Nevada King Gold (NKG.V): A Golden Empire in Nevada “Back-Stopped” by The Atlanta Gold Mine

March 16, 2022

I see Nevada King as one of those few juniors that check pretty much every important box I can think of. Thus I own shares and was happy to bring the company on as a banner sponsor and get the word out. In this article I will try to explain why at least I really like this story and why the Risk/Reward is something to behold in my opinion. As always, do your own due diligence and make up your own mind, and assume I am biased!

Nevada King Gold (NKG.V) in short:

- Ticker: NKG.V

- Tier #1 Jurisdiction

- Nevada, USA

- Margin of Safety:

- Atlanta Gold Mine

- Probable Growth:

- Atlanta Gold Mine

- Incredible Runway For Growth

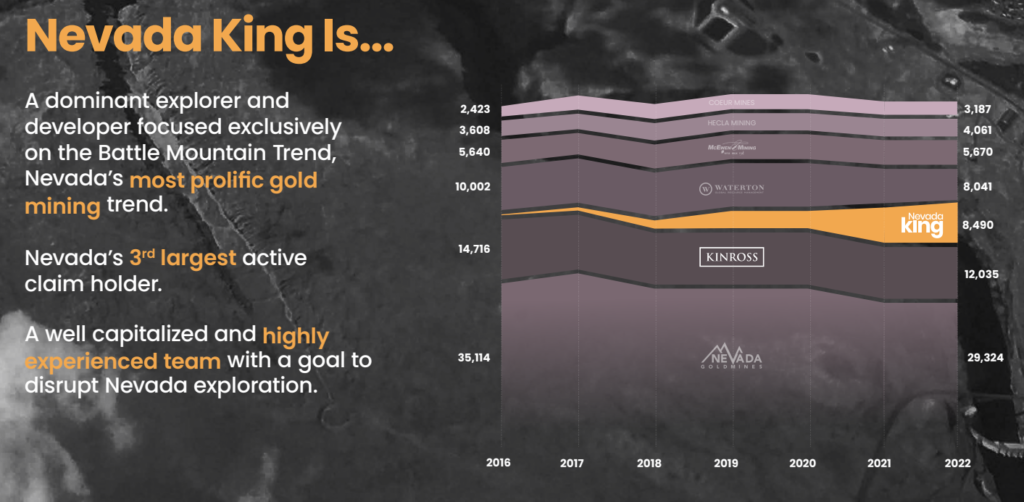

- Third largest claim owner in Nevada’s prolific Battle Mountain/Cortez Trend

- Multiple high priority targets

- Swinging for the fences at Iron Point

- Skin in The Game:

- Collin Kettell: 11%

- Board & Management: 5%

- Cashed up:

- ~$18.5 M in working capital (last reported)

- Price:

- MCAP: C$90 M at $0.37/share

- Enterprise Value: ~C$71.5 M

Given that I think Atlanta will more than likely be worth more than the total Enterprise Value of the company I see a Risk/Reward profile that is rare to come across. The combination of jurisdiction, margin of safety via the Atlanta Gold Mine and the obscene project portfolio makes Nevada King one of few companies I deem to be worthy of being a corner stone holding in a junior portfolio (In my opinion). The possibility of very low risk and probable upside due to immense “spin out potential” really tops it all off.

The case has gotten increasingly better over just the last few months on the back of some very impressive results out of the Atlanta Gold Mine. Why? Because the Atlanta Gold Mine, which forms the basis for the “Margin of Safety” aspect, has gone up a lot in implied value while Price has yet to react. This I see the Margin of Safety as having gone exponential lately as the Price-to-Value gap has widened. In my mind I am currently not even paying full price for the Atlanta Gold Mine right let alone any potential across some >10 projects. In other words I see it as Mr Market offering up one advanced asset for a Price which is less than what it is worth while throwing in every other project within Nevada King’s massive land position for absolutely free. Thus I find Nevada King to be a case where an investor can “steal” an absurd amount of prime real estate currently.

Let me make a prediction: When the gold mining sector gets hot again you will see a significant revaluation of Nevada Gold’s portfolio without the company having to lift a finger.

Why The Risk/Reward is Great

- Margin of Safety: The Atlanta Gold Mine

- Probable Growth: The Atlanta Gold Mine

- High Potential Growth: Huge blue sky potential across >10 projects in Nevada that I am not even paying for including the massive Iron Point target

- + Low risk/probable return potential: Option to spin out assets or do deals in a “hotter” market for little to no risk but substantial potential rewards

Nevada King is basically a text book example of what I would want to do if I started a company with the intention of having the best Risk/Reward profile I can think of going into a future gold and mining bull. The best part is that one does not need to compromise on any aspect really. Let me explain…

If one likes the Margin of Safety aspect in terms of bankable success (gold in the ground), so one does not end up in a gold bull without any, then the Atlanta Gold Mine takes care of that. If one likes the idea of Probable Growth (I know I do) then the Atlanta Gold Mine takes care of that as well given that there appears to be a lot left to unlock in the district. If one likes the High Potential Growth aspect (aka blue sky, swing for the fences, high risk/high reward stuff) then that comes with the immense portfolio which includes targets like Iron Point. Furthermore, in the case that a major discovery is made outside of the Atlanta Gold Mine (Margin of Safety), then the company can simply spin out said discovery and I as a shareholder (who took no valuation risk even) will get the typical upside belonging to a high-octane, pure discovery play. Thus escaping the “curse of undervaluation” that haunts pretty much every multi-asset junior.

Nevada King’s Risk/Reward profile with an emphasis on the Margin of Safety aspect is impressive enough for the company to be a cornerstone holding in the more conservative (risk averse) junior portfolios I help manage.

Upcoming Catalysts

- “Iron Point”: Currently drilling, first assays pending (4,000 m)

- “Atlanta Gold Mine”: Start of the upsized Phase II campaign (13,100 m)

- “Lewis Project”: Assays pending (1,200 m)

Why I love multi-asset juniors right now…

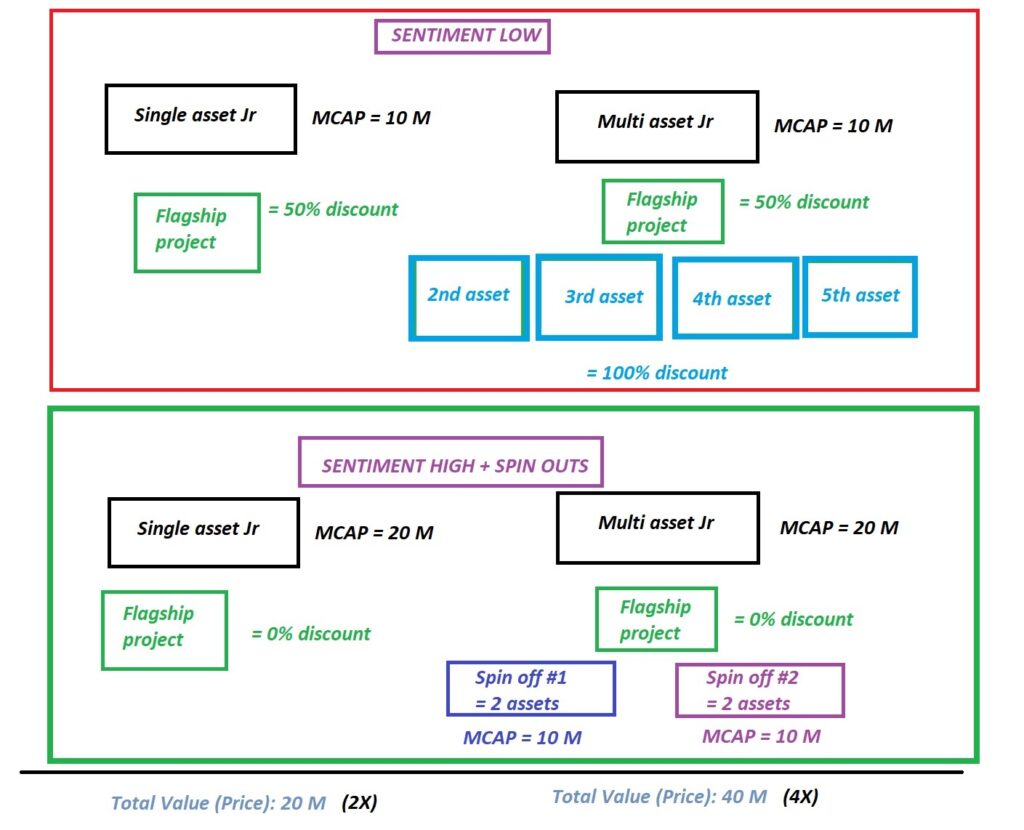

Here is a crude slide I did for a video/article where I discuss why I think being an “asset hoarder” with exposure to spin out potential is the “ultimate Risk/Reward”:

… The main thing is that during sentiment lows, like right now, one does often not even pay full price for a multi-asset company’s flagship project while getting all the intrinsic value of the other holdings for free. Said holdings can later be spun out, thus creating value for shareholders, with little to no risk. As you probably know one typically needs to take on risk as in for example assay risk in order to get returns. Hence why I call it the “ultimate Risk/Reward” strategy. On that note Nevada King does perhaps have an almost unique combination of both quality (jurisdiction, prospectivity, low threshold for success given location) and sheer “quantity” in terms of spin out potential:

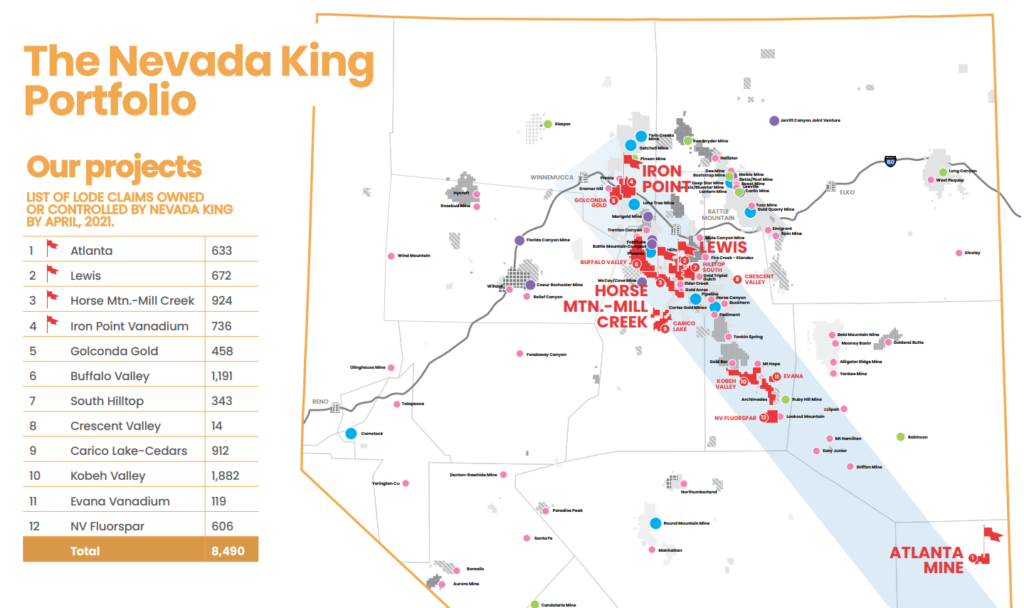

If we take Nevada King’s Market Cap of C$90 M and subtract say C$18 in Working Capital then we have C$76 M left. If we take C$76 M and divide it by 12 projects then we get C$6.3 M per projects. If we instead assume that the Atlanta Gold Mine, with its very impressive results lately, is worth at least say C$50 M then we get a price of C$2.4 M per peripheral project…

Which begs the question: How much in terms of combined Market Caps could an investor be sitting on if Nevada King some day decided to spin out say 1) Lewis, 2) Horse Mountain, 3) Iron Point, projects #5-#8 in one vehicle, and projects #9-#12 in a final vehicle?

Instead of owning Nevada King one could lets say (theoretically) end up owning shares in #6 different (theoretical) companies:

- “Atlanta Gold Mine Corp.”

- The Atlanta Gold Mine

- “Lewis Exploration Ltd”

- The Lewis Project

- “Horse Mountain Resources”

- The Horse Mountain-Mill Creek project

- “Iron Point Exploration”

- The iron point Project

- “Cortez Consolidated Resources”

- Projects #5-#8

- “Battle Mountain Exploration”

- Projects #9-#12

And consider the fact that this isn’t moose pasture out in the middle of nowhere. It’s land centered in and around one of the most prolific gold trends in the entire world in the #1 ranked jurisdiction in the world. Some of this land used to belong to the likes of Barrick up until the depths of the 2015/2016 bear market in gold when over-levered miners felt forced to shed a lot of assets just to stay afloat.

The main point is that C$2.4 M per project is absurd and in my opinion it is remarkable that an investor can “steal” all this land below (in red) for almost nothing:

In a good market I think some of these early stage projects could get spun out and fetch valuations of at least C$30 M. With that said I think what really makes the Risk/Reward absurdly good for Nevada King is that the company has “Margin of Safety” via the Atlanta Gold Mine (located in the bottom right corner in the picture above). Atlanta has a few things going for it. Firstly it is a past producing mine (Both open put and underground) which is a very good sign in my book:

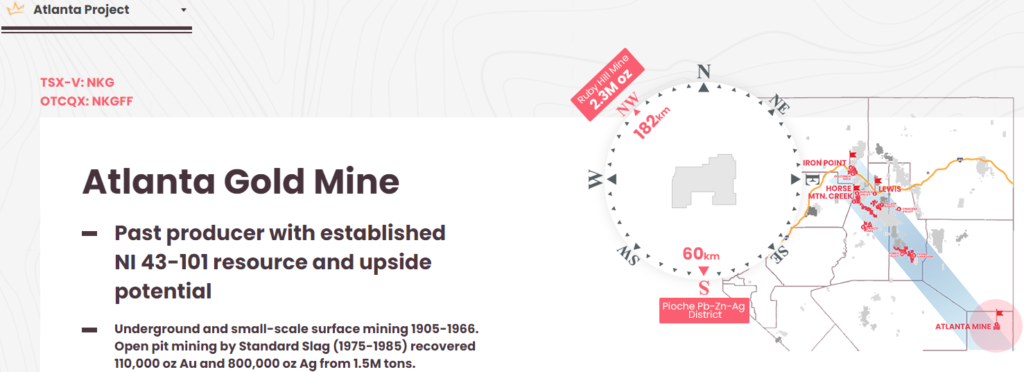

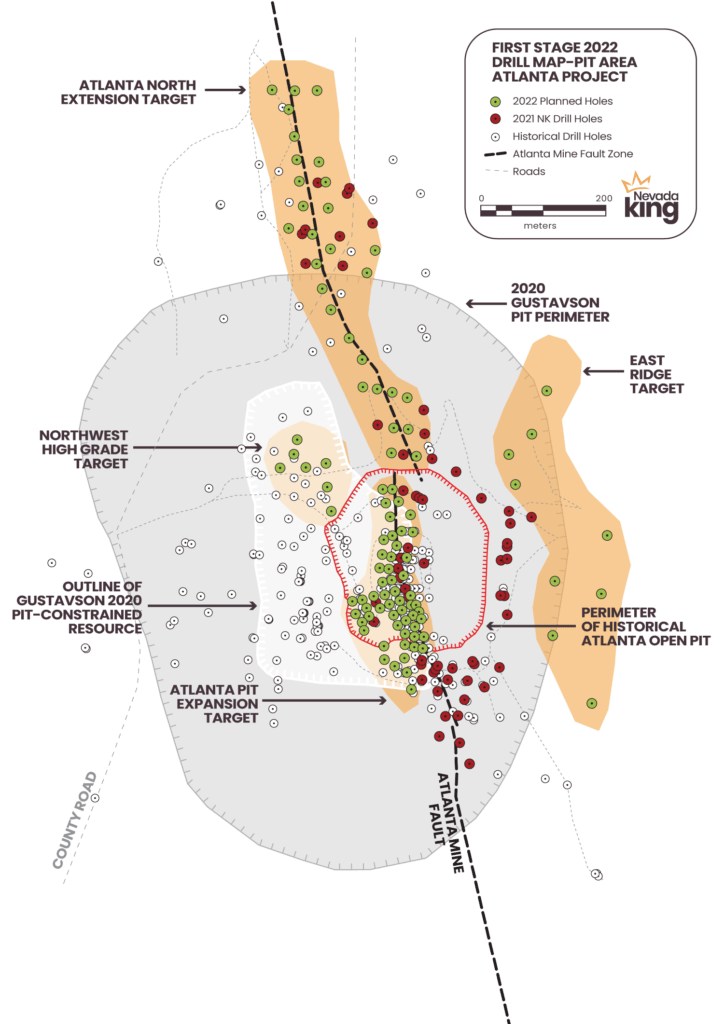

Atlanta also sports a 41-101 resource already which I see as a value floor:

Note that these grades are pretty good compared to some other low grade, open pit operations in Nevada. Also note that it comes with a lot valuable infrastructure like roads, a camp already in place, power and water provision. Furthermore Pan of Operations is in place. All in all these factors of course hike up the implied value of all ounces present and any future ounces which might be discovered. On that note the most exciting thing about about Atlanta, in my opinion, is that the company has discovered a high-grade zone that is present directly below the open pit and seems to continue both north and south along the “Atlanta Mine Fault”. In fact, the company has put out some truly outstanding high-grade intercepts over the last several months:

- 5.34 g/t Au over 54.9 m (Oxide, starting at surface)

- 3.35 g/t Au over 64.1 m (Oxide, starting at surface)

- 3.94 g/t Au over 41.2 m (Oxide, starting at surface)

- 2.52 g/t Au over 54.9 m (Oxide, starting at surface)

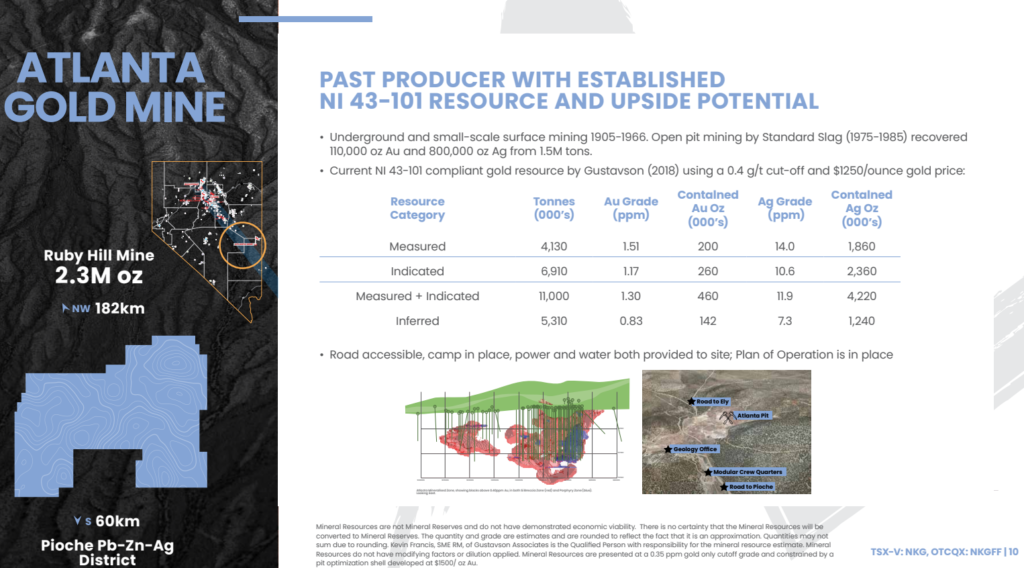

… Those are all over 100 gram-meters of high-grade, oxide, near surface gold intercepts in the heart of Nevada, and is a big reason for why the company hiked up the Phase II drill program from 1,000 m to 13,100 m, which is a whopping >13 fold increase in planned meters. In other words the realization that there appears to be quite a lot of high-grade gold here is a game changer for the Atlanta project. A new zone called the “East Ridge Target” has also emerged as a high priority target and will be explored this year. Overall the focus for the 13,100 m this year will be to follow the high-grade zone along the Atlanta Mine Fault and this East Ridge Target:

Given the grades they are hitting along this high-grade zone I expect there will be many wide, high-grade intercepts coming out of this upsized drill campaign. The inherent economic value that is incrementally proved up is significant in my opinion. One does not need much high-grade, oxide gold at shallow levels in order to slap on tens or even hundreds of millions in NPV. Furthermore there is likely more gold in the Atlanta district and the company is just getting started on expanding and upping the quality of the already existing resource. Personally I think the Atlanta mine will end up proving to be a robust deposit worthy of putting into production. This is basically why I love the “Margin of Safety” aspect for Nevada King given that I think the value of the Atlanta mine will one day eclipse the current Market Cap of the company alone. This is why I consider my recent share purchases akin to “stealing” some 10 projects across that massive land position.

If the known gold, and immediate potential around the pit is not enough, it is also good to know that the company believes there should be even more potential in the larger Atlanta district:

Fast forward a couple of years and I think the Atlanta Mine could have proven to be a significant multi-million ounce project with even more to come. Such a project could easily be worth several hundred millions of dollars. If I’m not paying for that potential future then I consider myself lucky since I love asymmetrical bets.

“Free upside” #1 – The “Iron Point” Project

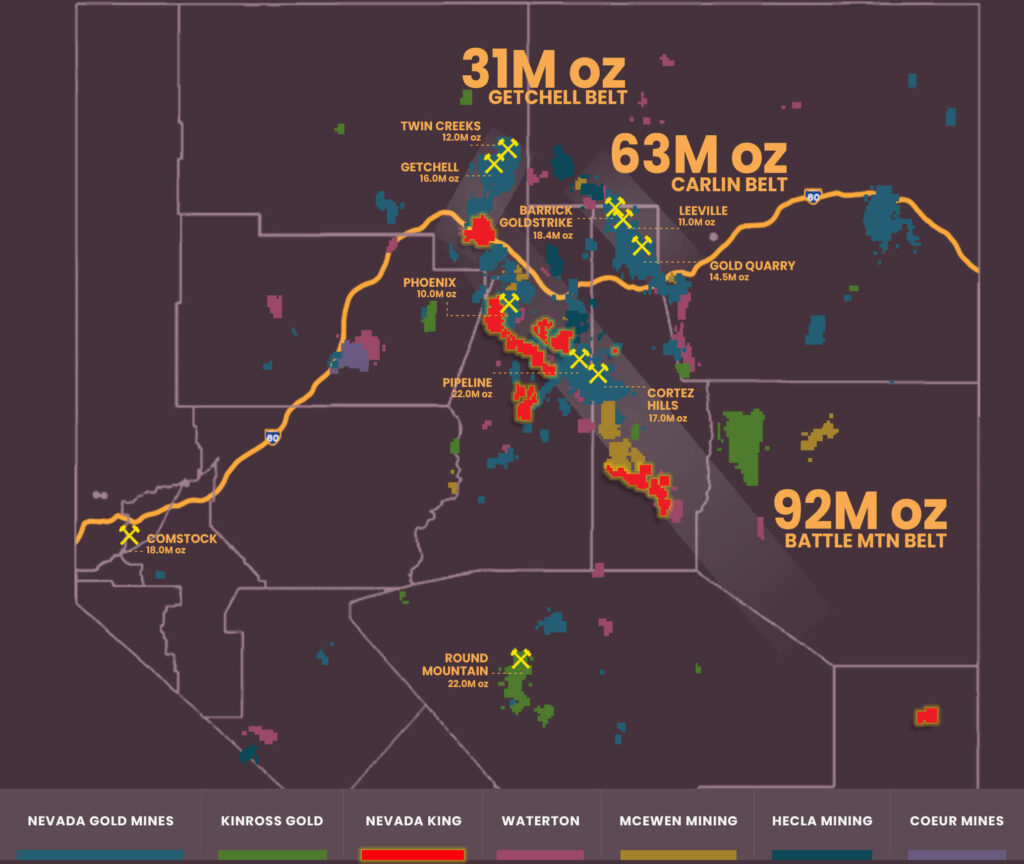

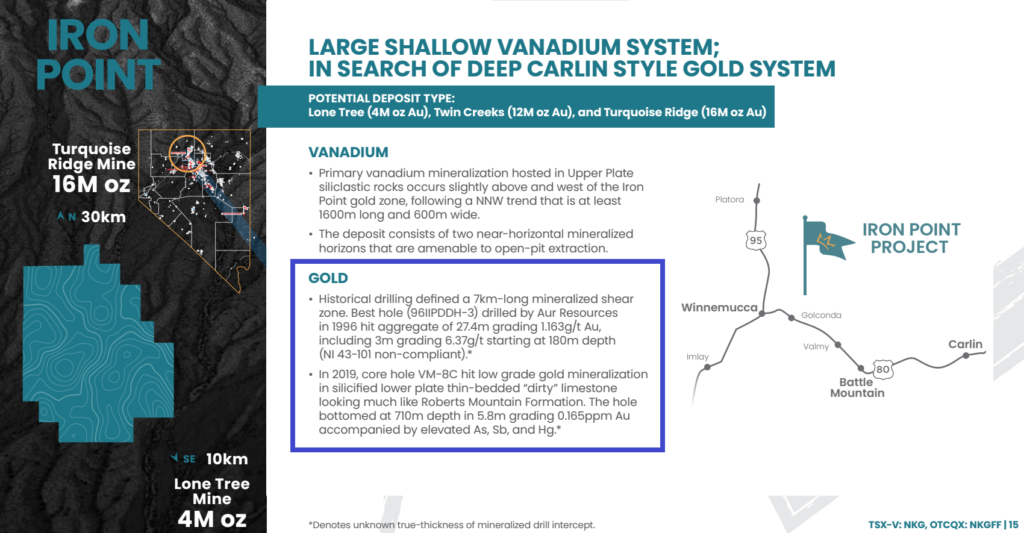

Iron Point is one of the more exciting targets in the Nevada King portfolio that I think an investor is getting pretty much for free. The project hosts known Vanadium mineralization and there have been plans to put a resource on it sometime in the future. This is a nice “gift” of course but lets focus on the gold potential. Well the company is currently doing a 4,000 m drill program at Iron Point and I expect assays to start trickling in over the coming weeks and months. Iron Point is located where the major Getchell (31 Moz) and Battle Mountain-Cortez (92 Moz) gold trends cross:

Iron Point sports a huge geochemical anomaly with pathfinder elements that are typical of Carlin gold mineralization. Basically there are elements that suggests that a huge amount of probably gold bearing fluids have penetrated the crust in this area. The trick is of course to find it and hope it’s been concentrated enough to form a large economic gold deposit.

More background on Iron Point in these short clips:

Oh and we already know there is indeed appreciable accumulations of gold at depth:

Make no mistake, the Iron Point project is an elephant target. The footprint of the geochemical anomalies suggests there is potential for a Carlin type monster to be hidden at depth here. In other words I think blue sky potential here is in the billions of dollars. Hence why the company is so anxious to do 4,000 m of drilling right off the bat.

The company is drilling Iron Point right now and I will be very interested to see if they will be lucky enough to announce a significant discovery hole in the coming weeks and months. And again, consider the worst case scenario. What if they miss on all holes? Is Nevada King all of a sudden expensive at today’s valuation given what they already have at Atlanta and the fact that there are 10 more projects? I would say no and that’s the beauty of the case in my opinion.

“Free upside” #2 – The Lewis Project

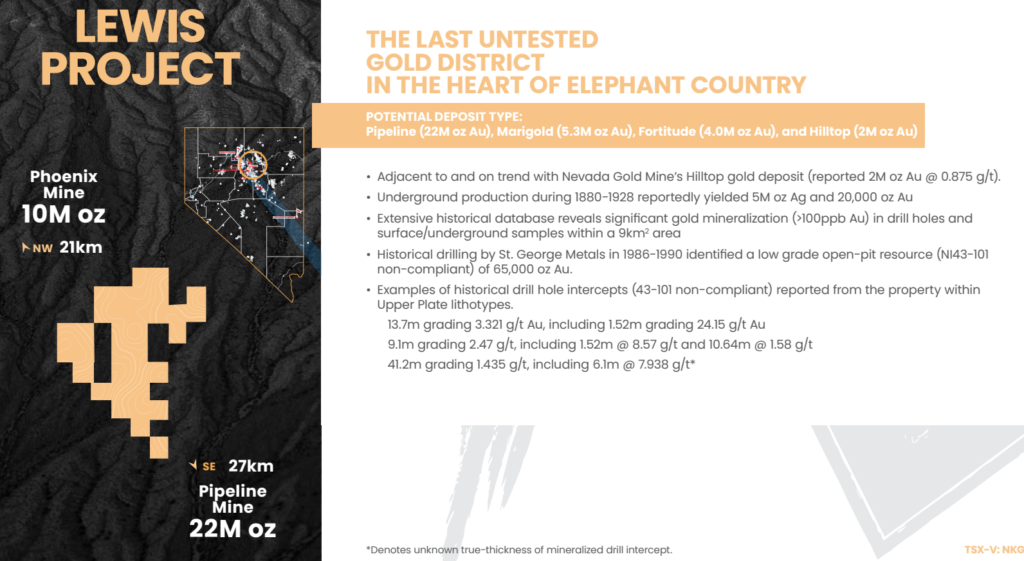

The Lewis project is adjacent to Nevada Gold’s (The Barrick and Newmont JV entity) Hilltop gold deposit, has seen historic mining and has a lot of “golden smoke” present:

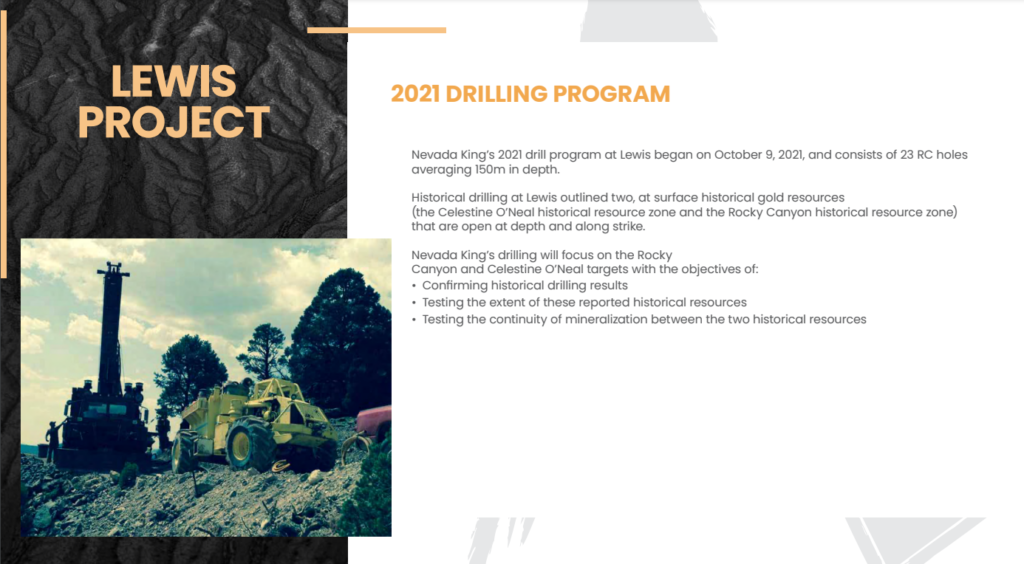

The description of the current drill program (assays awaited):

Again, what I love with this case, is that Lewis could produce 100% dusters and Nevada King would still be undervalued. So this drilling is free upside potential in my book. Furthermore this is not some moose pasture. This is prime ground and I think there is real potential for a company maker discovery here given enough time.

“Free upside” #3 – The Horse Mountain – Mill Creek Gold Project

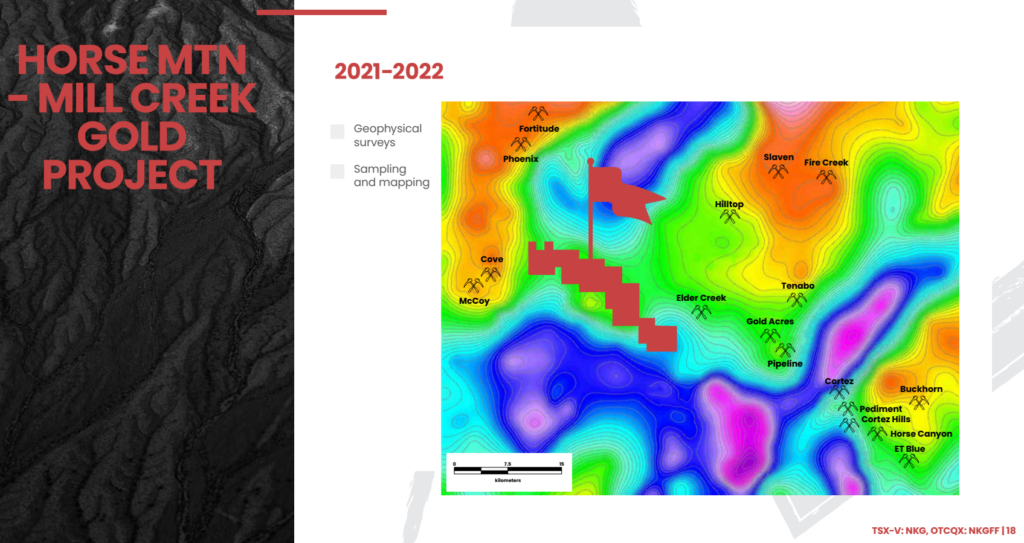

I will not go into details on this project since this article is already getting lengthy. Suffice it to say that this project is surrounded by famous Nevada mines and there have been sniffs of gold encountered in historic drilling by none other than Barrick Gold:

“Free upside” – #4 to #10

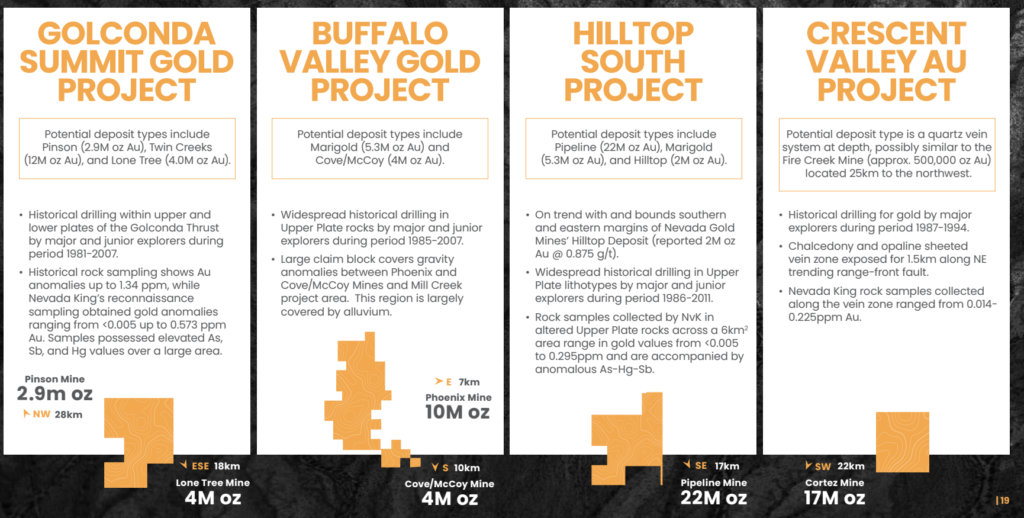

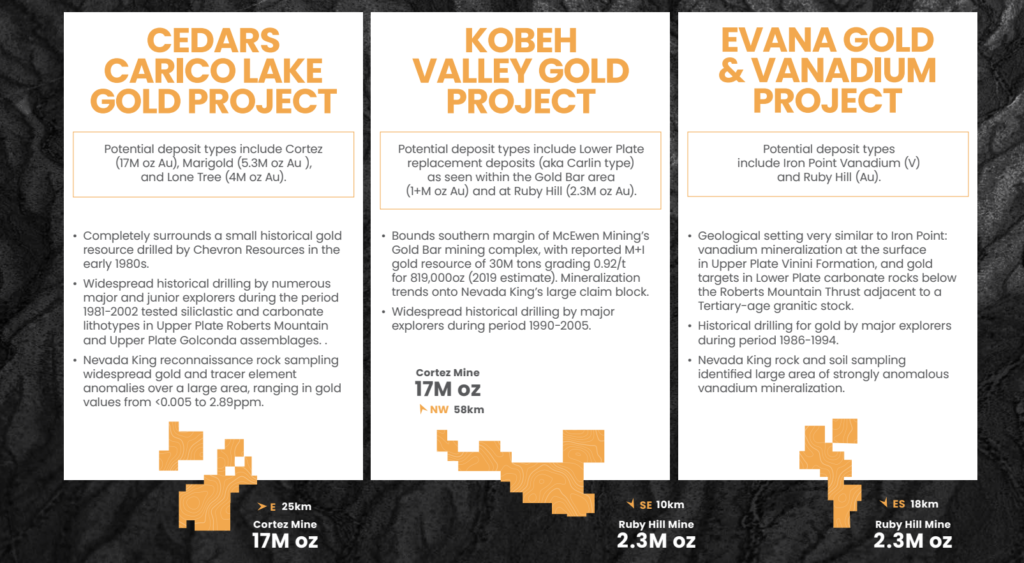

If there was any doubt just how cheap Nevada King is then just know that you get all of this as well:

… Again, just consider what the result would be if Nevada King simply spun out a bunch of assets into different vehicles in a hot market. My bet is that it would produce a very probable muti-bagger for shareholders. If “Plan B” is that good then what more can one ask for?

Closing Thoughts

It’s a simple case really. The company has a Market Cap of $90 M. The Atlanta Mine alone could be worth >$300 M in time. The longer term potential for the whole Atlanta Mine district could be a lot higher than that. I think Iron Point has multi billion dollar blue-sky potential that is far from being proven but one is not paying for right now anyway. Then there projects with known mineralization like Lewis and Horse-Canyon. Then there are several more projects on top of that…

I simply think one is getting an absurd amount of value + potential upside, for little risk, since the already known gold is not going anywhere. If the current Price of the company does not look very cheap in 12-24 months I will be genuinly shocked.

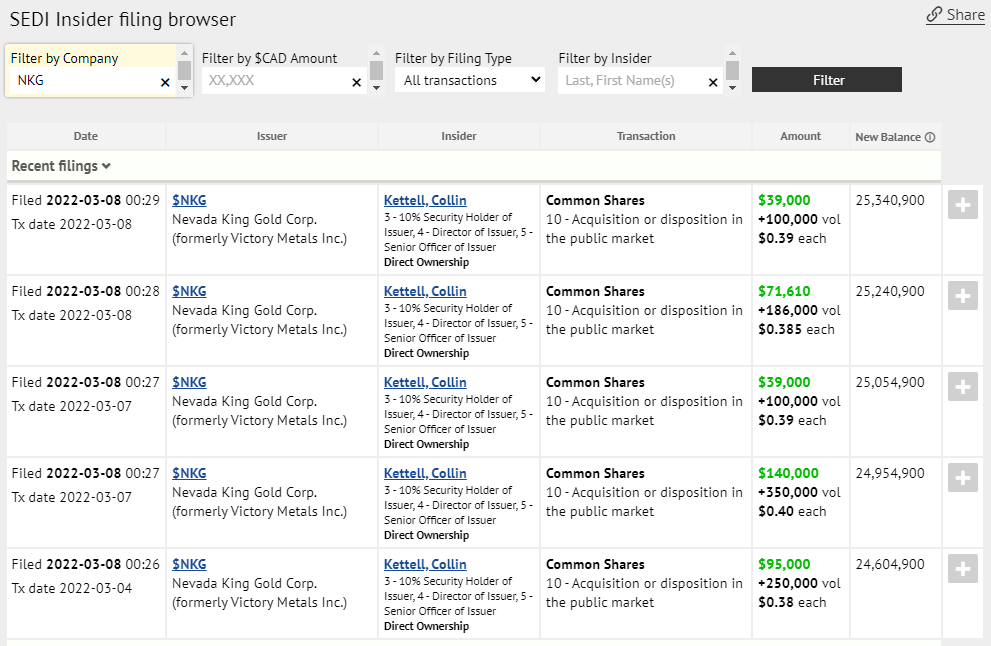

Oh and it appears someone who should know happens to agree and those are not small buys:

Amateur TA

To me it simply looks like the share price is consolidating while bouncing along the long term support line. For what it’s worth it would need to go up some 100% just to get back to the 52w highs when the case was not even as good as it is now (Price of gold up + Atlanta high-grade discovery):

Note: This is not trading or investing advice. Always do your own due diligence. I own shares of Nevada King and the company is a banner sponsor. Therefore consider me biased. Junior miners are volatile and risky. Never invest money you need and cannot afford to lose. You are responsible for your own decisions and I share neither your profits or losses.

Best regards,

The Hedgeless Horseman