“Keep Calm: Nothing to See Here”

July 8, 2021

This correction in miners have “finally” been able to take down the more advanced juniors in the space. The ones that have a lot of banked success which would take years and often cost tens of milliomns to replicate. Today many are selling well below replacement costs especially when factoring in the very low chance of success of even reaching such a point. It is at times like this when the inefficiency of the mining sector is most obvious. Companies start trading like a) It is easy to find a robust deposit, b) It is easy and cheap to prove up a robust deposit, and c) Like the gold/silver business is going to die. Abysmal valuations when gold was trading at $1,050 and few gold projects made sense from an economic stand point is much easier to wrap ones head around. To have abysmal valuations when major producers are throwing off cash hand over fist and many projects have NPVs of hundreds of millions to billions of dollar is a totally different thing. New discoveries are few and far between and advanced assets do not grow on trees. Meanwhile every miner on earth is depleting its reserves day in and day out. Thus, one can be sure that either new projects get put into production or the world will run out of gold and silver etc.

Never forget that the price action you see in the securities that are gold and silver futures are not much more than trading sardines with the names “gold” and “silver. A tiny fraction of the daily volume is made up of physical gold/silver actually changing hands. The vast majority of trades are simply artificial IOUs changing hands.

The new BASEL III rules were hoped to rectify this charade but it seems that the London bullion banks were able to buy themselves more time. If the gold/silver markets suddenly went majority “physical” then the house of cards would probably collapse in an instant given that the paper trading volumes dwarf the available supplies of physical gold and silver.

If I bought a car and proceeded to sell it IOUs on it 70 times over I could create a small car market. If I could not use IOUs said market would obviously collapse, resulting in 69 “owners” not actually owning a car, in contrast to what the IOU would suggest.

- Gold and Silver are artificial paper markets

- In the real world there are not many discoveries

- In the real world it’s not easy or cheap to prove up one of said rare discoveries

- Miners eat their future every day

- Miners will need to get new supply online… Or die.

- Time is on the side of real ounces due to the laws of physics REGARDLESS of how long the paper charade lasts

On that note I very much like this segment from Dr. Thomas Kaplan, the famous resource billionaire and lately “gold bug”, who argues that the best case for gold is the supply/demand picture:

In other words it’s the finite nature of the business that will ensure a coming boom in gold prices regardless of the “fear factors” such as central bank defaults, money printing or war etc etc.

Conclusions

When you see gold/silver go down like we have recently seen it is important to KNOW that the long “term fundamental pressure” is to the upside regardless of how the paper markets reacts to FED speakers, money printing or “chaos headlines”.

Time is on OUR side and the coming bull is not a matter of if but WHEN.

Which is why I am not tempted in the slightest to sell miners which are trading for a fraction of their current intrinsic value let alone their future intrinsic value when the gold/silver bull really gets going. I’m not in this sector for a “quick” 30% return from a short term leg up but for hundreds of percent’s of returns over the coming years. In other words I am HODL:ing and buying larger stakes of many mining companies until the REAL value of REAL gold/silver is reflected in the companies that mine it.

The daily/weekly/monthly swings in the paper markets are noise…

The supply/demand picture in the real world is the signal…

And no matter how hard paper gold gets slammed on the COMEX it doesn’t miraculously bring on more supply, rather the opposite, which further improves the long term case for gold.

Money printing can’t produce real gold.

The lower paper gold goes the better the case becomes and as long as miners are “even” way undervalued relative to the current paper price of gold I would be a fool to sell if I thought myself of as an investor.

I am fully prepared for more downside in the short term. I have seen my mining portfolio correct >40% on multiple occasions just in the last six years. Every time I HODL:d and every time I have been rewarded for HODL:ing with new ATHs even if it took a year. It’s not fancy. It requires a lot of patience and a high threshold for pain… But most importantly it ALWAYS WORKS. 95% of people are unfortunately not able to do so and believe that a successful long term investing strategy means that there are no deep nor lengthy corrections on the way.

My list of “buys” have never been longer than it currently is. I can throw darts in the junior mining sector and fully expect to see several hundred of percents of gains, on average, within 24 months. That’s the kind of return one could kill for and it is only possibly by buying CHEAP (like now). If miners get even cheaper then my next dollar invested will simply have an exponentially better average return than the dollar I invested last week. Regardless I win and it’s just a matter of WHEN and HOW MUCH.

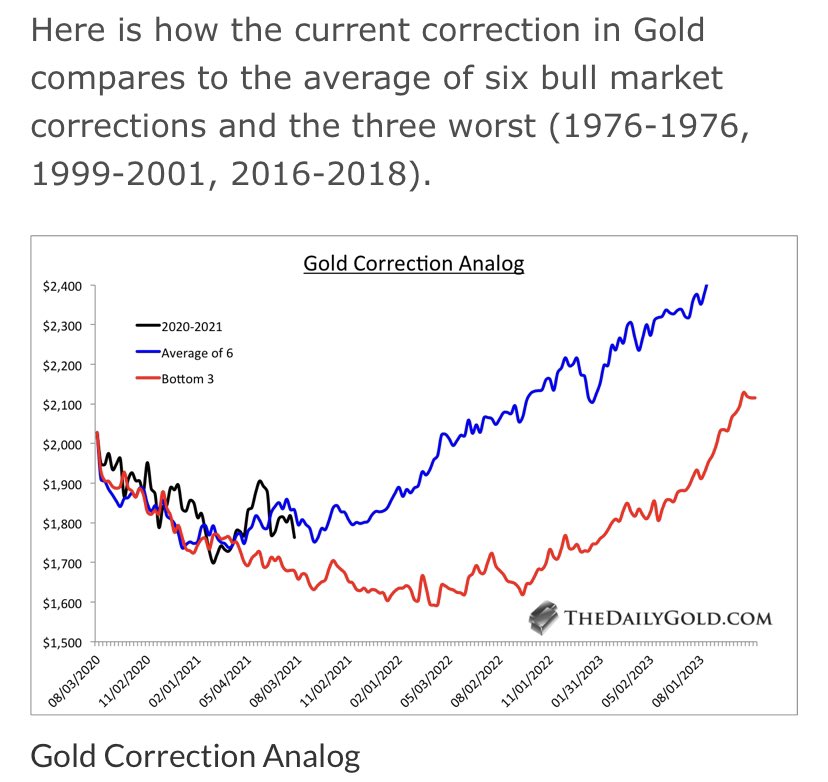

Lastly, some added perspective from @TheDailyGold on twitter:

Best regards,

The Hedgeless Horseman