Novo: Updated Sum of its Parts

FLASH UPDATE, Sept 8:

“Novo Completes Acquisition of Millennium Minerals Limited”

… Novo has a mill and all of Millennium Minerals assets now!

Return to article:

What follows are my personal opinions and some elementary school math…

Novo will, in my (biased) opinion, soon have:

- Much higher grade ore than MOY

- All of MOY’s assets (mill, housing, resources and plenty of targets), plus:

- The Beaton’s Creek deposit which is open in multiple directions

- Talga Talga (which a company recently purchased royalties on, hint hint)

- Virgin Creek

- Contact Creek

- Mt Elsie

- Plenty of water compared to MOY

- A better mining team than MOY

- Better geologists than MOY

- Higher margins than MOY

- Better recoveries than MOY with a lot of gold looking to be captured by an expanded gravity circuit up front

- Head grade that can surprise to the upside due to the nugget effect

- As evidenced by the mean grade of the largest bulk samples being higher than the resource number

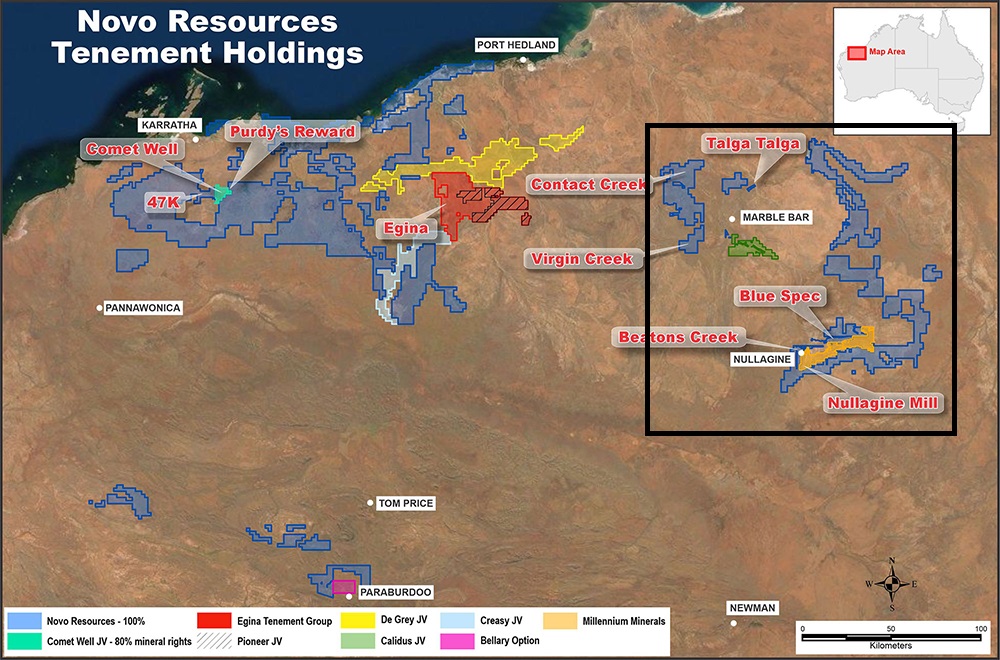

The Easter Pilbara block alone is worth a lot more than the current Enterprise Value in my opinion:

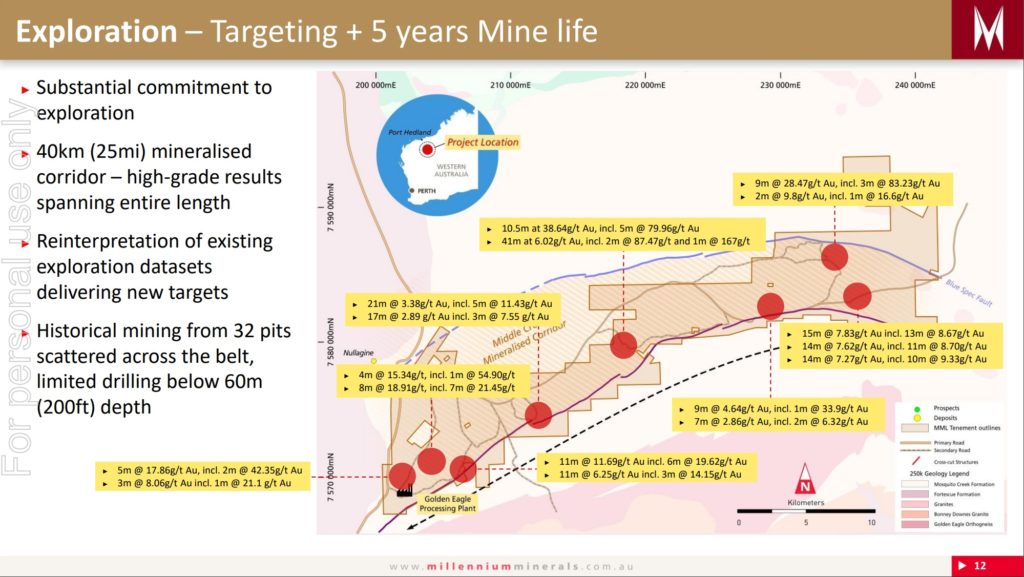

The ground picked up from Millennium (orange area) alone has a 40km mineralised corridor to explore:

Think about it this way:

When MOY did not have the water problems etc I think it reached a peak valuation of around A$320 M when gold was trading at around $1,300/oz. The company had total resources of around 900 Koz at almost half the grade of Beaton’s Creek. Then one can think about what the value would be for ONLY Beaton’s Creek + Millennium’s assets: a) The resource doubled and the average ore quality increased at the same time, b) No water problems, c) a lot more exploration potential and a better team overall. With that said the MOY assets should be worth more in the hands of Novo compared to the hands of MOY due to the obvious synergies such as ownership of the surrounding land on top of elimination of the water issues coupled with a bank account which allows optimization of the milling operation etc.

In short:

The MOY assets should be worth more under the umbrella of Novo on a stand alone basis and the synergies created increases the value of not only the MOY assets, but Beaton’s Creek and any target/prospect that could be trucked and processed at the Golden Eagle mill.

Then you add the other assets in Eastern Pilbara:

- Talga Talga

- Virgin Creek

- Contact Creek

- Mt Elsie

- Blue Spec

… What’s that worth?

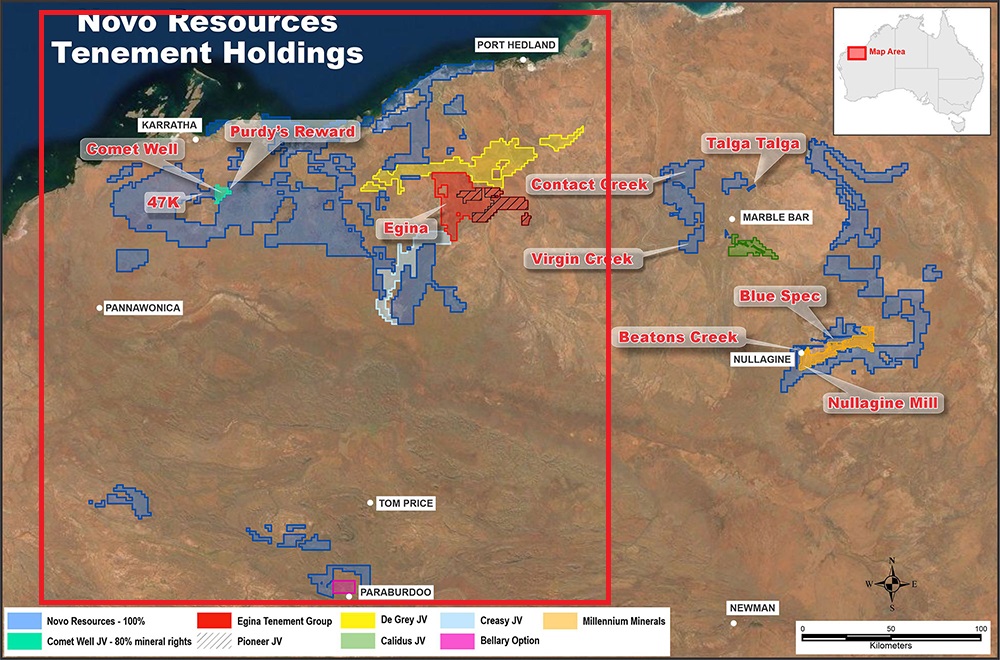

Then add everything in the red box:

- All Egina type lag gravel holdings holdings across Pilbara

- And the “Egina Project” ALONE is considered to have enough potential value that Sumitomo Corp is earning in 40%

- All ground prospective for Mt Roe conglomerates over 14,000 km2

- Including Comet Well, Purdy’s Reward and the outcropping Mt Roe sources around Egina

- All ground in Central Pilbara prospective for Hemi style lode gold

- All ground prospective for Hardey Formation conglomerates (the sequence which was proven to be gold bearing 50 km down dip into the basin)

- East Well

- 47K Patch

… Just the Eastern Block of Novo’s Pilbara land package should be worth more than the current Enterprise Value of the entire company.

Then add:

- Ore sorting

- Ore shrinkage and mill leverage

- Outstanding satellite deposit potential across the basin

- Green processing

- Lower risks and perhaps easier permitting

- Extremely low CAPEX potential (especially for Egina)

- Hopefully self funded for open ended growth come Q1

- Main three target types are LATERAL, not VERTICAL, which means that the percentage of prospective ground across each km2 is exponentially higher than conventional targets

Then add:

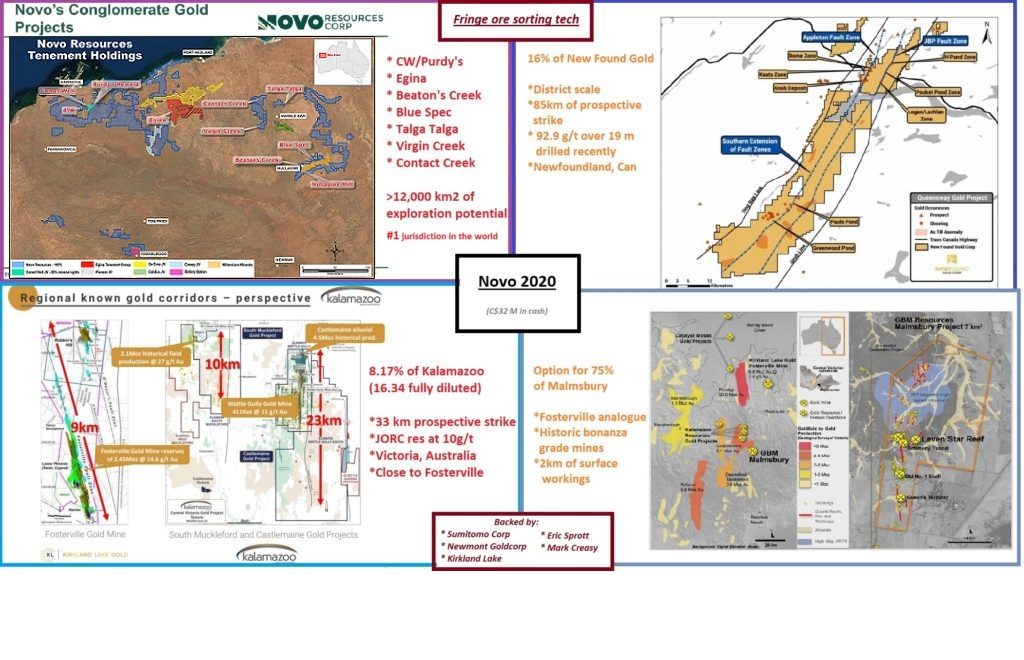

- Shares in New Found Gold currently worth US$23.4 M

- Which has just started a 100,000 m drill program which could revalue shares a lot higher obviously

- Shares in Kalamazoo Resources currently worth US$5 M

- Who owns 1.65 Moz in Pilbara, possibly the best land in the Bendigo Zone and ground in Central Pilbara

- Option on Malmsbury which is located next to Kalamazoo in the Bendigo Zone, Victoria

- 10% stake in Elementum 3D

- Which saw Sumitomo Corp invest in it and has customers such as Lockheed Martin and NASA

- Shares of Calidus Resources

Then add:

- Gold at US$1,950

- Western Australia having been a top #1-#3 mining jurisdiction in the world for ages

- Backed by Sumitomo Corporation, Kirkland Lake Gold, Mark Creasy, Eric Sprott and Newmont Mining

- Beaton’s Creek being high grade, easily recoverable gold should lead to high margins that could fund exploration at numerous targets

… As I see it I am paying for the Beaton’s Creek and some MOY assets while getting everything else in that picture for free. Every patch of land, prospect, target, equity holding and option. Yes, including getting all Egina type ground for free… You know the lag gravels that Sumitomo Corproation, which Buffett recently invested in, is earning in 40%… And that’s just about 1/3rd of Novo’s total ground which is considered prospective for lag gravel gold.

Conclusions

Novo’s total asset base could easily keep 10+ juniors busy for a long time if one chopped it into 10+ pieces. Whilst most juniors have a readily visible “growth cap”, there is no junior that has this kind of long term blue sky potential, not to mention the ability to go into high margin production with gold prices at ATH. When listening to Quinton speak about his vision for Novo it is obvious how impactful ore sorting could become in terms of super charging the value of a certain mill. Furthermore, Egina could be a very high margin mining operation which requires abyssmal CAPEX and OPEX spending.

The advanced stage of Beaton’s Creek, the characteristics of the deposit, ownership of a mill and the obvious exploration potential should mean that Novo will have a significantly cash flowing operation as a floor going forward. Since Novo has only drilled off a small corner of the Beaton’s Creek conglomerates, and that these are confirmed to extend much further, I see Beaton’s Creek alone as an up and coming mine with 3-5 Moz potential. In a scenario where Novo only had Beaton’s Creek , gets it into production and focuses on adding ounces, then such an operation should be worth more than the entire current Enterprise Value in my opinion…

Anyway, a case where one is paying perhaps fair value for one asset across 14,000 km2 and get enough projects to keep 10+ juniors busy for a long time for free, is remarkable in my book. These comments could not be made unless the market was totally clueless and severely miss priced the intrinsic value of course.

With Novo hopefully becoming self funded in short order the motivation for a higher share price has hit rock bottom for me personally. The reason is because Novo is perhaps the only case I know of where I see a 10++ year investment horizon and where actual dividends is the main prize. Compare this to 99% of juniors which will either a) never get into production or b) not get into production within the next 10 years. In that case the future cash flow (value) should be heavily discounted and there are never even any guarantees that it will happen. Furthermore if we play with a scenario that Novo will for SURE pay out $1/share in dividend in 3 years, without any further dilution, then the last thing one would want to see is share appreciation since it will only decrease the forward looking yield.

- Does Novo have any business trading at these levels given that it looks to be becoming a producer with the single largest asset base in the world located in perhaps the best jurisdiction in the world? No, not in my opinion.

- Would an actual investor want it to be “efficiently” priced at this point in time, or ever? Not if one is looking for a potential dividend champion.

Closing Thoughts

I think Novo is by far the hardest case for any mining investor to grasp. Therein lies the opportunity as well as the reason for frustration for the typical mining investor (speculator). Why? Because there are almost no cases that anyone can remember where a company has been able to continually grow and grow dividends over any meaningful period of time. The majors got over levered and acquired assets at the top. Debt and assets that they would pay dearly for during the down turn when dividends were also withdraw. In essence the mining business is so crap on average that it has forced almost everyone to become a trader. I mean just think about the fact that GDXJ went down around 90% after it peaked out in late 2010. What “average Joe” would take that ride and not reach the conclusion that there is no such as HODL:ing in the mining space?

It’s pretty funny to see so many “professionals” in this space ridicule Novo while the company has perhaps the most impressive list of backers of any junior in the space. It’s even funnier that people I talk to who are not “colored” by the “conventional wisdom” of mintwit or whatever readily get the value proposition and risk reward. I mean it’s a pretty straightforward case…

The value of Novo will soon be underpinned by two advances assets + a mill and any and I get all upside in the largest ever junior asset portfolio for free. This is not rocket science and Novo remains the #1 no brainer investment case in my book…

Lastly I would point out that no one on earth has any previous experience of having invested in a case like this. No reference points. The closest one would be anyone with experience from De Beer’s CDM deposit which shares similarities to the Egina part of Novo’s portfolio and it just happens to be that at least two ex De Beers employees are totally sold on Novo… Food for thought.

(Note: This is not a buy or sell recommendation. This is not investment advice and I am not a geologist. This article is highly speculative, forward looking and I can’t guarantee accuracy. Always do your own due diligence. I own a lot of shares of Novo Resources which I have bought in the open market and am thus biased. Novo is a passive banner sponsor on my site. Assume I am biased and make up your own conclusions! )

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

The “typical mining investor” has the IQ of that tree squirrel laying dead in the middle of the road, the common sense of that moth about to Kamikaze into the nearby flame, and the attention span of a gnat. And you expect the “typical mining investor” to “get it”? Be grateful for the unwitting favour that lets a person still get The Bargain Of A Lifetime here.