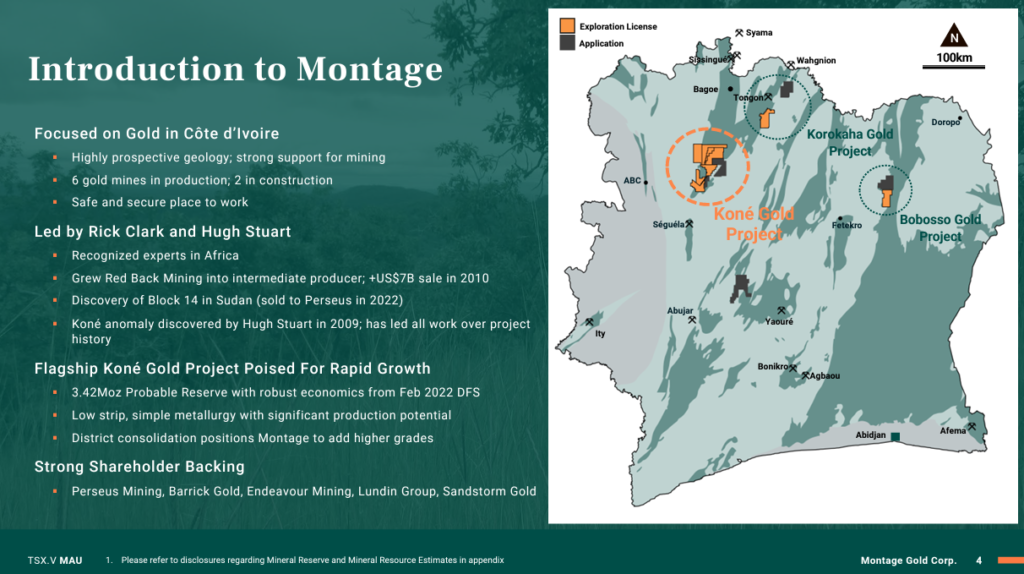

THH – Montage Gold (MAU.V): Lundin Backed ~4 Moz Gold Story Just Got a Lot better

This article will be about Montage Gold that recently completed a transaction, which in my opinion, materially changes the overall investment case for the better. I have had a position in Montage Gold for quite some time and have been following the development of their flagship Koné Project closely. While the gold endowment at Koné has become impressive, and the economics are robust, I think the story needed something more to really make the Risk/Reward stand out. With the previously mentioned transaction just having closed I think Montage as an investment case changed changed a lot. It is somewhat along the lines of what recently happened in another favorite of mine which is Magna Mining. In that case a transformational transaction was completed but some >2 months later the market is still in the process of pricing in the sudden addition in value. The transaction for Montage might not be as transformation at face value but the fact that the market still has not figured out that it changed the case a lot makes it a similar opportunity in mu book. And not only do I think the banked value got hiked up, but also the quality of the project, as well as creating a steepened potential growth curve (future value trajectory). I expect great things from Montage Gold in 2023.

This article will include forward looking statement and my subjective opinions. Given I am a shareholder of the company you should consider me biased. The company is not a sponsor but I would gladly accept them as one in a heart beat for what I think will soon be obvious reasons…

My Case for Montage Gold in Short:

- Team: Truly world class

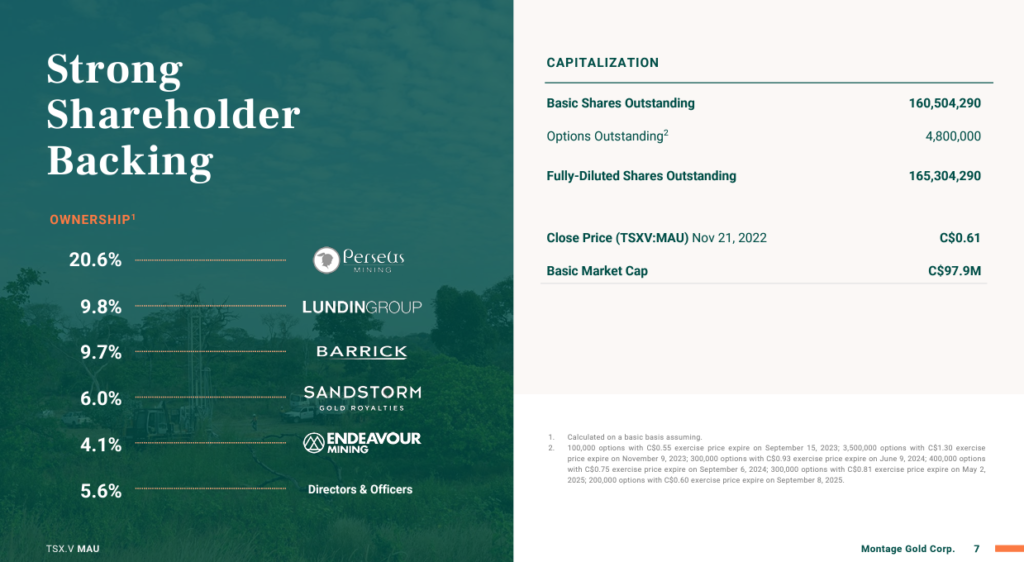

- Backers: Lundin family, Barrick Gold, Endeavour, Perseus Mining & Sandstorm

- ~4 Moz of gold with >$1 B NPV at $1,800 gold

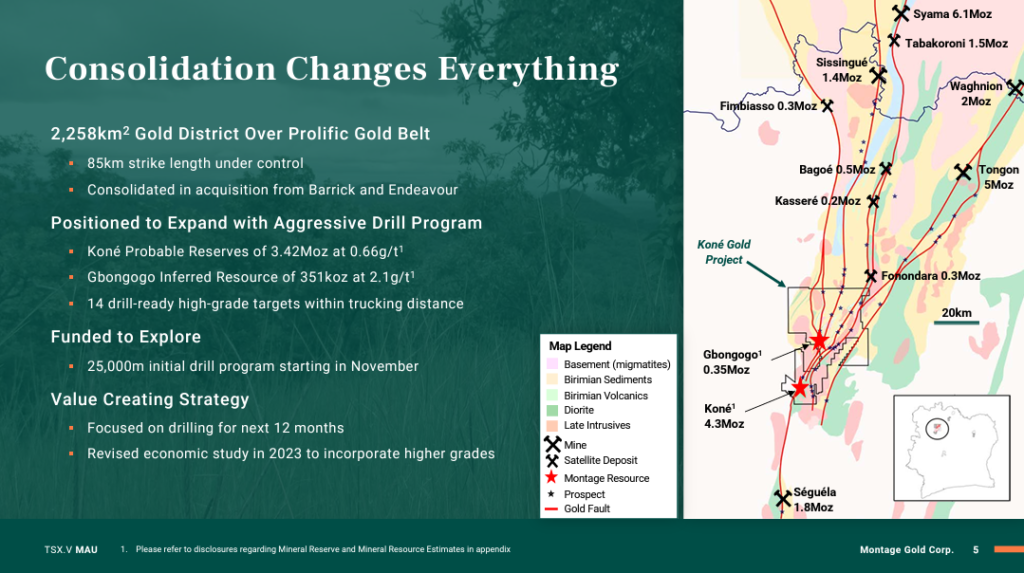

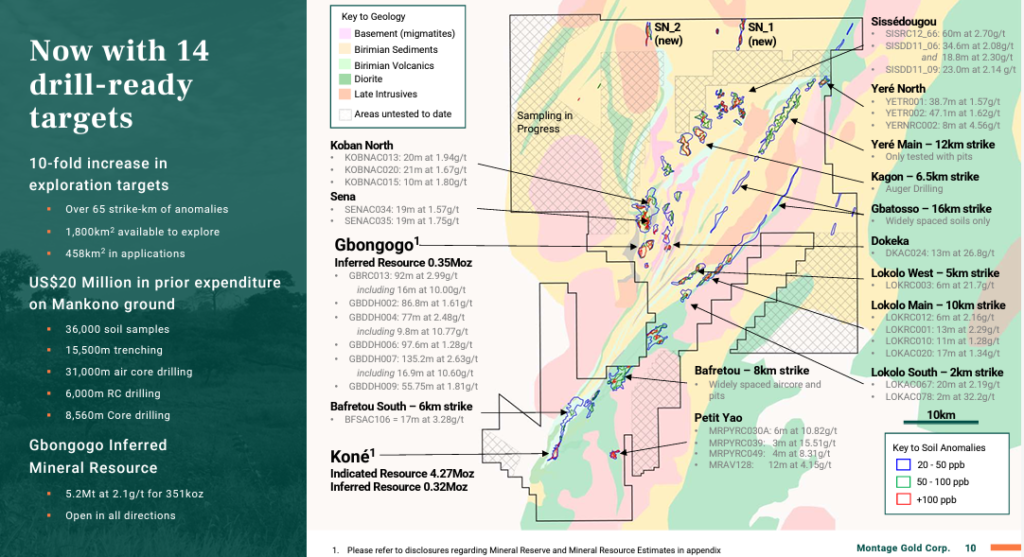

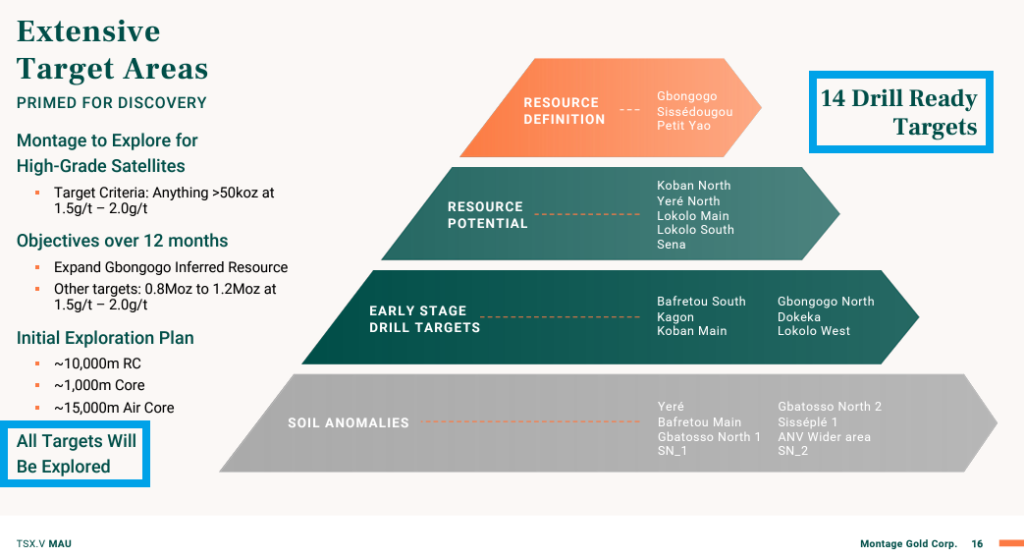

- A transformational transaction was closed less than a month ago which completely changes the case

- Adds 350,000 Koz of gold with an expected value of ~$200 M

- Adds a district scale land package with #14 drill ready targets

- Market Cap: C$123 M

Montage Gold is one of very few junior gold miners I would be pretty comfortable buying even if I literally could not sell for two years. In other words it is one of the better “HODL” cases I know of.

- Margin of Safety [X]

- Probable Growth [X]

- High Potential (in light of current Market Cap) [X]

Catalysts

- 25,000 m of drilling with first assays expected shortly from the new ground

Setting the scene

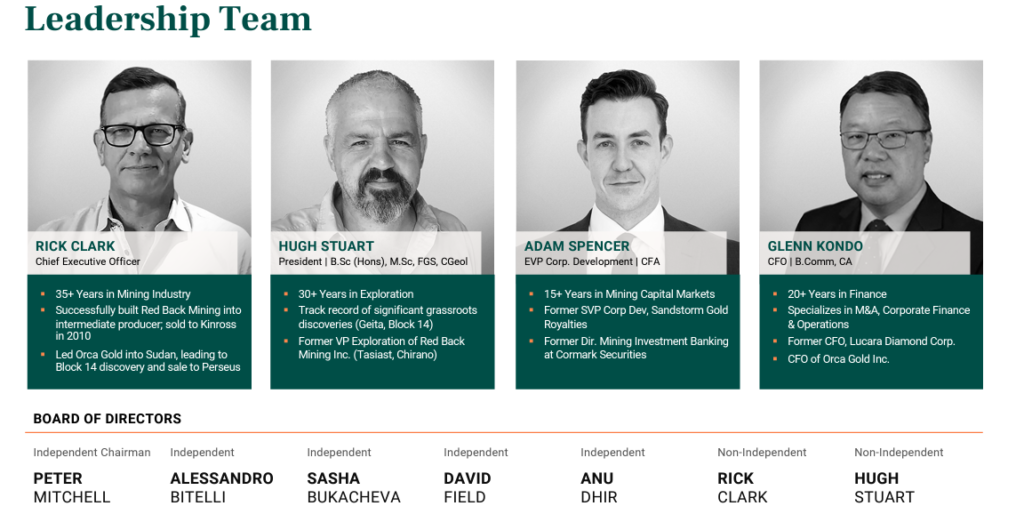

Montage Gold’s Big Competitive Advantage: The Team

When you buy into a company you buy a piece of all assets and the value creation skills (labor) of the team involved. The single best way to avoid making mistakes is to bet on the best teams who wouldn’t get out of bed in the morning if they did not truly believe that their endeavor has merits. Furthermore the most reliable way to produce a higher share price in the future is of course to create value and this team is famous for creating a lot of value…

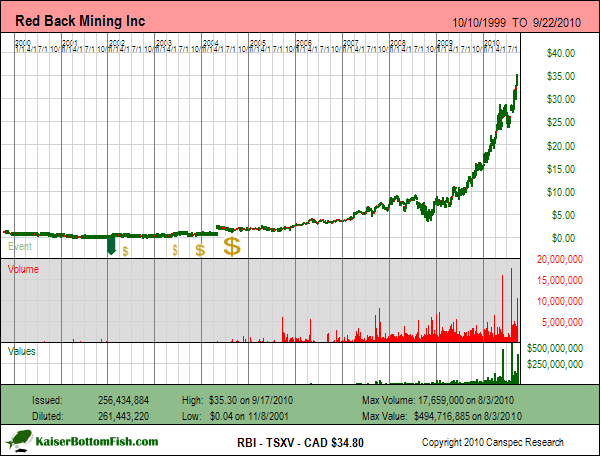

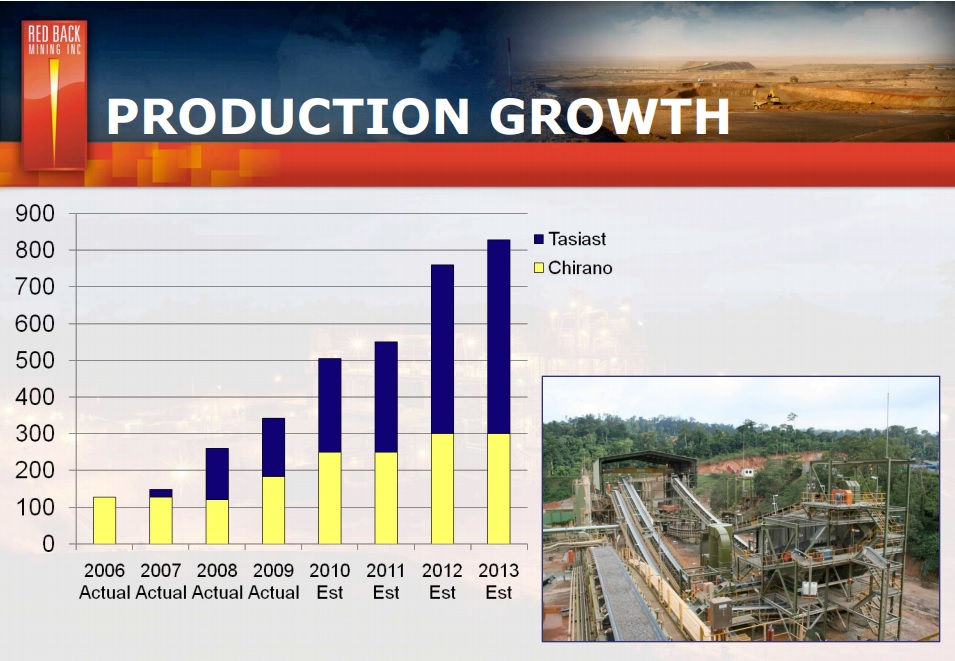

- Red Back Mining – SOLD at ATH for US$7.2 B in 2010 to Kinross Gold

- Discovered Koné

- Orca Gold – SOLD at ATH (post Red Back team reunion) for C$215 M in May, 2022 to Perseus Mining

- “re-acquired” Koné from Kinross and put it in the private entity Montage Gold

- Montage Gold (spun out of Orca Gold) – TBD

- Koné as flagship project

The wealth that was created for shareholders in Red Back Mining is rather breath taking. The team, backed by the Lundins, had successfully taken two projects all the way from exploration to production and was able to sell it around the peak of the epic 2011 bull market in gold. Next up for the team, again backed by the Lundins, was Orca Gold which started off as a private company exploring for gold in Sudan. Later on it got a public listing and on Au 29, 2016 it was announced that “Orca Gold Reassembles Red Back Management Team to Advance Block 14 Gold Project”

I do want to point out that even though the price tag for Orca Gold might seem low it was still a big success for most. Why? because the anyone who bought and held the stock at any point, after the Red Back team was reassembled, ended up with a good profit and would have beaten the GDXJ handedly on average. And this is in a junior explorer operating in Sudan which is probably perceived by investors to be one of the worst jurisdiction on earth (so talk about headwinds). Oh and they made it happen almost 2 years into a bear market to boot.

Orca Gold – Last 3 years up until it was acquired:

This team has basically been the gold exploration arm for the Lundin family for over two decades and pretty much has been the manifestation of a team to “HODL”. One could have bought Red Back Mining at any time, over many years, and each and every buy would have returned a profit in the end. In Orca Gold one could have bought it at any time in at least the last 5 years and one would have beaten GDXJ and come out with a profit.

The Only Way to Capture The Alpha of a Superior Management Team: Time

Time is the friend of a shareholder in a company run by one of the best management teams in the world. Hold a stock of two different juniors for one day, with one management team being really bad and the other being exceptionally good, and you will see no difference. Hold both over 5 years and you will probably see the stock with the exceptional team some 500% higher and the other some 50% lower or delisted. Exceptional teams solve problems and create value over time. Low quality teams create problems and destroy value over time. Allow me to use another example showing the value of time being the only real way to capture the edge of a superior team. If you put me in an NBA team and Michael Jordan in an identical team and gave me and Michael Jordan 1 second of playtime each, we would probably have an identical impact on the team’s success (none). Let us play 100 full games and the difference in results would be staggering. OK one last example. If you compare Warren Buffet’s portfolio with the average investor on any given day there is probably a 50/50 chance the average investor will have a better result. Give both 10 years, to make good and bad investing decisions, and Warren Buffet would probably outperform the market handedly while the average investor would underperform it with 95% certainty… More time… More time to make decisions… More opportunities to make good or bad decisions that compound.

Case in Point:

Both shareholders in Red Back Mining and Orca Gold inevitably saw 30% to 50% retracements in the share price of the companies now and then (standard short to medium term volatility). But ALL shareholders would be in the green on every single stock purchase, no matter how high, at the end of the day… As both companies were acquired and the maximum amount of TIME had passed by definition since the “Red Back Team” had started to do what they do best which is creating value over time.

In short: Anyone who ever purchased a share of either company at any time, while this team was at the helm, would end up making money. The worst “market timer” in the world would thus end up making money, as long as he/she was able to just hold on to the stock, and let the team compound the company value.

Chart of Red Back Mining:

Red Back Mining production growth 2006-2013:

It is not often one I can say that I think there is a very real possibility that I think I can HODL Montage Gold and one day get a natural exit at ATH. Montage Gold would be one of those cases where I think most shareholders would outperform the market, and their previous track record, by simply throwing throwing away the computer/phone for a few years so they can’t sell. Cases like this are extremely rare simply because world class management teams with backing from the Lundin Group et al are extremely rare. This combination makes it pretty much impossible to be making a mistake by owning Montage which is also the reason that I think such cases

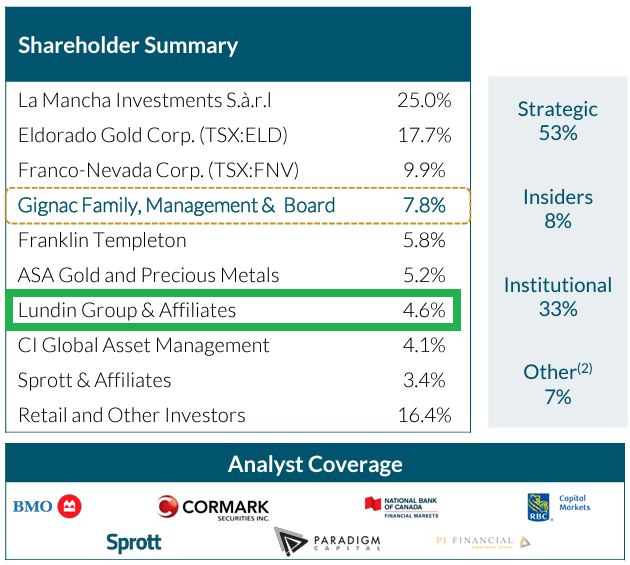

Notable shareholders who are betting on this team and Montage Gold:

… All of the above are betting on this team and pretty much by default it would thus be stupid not to do the same. Their cumulative knowledge of geology, mining and value creation is pretty much unrivaled in this space. If one would be bearish on Montage one would by default be betting against all these players which, when you think about it, might be one of the dumbest bets around.

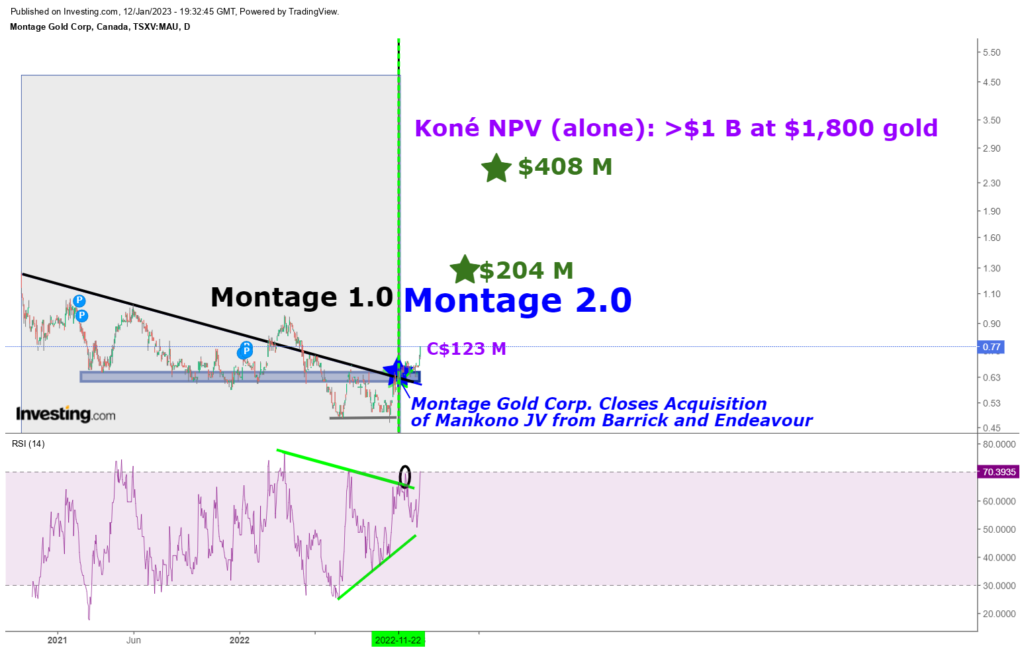

Montage Gold 1.0: Pre-Transaction

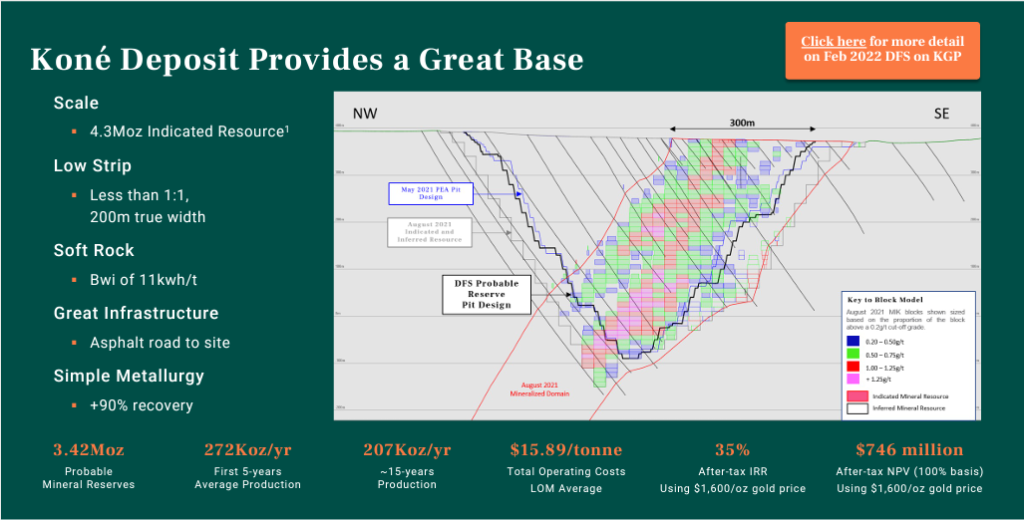

Montage was already a smaller shareholding of mine before the transaction (and Orca Gold before that). Why? Because it’s pretty much stupid by default not to bet on these guys. The company had been able to drill up a substantial resource at their flagship Koné deposit to the tune of 4.3 Moz in almost record time and even had a Feasibility Study done. As a matter of fact the company was already starting to look for financing options, to build this large mine, just in time for the long sought after land deal with Barrick and Endeavour finally came to fruition. That’s how advanced and de-risked the flagship asset of the company is:

Note the impressive production profile of 272 Koz ounces of gold per year in the frst 5 years, 35% after tax IRR, and NPV of $746 million (100% basis) at a gold price of $1,600 per ounce ($1,043M after-tax NPV5% and 47% IRR at $1,800 gold price). The downside is that it requires $554 M in CAPEX if I remember correctly which is on the larger side for a junior and certainly way above the company’s Market Capitalization.

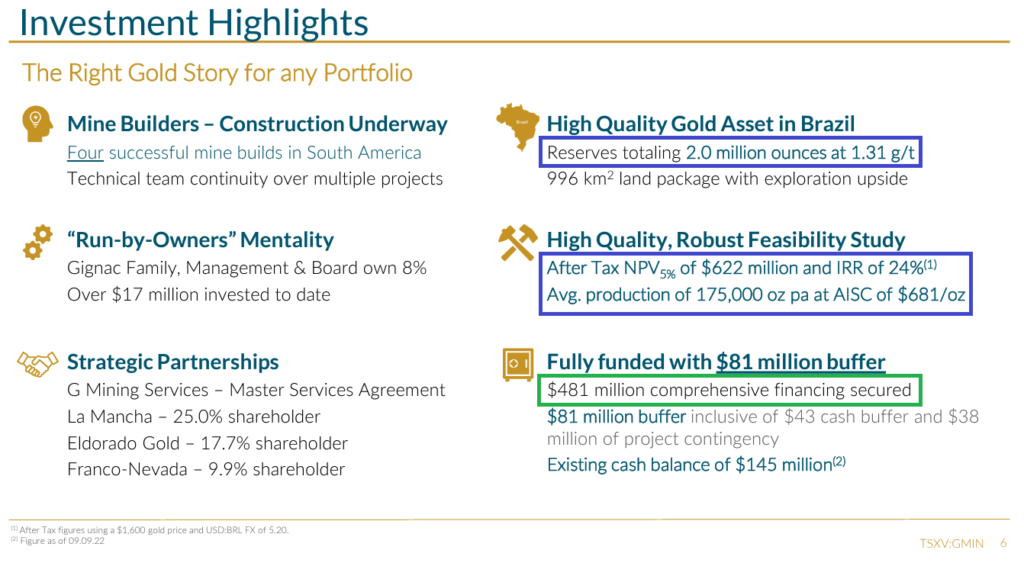

With the above said the Lundins are famous for backing companies/projects that end up getting financed and built (Even in sub tier 1 jurisdictions). Recent examples would be Lundin Gold’s Fruta Del Norte mine in Ecuador and the most recent G Mining Ventures in Brazil:

G Mining Ventures Announces US$481 million Financing Package for Tocantinzinho Gold Project – Source

It’s not the best deposit in the world. It’s not in the best (perceived) jurisdiction in the world.

The Koné gold deposit on a standalone basis is arguably a more impressive project than G Mining’s gold project which recently got financed to the tune of US$481 M. By acquiring the nearby ground from Barrick Gold and Endeavour Mining, Montage’s “greater Koné gold project”, which would include Koné and any satellite deposit, becomes even better…

Montage 2.0

On November 22 the deal with Barrick Gold and Endeavour Mining was closed:

“Montage Gold Corp. Closes Acquisition of Mankono JV from Barrick and Endeavour Exploration of High-Grade Targets Underway” – Nov 22, 2022

Vancouver, British Columbia — Montage Gold Corp. (“Montage” or the “Company”) (TSXV: MAU) (OTCQX: MAUTF) is pleased to announce that it has closed the acquisition of a 100% indirect interest (the “Transaction”) in the Mankono Sissédougou Joint Venture Project (“Mankono”) from subsidiaries of Barrick Gold Corporation (“Barrick”) and Endeavour Mining plc (“Endeavour”).

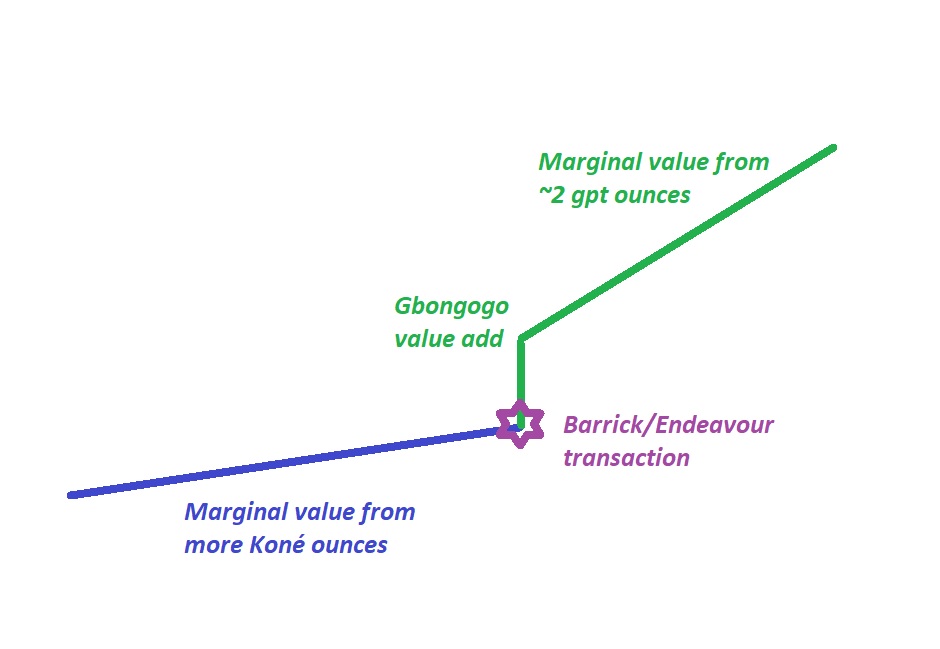

As the slide below suggests this deal “changes everything“:

During the Beaver Creek presentation in September Hugh Stuart did a good job explaining just what kind of impact this deal has for Montage Gold…

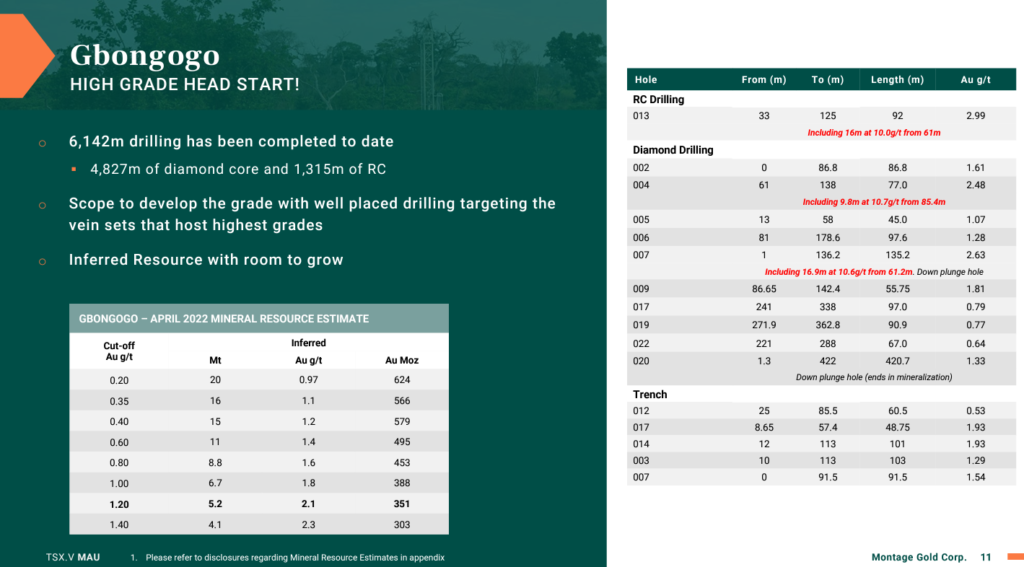

First of all the Gbongogo deposit which “only” has a 351 Koz inferred resource at 2.1 gpt could potentially add a whopping ~$200 M to the NPV of a “greater Koné operation” if used as satellite feed. The high grade nature of Gbongogo could also potentially reduce the payback period for the whole operation by 9 months. These are obviously highly significant factors for a junior with a Market Cap of only C$123 M. Lastly, it has the potential to give a nice bump to production during the first ten years.

To sum up: Gbongogo with 350 Koz probably adds more actual value to Montage than the total value of a given junior with a >1 Moz standalone deposit.

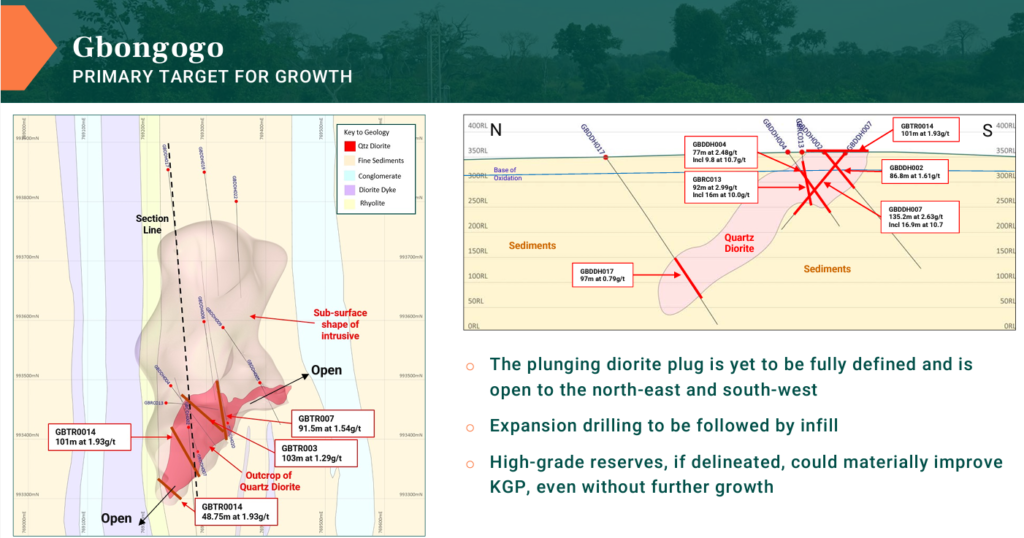

Despite Gbongogo only having seen 6,142 m of drilling so far it still has produced quite impressive drill intercepts:

And there might be a quite a bit left to find to drill up to boot:

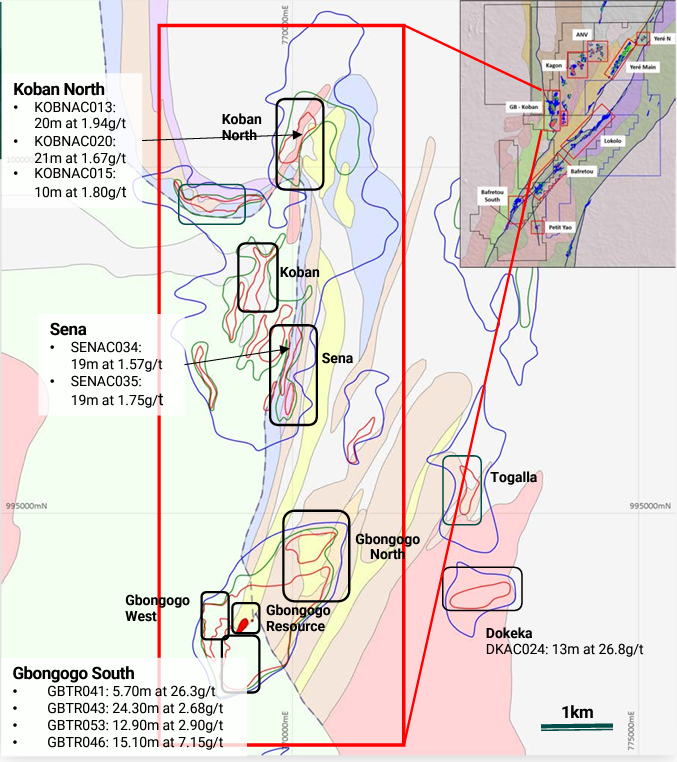

Furthermore the currently small Gbongogo resource, which potentially is already worth $200 M to Montage, is just a tiny blip in a larger 10 km trend:

(The Gbongogo resource is that tiny red peanut in the bottom part of the next slide)

To sum up the direct value add potential to Montage Gold from the CURRENT version of “Gbongogo” ALONE:

- NPV -> +$200 M

- Payback -> – 9 months

- Production year 1-10 -> From 250,000 oz to 280,000 oz per year

This significant value add is is JUST based on what is SO FAR confirmed (implied), from ONE underexplored target, which is Gbongogo. And there are many additional targets, including as many as #14, which are drill-ready(!):

It might be a bit hard to see some of the highlighted holes in the slide above but here are some examples from other targets than Gbongogo:

(Note: This is from limited drilling)

- Sissédougou

- 60m at 2.70 gpt

- 34.6m at 2.08 gpt

- Lokolo West

- 6m at 21.7 gpt

- Lokolo Main

- 13m at 2.29 gpt

- Lokolo South

- 20m at 2.19 gpt

- Koban North

- 20m at 1.94 gpt

- Sena

- 19m at 1.57 gpt

- Yeré North

- 38.7m at 1.57 gpt

- 47.1m at 1.62 gpt

The Supercharged ROI Potential in The New Montage Gold

Now lets consider the value potential from the total land package excluding Gbongogo which was already discussed. The following comments from Hugh Stuart during the Beaver Creek presentation:

- “50,000 ounces at 2 grams generates $50 to $70 million dollars in value for the project” – Source

- “We believe that anything in that map that we discover above 50,000 ounces at 1.5 grams is relevant and can be trucked into Koné” – Source

These comments together with the comments about the potential impact of Gbongogo readily explains why the case has changed in a significant way. To any early stage junior finding a deposit of 50 Koz or 350 Koz of gold is almost meaningless (worthless) on its own. Why? Because almost nobody would care about such deposits on a standalone basis even it they graded 2 gpt. With Montage already having ~5 Moz at Koné which is already enough to warrant building a large, long lived operation the value of these high grade satellite deposits go up in value by orders of magnitude. Why? Because they will be low cost, high margin “juice” fed to a plant that is already viable in light of the large low grade Koné deposit.

Just think about it. If a junior finds a 350 Koz deposit somewhere that is not close to an existing, hungry mill, that deposit will most likely never get mined and for all intents and purposes be worthless because an ounce in the ground ONLY derives its value from the economic benefit of actually recovering and selling that gold. On the other hand if you already have a mine with a hungry mill and find lets say 50-350 Koz of high grade gold nearby then that will surely get recovered and sold because all the infrastructure (sunk costs) is already there. In other words every 50 Koz of gold found for Montage in this entire land package might actually be worth some $50-$70 M whereas $50 Koz for a typical junior might literally be worth $0.

Just think about the lets say Return on Equity potential after this deal when you consider the fact that every additional 50,000 ounces of gold found at 2 gpt could hike up the economic value of the project (and thus company) by $50 to $70 M while the current Market Cap of the entire company is a mere $102 M. In other words every additional 50 Koz of gold found could add 50%-70% of the current Market Cap in value. And this is not some highly theoretical value, which is the norm in the junior mining space, because Koné is already large enough to be a standalone mine and this team (and their backers) are actually world class mine builders.

ROI on Drilling

Hopefully it will now be obvious why I think the investment case for Montage Gold completely changed after this transformational transaction as the company went from primarily being a “mature” (Beta) deep value play to a deep value play (Beta) with exceptional growth (Alpha) potential as well.

If I were to visualize the immediate value change and increased pace in growth potential it would be something like this:

Lets say the ounces from Gbongogo are indeed worth some $200 M. If so the Value for Montage has jumped more than the Price of Montage and thus the opportunity got even better as Montage suddenly became even cheaper. Then we add the potential for any additional higher grade ounces that could have a great impact on the economics of the project. Furthermore we have the “ease” of only needing say 50 Koz for a significant value add and I think it becomes obvious that both the Price to Value gap increased as well as the Price to Expected Future Value gap at time X (via increased value creation pace potential).

Going Forward

The company has re-hit the ground running and two drill rigs are already active and are testing #6 initial target areas with first assays expected around year end. In total an impressive 25,000 m of drilling is planned and the total amount of drill ready targets are #14. – Source

Montage will also be doing infill soil sampling program on known targets and when all is said and done a new Economic Study will be produced which takes in both the large Koné deposit and any significant findings from the 25,000 m program.

The best part is that these 25,000 m of drilling and additional soil sampling programs have no way of making Montage expensive since the company is cheap relative to what is already confirmed. In other words it’s pretty much a situation of heads I win and tails I don’t lose aka “Risk free upside potential”.

Expectations

The short term is volatile and I personally believe it is a fool’s errand to guess where a stock will trade a day, a week or a month from now. My preferred strategy is to simply compare what PRICE I am paying today for a company and what the base case VALUE might be say 12 months from now. Believe me, almost nobody is pricing any of these junior mining companies based on what they will look like in 12 months. Instead everyone is buying/selling based on where they think a stock will a week from now and/or focus on the very next news release.

So, lets try to jump into a time machine and think what Montage might look like in 12 months…

We know what is already there and that is a large, almost 4 Moz deposit at Koné with a NPV of $746 M at $1,600 gold ($1,043 M at $1,800). We know that Gbongogo has a good shot of getting included in the next economic study and might bump the NPV by ~$200 M. That takes us to an expected value of around $946 M on paper. Now lets say a base case for the 25,000 m of drilling proves up at least 250,000 ounces, at good grades, and lead to a further $200 M bump (Note that the internal company objective is to delineate 0.8-1.2 Moz and not 0.25 Moz!) that puts the NPV in lets say 12 months at $1,146 M at lets say $1,600 gold. If this “base case” comes to pass I dare say that there will be considerable pressure to the upside from the current valuation of Montage.

Depending on the success the company might choose to redo the size of the operation. This would decrease CAPEX, decrease Payback time, and probably make the overall project more attractive from an economic and risk stand point.

Most importantly I look at the fact that Montage is seriously undervalued RIGHT NOW and there is a very real possibility that the company will add multiples of the current Market Cap in additional value over just the next 12 months (Let alone over the coming years).

I cannot say how much I love stories where it is pretty much impossible to be overpaying for what is already known (Unless Lundin, Barrick, Endeavour, Perseus and the current economic study are wrong) and there is also Significant Probable Growth ahead. If I had to bet, which I am, I would say there will have been a lot of upside pressure from now till Dec 2023 has transformed into the new now:

Of course if the company does end finding close to the management team’s internal goal of 0.8-1.2 Moz of higher grade satellite feed and we use a gold price of $1,800 then the $1,146 M number would probably be very much on the low side…. But hey a no brainer case should afford a big margin otherwise it would not be a no brainer.

I know people hate this recent >2 year bear market in the juniors because everyone wants everything to go up all the time. But if it were not for the long bear market, and currently abysmal sentiment, there would simply be no way one could be able to pick up stories like this for $100 M. Big returns are first crated months or years ago when somebody bought something that was cheap. Can’t have the former without the latter.

Strategy

Pretty simple… Hold, hold, hold, hold, hold until this team has hopefully created so much value that I’ll ask myself “How could you have bought all this for ~$100 M in 2022?”. In 12-24 months I believe I will either be down, or up a lot, and my bet is on the latter.

The more time I give this team the more I expect to make.

Amateur TA

Well I simply think the bottom is already in and that a revaluation is coming in the coming weeks, months and years while value keeps increasing as well. Might be some resistance in the current $0.70 area but when those sellers (who I think are making a mistake) have sold their shares I don’t see much resistance for a while FWIW. Over the long term a cent here or there should be of trivial importance of course…

Note: This is not investing advice. Junior miners are risky. You might lose all your capital. Do your own due diligence. I own shares of the company and am therefore biased. Assume I may buy or sell shares at any time without notice. Always make up your own mind. I cannot guarantee the accuracy of the content in this article.

Best regards,

The Hedgeless Horseman