Novo Resources: What I see, chart wise

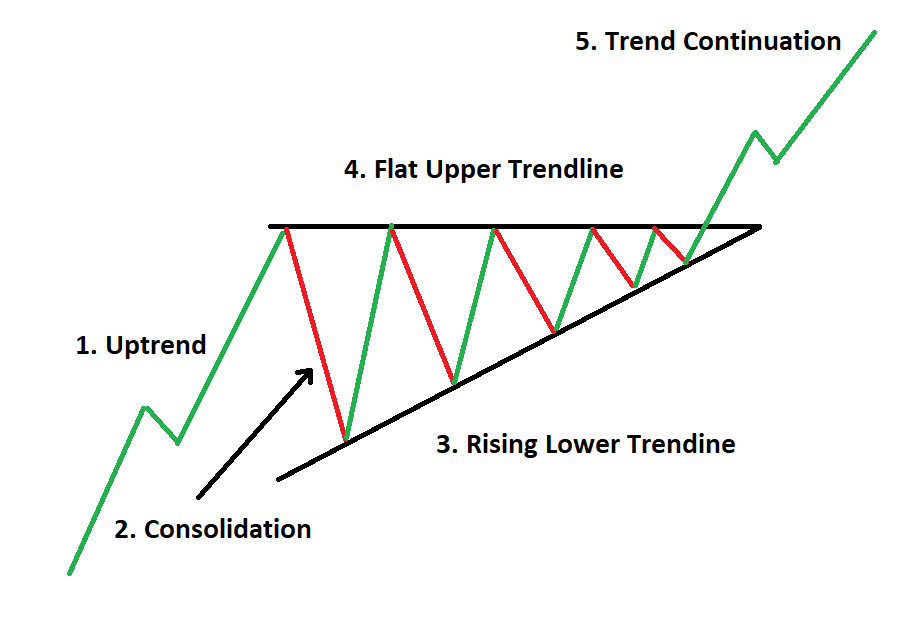

As some people know I was hoping that Novo would stay a bit subdued until I could free up some more money but I gotta say that the chart is starting to look a bit scary for anyone who has been hoping that Novo would stay quiet. We are currently at a long term resistance zone (around $4) and it looks like we are in the middle of an “Ascending Triangle” continuation pattern:

An “Ascending Triangle” continuation pattern:

Novo chart zoomed out:

Novo chart zoomed in (Hourly):

… Note that Novo is my largest position because of fundamentals and I don’t really care where the share price heads in the short term. With that said, I of course prefer to buy shares as cheap as possible and if this pattern indeed ends with another leg up in the not too distant future then I want to have my position ready before that if possible. I still expect/hope that these levels will look very cheap in a few years. Lastly, I would point out that I don’t consider myself a good Technical Analyst and neither should you :).

I am a shareholder and Novo Resources is a banner sponsor of my site and thus I might be biased. Always do your own due diligence and don’t consider this as either trading nor investment advice!

Sir,

I have a wager with my cousin as to the price Novo can reach in 2020. MY guess is $7.50

US dollars, I would like to get your realistic guess for this year and next. I really do believe most of the news flow from the company will be good. thank you.

Joe

Hi Joe,

I don’t really dare to guess. The thing is that this kind of story has the widest event horizon that I know of. Then add the fact that sentiment will amplify it more than your average junior… What if trial mining at Egina is excellent and we start going for commercial scale production in hurry? What if we get a mill? What if BC becomes a producer this year? What if Novo reveals a lot of discoveries? What if Karratha and Mt Roe gets de-risked big time? What if Egina gravels are proven up all over the place? Not only do I not know if these things will come to pass, I have no idea how the market will respond either. I’m just trying to focus on the meat and potatoes (the actual fundamental value I see) and share price is secondary. If Novo turns into a dividend company in the future, like I hope, then it’s the dividends and not the share price that attracts me.

Best regards