THH – Red Pine Exploration (RPX.V): High Grade Gold in Wawa, Ontario, Canada

Given that gold is again around $2,000, and by definition not too far away from breaking out new all time highs, I think that advanced explorers/developers provides some of the best Risk/Reward opportunities since banked success tends to still be dirt cheap. There are of course exceptions but overall the “when” and not “if” stories really shine from a compounding and risk perspective when the entire sector is selling at fire sale prices. A early stage exploration story can be cheap but the chance of success might be less than 10%. An advanced junior, with ounces in the ground, will most probably see a big revaluation when the tide comes into the sector and revalues ounces in the ground higher.

I have bought shares of Red Pine for myself and the HODL-folios. I am glad to say that I got the company to come on as a banner sponsor as well. So consider me twice biased!

My Case in Short

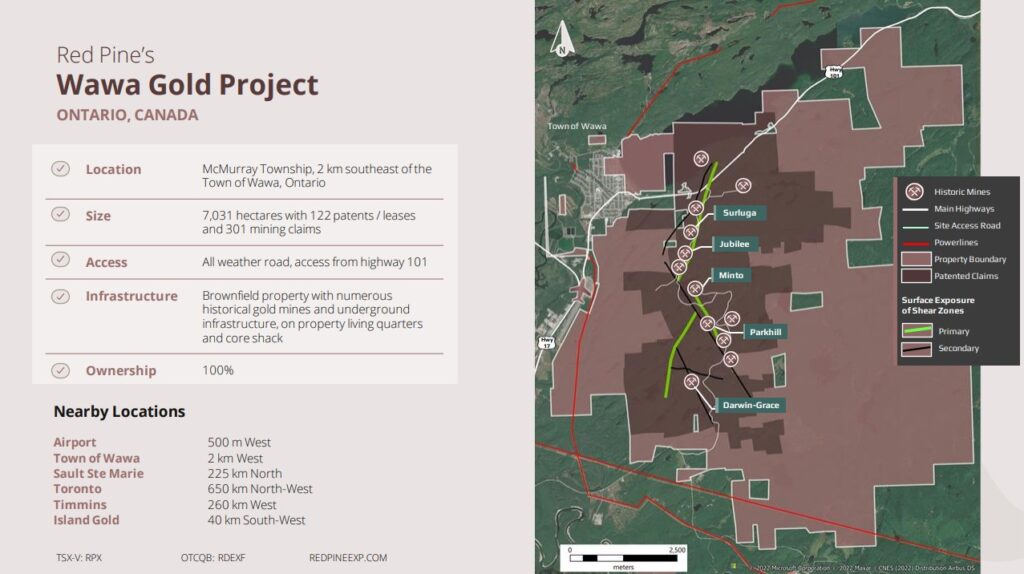

Gold is rare. Good projects are rarer still. Good gold projects in real tier 1 jurisdictions are some of the rarest things in the world. The problem with some of the first world jurisdictions is that even though one might be able to keep the “fruits of ones labor”, the permitting situation could be so challenging, that said fruits never get monetized. Thankfully Red Pine also has pretty much all the primary areas of interest on Patented Land to boot which is a very big deal.

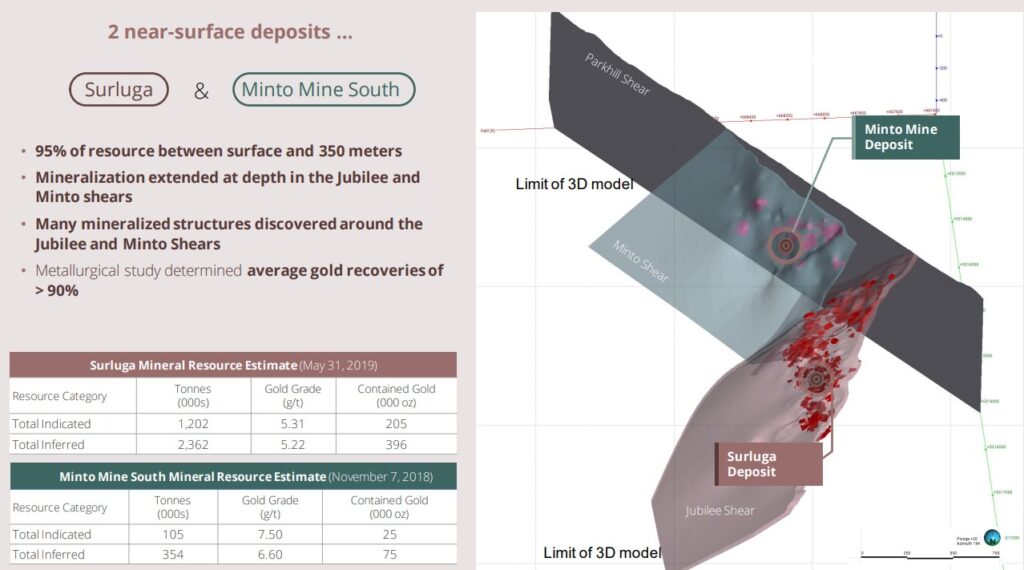

Red Pine Exploration already has (outdated) resources in the ground. I expect the next resource update, which should come in 2024, to show around 1.5 Moz of high-grade gold in Wawa, Ontario, Canada. In a location with great infrastructure, great mining culture, and the company has quite a few permits already.

In the big picture this could be a gold camp that will produce gold for decades to come given that Red Pine has hit gold over kilometers of strike and the system(s) are wide open in pretty much every direction.

To sum up

- Banked success with resources in the ground

- Probable, high quality growth

- Large, high quality blue sky

- True tier 1 jurisdiction

- True tier 1 location (roads, powerlines, work force, “mining town”)

- Patented Land(!)

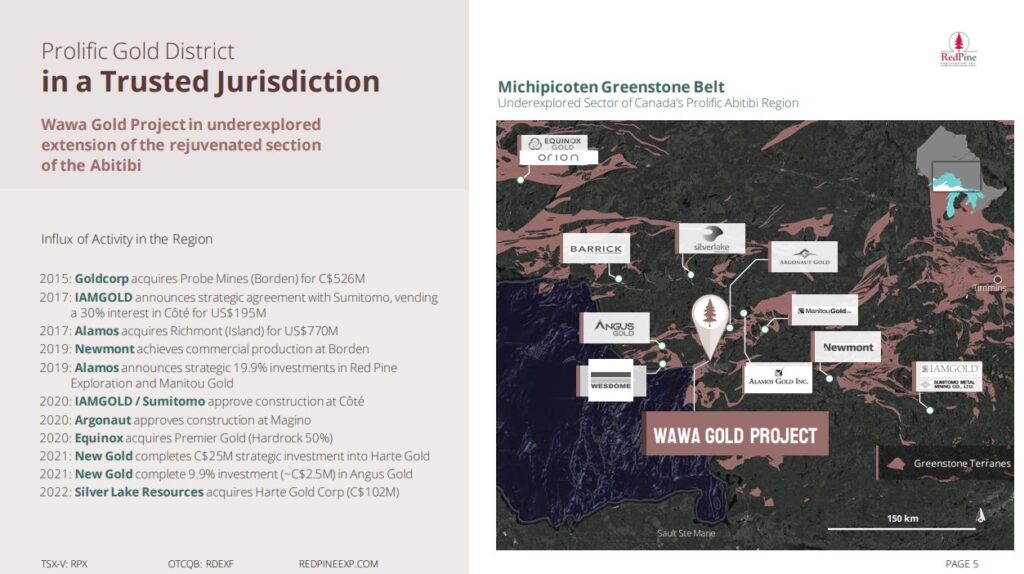

- Surrounded by Major and Mid tier miners

- Alamos Gold owns 19.4% of the company (Third party validation)

- Cashed up

- Drill season: 12 months per year (rare for northern explorers)

… How many gold juniors in the entire junior space check the criteria above? I can’t come up with many off the top of my head. Personally I see Red Pine Exploration at C$30 M in Market Cap as a low risk, high reward opportunity.

I think Red Pine is one of the best advanced explorers out there, especially when you factor in the current Price, and the amount of boxes ticked. I expect this to go up a lot in the next bull if not sooner. Simple as that.

Tier 1 jurisdiction and location

There are mines here and miners want to be here…

For some added context we know that the CEO of Agnico Eagle has publicly stated that the company sees itself as a Canada focused mining company today. We have also seen a lot of Major mining companies do M&A in Canada over the last few years (as you can see on the left side in the slide above)…

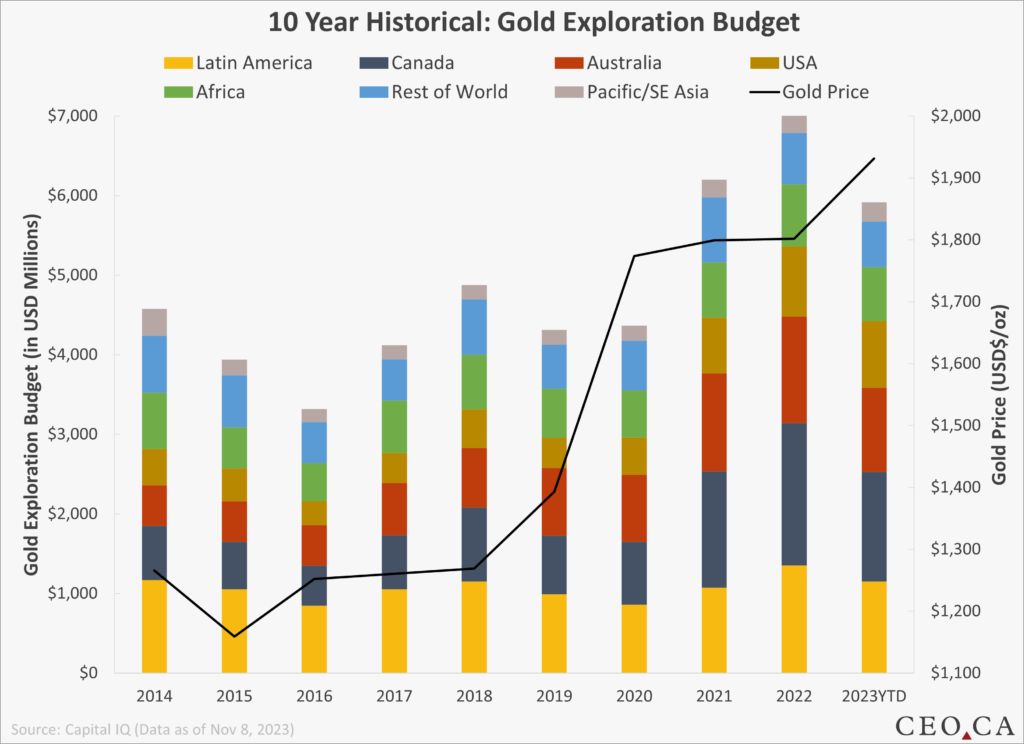

On that note, the exploration spending done by companies show the same, as Canada is nowadays where companies spend the most money:

(Curtesy of CEO.CA)

Basically I think that Canada is #1 in the world when it comes to jurisdictions where Majors, and Mid tiers, would want to operate and grow their businesses. With so many of said companies already having projects in the area around Red Pine it obviously opens up the possibility for value added synergies. This in turn would probably make a potential acquirer willing to pay even more for Red Pine.

As mentioned earlier, the challenge in some of the true tier #1 jurisdictions is that permitting can be very challenging, if not impossible, and projects can be very remote and lack infrastructure. But here is maybe where Red Pine shines the most given that the project is near a “mining town”, with good infrastructure, and better yet a lot of the ground is Patented:

(Patented ground in Dark Brown)

The banked success

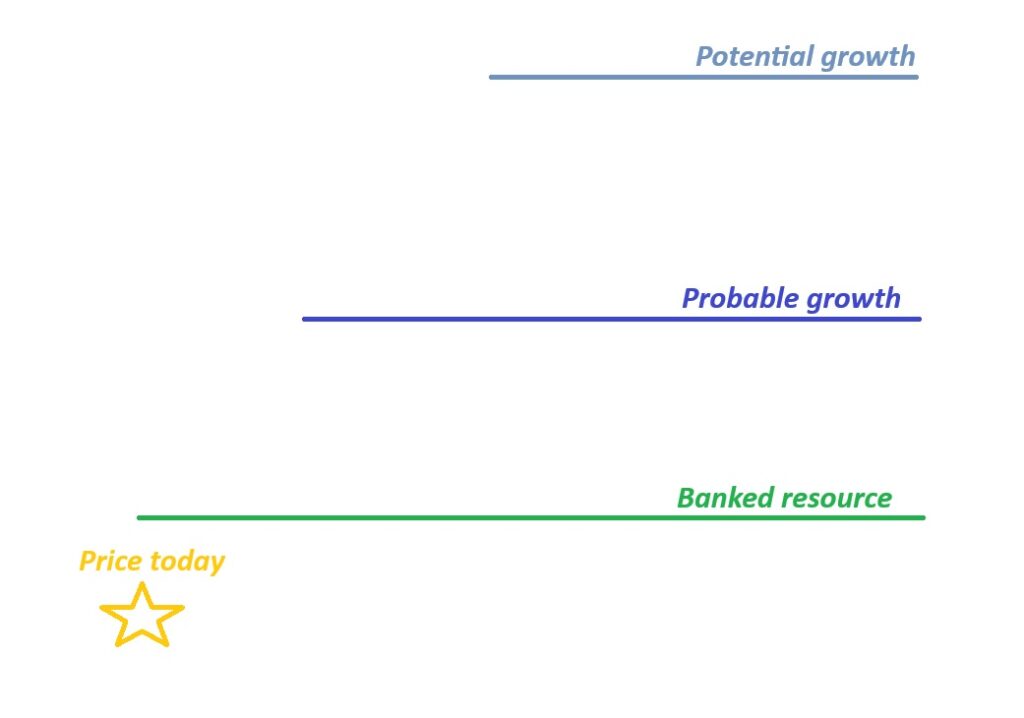

My favorite type of plays right now are the Alpha/Beta hybrid. I prefer to have some gold in the ground so that I can be on board for the next big sentiment swing (higher) in this sector. If there are not a single ounce in the ground then there are no banked ounces to revalue.

I also do want to see Alpha potential. That is the probable and potential growth aka “the birds in the bush”. If I can buy a cheap bird in the hand (banked success) then it is very probable I will make money on a story if I buy at extremely depressed levels (like right now). It would be even better if there are a few birds in the bush that have good chances of being converted to birds in the hand.

Think of it this way…

When this sector is hot then gold ounces in the ground, in tier 1 jurisdictions, might be trading for $150/oz. When the sector is ice gold said ounces might be trading at $25/oz. If I buy these ounces for $25/oz then sooner or later they should be valued at $150/oz and I will see a very good positive return. If a company also doubles the amount of ounces in the ground then that will act like a multiplier effect…

If I bought a story with 1 Moz for $25 M ($25/oz) and it revalues to $150/oz then the price has gone up 6X (150/25).

If the story doubled the amount of ounces, to two million ounces, then it could fetch a price of $150 x 2 = $300 M. And that would be a $300/$25 = 12X return.

There are plenty of early stage exploration stories that COULD go up 10X-20X but the chance of that happening might be les than 5%. Said storied might then have a 95% chance of finding no significant amount of ounces and be a dead story going into a bull. But when you have ounces in the ground already there is a good chance you will make a good return as long as the company is a) Still around, and b) Has not diluted the share count to infinity. Then the additional exploration upside becomes the cherry on top which you are not even paying for (taking valuation risk for).

Compare these two cases:

Early stage exploration story with no resources

- 5% chance: +2,000%

- 95% risk: -50%

Advanced explorer with ounces in the ground

- 80% chance: +400%

- 20% chance: +800%

From a compounding perspective the latter proposition is superior. From an Expected Value perspective the latter is also superior.

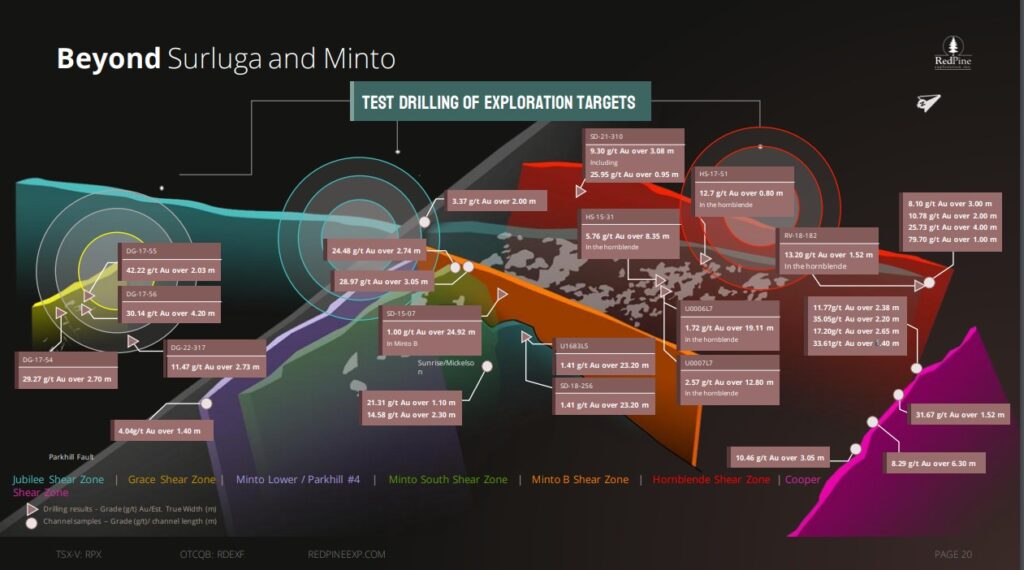

Now lets look at why Red Pine could be exploring, drilling, and growing for years to come and thus have a long runway for growth…

Blue sky – Strike

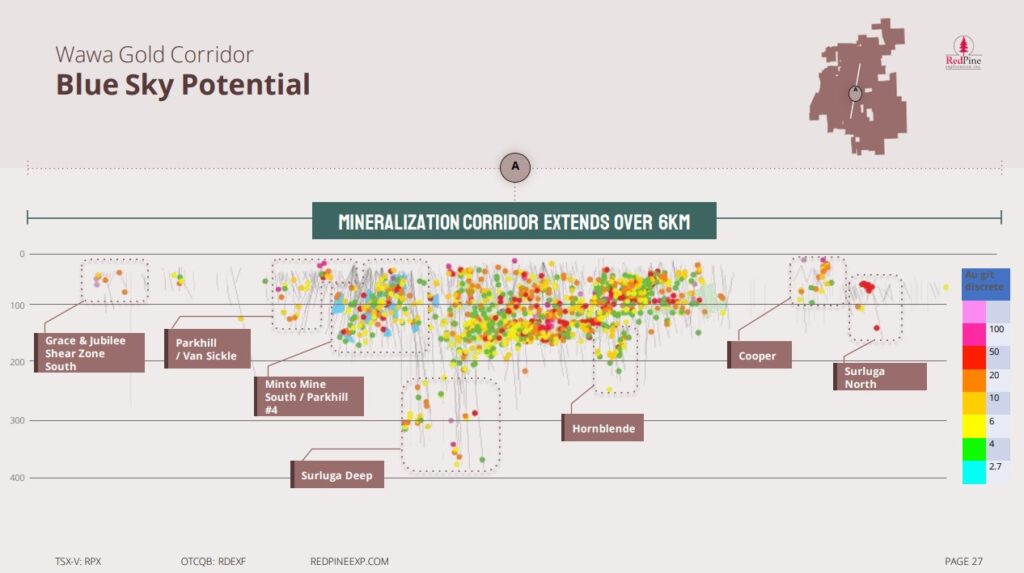

The known strike of gold bearing mineralization is impressive to say the least. There are historic gold mines and confirmed gold hits along a whopping 6 km long corridor:

I bet one could drill many thousands of meters here, over many years, and the resource could still be growing along strike. What makes this picture even better is the fact that this system(s) has seen mostly shallow drilling and these lode gold systems are known to go down to incredible depths…

Blue sky – Depth

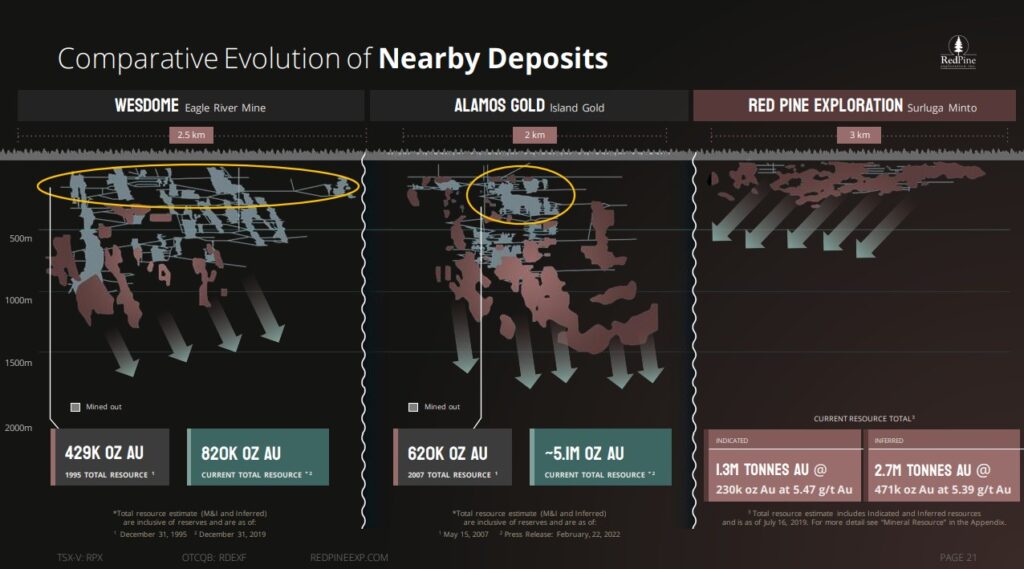

Alamos Gold, who happens to be the largest shareholder of Red Pine, operates the Island Gold Mine which is not far away from Red Pine. Said mine was acquired via the acquisition of Richmont Mines and that system not only goes to great depth, but it also got better with depth.

First of all one can see that both the Eagle and Island Gold Mines go to considerable depths and the current depth Red Pine’s resource is like the tip of the ice berg if the same holds true here. I am also intrigued by the fact that the plunge appears to be much lower angle at Surluga Minto (Red Pine). That could translate to a higher number of ounces per vertical meter.

On the topic of blue sky potential I would recommend listening to Quinton’s latest comments on Red Pine (Video below). In it he talks about how the latest news release where the company hit gold outside

“…This thing’s got a lot of runway down dip…”

“I think… If anything..: This stuff they have been drilling near surface… Is just the smoke off of something much bigger..”

“My bet is… This story is going to be a big darn deal over the next few years…”

– Quinton

Two Gold Systems

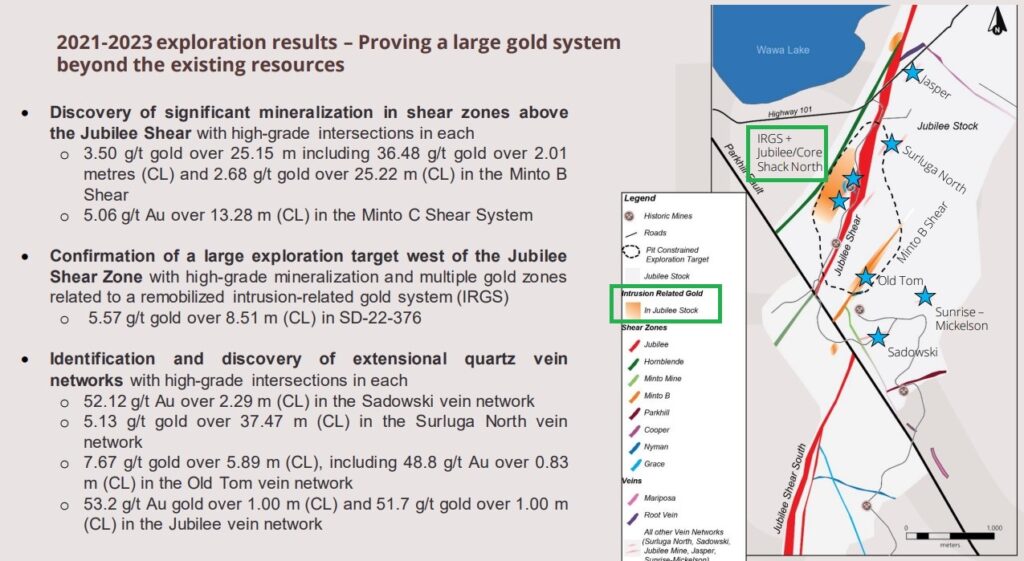

The gold system that Red Pine has is actually believed to be two systems. One being an Orogenic Gold system with an “overprint”(/proximal) of an Intrusion Related Gold System (“IRGS”):

This leads to a twist given that the two systems produce mineralized zones which appear to strike out with different orientations. One might also have more concentrated gold veins while the other might produce more bulk type mineralization. Anyway, what is obvious is that there is a lot of gold on this ground and there is probably more gold in a given area than one drill hole (orientation) might suggest:

Maybe this is a camp that will be mined for decades to come and when all is said and done maybe over 10 million ounces of gold will have been produced from this ground. With that said I am not planning on owning Red Pine for decades to come and see the blue sky materialize fully. It is however important for an acquirer to see such potential.

Bottom Line

In my opinion Red Pine is just ridiculously cheap and valued like there is no shortage of juniors that check this many boxes. Quinton Hennigh believes the overall potential within the land package is on par with what Great Bear Resources had. Regardless if that is the case we know that right now the Market Cap is C$28 M and pricing in $28/$1,400 = 2% of a Great Bear price tag. Of course Great Bear were using multiple rigs, and drilled hundreds of thousands of meters, to prove up what they had. Red Pine is not that aggressive. Yet at least. But in a better market I think we could see this story heat up in the blink of an eye and thankfully the company can drill all year round so there are no natural “boring periods”.

As always the theoretical downside is always 100% and the theoretical upside is open ended. And I see quite a lot of upside potential for a C$28 M MCAP company with this asset.

Lets say the company proves up some 2 Moz over the next 12 months and we go into a gold bull where Canadian, high quality ounces might trade for $150/oz. That’s already $300 M. Thus I personally think this company has >10 bagger potential over the next 12-24 months.

Amateur TA

At the bottom of a bear market one can find real bargains obviously. I think Red Pine is ridiculously undervalued and one of these days I expect the black resistance line to be broken to the upside. That would be the start of the real revaluation in my eyes.

Note: This is not investment advice. I own shares of Red Pine and the company is a banner sponsor. Thus consider me biased. Assume I may buy or sell shares at any point without notice. Do your own due diligence. I share neither your profits or your losses. I cannot guarantee the accuracy of the information in this article.

Best regards,

The Hedgeless Horseman