with more bedrock (lode) gold over the coming months and years. The pace of 5 discoveries within last 18 months is telling and I can see that kind of trend continuing given how many areas are still left to be tested…

Lots to do. Lots to do… And Cabral will do… lots this year…

… Again I think the story is too big and complex for the average retail investor to fully grasp (I have trouble with it myself). All I know is that I expect Cabral to get to 3 Moz sooner rather than later and that number could be increased every year for years to come. I love companies with long, preferably very long, runways with PROBABLE growth.

Oh and while the market cares not about the (so far) three oxide blanket discoveries I think they could end up being worth quite a bit. They could also be extremely cheap to put in production as well as quite high margin. What if Cabral can set up a simple oxide blanket operation in the future which could fund the company’s blue sky exploration in the future? I certainly think that is a possibility and assuming very low CAPEX and simplicity it could be a quite low risk, cheap and quick way to literally get into production.

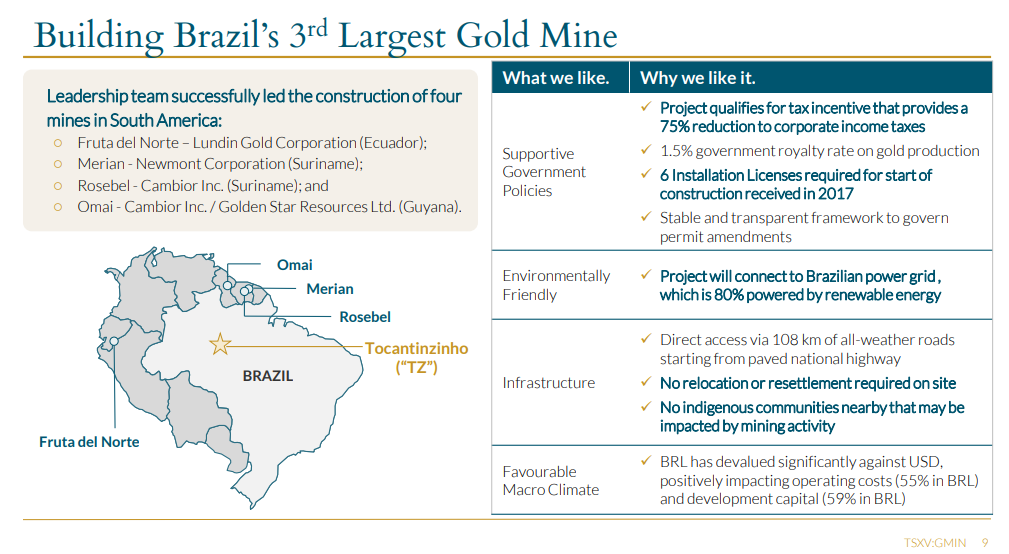

Oh and one cannot turn a blind eye to what is happening right next door…

“G Mining Ventures Corp.” which is backed by Lundin, Sprott and the Gignac family is building what will be Brazil’s THIRD largest gold mine:

The development capital needed for the “Tocantinzinho” mine is estimated to be $458 M and funding is scheduled to be be wrapped up this half of 2022. So what the Lundins etc are saying is that they and others will be happy to invest $458 M there which, again, happens to be right next to Cabral Gold. This is a huge thing for a retail shareholder like myself who has no boots on the ground knowledge and can’t gauge the “political climate” in that part of Brazil. They’re showing one can build a mine there, and they’re saying they want, and expect to have a mine there… If it’s good enough for the Swedish demigods aka the Lundin then it’s good enough for this Swede as well.

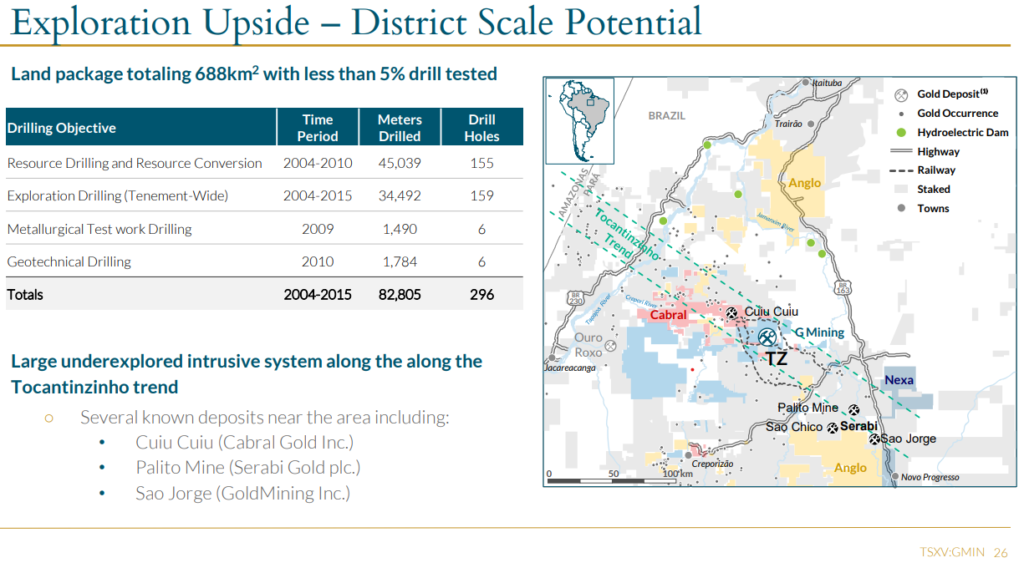

Oh and wouldn’t you know, G Mining Ventures even has a slide titled “Exploration Upside – District Scale Potential”, and Cabral with Cuiu Cuiu is highlighted in red no less:

… This tells me consolidation and M&A is a very much present in their minds. Who wouldn’t want to control and unlock a gold belt that literally saw one of the greatest alluvial gold rushes in history?

To sum up

Juniors overall:

Market is currently very dumb. Market is depressed. Market will get better. Juniors will go higher.

Cabral specifically:

Market does not get it yet and in light of what is already proven (>1 Moz), five discoveries, five drill rigs, and a growth profile that I think will go to 3 Moz and beyond I would say Cabral is very cheap. And G Mining Venture’s actions suggest that smart money believe this is an area to be in in the coming gold bull.

Cabral in a nut shell:

- $60 M in MCAP

- $5 M in cash

- 1 Moz of gold on the books already

- #5 drills operating

- >#9 known targets to drilled

- #43 peripheral targets identified

- New resource estimate this year

= Possibly a very eventful year where lots of additional value could be created.

My strategy:

Primarily sit on my ass for the next couple of years and let my shares of Cabral to continue to increase in VALUE and drag PRICE along as we leave this sentiment bottom. Hopefully I can check back in a year or two and see a multi bagger…

Remember: There are no guarantees. Only Risk/Reward.

Note: This is not investing advice. I own shares of Cabral Gold and the company is a banner sponsor. Therefore assume I am biased and always form your own opinion. Juniors are risky and volatile. I cannot guarantee the accuracy of the content in this article. Never invest money you cannot afford to lose. I share in neither your profits or losses.

Best regards,

The Hedgeless Horseman