THH – Magna Mining (NICU.V): Why I Think This Sector is Extremely Easy Right Now

“We have no peers” – Jason Jessup, CEO of Magna Mining

This is a short article on one of the best cases I have seen in many years. There will be forward looking statements and my personal opinions. I am biased as I own a very significant amount of shares and the company is a banner sponsor. Do your own due diligence!

Setting The Scene

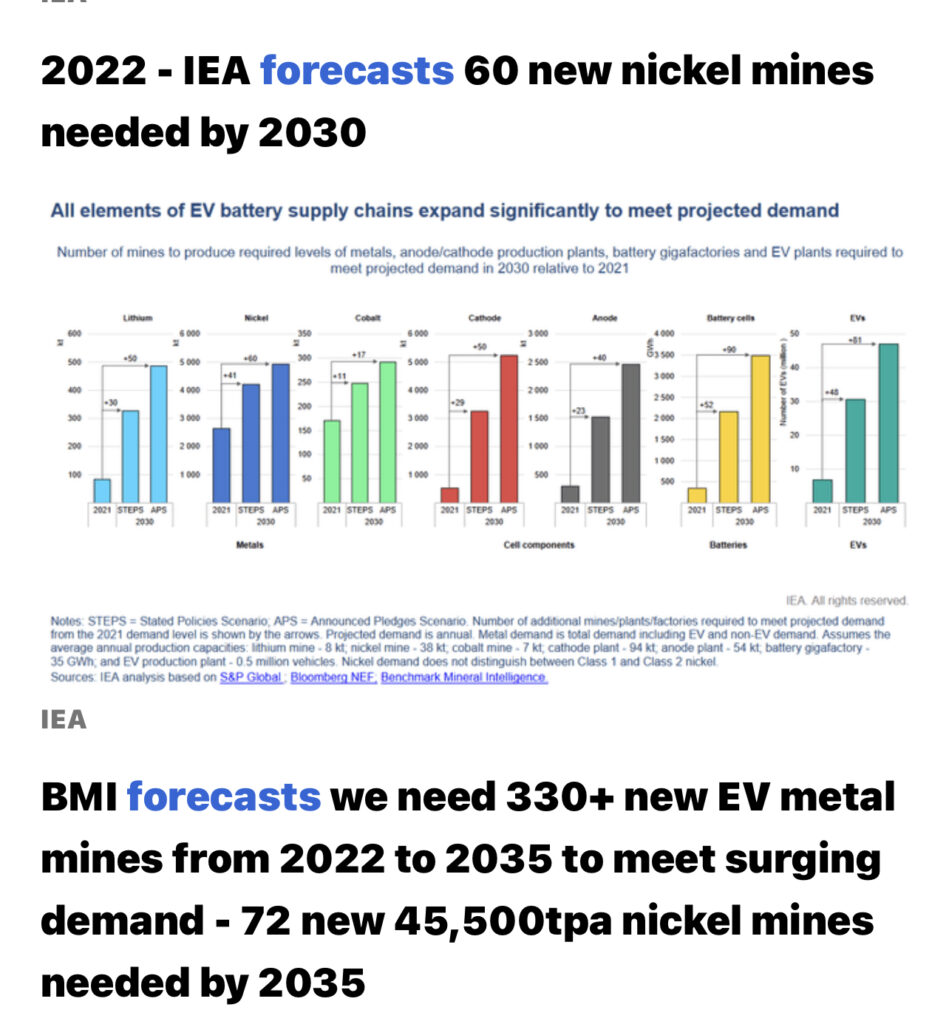

We have IEA’s forecast that #60 new Nickel mines will be needed by 2030 which is only 7 years away.

Wehave Canada and the US competing in terms of becoming the hot spot for EV battery production:

“Ottawa preparing to go toe-to-toe with U.S. to subsidize EV battery production in Canada” – Source

We have BHP saying:

“We anticipate demand for nickel in the next 30 years will be 200% to 300% of the demand in the previous 30 years.” – Source

Then you have both the US (even the US defense department) and Canada supporting “Critical Metals” development via grants and what not (Google it).

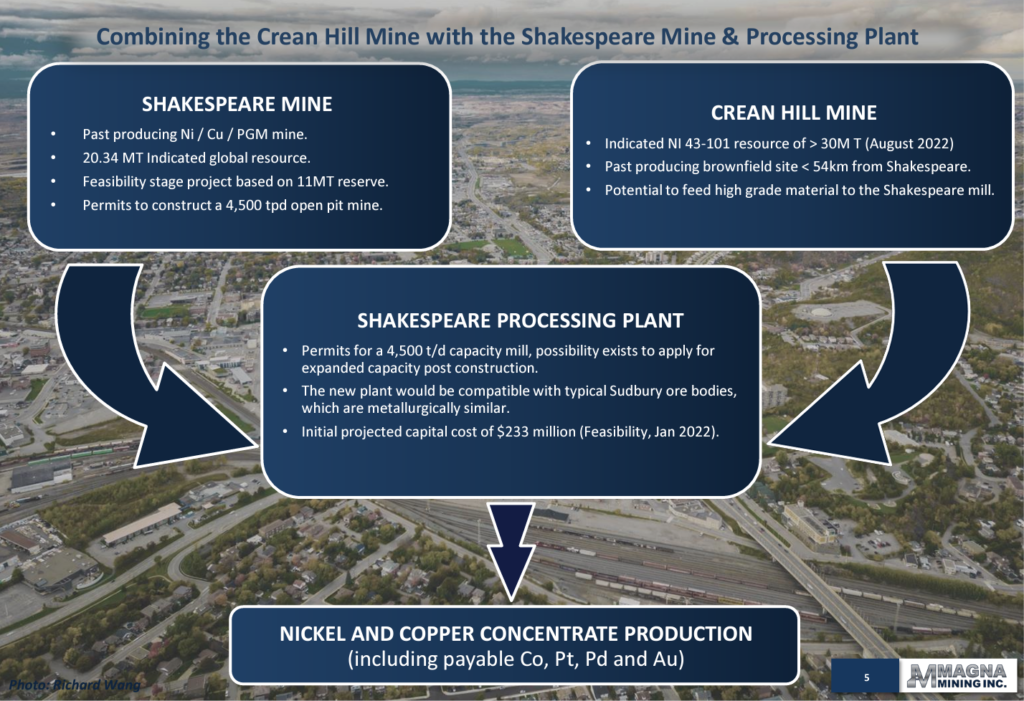

From what I understand mining companies can get grants to the tune of 50% of the CAPEX for a critical minerals project. Magna Mining is only one of two juniors in North America which has a FS stage Nickel project which apparently is the requirement. For Magna that is theoretically a >$100 M grant for Shakespeare (Which is FS stage) and would be as much as the current Market Cap of the entire company.

… Then we have Magna Mining which has a bunch of ex FNX Mining members and their CEO (Ex FNX Mining) saying:

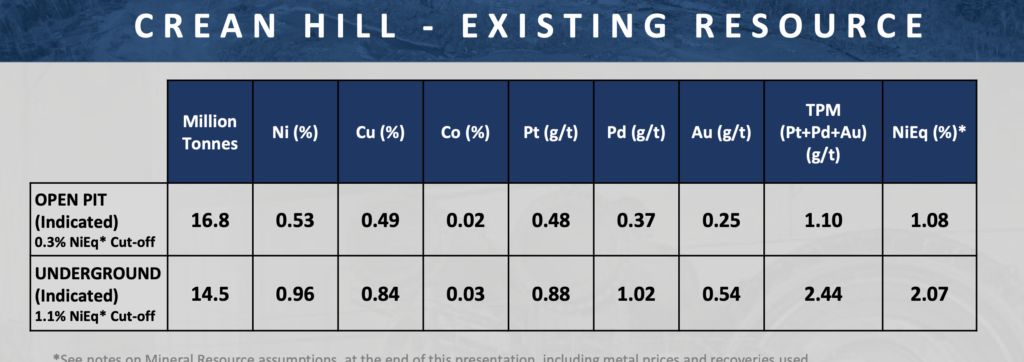

“We get asked all the time… How do we compare you to your peers… And it’s really hard because we don’t have any peers… There are no junior Nickel, Copper, PGM exploration-development companies out there that are in a tier 1 jurisdiction, with permits, with a very significant resource… The contained Nickel in the Denison resource alone at Crean Hill is over 500 million pounds… So very very significant amount of metal at very decent grades… You know… Typical grades that were mined for over 80 years… So there is no one else that really compares to us..” – Source

Crean Hill Resource

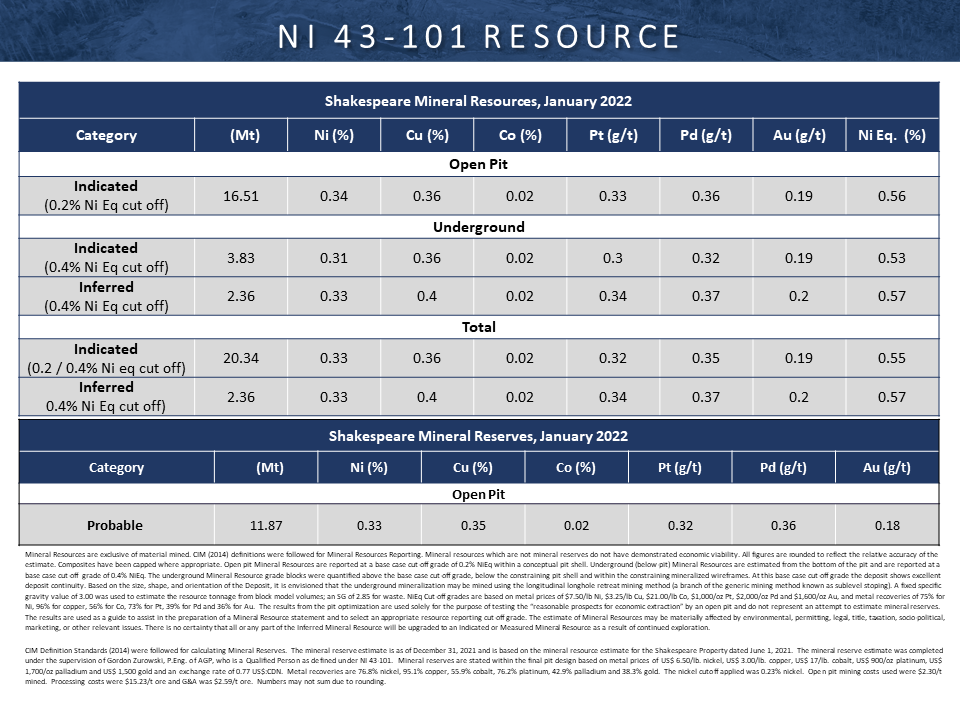

Then we have Mitsui suggesting that the Shakespeare deposit alone (not even the whole Shakespeare land package) was at least worth C$64-C$100 M at much lower nickel prices than today. – source

Shakespeare Resource

So if you have something worth C$64-C$100 M at lower nickel prices and then ADD a much better and bigger resource in Denison just how much is Magna Mining worth today at the current Nickel prices? I don’t know but if I had to guess I would say some >C$300 M at least. In that case there is a huge gap between the current C$90 M Enterprise Value and the Fair Value. A five year old should be able to tell that this company is absurdly undervalued IMO.

There is not a single Nickel/Copper/PGM junior in North America that is closer to production than Magna Mining and according to IAE the world needs #60 new Nickel mines in the next 7 years and everyone is scrambling to secure domestic supply in NA and build out EV battery production which will need nickel.

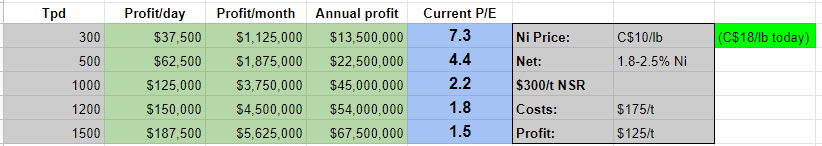

Magna Mining also has the very realistic option of getting self funded via toll milling for what I would expect to be very low CAPEX. Given the high grade UG resource at Crean Hill I estimate that there could be very robust margins from even small scale production at much lower nickel prices than we are seeing today:

(Note that these are crude, theoretical and forward looking scenarios!)

The spreadsheet above assumes a Nickel price of C$10/lb while it currently is trading at around C$18/lb. So if it covers the costs and provide good margins at C$10/lb nickel then a 80% higher nickel price would all go directly to the bottom line.

And these guys know Toll Milling because FNX Mining ONLY used Toll Milling (successfully) and was acquired for over $1 B dollars over a decade ago. These guys are not cowboys as they have literally done what they are drying to do with Magna Mining before.

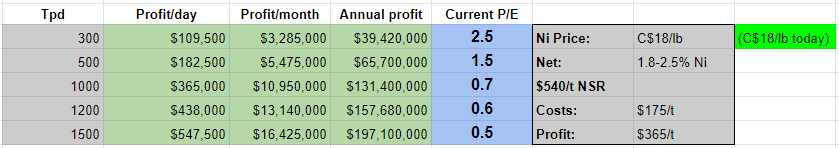

If we take today’s price of C$18/lb and just do a “dirty” cash flow calculation by upping the NSR value by 80% then the numbers get ridiculous from even very small operational “trial mining” scenarios:

(Note that these are crude, theoretical and forward looking scenarios!)

Imagine if it would cost say C$20 M to get a trial mining operation up and running with a throughput of 500 Tpd at today’s nickel prices. Then compare that to the Market Cap of C$97 M. And we’re not talking some far fetched future. We’re talking about a case where trial mining could potentially be started in 12-18 months I think. This is why I think Magna Mining is so absurdly cheap today it’s unreal. If there is even a 20% chance that were to happen it would be cheap today and I think it is more likely than that. Thus I think the Risk/Reward in Magna Mining is one of the biggest layups I have seen in years.

When you have cases like Magna Mining readily available I don’t think anyone has the right to call this sector “hard” at a time like this. This sector is really easy right now because it is almost impossible to overpay for anything. Outsized future returns are birthed when we start off by buying something significantly undervalued. The outsized returns materialize and can be harvested in the future when the market goes from being a short term voting machine to a weighing machine. It is very hard to have outsized long term results without first “stealing” a significant amount of value.

If I had to guess how opportunities like this are even possible I would say there are several factors at play that is creating a “perfect storm” for buyers; a) Juniors have been in a >2 year long bear market so nobody feels good buying anything, b) We are still in tax loss selling season so sentiment gets even worse since upticks are muted and crashes get exaggerated, c) People who have been tied up in Magna for years and need to plug holes have a chance to re-balance for the first time in a long time, d) Magna Mining is still a very unknown story overall, e) The Denison acquisition just closed so a lot of people are very much oblivious to just how much the case changed for the better (if they are even aware of Magna in the first place), and f) Nickel/PGM juniors are not “hot” in the eyes of retail so they are currently trading at cheaper valuations than hotter metals…

On that note I stated the following in the forum:

“What I think is going on is that the retail that is left in the Jr sector are broadly def to Nickel/PGM plays. If this was a gold junior with equivalent tonnes, grades (net margins including recovery losses) etc this would get a lot more attention. The good part for us is that unlike most juniors who at the end of the day are trading sardines because they can’t “force” value as go into production (very rare) or get acquired (very rare) Magna can actually toll mill and I dare say that there ought to be a big list of suitors willing to throw money at this (including govs). So lack of retail awareness is not that bad in this case… I’d like to see the market ignore Magna once toll milling and/or some big player throws cash on us or say a $100 M government grants comes our way.”

Magna Mining is one of few juniors that I think is able to “force the issue” because the company has good backing and could likely get to cash flow quite cheaply. For a junior with no hopes of materializing the value, as in fund say a $400 M CAPEX project, it might stay a “trading sardine” forever and be undervalued for a long time. I’d like to see Magna Mining stay close to this valuation if/when the company is throwing off $50 M in cash flow or more per year.

Talon Metals might be the closest “peer”. That company has more exploration potential but a lower resource base and is probably many years away from production. Regardless, Talon has a Market Cap of C$383 M while Magna has a Market Cap of C$98… Again despite being much more advanced, de-risked, and much closer to potential production.

I can’t guarantee Magna will become a multi or a ten bagger but I can ALMOST guarantee it’s friggin undervalued.

Note: Not investing advice. I own a LOT of shares of Magna Mining and the company is a banner sponsor. Consider me biased, do your own due dilience and think for yourselves!!! Assume I may buy or sell shares at any time. Juniors are risky and there are no guarantees of profits. I don’t share your profits or your losses.

How much of the demand is for battery destined nickle – there are a number of competing battery formulations coming down the pipe – even ZnBr from a 100 years ago. A number of them look ready to knock Li off its perch (Graphene, Sodium, etc). In the event that they really are better and cheaper, what is the chance of replacing the battery tech that uses Nickle or Cobalt? Anybody looked that this?