Novo: When Proper Due Diligence Gives You a Material Edge

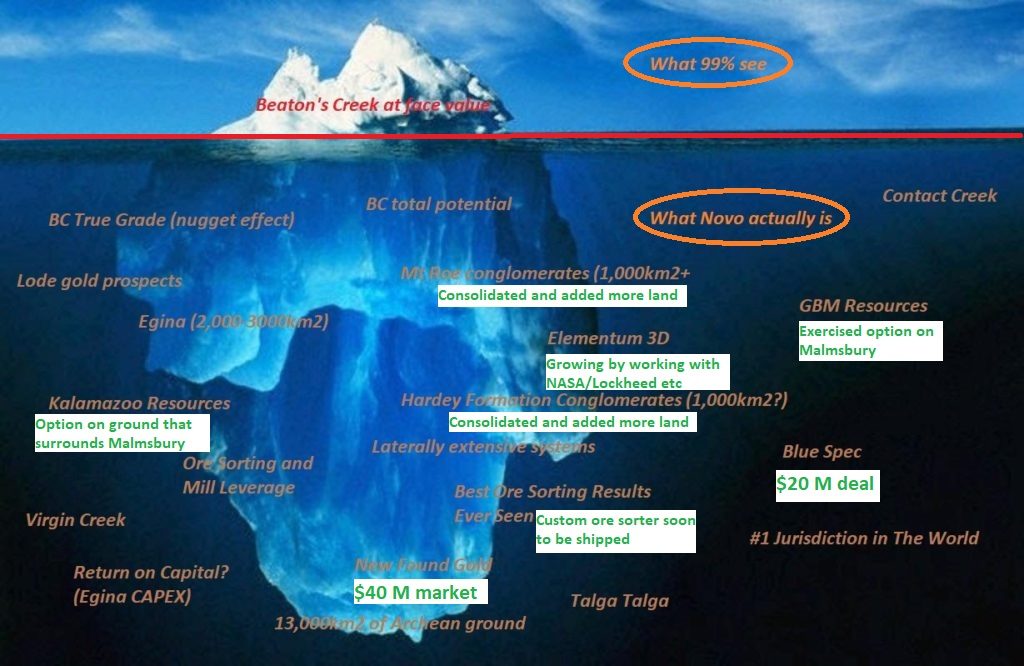

What majority of people in the mining space sees:

(I added some of the recent developments, in green text)

If you do lazy analysis you will keep getting surprised by the fact that the actual size of the ice berg has been growing a lot.

Just a few recent examples…

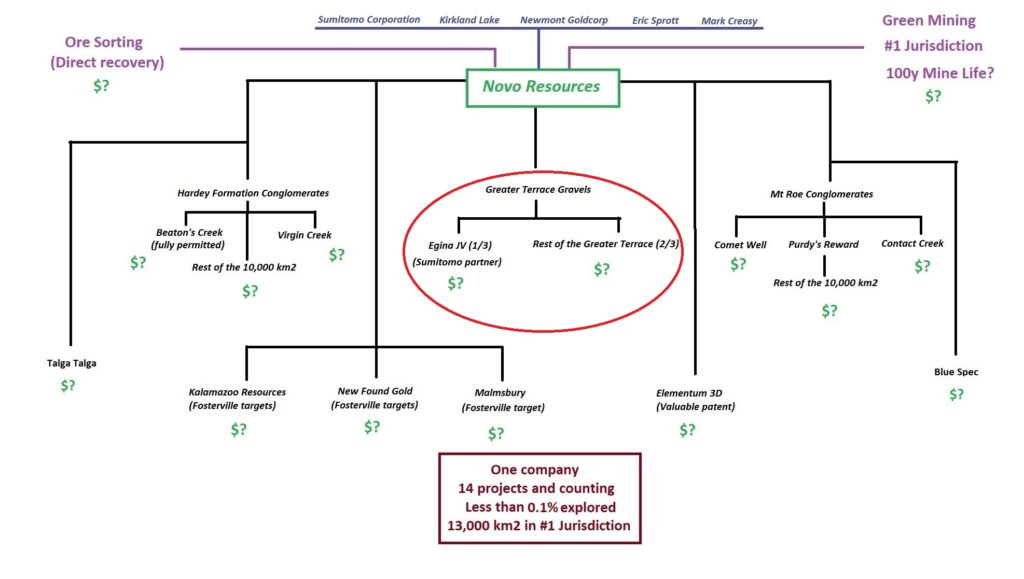

- “Novo Sells Part of Blue Spec Project to Calidus Resources for Cash Consideration of A$19.5 Million“ – Source

- Novo’s equity stake in New Found Gold is currently worth C$40.2 M after the company hit high grade gold in holes 2km from the superb hit in the Keats zone…

- “New Found Intercepts 41.2 g/t Au over 4.75 m and 25.4 g/t Au over 5.15 m in New High-Grade Discovery at the Lotto Zone, Located 2 km North of the High-Grade Keats Discovery”

- … And the 100,000 m drill campaign has just begun in the district scale land package up in Newfoundland.

- Novo owns 12.57% of Elementum 3D (“E3”)which recently got its patent granted for basically 3D printing metals in multiple jurisdictions

- “ELEMENTUM 3D GRANTED PATENTS IN U.S., CANADA, AND AUSTRALIA FOR REACTIVE ADDITIVE MANUFACTURING TECHNOLOGY“

- Prior to the patent being granted E3 got an investment from the circa $40 B entity known as Sumitomo Corporation

- Elementum 3D in the news recently…

We are advancing an additive manufacturing technique to 3D print rocket parts using metal powder and lasers. This innovative method could bring down costs and lead times for producing large, complex engine components.

More about this technology: https://t.co/m5rrwpvO3o pic.twitter.com/X91qs9t44d

— NASA Technology (@NASA_Technology) September 11, 2020

Keep in mind that these are just three of many examples, of value being created for Novo, which the majority of market participants are totally unaware of. The next “surprise” might be just how well and how impactful the ore sorting tech really is. Stay tuned…

If you think Novo’s intrinsic value is explicitly contained in the current version of Beaton’s Creek then it is beyond clear that you have no idea what you are talking about and will keep getting surprised by all the “unseen” value being created beneath the surface. Remarkably this seems to be the consensus which in turn opens up an opportunity for the people who have done their home work and knows what one is actually buying when buying a piece of Novo Resources. Don’t be the lazy investor who keeps getting surprised by the fact that Novo has more irons in the fire than any other junior around and be looking at Novo like it is a one trick pony. I am expecting a lot more of these positive developments to come from multiple areas over the coming months and years.

It is impossible to constantly have a all of Novo’s avenues for value creation in mind at any given time. But that is why investing should be based on thorough due diligence and a rational investment case and not on your impulses. Even though market participants with a short attention span just views Novo as a one trick pony doesn’t mean that you should, obviously. Try to look at the big, total picture of any investment case and make up your mind in peace and quiet. Listening to the noise of the “blind” will make sure that you have no edge in this market.

If you can’t spot the fish at the table then YOU are the fish.

(Note: This is not a buy or sell recommendation. This is not investment advice and I am not a geologist. This article is highly speculative, forward looking and I can’t guarantee accuracy. Always do your own due diligence. I own a lot of shares of Novo Resources which I have bought in the open market and am thus biased. Novo is a passive banner sponsor on my site. )

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

Thanks for the info. Last night I just asking my son if he knew of the other stuff NOVO

Owned .

I’ve read whatever I see on NOVO.

There are several places I find it

However I never Wright it down.

Also I read it Fast,certainly not getting it

All .

At first I did not beleave that a explorer

Would or could buy other business ,

So I didn’t pay attention, I’m always in

A hurry also.

Now I would like to know of all the stuff that

NOvO own. And what interests in other things

They have?

I’m under water currently in NoVo , I’m not a. Bit concerned, I did not discover them until when they went up fast to $5

I think I schould buy more, But l own a lot already, what’s to much ?

I think my average is now $2.5 US

I got go,

I have a lot of Questions

Thanks Roger

I know Novo has a very big open interest, but I can’t understand why this stock continues to languish and tread water?

Based on its size, IMHO, Novo has too many investments/land areas in play. We always tell young entrepreneurs how maintaining focus is linked to their success. Apparently, this doesn’t apply to Novo?

The write-up mentions 3D printing. Gee, I was an “early investor” in 3D laser printing… nearly 30 years ago. In other words, the technology is not new, just further refined. A Novo investment here is so unfocused that I can only conclude that it was made to appease Sumitmo Corporation and that company’s role in Irving Resources.

Horseman, great analysis of Novo’s assets.

I’m not lazy but your analytical expertise is way beyond mine. I was wondering when you might be doing some 2021 quarterly revenue forecasting for Novo since we know the Golden Eagle production capacity and BC grade. I did my back of the napkin estimate but would like to see your estimate.

Thanks in advance!

First of all, Quinton is spreading himself too thin; that’s problem #1. Second, I find it very interesting that there was none of the usual “Quinton commentary” in today’s PR; he usually trips over himself to add colour to any PR, so the conclusion here is that he’s been told to “shut up”. The next question, of course, is “Why?” Methinks the story is about to come unraveling. Is that a helicopter I hear warming up?

I appreciate your thoughts. However, if this is another Bre-X, then it needs to run to $100 first, which is not the way it is trading The explorer space has always been rife with deception and laziness and so it is essential/required to be suspicious as an investor. I’m invested because I trust Quinton’s honesty, experience and just as importantly, his energy. IMHO, he is at the enviable point in his life where he is “firing on all cylinders”.

The explorer space has always been rife with deception and laziness and so it is essential/required to be suspicious as an investor. I’m invested because I trust Quinton’s honesty, experience and just as importantly, his energy. IMHO, he is at the enviable point in his life where he is “firing on all cylinders”.

Just like Lion One is experiencing now, there is “overhang” coming to Novo’s stock. In late December, 1/2 of the new Novo shares issued in August will unlock for trading. So basically you have to ask yourself, are you a short-term trader or a long-term holder that allows a real company to execute its plans.

I very much appreciate your periodic in-depth analysis. I agree Quinton has his hands in lots of things, but as you say he is “firing on all cylinders.” A case in point was to buy the mill so he can go into production in a few months. If he was just looking to acquire properties until some big fish came along and gobbled up Novo, I do not believe he would have stretched things financially to purchase the mill. Instead, I truly believe his intent is to make NOVO a top tier mid level producer sooner than later, and in time start production on the rest of Novo’s holdings in Australia.

I have been through all of the stock price gyrations with Novo and have never sold a share. Instead, I have picked up more on the dips.